The most important component of successful investing is time. The longer your money is invested, the more it will grow. This means you need to start investing right away – like the second you finish reading this article type of right away!

And there are lots of ways to invest. Some of them are riskier than others like day trading and cryptocurrencies. Some of them are easier than others like ETFs and mutual funds.

Because time is of the essence, you don’t have time right now to learn enough to successfully target individual stocks to invest in.

You need a quick and relatively foolproof method of investing, something any American can do with whatever amount of personal finance knowledge they have right this minute without hiring an investment advisor. ETFs and mutual funds both fit that bill.

But is one better than the other? Is there any difference when it comes to an ETF vs. a mutual fund? We’ll break down all the details so you can stop wasting time and start investing.

Small Differences are Still Differences

We know that you’re chomping at the bit to start investing and in your hurry, you might think that ETFs and mutual funds are the same things, so it doesn’t really matter which one you choose.

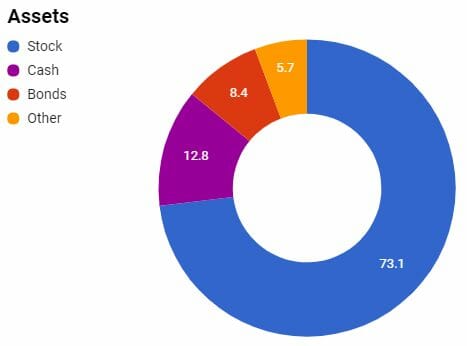

Both an ETF and a mutual fund can give individual investors a low fee, well-diversified portfolio of stocks, bonds, and other assets.

But there are some key differences, and when you understand those differences, you’ll be able to make a more informed decision when it comes to choosing the best kind of investment for you.

What is an ETF?

ETF stands for Exchange Traded Fund. It’s a fund that can be made up of stocks, bonds, commodities, or other assets that are designed to track a particular index like the Dow Jones, NASDAQ-100, S&P 500, etc.

Just like stocks, ETFs trade daily on stock exchanges and their prices fluctuate across the day. When you buy a share of an ETF, you’re buying shares of a portfolio that tracks the yield and return of the index it tracks. ETFs don’t aim to beat their tracked index’s performance, just to replicate it. An ETF isn’t trying to beat the market but to be the market.

What is a Mutual Fund?

Mutual funds allow individual investors to invest a pool of money with fellow investors to buy a “basket” or portfolio of stocks, bonds, or other securities. The price of a mutual fund is determined by the total value of the assets in the portfolio.

Mutual fund managers make decisions on buying and selling securities with the goal of beating its benchmark, an index like the ones mentioned above, Dow Jones, NASDAQ-100, S&P 500, etc.

Hands Off or Hands On? ETF vs. Mutual Fund

Often when you see a straight up, This vs. That, there is a clear answer, one thing is clearly better than the other. Is that true when it comes to an ETF vs. Mutal Fund? Let’s break it down.

Hands Off ETF’s

ETFs are usually passively managed. Rather than having a fund manager select individual securities to build a portfolio, the investments are automatically chosen to match an index or part of the market.

This is part of the reason ETFs have a lower expense ratio compared to mutual funds. An expense ratio is how much of a fund’s assets go for paying administrative and operating expenses.

Not paying a fund manager to actively manage a fund means ETF investors will pay fewer fees than will mutual fund investors.

ETFs trade like stocks. The price is determined by what investors think the market value is and you can buy and sell shares throughout the day.

Mutual funds, on the other hand, can only be bought and sold after the stock market closes at the end of the trading day and the price is based on Current Net Asset Value. So ETFs are more flexible than mutual funds.

ETFs generally disclose their holdings every day while actively managed mutual funds only do so quarterly or semi-annually.

Hands-On Mutual Funds

If someone’s job is investing other people’s money, they must be good at it, right? They wear a fancy suit and work out of a fancy office. They surely know better than us amateurs right?

Most mutual funds are under professional management. A fund manager tries to beat the market by hand choosing individual securities based on their expertise. This practice is known as active management, and it comes at a cost.

Well, so what? If portfolio managers and getting mutual fund investors higher returns, it’s worth the cost.

But do actively managed funds outperform the market? No, they don’t.

For the 15-year period of April 1, 2001, through March 31, 2016, only 29% of actively-managed U.S. large company funds were able to beat the S&P 500 Index.

So far this has been pretty one-sided in favor of ETFs but here’s a point in the mutual fund column. You can trade mutual funds without paying a commission. That’s not true of most ETFs, and the ones that are commission free will have higher expense ratios to make up for it.

Pick the right mutual fund though. Front-end or back-end load paid when buying or selling is about the same thing as paying commission. There are no-load funds you can buy and sell with no broker commissions.

Get our best strategies, tools, and support sent straight to your inbox.

It’s the Taxes Dummy

Taxes and interest are two of the most significant expenses in life, so we want to (legally) avoid them both when we can. If you’re looking to avoid taxes, specifically capital gains taxes, ETFs have an advantage over mutual funds.

A person doesn't know how much they have to be thankful for they have to pay taxes on it.

Tweet ThisWhen you invest in an ETF, you only incur capital gains taxes when you sell the fund. Mutual fund investors will pay capital gains taxes when the shares within the fund are traded during the life of the investment.

Which is Best for You?

We always encourage everyone to invest, but some people don’t because they think you have to have a lot of money to do so. Not true! There are ETFs and mutual funds that don’t require a big initial investment but ETFs generally have lower initial investments than do mutual funds.

Both ETFs and mutual funds allow investors to diversify their investments in relatively low risk (all investing comes with some risk) way. Which you choose depends on your investment strategy.

I hate those kinds of answers. “Well, they’re both great in their own ways.” It’s like when you ask a parent who their favorite child is. They all have one but they won’t admit it and give some bs answer. (I know this is true because my parents told me I’m the favorite!). So here is the non-bs answer.

ETF

If any of these apply to you, you should consider an ETF:

- You’re an active trader

- You want exposure to niche markets

- You want tax efficient investments

If you’ve been with LMM for a while, you’re probably familiar with Vanguard. We talk about Vanguard index funds but Vanguard also offers commission-free ETFs.

Mutual Funds

If any of these apply to you, you should consider a mutual fund:

- You want variety (there are countless types of mutual funds to choose from)

- You’d prefer automatic investment options (you can set recurring transfers into your mutual fund)

- You believe in the ability of a fund manager to beat the market

If you have a 401k through your employer, you may be familiar with Fidelity. Fidelity provides 401k retirement accounts for businesses and is one of the best known mutual fund companies as well.

If you want to invest in an ETF or mutual fund, Morningstar is a good place to research either. They rate both with an easy to understand one to five-star basis, one being poor and five being the best.

That’s the ETF vs. mutual fund smackdown. They have more similarities than differences and the important thing is that you’re investing so you can comfortably choose either. Both are easy, low-risk ways to invest your money and diversify your portfolio.