- What is Socially Responsible Investing?

- You’re Not a Hippy: Why Should You Care?

- The Opposite Of Socially Responsible Investing

- Does Socially Responsible Investing Make Money?

- SRI Performance

- Less Volatility

- SRI Growth

- SRI Types

- SRI Pros & Cons

- Where Can You Start SRI

- You Can Do Something

- Show Notes

There are a lot of bad things happening around us: climate change, weekly mass shootings, rampant opioid addiction, income inequality. But rather than feeling helpless and frustrated, let’s take matters into our own hands. That’s where socially responsible investing comes in. You can invest in the world you want to live in.

There are two great forces for motivation in humans; sex and money. When promised these two things, humans will adjust their behavior to attain them. This is a money podcast, so that’s the one we’re going to talk about.

Socially responsible investing also called impact investing, ethical investing, or sustainable investing, could be considered the child of a similar movement known as divesting. Divesting means pulling investments out of a company or industry whose business practices you disagree with. It worked on one coal company.

Peabody, the world’s biggest coal company, announced plans for bankruptcy in 2016, it counted the divestment movement as one of the reasons it was unable to raise the capital needed to survive. As if to confirm the diagnosis, analysts at J.P. Morgan and Goldman Sachs have explicitly asserted coal divestment’s causal impact on suppressed Peabody share prices as well as the industry’s de-rating as a whole.

One down. Divesting punishes companies for their wicked deeds. Socially responsible investing rewards companies for their good deeds.

What is Socially Responsible Investing?

Socially responsible investing (SRI) is an investment strategy where you invest your money in companies whose business or business practices align with your beliefs.

An SRI company can be a producer like Solar City, which makes solar panels. It can mean a company that consumes in a responsible way like Apple. Tesla is both, it produces solar panels, and its factories run on solar panels.

An SRI company’s whole driving force should be to create a positive social impact which is the case for Toms Shoes.

Corporate governance also falls under the SRI umbrella. Corporate governance means that employees are paid and treated well which includes things like providing benefits, family, maternity, and paternity leave and have some diversity among its workforce, management, and board and reigning in CEO compensation.

A lot of SRI revolves around environmental impact but more broadly, SRI is not just about being green, it’s also about being ethical, social responsibility, protecting human rights, and making a responsible investment.

You’re Not a Hippy: Why Should You Care?

You don’t have to be a lefty, a hippy, or any other word the Right uses as a pejorative to care about using SRI investing strategies.

Do you live on planet earth? If you answered “Yes”, you should care about SRI.

I’ve become increasingly convinced in recent years that the only kind of activism that matters is that which you do with your money. The votes you make with your dollars count far more than your actual vote which can be rendered null by things like gerrymandering and the outdated electoral college.

When you employ SRI strategies, it incentivizes companies to act more responsibly and encourages better reporting and transparency among corporations. It’s not that “bad” companies do things because they’re evil, although you could argue there are some with sinister motives.

It’s that they’re motivated by money and profits.

If Walmart sees that people are investing in and shopping at Costco based on their business practices, they’ll straighten up.

And last but not least, do it for yourself. You are the choices you make. Your choices should reflect your values.

Get our best strategies, tools, and support sent straight to your inbox.

The Opposite Of Socially Responsible Investing

Sin stocks are the ones you want to avoid when trying to build an SRI portfolio.

A sin stock refers to a publicly-traded company that is either involved in or associated with an activity that is considered to be unethical or immoral.

Sin stocks are generally found in sectors that deal directly with activities that are frowned upon because they are perceived as making money from exploiting human weaknesses and frailties.

Sin stock sectors are things like tobacco, gambling, sex industries, weapons, and alcohol. Don’t threaten me with a good time! That’s not my list. Three out of the five are among my favorite things. New Orleans wouldn’t exist without all five. I don’t believe in sin anyway, so maybe my opinion is skewed.

Clearly, what can be considered a sin stock is open to some individual interpretation. Some consider big ag and big pharma belong on that list.

If you live on planet earth you should care about SRI investing.

