- 1. You Need to Start Investing

- 2. Real Estate Investing

- 3. Get That Free Money

- 4. Keep Track Of Everything and Budget

- 5. Be Smart About Debt

- 6. Ask For More Money

- 7. Earn More

- 8. Pick the Right Place

- 9. Mind Your Credit Score

- 10. Don’t Buy Things You Don’t Need

- 11. Avoid Checking Account Fees

- That One Trick

- Ivy Portfolio

- Minimum Variance Portfolio

- Lazy Portfolio

- Permanent Portfolio

- Coffeehouse Portfolio

- Swensen Portfolio

- Larry Portfolio

- Dividend Aristocrat Portfolio

Are you ready to take control of your financial future and embark on the journey to amassing one million dollars? We have a few tried-and-true strategies for creating wealth and achieving your ultimate financial goals. No longer will you be left wondering how to break through the barriers holding you back.

One million dollars is and is not a lot of money, and the first million is the hardest, which is what people mean when they say it takes money to make money. Once you make the first million, your money starts doing the hard work. So let’s get those 1 million dollars!

Unless you hit the jackpot, there are a few decisions you have to make at a relatively young age, and they can help or hinder your progress to seeing those seven figures in your bank account.

1. You Need to Start Investing

Investing is easily the most significant thing on this list. If you want to be a millionaire (or billionaire), this is how you do it. It is the most crucial step in your personal finance journey and the key to financial success.

There is no substitute for time when it comes to investing. The earlier you compound your money, the faster you will make one million dollars.

“On average, millionaires invest 20% of their household income each year. Their wealth isn’t measured by the amount they make each year, but by how they’ve saved and invested over time,” writes Ramit Sethi in his New York Times bestseller, “I Will Teach You To Be Rich.”

In other words, a project manager could earn $50,000 per year and be wealthier than a doctor earning $250,000 per year — if the project manager has a higher net worth thanks to saving and investing more over time.

You don’t need a lot of money or a lot of knowledge about investing to get started. M1 Finance is a great place to start, and there are no minimums, the fees are low, and the process is simple.

If you’re not investing, stop reading this and just get started already. As they say, the only thing more important than timing the market is time IN the market, which is a great easy way to grow your nest egg.

If you want to save on fees and have more control over your investments, then you’ll want to look at a popular investment strategy created by an expert; we recommend the All-Weather Portfolio by Ray Dalio.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

These are a few more investment strategies we’ve covered:

2. Real Estate Investing

We have written a lot about real estate as a great source of passive income, and it is. A

And you don’t need a lot of money to start.

Fundrise lets you invest in real estate. It can be a great way to get your foot on the property ladder before you have the money to buy a

Diversify into income-producing real estate without the dramatics of actual tenants. Fundrise eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy.

Disclosure: When you sign up with this link, we earn a commission. All opinions are our own. I am investing with Fundrise

When you are ready to buy a

In fact, we created a course that focuses exclusively on a laissez-faire approach involving turnkey real estate: Rental Properties for Passive Investors.

You’ll learn our criteria for finding (and closing) the right property, the foundations of a successful rental business, the advantages of shielding your assets with an LLC, market trends, managing cash flow, and much more.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

3. Get That Free Money

An employer-sponsored 401k retirement plan is the first foray into investing for many of us, and it’s an excellent place to do it.

A 401k is a retirement savings plan sponsored by employers, enabling you to allocate a portion of your salary into an investment account before taxes. This money, taken directly from your paycheck and invested before landing in your checking account, grows without being taxed until you begin withdrawals post-age 59 1/2.

This setup is especially beneficial for those tempted to spend readily, ensuring a disciplined approach to savings.

A 401k also lowers your taxable income. For example, if you earn $5,000 a month and invest $1,000 into your account, you are only taxed on the remaining $4,000. Some employers offer to match.

If you invest 6% of your income, for example, the company will match 3%. Even if you have high-interest consumer debt, like credit card debt, you should invest enough to get the match because it is free money!

You can invest up to $20,500 a year in your 401k. Your employer will offer you a few choices of different investments; most plans are made up of mutual funds that include stocks, bonds, and money market investments.

4. Keep Track Of Everything and Budget

What gets measured gets managed, so it’s important to know what is going on in your finances. It won’t matter how much money you earn if you don’t know how to spend that money well.

A budget doesn’t have the magical ability to control your spending, but it can help keep you accountable and show you exactly where your money is going.

