So, you’ve got your debt under control, and you want to know what’s next? That’s great because investing is where real wealth is built.

In this guide, I will explain in excruciating detail exactly what I think you should do with your money. It’s a conservative investment strategy, diversified and should clock you in at over 7% a year on average.

All you need to get started is $100 and the determination to stay the course in good times and in bad.

Like all great courses, there are some prerequisites. While I can’t stop you from reading the guide now, I would like to stop you from having to read it multiple times OR misunderstanding my points and making mistakes.

For you to get the most out of this article and plan your investment strategy, you will need to have read and understand:

- An Introduction to Simple Investing: Why don’t you stuff all your cash in a mattress? What’s healthy diversification? Why are savings accounts a waste of time? Why do the markets crash, and can you use that knowledge to your advantage?

- An Illustrated Guide to Investment Types: You should never invest in something you don’t understand. In this article, we explain how things like Stocks, Bonds, and ETFs work and what roles they will play in your portfolio.

- Protect Yourself From Greed: This article will teach you how to avoid timing the market poorly and how to prevent greed from torpedoing your investments.

One last thing before we begin.

If you have ANY debt that is not a Mortgage or a Student Loan, you should NOT be investing. Why? Because mathematically, it makes no sense. The goal of your investment strategy should be to build wealth, not diminish it.

If you do have debt, it’s not the end of the world as we have some excellent resources to help you.

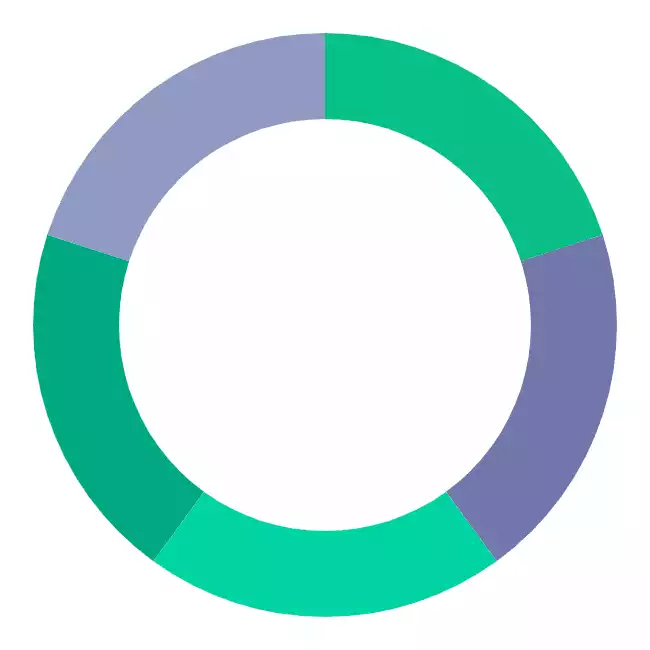

We also discuss this on the show. And here’s our updated v2.0 approach which is more focused on your core financial accounts and less on investment-specific ones:

The Core Components

Before we can discuss your investment strategy further, we need to go over a few terms and what they mean. We’ll be using these terms throughout the guide to simplify the discussion a bit.

If you have any questions or doubts about their definitions, then just roll on forward to the four rules that follow, which will explain the meanings and our investing mindset in more detail.

Checking Account

Otherwise known as our working capital. That is the cash needed to cover your expenses from monthly purchases plus 150% extra for breathing room.

So, if you spent $2,000 a month on stuff, your checking account should always have $5,000 in it ($2,000 x 2.5 = $5,000).

Until you reach your working capital goal, you won’t be able to proceed into building out your investments. If you want to buy a TV, you only ever take the cash out of your working capital, never your investments or Emergency Fund.

So, if you need $4,000 for a TV, then you must grow your working capital to $9,000 before you can do it ($5,000 + $4,000 = $9,000).

Savings Account

This account doesn’t exist because we know that interest wise there is virtually no difference between a savings account and a checking account. If you read An Introduction to Simple Investing, you would know this.

Imagine that in ditching your worthless savings account, you split its old purpose between your checking account and your Emergency Fund. That’s what we’ll do, and it will simplify your life while boosting your overall returns.

