Imagine if investing wasn’t as complicated as you thought. In just a few easy steps, you could have a fully-automated account set up earning you money while you sleep. The best part: it’s tailored to your specific investing goals.

You’d feel pretty comfortable knowing that with every passing year, you’re not only increasing your financial security but your peace of mind. Why?

Because having less stress in your life means you’ll make better decisions about what to do with your money – and not panic when the going gets tough. You’ve devised a plan.

While this may sound like wishful thinking, I can assure you it’s not. In as little as five minutes, you can create your account and get started building wealth today.

So, what steps should you be taking?

I’m going to show you how creating a lazy portfolio with

Whether your goal is short-term or long-term, their approach saves you time by taking the guesswork out of investing.

Leaving you more time to spend on things that matter – like searching for the most epic location to plan your next bungee jump. Or planning your trip to Dublin, Ireland because damn it, you’ve always wanted to taste a pint of Guinness straight from the source.

If the idea of playing more, working less, and providing yourself with a stable financial future sounds appealing to you, read on.

Humans are lazy by default - why should your portfolio differ?

Tweet ThisWhat’s a Lazy Portfolio?

In a nutshell, lazy portfolios are:

- Low-cost

- Passively managed

- Diversified

- Tracks an index.

Lazy portfolios are not:

- Actively managed

- Trying to time the market

- Trying to beat the market

- Loaded with high costs and fees

- Picking individual stocks

They’re hands off – hence their name, lazy. You set it and forget it.

If you think you’re going to retire rich because the stock you’ve chosen to invest your life savings in is going to be BIGGER than Amazon, you’re fooling yourself.

Stick out your hand because I want to sweetly smack you across the knuckles with a ruler. That hurt me more than it hurt you – but I did it out of love.

Example Lazy Portfolios

Rick Ferri Two-fund and Three-fund Portfolios

There are a lot of lazy portfolio examples out there. Famed personal finance author and columnist, Rick Ferri, has talked about the simplicity of two-fund and three-fund portfolios in his many books.

His two-fund portfolio example consists of this allocation:

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 60% | Global Equity Fund | Stock |

| 40% | Total U.S. Bond Fund | Bond |

While his three-fund portfolio example consists of this:

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 40% | Total U.S. Stock Market | Stock |

| 20% | Total International Stock Market | Stock |

| 40% | Total U.S. Bond Market | Bond |

For a deeper dive, check out his books, All About Index Funds: The Easy Way to Get Started and All About Asset Allocation.

Typically, three-fund portfolios hold a combination of U.S. stocks, international stocks, and U.S. bonds. Rick Ferri allocates 40% to U.S. stocks, 20% to international stocks, and 40% to U.S. bonds.

The Coffee House Portfolio

Bill Schultheis coined his seven-fund portfolio, The Coffeehouse Portfolio, and is named after his popular book, The Coffeehouse Investor.

This portfolio takes its name from the idea that it’s such a straightforward investing strategy you could create it while sitting in a coffeehouse. It focuses on diversification and keeping things simple - it's also exceptionally conservative.

Its funds are built with a 50/40/10 stock, bond, and real estate split. He breaks it down even further than the two and three-fund portfolios.

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 10% | U.S. Large Cap Equities | Stock |

| 10% | U.S. Large Cap Value | Stock |

| 10% | U.S. Small-Cap | Stock |

| 10% | U.S. Small-Cap Value | Stock |

| 10% | International Equities | Stock |

| 10% | REITs | Real Estate |

| 40% | U.S. Total Bond Fund | Bond |

William Bernstein’s Coward’s Portfolio

William Bernstein, the author of The Intelligent Asset Allocator and The Four Pillars of Investing fame, goes one step deeper with his granular 55/40/5 stock/bond/real estate split.

An alternative to the 60/40 stock/bond portfolio mix, the Coward's investment strategy seeks to further diversify the equity portion with uncorrelated asset classes that respond differently to economic events. It's not heavily-weighted in any single sector and is seen to increase returns with less volatility.