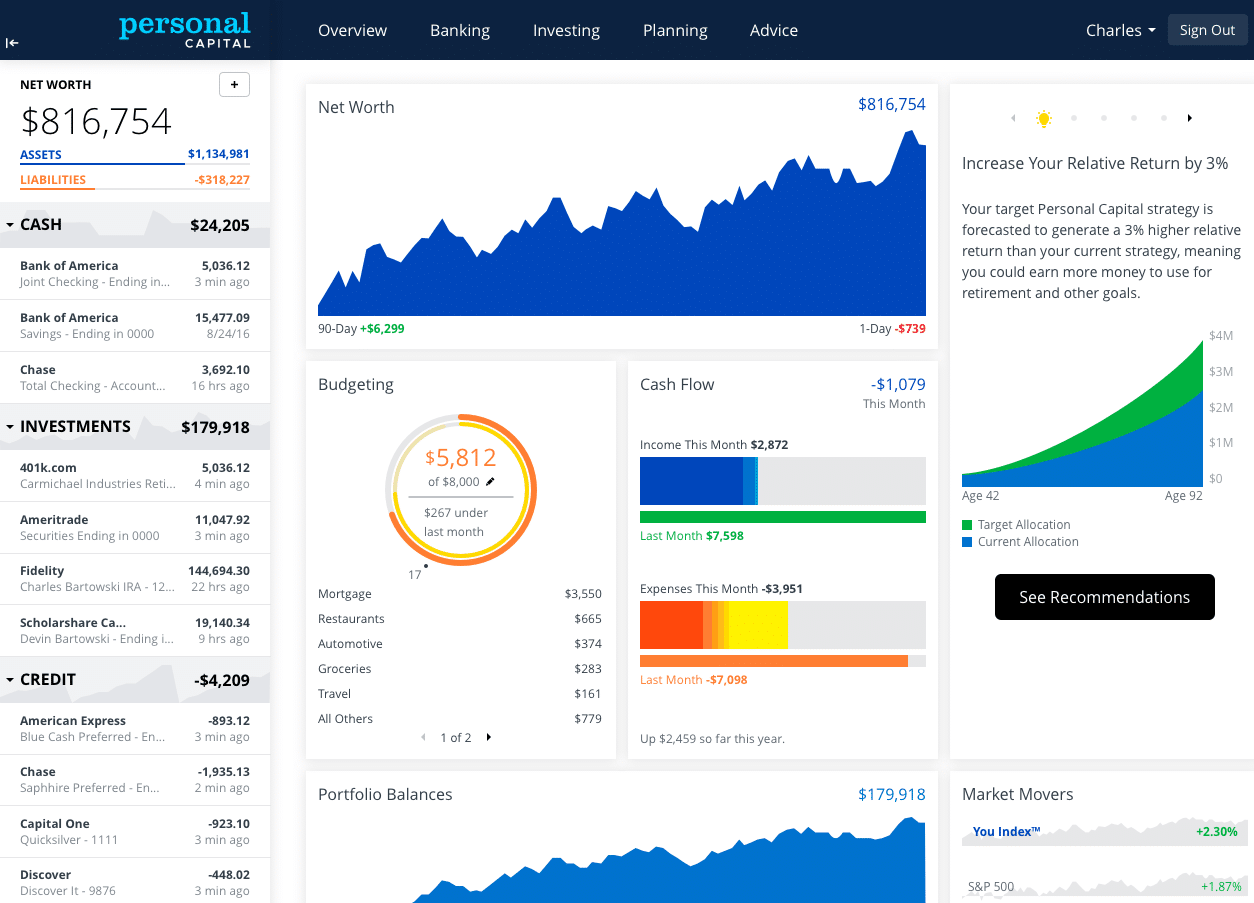

We have you covered if you’re unsure how to set up your budget categories. If you don’t know how to allocate your money, use the 50/30/20 rule. It makes things nice and simple. Personal Captial has excellent free budgeting software.

Manage your cash and optimize your investments in one place. Personal Capital is a great free, easy-to-use platform to manage your money and grow your wealth.

Once you have all your accounts linked, you can also leverage their Retirement Planner to plot exactly what your retirement would look like. Then, using a Monte Carlo simulation, they determine how likely you’ll reach the level of income in retirement that you’re hoping for.