Emergency Fund

We consider this our “safety net.” It will only be tapped in an emergency. I won’t go and tell you what an emergency is, but if you’re in doubt, click here. How often do emergencies happen? Between 0 and 3 times for your entire life.

If you have frequent emergencies, it’s often an indicator of poor planning. If you blow out the tires on your car, that’s not an emergency and should be easily absorbed by your Working Capital.

If you’re poor or ultra-wealthy, you should fill your Emergency Fund with 6 – 9 months of expenses and then let it ride.

One common trait of wealthy people is that they plan for failures in advance. That is why it’s critical to build and maintain a healthy Working Capital account.

Invest this in a standard, taxable

If you’re unsure about the features of a

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

If you do withdraw from the account, add back whatever you removed before moving back to contributing to your investments.

NOTE: If you have ANY debt that is not a Mortgage or a Student Loan, you should NOT be investing or building an Emergency Fund until that is taken care of. A full Working Capital account should be sufficient for common setbacks, and you can always take on debt to cover a real emergency if it happens before you are fully prepared.

Investments

We’ll use Dollar Cost Averaging to contribute, and we’ll buy and hold regardless of what the short term market looks like.

The Rules of Investing

Now that we have the core concepts in place, I want to go over a few ground rules. If you’re a bit confused, don’t worry, I’ll explain everything.

Rule #1: Don’t Lose Your Money or Your Pants

There are two obvious goals here, don’t lose money and don’t lose everything. That means we’ll need to be vigilant about what we invest in. To do that, we need to avoid overexposing ourselves to risky investments.

What’s a risky investment? Commodities (gold, silver, oil, etc..) are risky, just like investing in an individual company or an IPO. Buying any of these things involves tremendous amounts of research, so unless you are willing to do it, you need to back away from the slot machine.

You’ve been warned.

It’s even more vital that you diversify your investments. We diversify so that any single event doesn’t wipe out our wealth.

Guess what, the crash of 2008 didn’t destroy my wealth because I was diversified. I both worked for Lehman Brothers and was invested in the company, but I turned out fine.

The big secret? Buy a little bit of a lot of stuff Index Funds, Mutual Funds, individual companies, retirement accounts, etc.

Rule #2: Your Emergency Fund Comes First

I can not stress this enough. Your investment strategy must always protect your emergency fund. Once your Emergency Fund reaches $8,000, you’re going to be itching to spend it.

Don’t spend it, except on emergencies. If it’s found in a store, it’s almost certainly not an emergency expense.

Without a stable Emergency Fund, we’ll always be but a few steps away from the poor house. Only withdraw in an emergency.

Beyond that, you’ll need to relentlessly focus on building your Emergency Fund to the proper size. Imagine the storms that you can weather with six months worth of expenses.

Imagine if you were building a skyscraper. Your Emergency Fund is the foundation you build one million floors upon.

Rule #3: Always Accept Free Cash

If there is a 401k, TSP, HSA, or equivalent where you’ll get some free funds from an employer to match your contributions, then you need to be all over that like white on rice.

Does your employer match 5% of your salary? Then you need to contribute 5% of your salary to the relevant retirement account.

Always, no matter what – even if you have debt.

Why is that? Because even on credit card debt, a 100% return is unbeatable. Matching is, at its worst, four times better than the worst credit card (100% return vs. 25% return).

While retirement accounts with matching are the most valuable thing you can do, you need to stay away from employer stock matching programs. They are often pretty illiquid, and it exponentially increases your risk.

When you have stock in your company, if your company goes down, so do your savings. Few exceptions may be companies like Apple and Google, but even then, I’d be nervous and stay away.

Rule #4: Give Yourself Some Respect

You’re not some chump, so don’t act like one. Your future self isn’t a chump either, so it’s even more important not to screw the future you. How do you do that?

Don’t belittle yourself, your work, or your time. Since you spend time working, you need to continually focus on being more effective.

By belittling yourself, you tell yourself that you can’t meet your goals, that the road is too long and far. Well, guess what – the road is too long and too far.

