Over two million people use Personal Capital’s free tools. See all of your financials in one place while you track investments, monitor your budget, and plan for retirement. This review details all of the pros and cons of its features along with a closer look at its wealth management service. In short, if you’d like to discover whether they’re the one-stop-shop for all of your money needs, read this post.

Perhaps you’ve already heard about Personal Capital’s suite of free tools. Or, maybe you’re curious about scheduling a call with one of their financial planners.

Either way, you’re here because you want to manage your money better. But you need the right tool to get you there.

What Is Personal Capital?

Personal Capital is both a financial tracking tool and a financial advisory service. They’re also a fiduciary which means your interests come first should you decide to use their wealth management service.

Along with over two million users, they also have over $12 billion in assets under management (AUM).

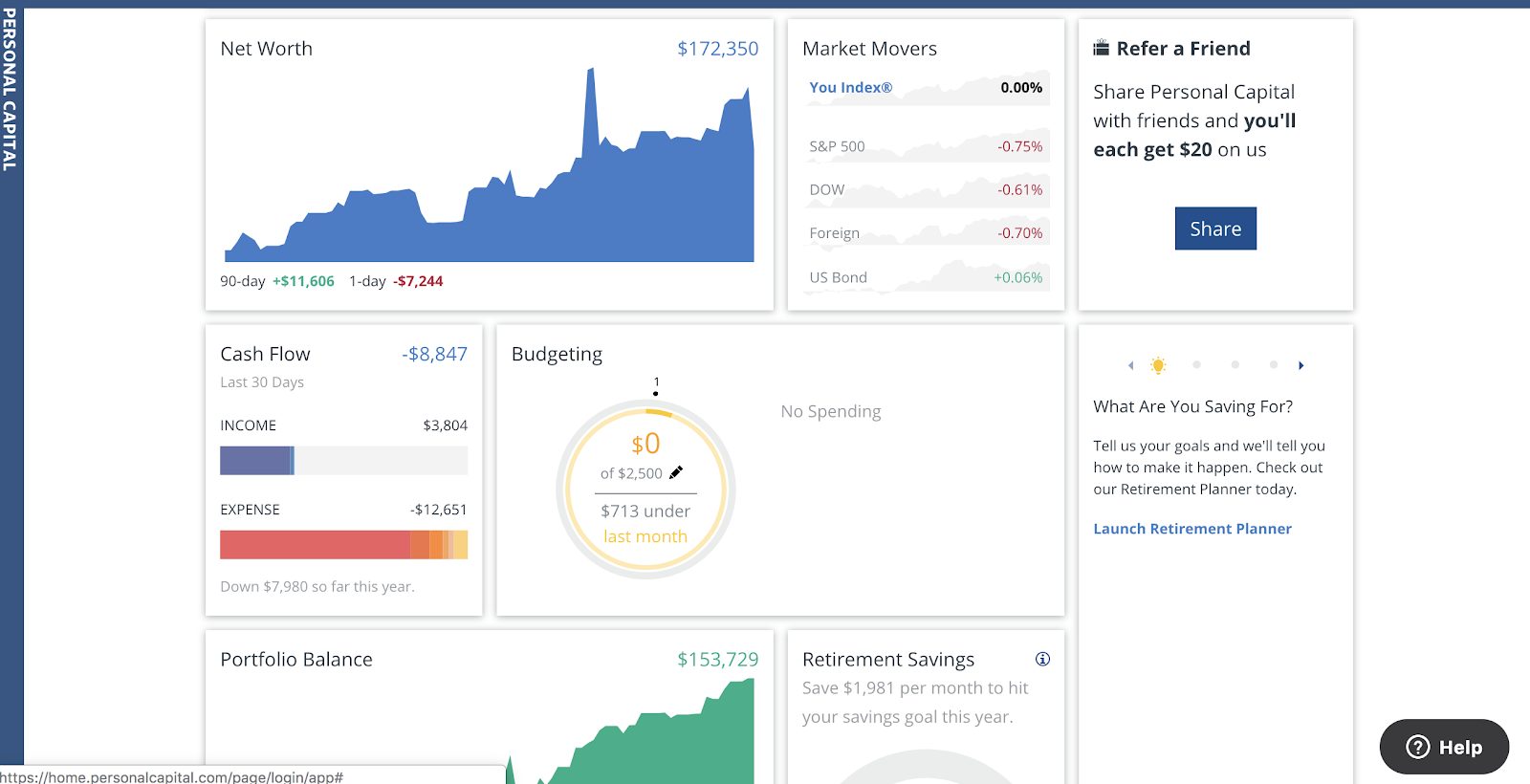

You can manage all of your accounts in one place, features a user-friendly dashboard, and has become the go-to in money management apps.

Creating a Personal Capital account is simple to set up and you can do it from either your phone or laptop.

You’ll start by linking your banking and investment accounts to their software and finish by completing your investor profile.