5. Be Smart About Debt

In every life, some debt must fall. That’s not true for everyone, but it’s true for most of us.

There is good debt and bad debt. Good debt is taking out student loans to get a degree in a high-paying field or borrowing money for a down payment on a home, and bad debt is buying stuff on credit cards you don’t need.

And because you’re spreading the payments out over many months or years, you can buy the item you’re financing immediately instead of waiting and saving up enough money to buy it all at once.

On top of that, good debt tends to carry a relatively low-interest rate in the single digits.

But good or bad, we want to pay off debt smartly. If you have student loan debt, you can refinance it for a lower interest rate through Upgrade. If you can refinance with an interest rate just 1% lower than your current rate can save you thousands of dollars over the loan term.

Upgrade offers personal Loans up to $50,000 with competitive and low fixed rates and fast funding. A personal loan can help you eliminate high-interest credit card debt, streamline your credit or upgrade your life with a fixed-rate loan instead of a high-interest credit card.

Should you wait to invest until you’ve paid off your student loan debt? No! Remember, there is no substitute for time when it comes to investing.

Because student loan interest is usually relatively low, 2-4% and the average return in the stock market is 7%, you can make more money investing than you are paying in interest.

Credit card debt, on the other hand, is an emergency. Because the interest is so high, you need to pay it off as quickly as you can. If you have credit card debt, make a plan to pay it off. Just throwing extra money at various balances isn’t efficient.

Use the snowball or stacking method to pay it off quickly and efficiently. You can apply for a balance transfer credit card if your credit is good enough. The card has a 0% APR period, so your transfer balance from a high-rate interest card can be paid off without accruing additional interest.

6. Ask For More Money

Whether it’s from your 9-5 or a side hustle, if you want to make a million dollars, you need to get more money.

Are you being paid what you’re worth? Do you even know how much you should be making? Most employers aren’t just going to give you a raise because you’ve been with the company for another year. If you want a raise, you need to ask for one.

You can find out what people in similar positions in your area are making on sites like Glassdoor and PayScale. This gives you a starting point when it comes to negotiating a raise.

Before you ask for a raise, compile a list of the reasons you deserve one. What have you achieved over the past year, and how has it helped your boss or the company?

While getting a raise is great, it might not mean much more money in your pocket. The average raise is just 3%. If you want to earn more money, you should be changing jobs, and often.

Those who change jobs every two years earn an average of 50% more over their careers than those who stay in the same position for longer.

If you get a new job offer, don’t just accept whatever salary you’re offered, like a supplicant. Again, know what others in similar positions near you are earning and be prepared to negotiate for more money and better perks.

7. Earn More

Most of us are not on the limit when it comes to having the time to make more money outside of our day jobs. If we spend five hours a day watching TV or on social media, we can spend a few of those hours making more money.

And if you want to grow your wealth to a million dollars, you have to.

Everyone should have more than one income stream. We could lose our jobs through no fault of our own, and then what? Even if you have a heart emergency fund, it’s nerve-racking not to have any money coming in.

I'd rather hustle 24/7 than slave 9 to 5.

Tweet ThisYou can aim high and look to be an entrepreneur and start your own business while working full time, but that admittedly takes time to work on it and time before it starts to make any money. It can be worth it, though. Creating a niche website has very low start-up costs.

8. Pick the Right Place

After college, you need to decide where to live. You often have to decide this based on where the jobs are, and the jobs are in cities, and cities can be expensive.

But there are low-cost cities apart from New York and San Francisco, both of which have some of the highest living costs in the world.

Don’t discount smaller, “second-tier” cities when you’re looking for work. And don’t be dazzled by a significant salary offer. I can tell you that even low six figures don’t go that far in New York City, especially if you plan to throw a kid or two into the mix eventually.

In New York City, you’re just scraping by on $80,000 a year unless you live with a roommate or two (or three or four), but in places like Pittsburg, Asheville, and New Orleans, you’ll live like royalty on that kind of money and maybe even $20,000 less.

Before you start applying for jobs, make a list of a handful of cities you’d be happy living in. Next, research sites like Glassdoor and PayScale to see what someone in your job, with your experience level, is earning in each of those cities.

And finally, plug those numbers into a cost of living calculator and pick the top three cities with the best results.

Now you can start applying for jobs in those cities. I know many people want to be in a top-tier city and a city with a lot of work in their given industry, but if you’re going to make a million dollars fast, the cost of living will matter a lot. And the pandemic changed the work scape in many ways. It’s now not that unusual to have a position that is entirely remote which means you can live in a low-cost-of-living area while making big city money.