The portfolio seeks to hedge its bets against the poor performance of any one sector by diversifying the stock weightings into slivers of a larger equity pie.

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 15% | U.S. Total Stock Market | Stock |

| 10% | U.S. Large-Cap Value | Stock |

| 10% | U.S. Small-Cap Value | Stock |

| 5% | U.S. Small-Cap Blend | Stock |

| 5% | European Equities | Stock |

| 5% | Pacific Equities | Stock |

| 5% | Emerging Markets | Stock |

| 5% | REITs | Real Estate |

| 40% | Short-Term Treasuries | Bond |

So, what does this have to do with

Imagine if the above examples could be determined in under five minutes of your time. Without having to do any research or even know the difference between a large-cap and large-value stock?

The lazy portfolio just got lazier.

Creating a

Oh, you want to know more? Fantastic! I didn’t spend hours writing this article for nothing.

Get our best strategies, tools, and support sent straight to your inbox.

What’s A Robo-Advisor ?

Robo-advisors are online advisors who use computer algorithms and advanced software to engineer optimized portfolios better than the average human could do on their own. Or at least require less effort than a human.

Unless the human in question is Ray Dalio.

A

So, all those portfolio examples I mentioned earlier require a little more work from you if you want to implement the tools as

It’s kind of like an online bank offering higher APYs than a traditional brick-and-mortar bank – same with

The barrier to entry is low, which makes

For those who require that human touch, there are financial planners available to speak with for a small fee.

If you like the idea of an automated portfolio service doing the heavy lifting for you so you can remain hands-off – Betterment might be a good fit.

They select an asset allocation for you based on your risk tolerance and then maintain the allocation using advanced, fully automated technology.

Spoiler alert:

How To Build A Lazy Portfolio with Betterment

That’s why the first thing

Is it a long-term goal like retirement or something non-specific like accumulating wealth over time? Set it as a Retirement or General Investing goal.

By asking you what’s the purpose of the account you’d like to open helps

Betterment determine the right place to stash your cash.

If you don’t have a time horizon or specific amount you’re saving for they’ll use your age.

However, even that varies if you’re not withdrawing from your account when you hit 65. Some folks don’t need that money right away. This lets

They run the numbers on your exposure to various asset allocations of stocks and bonds when considering your risk tolerance. They look at how these variables will impact your portfolio.

For example, having a risky portfolio that’s too aggressive in hopes of hitting higher returns versus a portfolio that could’ve earned more but didn’t because it played it safe.

After running every possible scenario based on when you need the money let them adjust your stock allocation accordingly.

So, if you’re in the “don’t need the money for 20 years” category, they’ll recommend a portfolio that’s 90% stocks and 10% bonds.

If it’s a short-term goal, like saving for a car, they’ll suggest a 10% stock and 90% bond portfolio. Equities serve as your anchor.