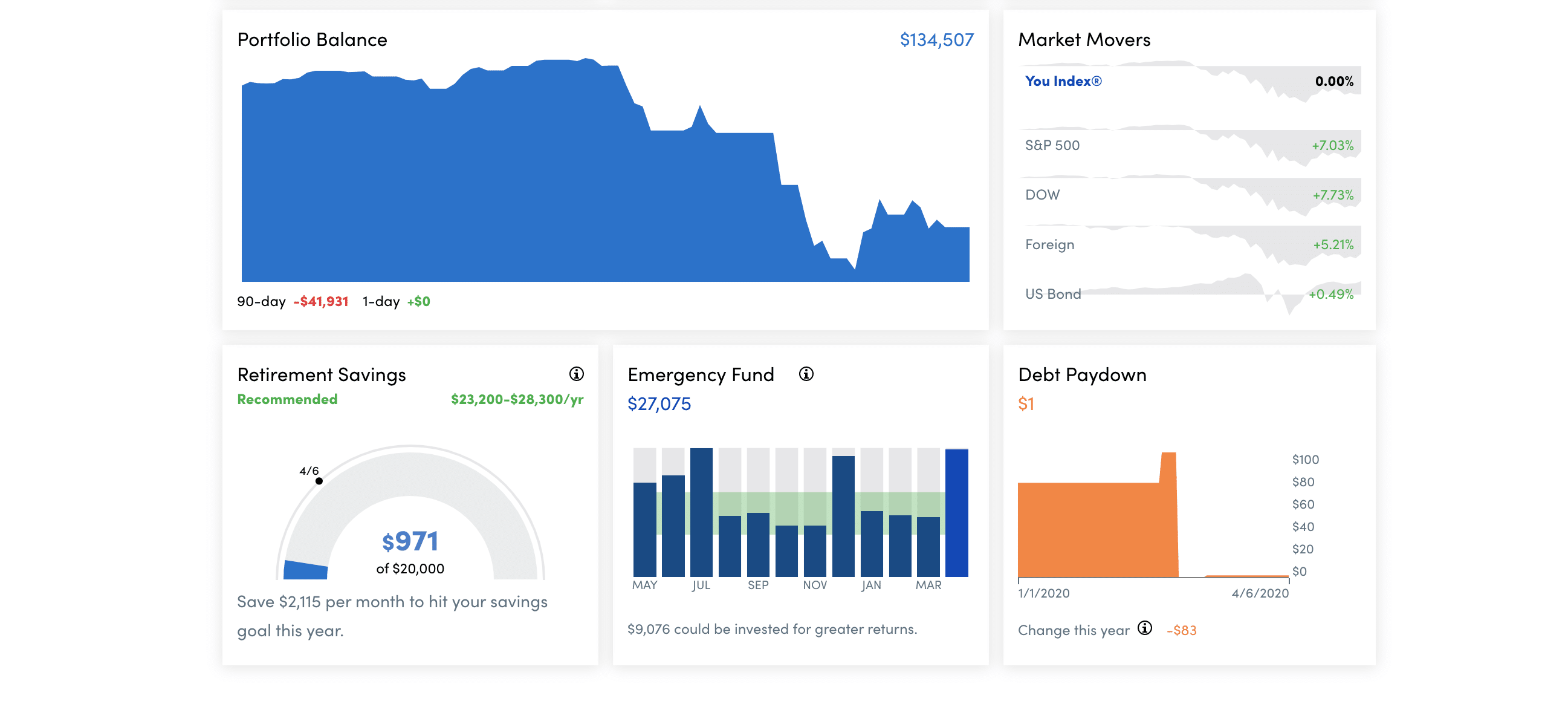

Everything is displayed on your dashboard. You’ll see your net worth, cash flow, budgeting, and portfolio balance in one place. All account balances display in real-time.

Free Tools at a Glance

| Fee Analyzer | Discover hidden fees impacting portfolio performance |

| Retirement Planner | Determine if you're on track to hit your retirement number |

| Education Planner | Anticipate future college expenses |

| Cash Flow and Budgeting | Monitor income, expenses, and individual transactions |

| Net Worth Calculator | Displays all of your assets and liabilities |

| Investment Checkup | Reviews portfolio performance and whether investments are trending up or down |

Financial Tools

Personal Capital has a suite of free tools to help you manage every aspect of your financial situation. See all of your accounts in one place, analyze fees, set financial goals, and more.