So, if you’re not up for a challenge, just roll up in a ball and hide. Or, step up to the plate and be the person you were destined to be. All winners started as losers.

By belittling your work, you prevent yourself from getting the experience you need. You can always increase your salary through a new job, but you can’t create an experience out of thin air.

Take pride in doing your job well, even if the job or company sucks. The first step to doing better is always to learn, so if you focus on that, you’ll do all right.

Finally, you can’t belittle your time by throwing away all that you’ve worked for. Want to spend your Emergency Fund?

You’re just shitting on all the time you’ve spent working towards a secure future. The Emergency Fund is not for taking a vacation or buying a computer.

Have some respect for your efforts, don’t be a self-saboteur.

Get our best strategies, tools, and support sent straight to your inbox.

Building the Emergency Account

Until you reach $25,000 in your Emergency Fund account, all you will focus on is building up your Emergency Fund.

However, as part of our investment strategy, we will not build this account at all if we have any credit card debt or any other type of debt, excluding a Mortgage and Student Loans.

If you have a Student Loan, I strongly suggest you pay that down first. However, it is debatable whether it’s an emergency or not.

The process in which we build our account will be Dollar Cost Averaging. That means that we will contribute a fixed amount of dollars every month, and this number will never drop.

If you have $500 extra cash a month, then at least $250 of that should be auto-deposited in your Emergency Fund. Doing so will allow you to avoid poorly timing the market and slowly but steadily grow your Emergency Fund.

Consistency is more important than the percentage of income you contribute. If all you can do is $50, then as long as you can do it every month, it will still add up quickly.

Where does this emergency fund live? The emergency fund account is a highly liquid medium to low-risk investment account.

That means that as we get about $8,000 into funding the account, you’ll notice that it will start earning meaningful amounts of money on its own.

It makes no sense to keep extra money in a savings account as you will earn next to nothing. We can debate this all day, but the pros outweigh the cons.

What is a low to medium-risk investment? A series of diversified index funds that consist of companies across the world and a certain amount of bonds to reduce your risk even further.

Our favorite tool for this job is

I don’t want to go into it too much as we’ve already said so much about it, but if you want to hear it on our podcast, we talked about it in Episode #77. If you want to read about it, check out our Betterment Review.

All Hail Vanguard

So, you’ve packed a cool $25,000 into your Emergency Account? Now it’s time to diversify your investments further and take on a little risk. What we’re going to do is build investments that grow at a stronger pace than our Emergency Fund.

Once our Emergency Fund is full we will divert our monthly Emergency Fund contributions to our Investment Account, steady as she goes.

First, why Vanguard? Two reasons, they have the lowest fees in the game, and you are their top priority. Vanguard, the company, is owned by its funds.

That means that when you invest in one of their funds, you’re also a part-owner of Vanguard.

Vanguard is a very prestigious company with a solid history of its funds growing exceptionally well. If you want to know why low fees are so important, check out what fees do to a 401k account as well as Vanguard’s explanation.

I’ve gone ahead and researched these funds for you; however, I don’t want you to take my word for it, so I’ve included my thoughts along with some compelling research.

You can find my picks in the next section, but If you want to pick your own, here are their key fund lists:

- https://investor.vanguard.com/mutual-funds/target-retirement/

- https://investor.vanguard.com/mutual-funds/vanguard-mutual-funds-list?&assetclass=sec

- https://investor.vanguard.com/mutual-funds/vanguard-mutual-funds-list?assetclass=stk

Opportunity Fund

As our good friend, Warren recommends, “Be greedy when others are fearful.” When the proverbial shit hits the fan, that’s when we move in and invest.

Remember in 2013, when Tesla cars were catching on fire? That’s the kind of fire-sale we love to buy.

The problem is, to take advantage of opportunities like this, you need some cash on the sidelines ready and waiting. That’s what the Opportunity Fund is for. We went into depth on Opportunity Funds in a previous episode.

The size of the fund is more based on personal preference – there is no wrong size. The more pessimistic you feel about the economy, the more you should pad your Opportunity Fund.

Typically we might not keep much more than the size of our Working Capital account in here, but, as we get closer to a correction, the account size balloons closer to the size of our Emergency Fund.