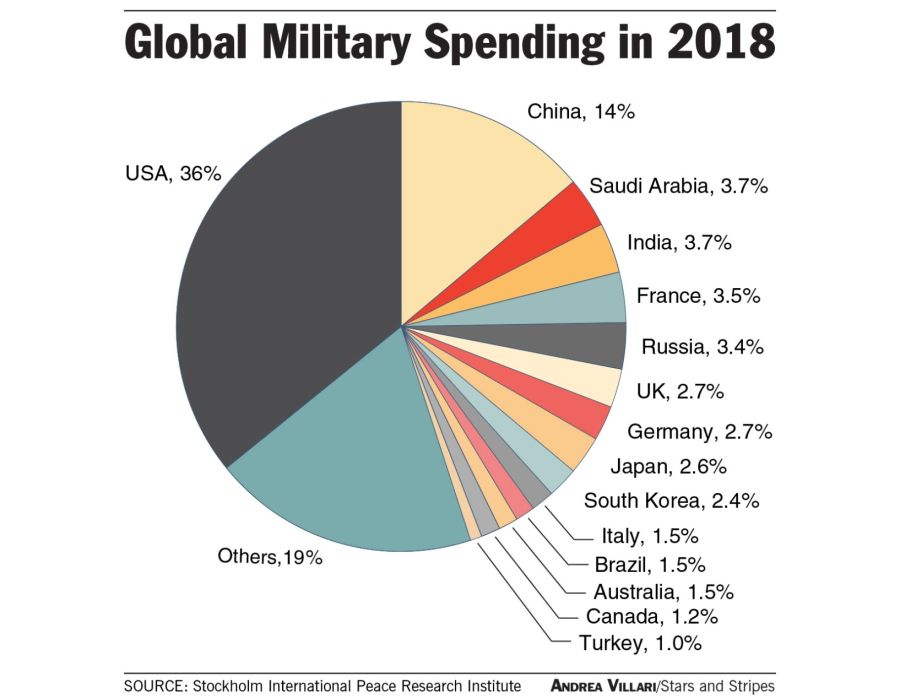

Tweet ThisWhich side of the road your political beliefs fall on can influence your list. A military contractor like Haliburton is on my no-go list, but you might consider that to be a patriotic investment.

Does Socially Responsible Investing Make Money?

Lezbereal. This is a money podcast, we like money, and you like money. So we can preach about how important SRI investing is until the cows or whatever Impossible Burgers are made of come home but if it’s not profitable, no dice. Even the most responsible investors among us want a financial return.

But SRI is indeed profitable!

The first half of 2019 saw sustainable funds in the U.S. with record flows. Flows into U.S. sustainable open-end and exchange-traded funds (ETFs) are on pace to smash the calendar-year record set last year.

Sustainable funds attracted an estimated $8.9 billion in net flows in the first half of 2019, surpassing their $5.5 billion inflows for all of 2018. Flows into sustainable funds have set calendar-year records for each of the past three years and appear headed for a fourth.

Vanguard’s FTSE Social Index Fund Investor Shares had a return of 16.10% compared to 15.27% from the S&P 500 over the last 10 years. This fund is similar to Vanguard’s Total Stock Market fund but the included stocks must meet Vanguard’s SRI criteria.

If you invested in Vanguard’s Social Index Fund, you would have both increased your gains by 0.82% over the last ten years as compared to the stock market AND have invested in a socially responsible fashion.

Win-win!

SRI Performance

Most funds have a relatively short history, but so far, so good!

- SRI funds are keeping up with their non-SRI counterparts.

- MSCI KLD 400 Social Index had a 7.53% average annual return over a 15-year period.

- That’s just below the S&P 500’s 7.77% return for the same period.

Vanguard’s FTSE Social Index Fund has been on par with the S&P 500 over the past ten years.

- Aggregate evidence from 2,200 studies (collected by the Journal of Sustainable Finance & Investment) shows a strong business case for ESG investing.

- 90% non-negative or positive relation for ESG investing.