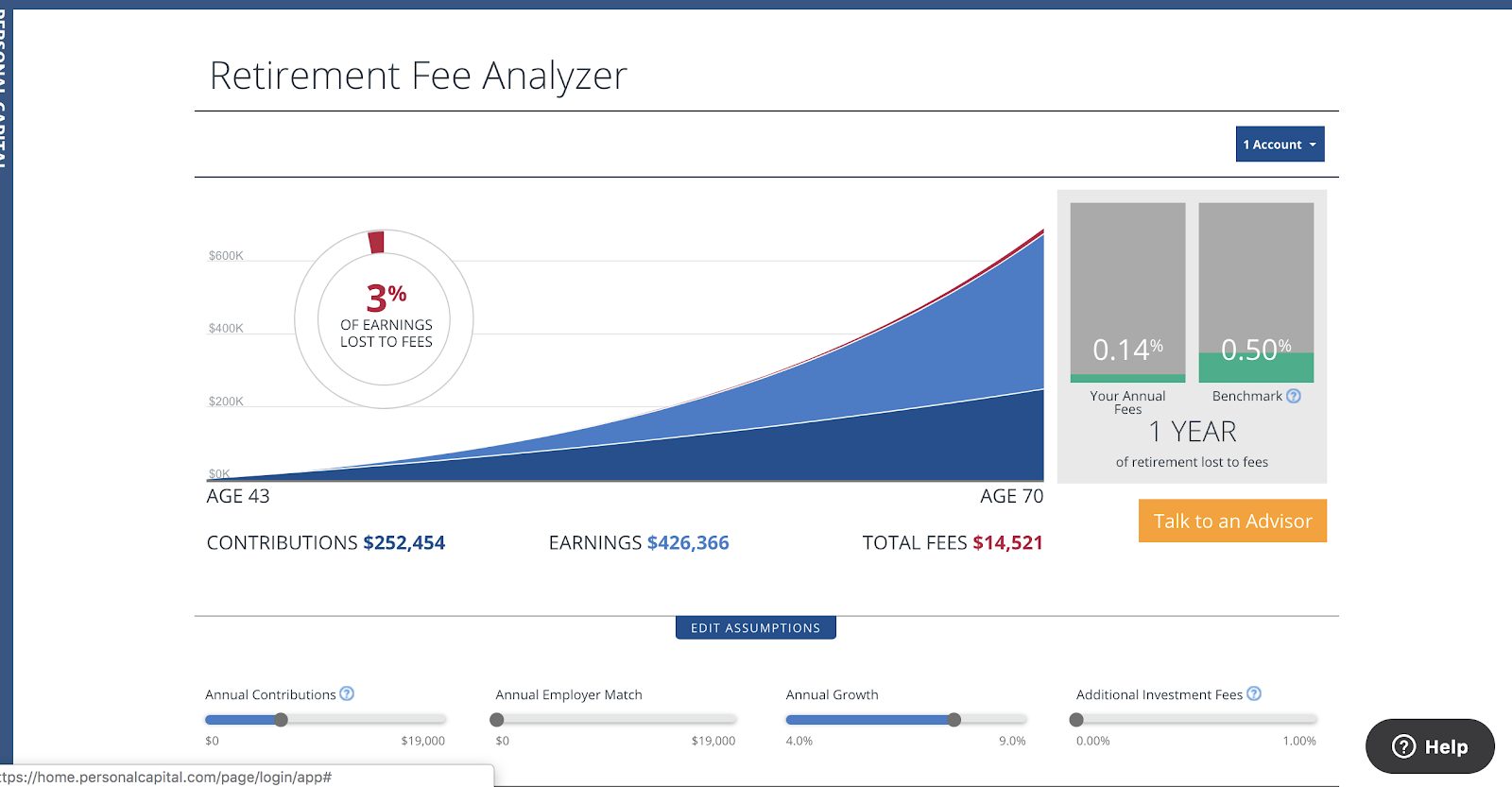

Fee Analyzer

Uncover how hidden fees impact your portfolio. Sync all of your investing, mutual fund, and retirement accounts with their software and assess how much you’re losing.

Financial institutions may charge annual fees in the form of 12b-1 fees, custodial, expense ratios, load fees, trading costs, market impact, and advisory costs. These fees can significantly reduce your portfolio’s value over the long-term.

The Fee Analyzer calculates your holdings, reveals all operational costs of the fund, provides projections, and demonstrates how they can postpone your retirement by several years.

It analyzes your data compared to their benchmark while displaying your lost earnings. Fee Analyzer will determine if it’s a worthwhile investment.

Retirement Planner

This planning tool shows you where you are and what you need to do to get there. It gathers data from all of your linked accounts while you select how much you plan to spend in retirement.

You can run scenarios including how far into retirement you plan on working or additional windfalls you might receive. Retirement Planner informs you whether you’re on track to hit your goals based on the year you plan to retire.

It shows you the impact various financial decisions have on your savings from travel to buying a home to planning a wedding. It even calculates your spending power in retirement.

The tool also considers income events including rental income, social security projections, and additional windfalls. Run simulations to assess the exact dollar amount you’ll need along with monthly spending considerations.

Or, run multiple scenarios against each other.

If you’re a client, the Smart Withdrawal Tool tells you which accounts you should have in retirement, which to withdraw from first, and in what order.