***Side note: these allocations are

The Betterment Glide Path

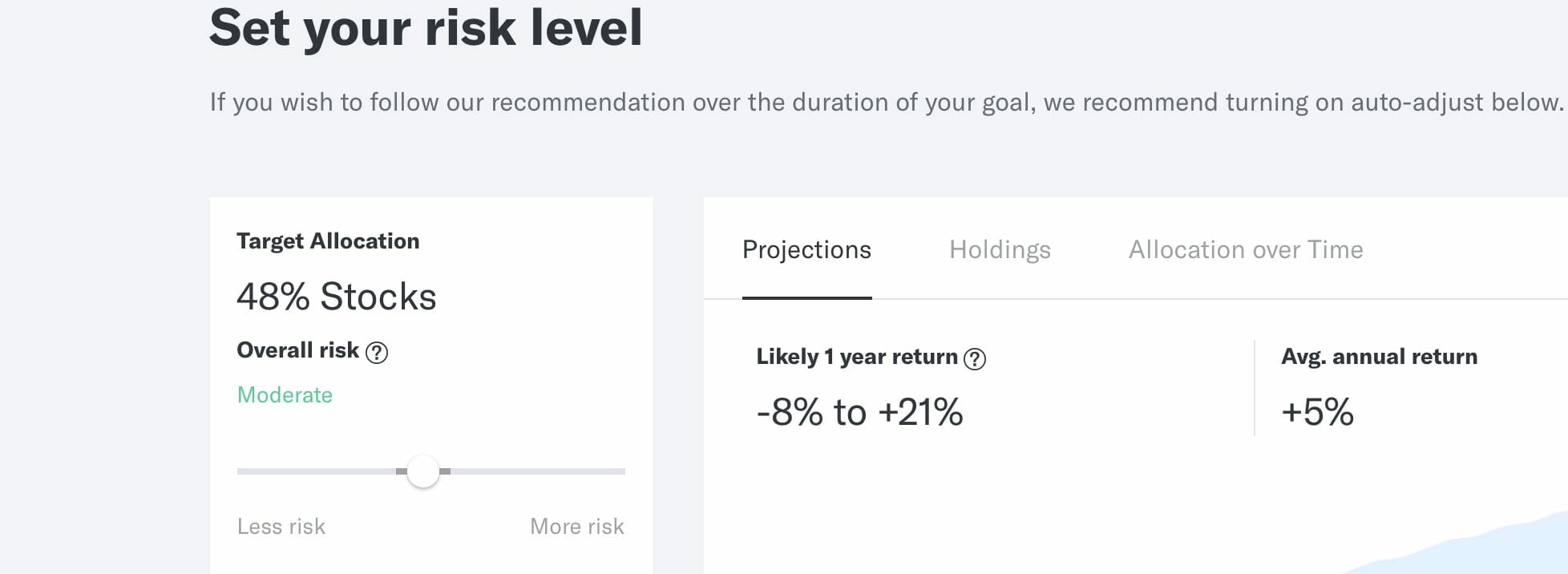

Their glide path works like a target date retirement fund in that it gets more conservative as your liquidation date nears. However, at

“Adjust the recommended allocation and portfolio weights of the glide path based on your specific goal and time horizon.”

Every investment bucket you have money in works this way.

Because each investment bucket is more personal, tailored to both your short-term and long-term goals.

You will not see a simple risk tolerance questionnaire to help place you in an aggressive, moderate or conservative portfolio. In

Their advice algorithm focuses on your time horizon, savings rate, and asset allocation to predict likely outcomes. Their portfolio is globally diversified using index-tracking ETFs.

ETFs track all the same things as a mutual fund does – the S&P 500 index, large-cap US stocks, FTSE All-World ex-U.S. index, and everything in between.

Why ETFs?

ETFs have several advantages over index mutual funds.

ETFs have passive mandates. This means the only thing a fund manager can do with that fund is track the index and replicate its benchmark – that’s it.

They’re heavily traded like a stock on an exchange. This means the more people trade it, the lower the cost to transact, as well as being highly liquid. They’re easier to create and rebalance on the spot.

Also, securities that trade multiple times per day are better suited to seize advantages like tax-loss harvesting.

ETFs keep costs low with transparent and unbiased fee arrangements. The average ETF expense ratio (the annual operational cost of owning the fund) for a

If you compare the cost of an ETF with its index mutual fund equivalent – the ETF is almost always cheaper.