The growing body of evidence of the success of ESG funds has resulted in several reputable financial companies endorsing ESG investing, including:

- Fortune

- Harvard Business Review

- The Wall Street Journal

- The Financial Times

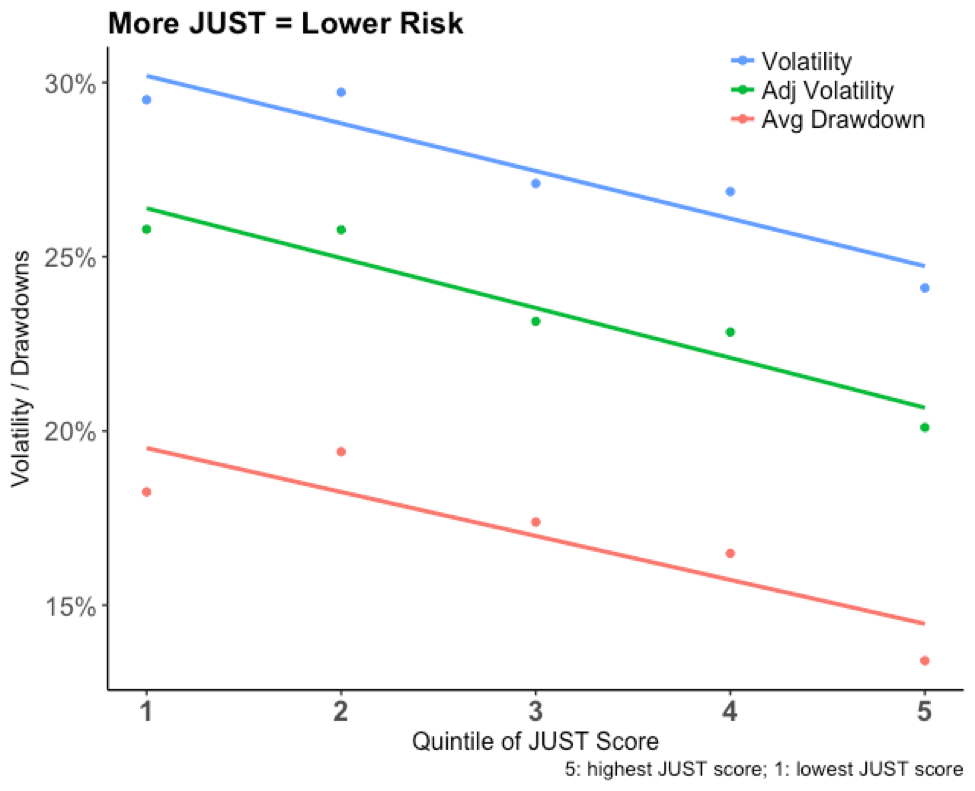

Overall, companies with better ESG-rankings/JUST scores demonstrate lower investment risk.

Yield Differences with Some Top SRI Funds

Some top-ranking fund examples include:

iShares MSCI KLD 400 Social ETF launched in 2006

- The “green” S&P 500 equivalent

- An expense ratio of 0.25% and a total return since inception of 7.82%

Parnassus Endeavor Investor (PARWX)

- An expense ratio of 0.95% with an average return since inception of 11.10%

Vanguard FTSE Social Index

- An expense ratio of 0.18% (again, low-cost leader) with a 15-year average return of 8.36%.

SRI vs. S&P investing with similar returns

- Used five top SRI funds and compares them over a 10-year period with the S&P 500

- For example, the Calvert U.S. Large-Cap Core Responsible Index returned 15.54% while the S&P returned 15.19% in the same period.

On average, SRI investing does carry higher costs because the funds are actively managed

- The fund manager has to carefully vet each company

- Doesn’t rely as heavily on algorithms like index investing

Less Volatility

JUST Capital, co-founded by Paul Tudor Jones, measures and ranks companies on SRI issues so Americans can make informed investment decisions. The company recently published a study in favor of ESG (environmental, social, and governance) investing that found:

- The top quintile of JUST companies have 18% to 22% lower volatility

- 6% lower beta (another word for volatility)

- 5% shallower drawdowns (when they dip they’re 5% less dippy!)