The tool could potentially extend the life of your portfolio.

Education Planner

If you’re saving for education expenses, the Education Planner helps to prepare. Anticipate the costs of specific colleges, in-state vs. out-of-state tuition, and the annual savings rate needed.

Similar to the retirement planner, you can run scenarios to determine how an additional year of college will impact your portfolio’s retirement readiness.

Anticipate retirement and educational expenses with a robust set of planning tools.

Tweet ThisCash Flow

Determine how your incoming and outgoing money affects your financial health. Cash flow analyzes your money’s moving parts.

Compare your income and expenses against last month’s and see how it stacks up.

Cash flow isn’t only tracking your checking and savings account, but your complete financial picture including all of your investment accounts, college savings, loans, and more.

You can view transactions from an individual account or see how your income and expenses are doing as a whole.

Budgeting

Set a monthly budget and let Personal Capital handle the rest. Works in sync with your cash flow for realizing your assets and liabilities.

You also get a detailed analysis of your income and expenses. Select a time frame or customize it for a specific report.

Every linked external account with an upcoming bill will display too.

Net Worth

Based on the financial data you provide, the net worth calculator portrays an accurate picture of your assets minus liabilities. You can even compare yourself to others in a similar age range or income bracket. It also sends financial advice on ways to improve.

Knowing your net worth is important for meeting your savings goals. The calculator highlights any debt you may have and how that affects your ability to save for the long-term.