Remember when I mentioned that

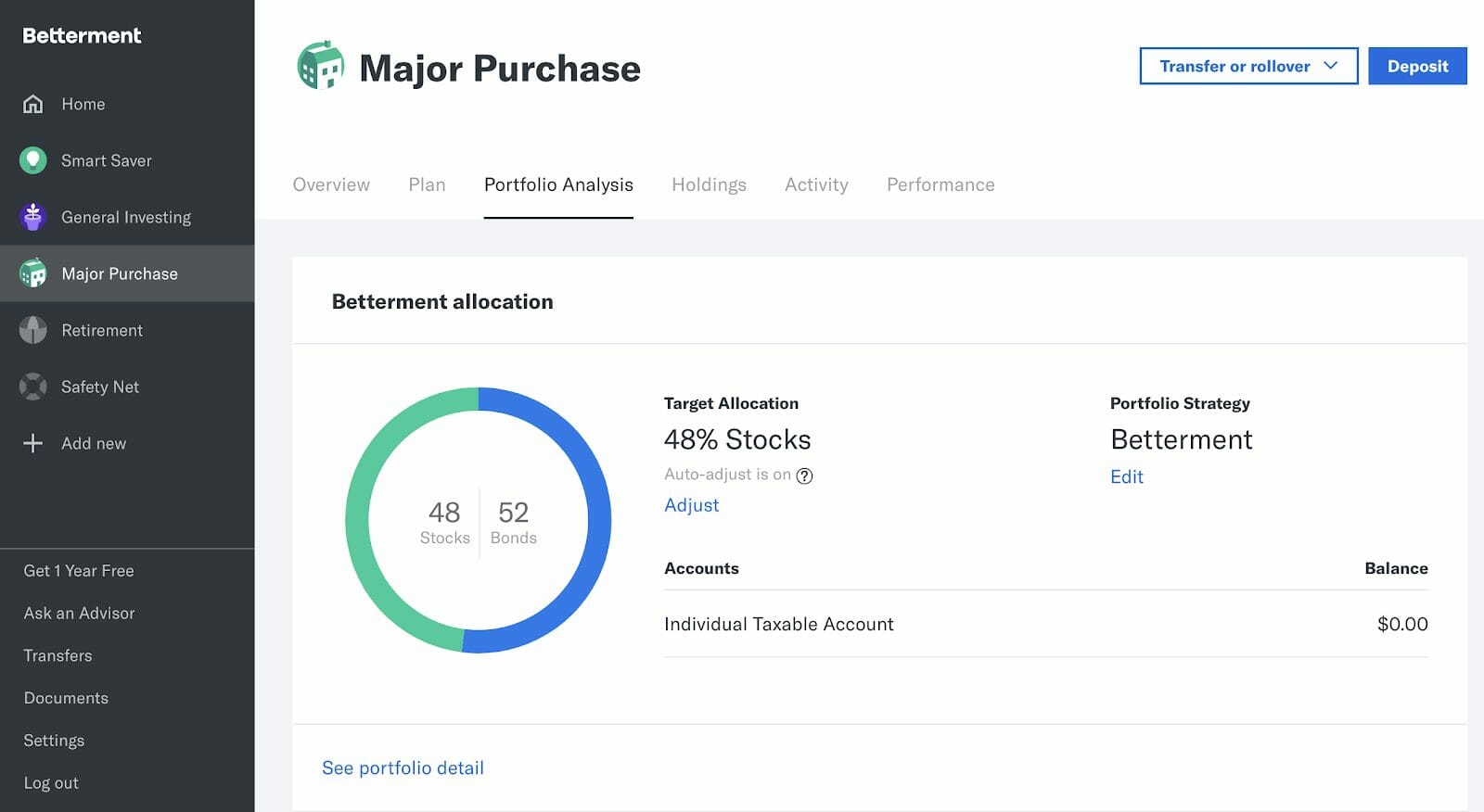

We’ll use the Major Purchase example from earlier to demonstrate just how a lazy portfolio under