- Nearly half the quarterly earnings-per-share volatility

SRI Growth

- January 2018 saw $11.6 trillion of all professionally managed assets under ESG strategies. That amounts to an astounding $1 of every $4 invested in the United States!

- Passively managed ESG funds are on the rise. Currently, there is $11 billion in assets under management spread across 120 ESG funds globally.

- In the U.S., ESG fund growth is up more than 200% from the previous decade.

- To date, the U.S. has seen $8.9 billion in net flows.

- The total number of open-ended and ETF funds has grown from 130 in 2014 to 279 currently.

- Two hundred additional non-ESG-focused funds are adding ESG criteria to the investment process.

Increasing SRI Availability

- Greater ETF availability and options have been a massive driver for growth and for lowering fees.

- 2014 only had two ESG ETFs focused on U.S. large-cap with 0.5% expense ratios.

- Today there are 47 diversified ESG ETFs covering stocks (foreign and domestic) and fixed-income.

- Broader availability has lowered costs: roughly between 0.09% and 0.4% in management fees

- ESG is quickly becoming mainstream and thought of as common sense to add to portfolio selection.

- S&P 500 rolling out its own ESG index: the S&P 500 ESG Index and will target 75% of the traditional S&P 500’s market cap.

- From the CFA Institute (Chartered Financial Analysts) on ESG: “The CFA encourages all investment professionals to consider ESG factors… and is consistent with a manager’s fiduciary duty to consider all relevant information and material risks in investment analysis and decision-making.”

SRI Types

There are four types of socially responsible investment funds.

Socially Responsible Investing Funds

- SRIs avoid “bad” companies entirely

- They don’t invest in alcohol, tobacco, firearms, gambling, or fossil fuels (e.g., oil)

Environment, Social and Governance Funds

- Not nearly as exclusive as SRI

- Will include a stock if they’re ESG-compliant

- Focus on funds that behave in ethical ways through careful analysis

Environmental components for analysis include:

- Climate change policies

- Greenhouse gas emissions goals

- Carbon footprint/pollution

- Renewable energy

- Water conservation/usage

Nike is a company that meets the environmental component of ESG with a chief sustainability officer overseeing environmental efforts.

Social components include:

- Employee treatment, pay, benefits

- Staff turnover

- Diversity in the workplace

- Employee safety practices

- Is the company consumer-friendly/history of consumer protections like lawsuits and recalls?

Costco is an example with a good social component with better employee benefits and wages.

Governance relates to corporate governance issues and includes:

- Executive salaries and perks

- Salaries tied to long-term business value, not short-term earnings-per-share (EPS) growth

- Transparency with shareholder communication and history of criminal action/lawsuits by shareholders against the company

- Relationships with regulatory agencies (e.g., the SEC)

Starbucks is an example of a company with a diverse board.

Impact Funds

- Similar to ESG but place a greater focus on fund performance

Faith-Based funds

- Adherence to Christian, Catholic, or Islamic values.

- Extremely exclusionary with no wiggle-room

- Limited to what you can and can’t invest in

Some findings seem counterintuitive. For example, a defense company specializing in missile production with a high ESG score would be allowed into an ESG fund.

ESG fund inclusion is merit-based versus SRI, which outright exclude.

SRI Pros & Cons

Pros

- You’re putting your money where your mouth is and investing according to your values.

- It helps support ethical companies.

- You’re investing in a cleaner, brighter future for yourself and the planet.

Cons

- It limits your investment options.

- Not all companies are SRI/ESG compliant – you must perform your due diligence.

- SRI definition is subjective – it depends on your world view.

Where Can You Start SRI

Most of the big robo-advisors offer SRI investment portfolio options, including:

- Betterment

- Empower

- Wealthsimple

- Earthfolio

Andrew and Laura include SRI in their Golden Butterfly portfolio by replacing Vanguard’s Total Stock Market Fund with the large-cap JUST equity ETF by Charles Schwab.

This portfolio is a socially responsible version of the Permanent Portfolio with one additional asset class. This is done to incorporate some of the characteristics of a few other notable lazy portfolios.

You can see how they did it using M1 Finance.