You’re able to track your investment’s performance with portfolio tracking tools. You can see how you’re doing monthly, annually, and over your account’s lifetime.

You’ll also see if your net worth is trending up or down. That allows for making the necessary steps to stay on track. A minor adjustment to your spending or savings habits might be all you need.

The net worth calculator is the aggregate of every account you’ve linked – bank accounts, investment accounts, retirement accounts, credit cards, mortgages, home equity, jewelry, art, and alternative investments.

After you’ve linked your accounts, Personal Capital displays everything you own as assets and liabilities.

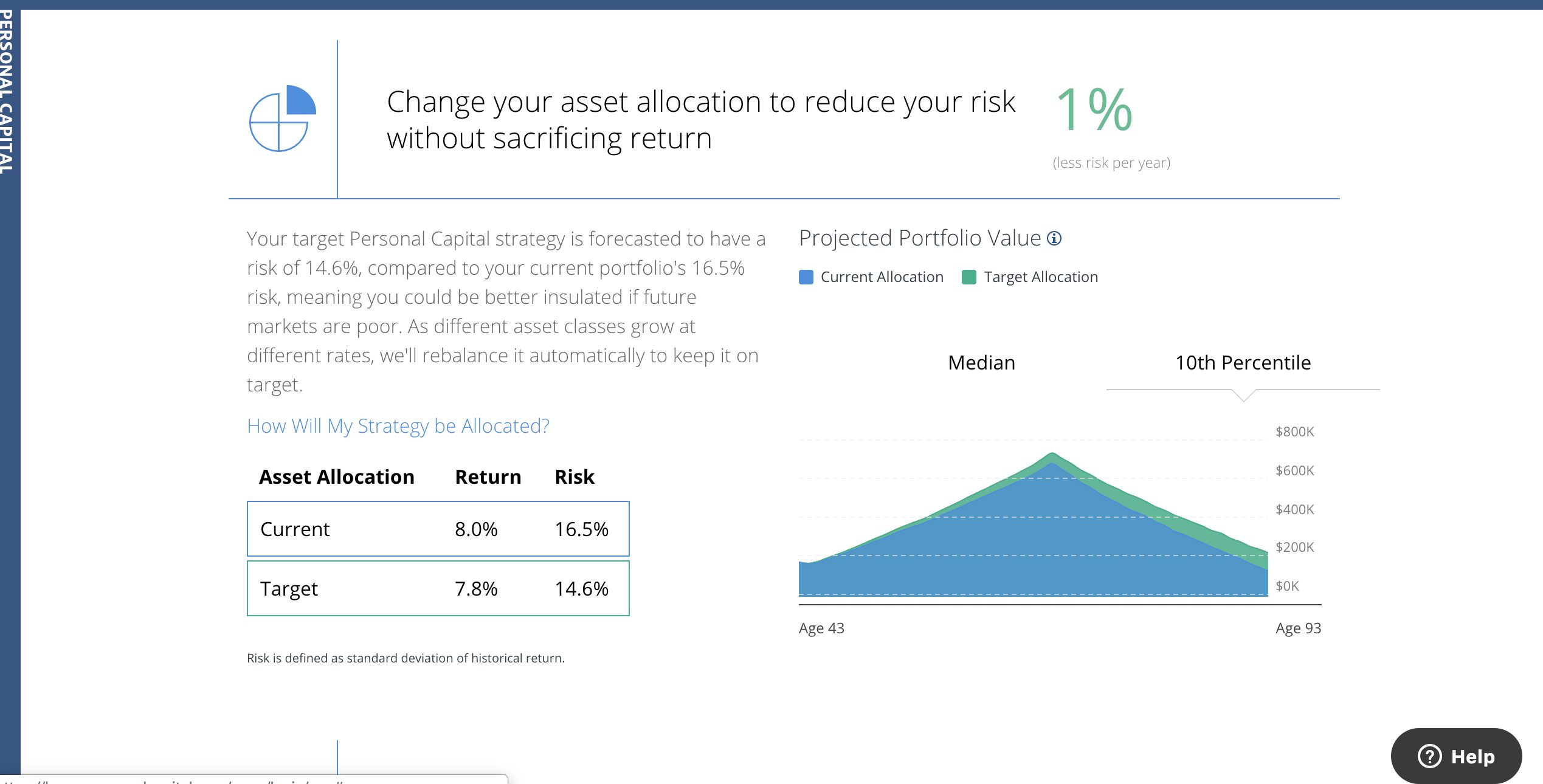

Investment Checkup

The Investment Checkup tool lets you see the performance of your investments and looks for ways to improve your current allocation.

It takes into account your risk profile and creates a target allocation designed to get the best risk-adjusted return.

Investment Checkup also analyzes past portfolio performance. You can see the performance of your investments over time compared to Personal Capital’s suggested target allocation.

Your checkup considers:

- How much you need to rebalance

- Compares your current situation to a target allocation

- Customized financial plan based on your current holdings and goals

Portfolio Balance

The Portfolio Balance feature accounts for all of your cash, ETF, mutual funds, and stocks; distills that into a single number and measures it against the S&P 500, the DOW, U.S. Bonds, and foreign markets.

It displays as the You Index.

It also displays U.S. holdings by how weighted you are in each sector (e.g.,22% of your portfolio is invested in technology versus 5% in utilities).

Personal Capital is Now Empower - Track your entire portfolio for free.

All your accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

Personal Capital Premium

Premium is a monthly subscription plan that costs $5.99. You’ll still have access to all of the free tools along with:

- A custom financial roadmap that sits in your dashboard

- Premium financial planning tools Savings Planner Premium and Smart Withdrawal

- Annual financial health report with goal check-ins and needed adjustments to hit your retirement date

- Dedicated phone support and priority issue resolution.

Savings Planner informs you how much you’re saving compared to your goals along with account recommendations to invest in.