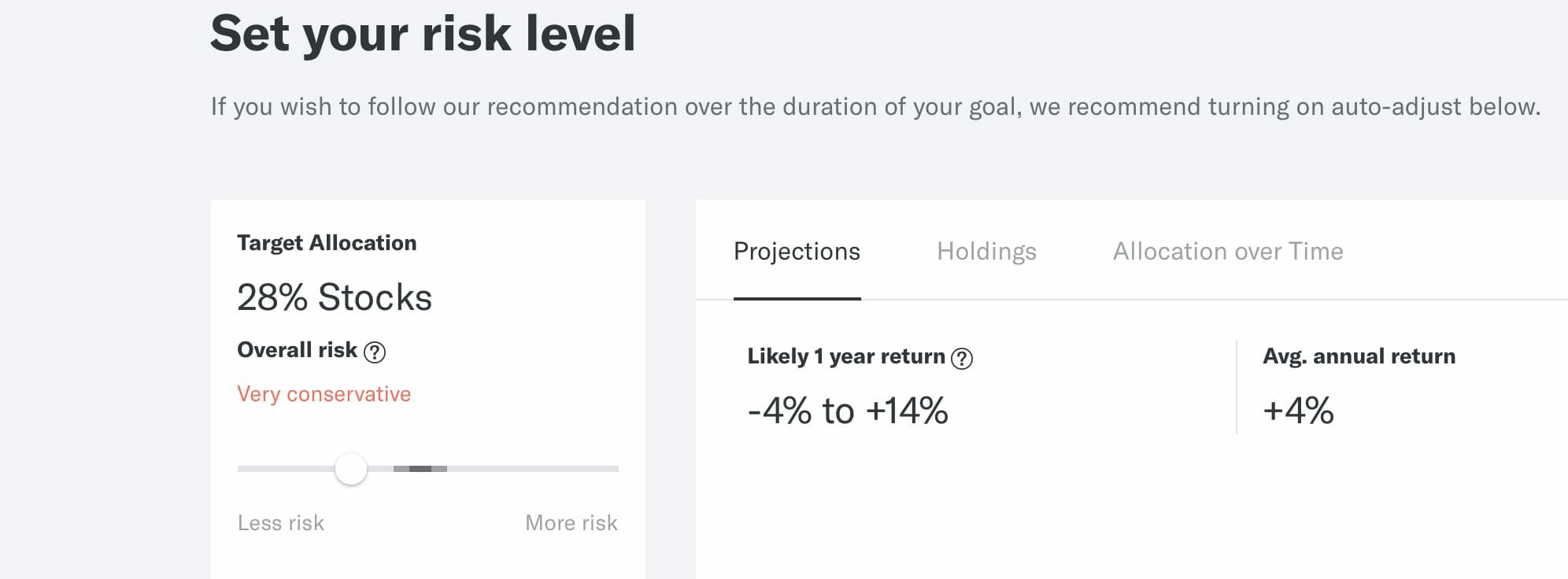

You’re then taken to this screen where you can move the slider to an allocation of your choosing. If you run the slider too far in either direction,

Here it’s deemed too conservative. When it’s in red it means

Back to our example with the original allocation in place. It’s selected your entire portfolio in seconds.