9. Mind Your Credit Score

A bad credit score will cost you money. How much debt you take on is partly determined by your credit score. When you want to borrow money for a home or a car or start a business, your interest rate depends on your credit score.

The better your score, the lower your interest rate. Having a good credit score makes your life cheaper.

There is no need to chase the perfect 800 score; you only need a score north of 760 to qualify for the best rates.

You can get your free credit score at Credit Karma. While having a good score is essential, you don’t need to obsess about it. It’s vital before you borrow money so if your score is not ideal and you’re considering borrowing money, work on improving it before applying for a loan.

Credit Karma is 100% free and only runs a soft credit check. We use this tool to monitor our credit scores and discover ways to improve them.

Improving your credit score isn’t tricky, and while it doesn’t happen overnight, it happens faster than you might imagine.

10. Don’t Buy Things You Don’t Need

What do you do when you get a raise, bonus, or tax refund check? Do you blow it? If you continuously upgrade your belongings and lifestyle every time you come into more money, you will never be a millionaire.

One common trait of wealthy people (and there is a very significant difference between being rich and being wealthy, you want to be wealthy) is that the wealthy live below their means.

Avoid lifestyle creep if you want to become a millionaire.

Spending well doesn’t mean not spending any money apart from what is necessary. That’s no way to live. But when you do spend your discretionary money, spend it on experiences rather than things.

Don’t buy a new one-hundred-dollar pair of shoes; buy some concert tickets instead. Why? Because it’s been proven that we are made happier by our spending when we buy experiences rather than things. And it makes complete sense.

Experiences become a part of our identity.

We are not our possessions but the accumulation of everything we’ve seen, the things we’ve done, and the places we’ve been.

Buying an Apple Watch isn’t going to change who you are; taking a break from work to hike the Appalachian Trail from start to finish most certainly will.

“Our experiences are a bigger part of ourselves than our material goods,” said Gilovich. “You can like your material stuff and even think that part of your identity is connected to those things, but they remain separate. In contrast, your experiences are part of you, and we are the sum total of our experiences.”

You buy a pair of shoes, great you have shoes. You might even show them off to your friends, who will nod and smile. The first few times you wear shoes, it’s fun! You like wearing them and look good in them.

But eventually, they become just another pair of shoes like all the others in your closet.

But when you buy the concert tickets, you enjoy the anticipation of the upcoming show. You will probably attend the show with another person and enjoy it together, and the concert becomes a happy, shared memory.

Buying experiences is much more satisfying and a good example of spending well.

11. Avoid Checking Account Fees

You might not think of fees when you think of ways you spend money because most fees are automatic; you don’t take out your credit card or cash to pay them. But you are paying them.

If your bank is nickel and diming you, open an account with Upgrade.

Accelerate your journey towards your financial aspirations with Premier Savings. Tailored to align with both your ambitions and lifestyle, this savings account offers an exceptional APY of 4.81% on balances exceeding $1,000. They value your hard-earned money by eliminating any monthly or annual account fees.

There are no fees with their Savings account.

There is no minimum balance, so there is no fee if you fall below a specific dollar amount, no monthly fees, no overdraft fees, and no foreign transaction fees.

While none of us wants to lose money to bank fees, it’s small potatoes when it comes to losing money to investing fees.

Between 401k and IRA fees, you’ll pay an average of more than $350,000 over your lifetime!

Personal Capital’s free tool can show you how much you’re paying in investing fees. It will analyze your investments to uncover where you are paying them (and how much).

Then they’ll find you cheaper alternatives with the same asset allocation. You connect your accounts in Personal Capital, and they do the work for you.

That One Trick

We’re sorry we don’t have that one trick for how to become a millionaire. If you want one million dollars, you will get it through a series of small, everyday actions and decisions. Being a multi-millionaire isn’t only for lotto winners, co-founders of tech start-ups, and Dr. Evil.

You are putting your bonus and tax refund into your Roth IRA instead of blowing it and staying in your small apartment even though you could afford a bigger one. Not buying things on credit you don’t need or have the cash to afford. Don’t invest in something you don’t understand, like Bitcoin.

All of the affiliate product displays in this post were built using our WordPress plugin, Lasso. Check out this detailed review to learn more about how to use it with your website.