Smart Withdrawal tells you which accounts you should use in retirement along with what order you should withdraw them. It also considers the tax implications of your withdrawals.

This upgrade comes with a 60-day free trial and you can cancel anytime.

Cash Management

Personal Capital Cash

While Personal Capital isn’t a bank, they offer an interest-earning cash savings account provided by UMB Bank and is FDIC-insured up to $250,000 (check with Personal Capital for its current APY).

Personal Capital Cash carries no fees, no minimum balance requirements, and features unlimited monthly transactions.

Editor's Note

Note: The cash savings account offered by Personal Capital doesn’t carry the usual six-withdrawals per month limit compared to most online banks.

If you’re a Personal Capital advisory client, you’re subject to a higher APY. You also have the option to open an individual or joint account.

Once you create your account, link an external bank and transfer your funds.

Wealth Management

Personal Capital features a financial advisory service and is a fiduciary which means they’re required by law to act in your best interests.

The account minimum is $100,000 to qualify for portfolio management.

The accounts supported with their wealth management services are, Traditional IRA’S, Roth IRA’S, rollovers, joint accounts, trusts, taxable investment accounts, and other non-retirement accounts.

Investment Management Overview

| Fees | 0.49% - 0.89% |

| Minimum Investment | $100,000 |

| Accounts Supported | Traditional and Roth IRAs, Individual Taxable, Rollovers, Joint, Trusts |

| Smart Weighting | Yes |

| Tax-Loss Harvesting | Yes |

| Rebalancing | Yes |

| Assets Under Management | Over $12B |

Investing with Personal Capital

You’ll have access to three levels of service depending on the amount of money you’re investing.

1st Tier: Investment Services Clients with assets between $100,000 and $200,000. Gains you unlimited advice from their financial advisory team, retirement planning and investment review, a professionally managed ETF portfolio featuring Smart Weighting, portfolio monitoring, rebalancing and tax optimization.

2nd Tier: Wealth Management Clients with assets between $200,000 and $1 million. Includes all of the above plus two dedicated financial advisors, access to specialists, financial decision support (includes insurance, stock options, home, and compensation), portfolio customization with individual stocks.