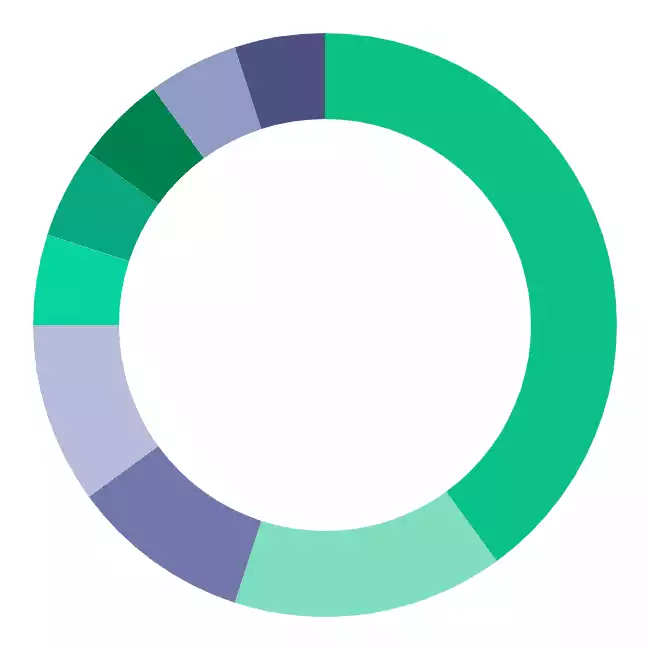

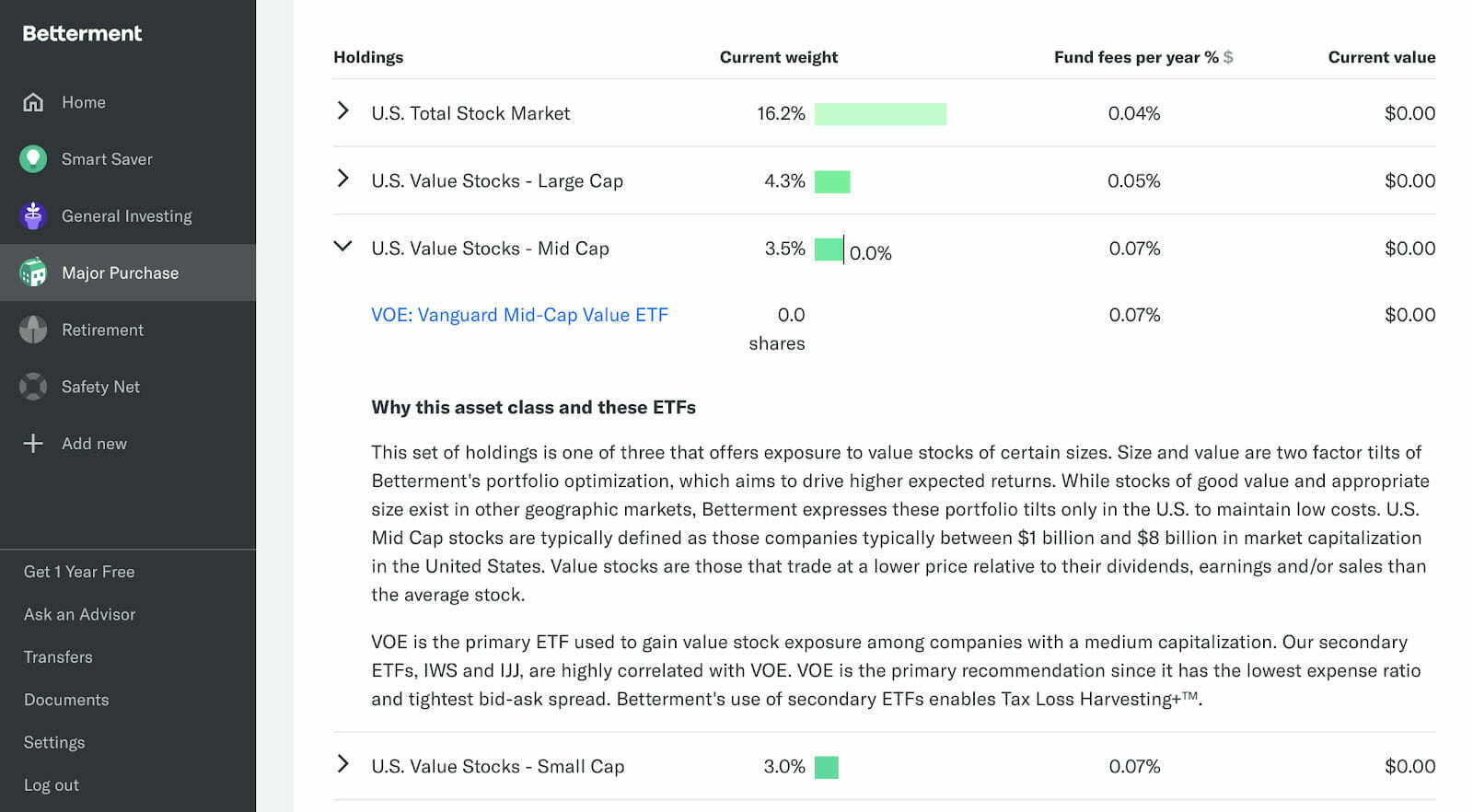

Shazam! Here’s the allocation for the Major Purchase investing goal broken down by asset class. If you’re curious about why they chose those funds, click on any one of them and it gives you a detailed explanation.

All of

Notice at the bottom of the explanation. It reads:

“VOE is the primary ETF used to gain value stock exposure among companies with a medium capitalization. Our secondary ETFs, IWS and IJJ, are highly correlated with VOE. VOE is the primary recommendation since it has the lowest expense ratio and tightest bid-ask price.

For the DIY investors out there, they leave the door open for you to duplicate their methodology because they’re 100% transparent and share their composition for free.

You can even open an account and buy fractional shares for $10 spread across 12 exchange-traded funds in your portfolio.

Because ETFs only have one share class, they’re all-inclusive. This makes it easy for anyone, regardless of how much money they have, to start investing.

For example, some funds break their shares into different classes like Vanguard does with its Admiral Shares and its Investor Shares. Admiral shares have a lower expense ratio (.O4%), but you need $10,000 to take advantage of this share class.

However, you can take advantage of this low expense ratio by buying funds of their ETF total stock market equivalent VTI – no minimum account balance required. This is what they’re talking about when they say ETFs only have one share class.

In the above Major Purchase example, 8 of the 11 funds in that portfolio example were Vanguard – all with meager expense ratios. You’ll have plenty of exposure to Vanguard funds in a

In

“The net effect (of exchange-traded funds) means multiple market forces keep the ETF trading in line with the underlying holdings.”

Costs are kept low!

The Method Behind Their Madness

In a nutshell,