And the DIY Brokers too including:

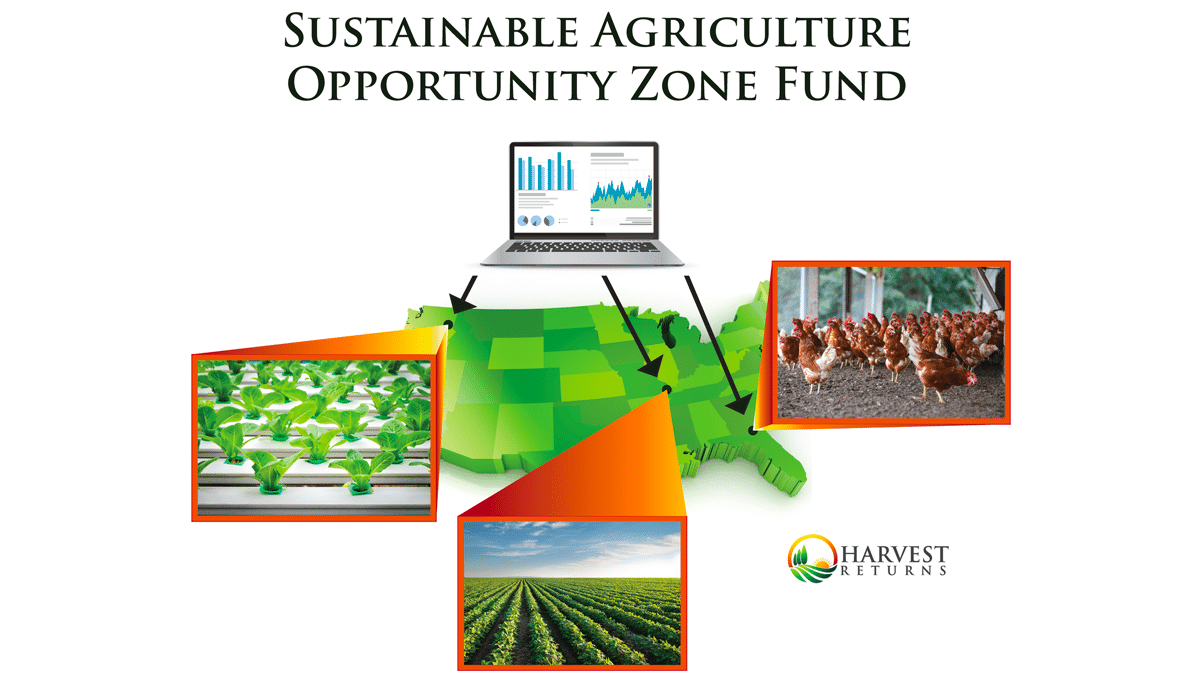

We recently did an episode on Harvest Returns which connects investors and farmers. Harvest Returns offers an opportunity to invest in something called Opportunity Fund Zones.

The investments are in struggling areas and meant to spur economic development and allow for community investing, maybe right in your own community!

Can You DIY It?

Because the definition of socially responsible investing is different for everyone, you may not be able to find investment funds that don’t include stock in companies you find objectionable, or maybe they don’t include specific companies you want to support.

If that’s the case, you can hand-select ESG stocks yourself, but you have to do some research to make sure they’re compliant. Morningstar and Yahoo Finance list a company’s ESG score.

You can also consult Fortune’s Best Companies to Work For, Forbes Just 100 and read employee reviews on Indeed or Glassdoor for the low down on how a company’s employees feel they’re treated.

You Can Do Something

Thanks to Citizen’s United, corporations run America, and most don’t have any sense of corporate social responsibility at all.

The bottom line is, if there’s no money in it, it’s less likely to get done. We have to do it. Socially responsible investing is one way to make corporations act as a responsible, ethical part of society.

Make a community investment by choosing a credit union over one of the traditional financial institutions that took down the world’s economy in 2008. Put your money where your ethics are.

![Universal Basic Income: Is It Just Another Handout? [UPDATED]](https://www.listenmoneymatters.com/wp-content/uploads/2018/01/LMM-Cover-Images-66-768x432.jpg)