3rd Tier: Private Clients with over $1 million in assets get all of the above plus access to Personal Capital’s investment committee, wealth planning (includes estate, legacy, and tax), private equity, private banking services, enhanced customization with individual bonds and private equity investments.

Fee Structure

| Assets Managed | Annual Fee |

|---|---|

| First $1M | 0.89% |

| Up to $3M | 0.79% |

| Up to $5M | 0.69% |

| Up to $10M | 0.59% |

| Over $10M | 0.49% |

Investment Methodology

Personal Capital’s investment strategy combines six asset classes of:

- U.S. stocks

- International stocks

- U.S. bonds

- International bonds

- Alternatives

- Cash

Clients receive customized, professionally managed portfolios and consider your personal strategy, strategic asset allocation, smart weighting, security selection, tax optimization, and rebalancing.

Personal Capital examines opportunities to lower your tax bill by avoiding tax-inefficient, mutual funds and placing higher-yielding assets into tax-advantaged accounts (retirement accounts).

For example, high-yielding stocks and fixed income securities are placed into your retirement account (Roth IRA, Traditional IRA). Investments paying non-qualified dividends (e.g., real estate investment trusts or REITs) are also placed in tax-advantaged accounts.

Tax-loss harvesting adds a layer of tax efficiency by selling losing stocks to offset any gains.

Disciplined Rebalancing

Portfolios receive daily evaluation for rebalancing opportunities. Typically, asset classes straying from the target allocation by more than three percent are rebalanced. Individual securities are rebalanced when deviating by more than 0.5%.

Smart Weighting

This strategy seeks to avoid overvalued stocks having a disproportional piece of an index. Smart Weighting evaluates the economic sector, style, and size of an investment with the goal of enhancing your risk-adjusted return.

Smart Weighting limits exposure to any one sector in favor of greater diversification. The idea is to insulate you from potential market downturns.

For example, a traditional capitalization-weighted index is based on the market value of the company’s shares. That’s the total number of outstanding shares multiplied by the price per share.

Certain sectors tend to represent larger portions of an index (like technology) based on the company’s market value.

Smart Weighting, on the other hand, spreads evenly across sectors.

Smart Weighting improves upon indexing by maintaining a more evenly weighted exposure to each sector.

It’s not market-cap weighted like a traditional index where more prominent companies receive a larger slice.

Smart Weighting simulations were shown to increase returns by almost 1% when compared to the S&P 500.

Buying individual securities also creates a more substantial opportunity for tax-loss harvesting and further tax optimization.

Security Selection

The U.S. equities portion of a Personal Capital portfolio is a well-diversified selection ranging between 80 to 120 individual stocks.

Personal Capital employs 12 style box categories and 10 economic sectors when choosing securities. It further breaks down large-cap stocks into mega-cap and large-cap explaining large-cap stocks is too broad a category.

Mega-cap stocks represent the biggest companies and account for 35% of the total market value.

Personal Capital also explains that because large and mid-cap stocks represent a vast portion of choices, they narrow it down by diversifying by industry.

For a detailed explanation of its process, read the white paper.

Socially Responsible Investing

Socially Responsible Investing (SRI), aligns investments with core values and factors environmental, social, and governance issues (ESG). These components have shown to increase a company’s profits and longevity.

Personal Capital’s SRI investing strategy screens for businesses with low ESG scores while excluding companies in sectors of adult entertainment, tobacco, gambling, and small arms.

Its inclusionary filter focuses on companies with high ESG scores in categories ranging from emissions to business ethics to occupational health and safety.

This approach still employs a strategy of maximizing returns while reducing risk. Securities falling under SRI must still demonstrate solid returns to qualify as an investment in your portfolio.

Is Personal Capital Safe?

Personal Capital is insured through the securities investor protection corporation (SIPC) up to $500k in cases of insolvency.