- Uses the Nobel-prize-winning research of Harry Markowitz’s Modern Portfolio Theory from the 1950s which said, “Y’all really should diversify more.”

- Embraced like a warm hug, the tilt toward value and small-cap stocks based on the research of Nobel Laureate Eugene Fama and researcher Kenneth French who said, “Bro, value and small-cap stocks tend to outperform their counterparts (to be read in a Jeff Spicoli voice from the epic film Fast Times at Ridgemont High).”

- Doesn’t try to beat the market because the market can’t be beat (unless you’re a unicorn like Warren Buffett). Instead, they replicate it because the market always goes up motherf@#$%&*! : )

- Knows that we’re all weak, scared humans who worry twice as much about losing money as opposed to gaining it. It’s why they’re focused on mitigating risk.

When

They offer a tax-coordinated portfolio which puts assets taxed at a higher rate in your IRAs, while assets taxed at lower rates go in your taxable accounts. For example, municipal bonds are exempt from Federal taxes, so they go into your taxable account.

This is all done automatically.

How much does

0.25% annually. No additional trading fees. No additional transfer fees. Unlimited rebalancing. That comes out to $2.08 a month on a balance of $10,000.

And if the thought of not talking to a human scares you, don’t worry.

But for those of you who want to answer a few questions and slide the glide path to determine your risk level and have your customized, globally diversified, tax-coordinated portfolio spit out to you in a matter of minutes, then head on over to

It doesn’t get any lazier than that.

Final Thoughts

Lazy portfolios are a thing of beauty. Their only job is to mirror the index they track. There’s no running around trying to time the market or beat the market by picking individual stocks.

Before robo-advisors like

Now things are different. It’s a no-brainer. You can set up an account in under five minutes and have a custom portfolio growing your wealth without ever having to get off your couch. Now, pass me that joint already.