We recommend that you put this in

- It’s easier to keep this money closer to your other investments. After a crash, all you need to do is transfer it over to your primary investment account or, you could use it to replenish your Emergency Fund if it winds up getting used.

- The account’s return will dynamically adjust based on US Treasury yields, which make up roughly 80% of the account’s holdings. That will pretty much guarantee that you’ll have a competitive return as compared to a typical savings account.

- During times of panic, people rush towards US Treasuries since they are universally considered the lowest-risk investment available. As a result, when it comes time to use your Opportunity Fund, you may find the balance much higher than you remember. For example, Vanguard’s long-term bond fund, rose 20% in price in 2008. In this regard, a Safety Net Opportunity Fund could easily be considered a win-win when there is a market crisis.

My Vanguard Picks

I encourage you to do your research, but I think these funds are a great place to start – or at least a benchmark for better funds that you may find on your own.

I’ve put the least risky at the top and the riskiest at the bottom. I also recommend you check out our full list of Vanguard funds that you should own.

1. Vanguard Target Retirement 2050 Fund

(VFIFX) (MorningStar) (Fee: 0.18% & 5 Year Return: 18.46%)

This fund will start with mostly stocks and slowly taper into bonds over time. The point is you take on risk now while you’re young and slowly reduce risk as you reach retirement age, so big market swings don’t wipe out your retirement money.

2. 500 Index Admiral Shares

(VFIAX) (MorningStar) (Fee: 0.05% & 5 Year Return: 18.38%)

That is the fund that made Vanguard famous. Invest in 500 of the biggest baddest companies around. Large-cap funds like this serve as a core component in many investment portfolios including the Coffeehouse Portfolio, Ivy Portfolio, and the Golden Butterfly.

This portfolio is a modified version of the Permanent Portfolio with one additional asset class. This is done to incorporate some of the characteristics of a few other notable lazy portfolios.

3. REIT Index Admiral Shares

(VGSLX) (MorningStar) (Fee: 0.10% & 5 Year Return: 22.70%)

Why own a property and rent it when your money gets stuck in the home, and there is so much work to be done? Instead, invest in a REIT and take rental profit and liquidity.

It’s not just a REIT but a fund of many REITs, so you’re heavily diversified in the rental game.

4. Growth Index Admiral Shares

(VIGAX) (MorningStar) (Fee: 0.09% & 5 Year Return: 19.27%)

Vanguard’s attempt at picking high growth companies that will knock it out of the park for you. It’s a bit riskier, but the returns are generally pretty solid. Check the graphs I linked to above and judge for yourself.

5. Strategic Equity

(VSEQX) (MorningStar) (Fee: 0.29% & 5 Year Return: 22.69%)

Like the Growth Index fund but smaller companies, potentially higher growth and a large portion of the fund’s composition is chosen by a computer. The fee is the highest here because proportionately the most amount of work goes into running this fund.

0.29% isn’t a big fee by a long shot, but I do think it’s important to note. Also, again, this one’s the riskiest of the bunch. Of your Vanguard investments, I wouldn’t make this one more than 10% of the total amount you invest.

Juicing Returns for the Advanced Investor

If you have $100,000 or more invested, then you can start taking on some of the riskiest types of investments if you’re interested.

Risky investments require a fair amount of research and the right instinct.

There’s no real way of knowing how to pick suitable risky investments. You just need to think about it as much as you possibly can.

Fundrise

You don’t have to purchase a whole property to get involved in real estate investing. Fundrise is an investment platform that makes it possible for just about anyone to get started in real estate investment.

With an initial investment, you can invest in commercial real estate. We did a full review of its platform, here.

Diversify into income-producing real estate without the dramatics of actual tenants. Fundrise eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy.

Disclosure: When you sign up with this link, we earn a commission. All opinions are our own. I am investing with Fundrise

It Ain’t Rocket Science

Nothing I detailed here is confusing or excessively risky (aside from

Why be original when you can just do what works? I’ve stolen this investment strategy from the best by reading and listening to everything they have to say.

Through my relentless focus, I’ve been able to build quite the nest egg. You can do it; you just need to start. The best time to start is now.