Your data is secure. Personal Capital uses AES-256 encryption with multi-layer key management and rated A+ by world-renowned Qualys SSL Labs. This level of encryption earned Personal Capital a stronger rating than most banks.

You must authenticate your device, and you’ll receive a phone call, text, or email verification to confirm your identity. There’s an added security layer with Touch ID on iPhone and mobile-only PINs on iOS / Android.

Your financial data is stored with 3rd party Yodlee – a fintech industry veteran. Personal Capital says your credentials are safer in Yodlee’s data center than they are in your browser.

They also don’t sell your data to telemarketers.

Additional Features

Zestimate by Zillow

If you own a home or have rental properties, you can track your real estate holdings and home’s value through Zillow’s Zestimate.

Advice with Non-Managed Accounts

While Personal Capital doesn’t manage 401(k)s, HSAs, or 529s, they do offer financial advice as to what your next steps should be when funding those accounts.

Customer Support

You can access Personal Capital by phone or email. There is also a large FAQ section on their website.

I’ve had great customer service experiences with Personal Capital. My advisor consultation took the time to answer all of my questions and I received timely emails with additional information.

Personal Capital even sent my advisor’s resume to me with a link to the SEC’s website that provided additional information for our consult.

Resources & Education

Their resource center, Daily Capital, relies on the strength and experience of Personal Capital advisors and financial experts. You’ll find many articles on topics related to investing and markets, financial planning, and current news.

Mobile App

You can access your Personal Capital account on both Android and Apple devices. You can even wear Personal Capital around your wrist to access your financial dashboard.

See real-time updates on your investment holdings, spending, portfolio performance, and current balance.

Personal Capital Alternatives

Cost

Free

Apps

iOS/Android

Budgeting Style

Business Style

Reporting

Income, Expenses, Investment Performance, Holdings, Allocation, Net Worth

Investing Tools

Retirement Planner, Retirement Fee Analyzer, Investment Checkup

Alerts and Reminders:

Email Alerts

Security:

Encryption, MFA

Cost

Free

Apps

iOS/Android

Budgeting Style

Category Tracking

Reporting

Spending, Income, Debts, Assets, Net Worth

Investing Tools

Performance Analyzation, Allocation, Value, and Stock Market Comparisons

Alerts and Reminders:

Email Reminders and Alerts, Goal Reminders within the App

Security:

Encryption, MFA

Is Personal Capital Right for You?

If you’re considering using Personal Capital for its free tools or its financial advisory services, here are a few things that stick out for me.

What’s to Like

- Suite of free tools: An all-in-one place to view your investment portfolio, track performance, manage cash flow, and receive tips on ways to hit your financial goals.

- Cash savings account: You can keep money in an interest-earning savings account for free with no minimums and unlimited transactions.

- Dedicated service: Personal Capital’s team of advisors and customer support is exceptional. They take the time to answer all of your questions.

- User-friendly interface: The software is simple to navigate and removes the guesswork of trying to figure out where everything is located.

- Holistic financial picture: All of your financial accounts display in one place. Easily view your net worth, cash flow, budgeting, portfolio balance, emergency fund, and debt paydown.

What’s Not to Like

- High management fee: While it drops to 0.49%, that only happens with assets greater than $10 million. Most will start with an 0.89% management fee.

- High account minimum: Personal Capital requires a $100,000 minimum to access wealth management. If you’re starting your investing journey with a low net-worth, its services will most likely be out of reach.

Bottom Line

Personal Capital’s free app is an industry leader. It’s functionality surpasses a simple budgeting tool considering it also analyzes your investments for potential opportunities to improve performance.

I’m a little put off by their wealth management fee, which is why I decided to not move forward with its advisory service.

The 0.89% fee is slightly lower than what most financial advisors charge, but is on the higher side compared to what most firms offer.

The other downside is the $100,000 minimum for its wealth management service which may make Personal Capital inaccessible for some.

However, Personal Capital does roll out the red carpet for its clients with an enhanced, personal touch. If you’re ok with the higher management fee, it’s an excellent service for the level of attention you’ll receive, especially if you prefer to not manage your money.