I used to worry about losing money in the stock market. I didn’t believe I was smart enough to manage it myself. It turns out; you don’t need to be a stock analyst to invest. You only need to understand a few simple principles, and you’ll do better than most.

This post examines Harry Browne’s Permanent Portfolio, its core components, and why he chose this specific asset allocation. Simply put, if you’re searching for ideas to build your investment portfolio, this post is for you.

What Is the Permanent Portfolio?

The Permanent Portfolio (PP) is a portfolio evenly split between stocks, bonds, gold, and cash. Harry Browne introduced the concept in his book, Inflation-Proofing Your Investments, in 1981.

Mr. Browne designed the portfolio to weather all economic conditions, and historically, it’s performed well.

It’s suited for risk-averse investors wanting to minimize losses while still receiving modest returns (because people hate the thought of losing more than gaining).

Harry Browne said a “portfolio split evenly between growth stocks, government bonds, precious metals, and Treasury bills would be an ideal mixture for investors seeking safety and growth.”

Mr. Browne was an activist, author, and investment advisor. He was also the Libertarian Party’s presidential candidate in both the 1996 and 2000 U.S. presidential elections.

He developed the Permanent Portfolio (PP) while teaching courses in economics and his time spent as an investment advisor. Mr. Browne died in 2006 of ALS.

The Permanent Portfolio Asset Allocation

The asset allocation of the Permanent Portfolio holds 25% in each of these four asset classes.

| Weighting | Portfolio Component | Asset Class |

|---|---|---|

| 25% | Total Stock Market | Stock |

| 25% | U.S. Short-Term Treasury/Money Market | Cash |

| 25% | Gold | Commodity |

| 25% | Long-Term U.S. Bond | Bond |

The even split between the above four categories makes it easy to model.

The Permanent Portfolio (PP) is a portfolio evenly split between stocks, bonds, gold, and cash. It’s best suited for risk-averse investors wanting to minimize losses while still receiving modest returns.

Gold, stocks, and bonds are volatile assets but can move independently of one another. The economic conditions will dictate their movements.

Browne suggests rebalancing annually to ensure your asset allocation doesn’t drift and maintains its efficiency.

A +/-5% or +/-10% rebalancing band is a common strategy employed when doing it yourself. Moving beyond the band’s threshold triggers a rebalancing event.

For example, using a +/- 5% rebalancing band, you’d rebalance anytime the portfolio moved above or below 5% of its target weighting.

The Permanent Portfolio Components

Total Stock Market Fund

Stocks for growth. When there is healthy economic expansion, stock prices rise. A total stock market fund owns all the stocks in the market and tracks an index.

For example, Vanguard’s Total Stock Market index fund follows the Center for Research in Securities Prices (CRSP) total market index, which holds over 3,500 stocks.

A fund like this gives you exposure to small, mid, and large-cap growth stocks and value stocks. Your equity exposure diversifies across the entire market.

Short-Term U.S. Treasury Bills & Money Market Funds

For times of financially distressed markets, cash works well. It’s not tied to what the stock market does, nor is your money locked up.

It’s one reason we suggest having an opportunity fund to deploy when the market is bad.

The U.S. government is seen as the safest investment you can make, which is why putting your money here is virtually risk-free.

Gold

People view gold as an inflation hedge, currency devaluation, and is considered to be a safe haven. It’s also been a store of value for over two millennia.

People like gold. It can move higher when economic conditions worsen. It’s seen as a portfolio diversifier, though a speculative one.

You can hold gold in either a fund, for example, iShares Gold Trust ETF, or purchase directly from a dealer (1 oz gold bullion coins).

Long-Term U.S. Government Bonds

You’re investing in government debt, and because there’s little chance of a government default, it’s considered another safe investment.

You’re loaning the federal government money when you invest in government bonds.

During times of low-interest rates (deflation), bond prices increase, and longer-term bonds see the most significant gains.

Get our best strategies, tools, and support sent straight to your inbox.

The Permanent Portfolio Investment Strategy

The Permanent Portfolio investment strategy uses four uncorrelated assets that respond to market fluctuations in specific ways.

Mr. Browne describes them as the four economic conditions.

Since there’s no way to predict what the market will do, he suggests holding all four in equal percentages to ward off catastrophe, preserve your wealth while generating modest returns.

The economic conditions are:

- Prosperity: Stocks win

- Inflation: Gold wins

- Deflation: Long-term bonds win

- Recession: Cash wins

You’ll inevitably experience both good and bad economies in your lifetime. By accepting that, you build a portfolio that does well in any circumstance.

Don't predict, prepare.

Tweet ThisThe portfolio is meant to profit from any single condition recognizing while one asset may do poorly, the others will do well.

Prosperity

It’s no secret stocks do well in a great economy. Stocks provide growth and outpace inflation. Every portfolio should hold a percentage of stocks.

Public sentiment is positively correlated to increases in the stock market. People flock to equities when things are good, there’s a rising GDP and reduced unemployment.

Deflation

Long-term bonds are designed to handle deflationary periods. Deflation occurs when the price of goods and services decreases. When a proprietor earns less money for his product, costs must be cut.

There’s also an increase in a currency’s purchasing power. With this comes lower interest rates making bonds an excellent asset to hold. Why?

Because as interest rates fall, bond prices rise. New bonds are issued with lower rates, making the older bonds (with, the higher yields) more attractive.

Longer durations mean superior performance due to the bond’s term risk (the length until the bond matures). Long-term bonds are riskier than short-term bonds but can generate higher returns.

Browne recommends U.S. long-term bonds for this reason.

You want to remove as much risk as you can in your portfolio. You can’t control the economy, but you can choose which investments to put in your portfolio.

Inflation

Your money buys less during inflationary periods. Increasing price levels decrease your money’s spending power (and the nation’s spending power).

A high money supply can also cause inflation. When there’s more money in circulation, it can increase spending, which pushes prices up.

In some cases, extreme inflation leads people to move currency into physical assets. Gold has been a safe haven and store of value for over two millennia.

Gold is meant to lessen the effects of a worsening market. It’s many things: a commodity, a currency, and a precious metal.

Fears surrounding whether the U.S. dollar is doing well drive people to gold. If your money buys less than it used to, it might cause you to think the dollar is in trouble.

Mr. Browne saw this asset as the perfect solution to inflationary times.

Recession

The Permanent Portfolio keeps 25% cash-on-hand for when the money supply is tight. This is usually when the market is at all-time lows.

Savvy investors can find bargains because goods are cheaper due to increased selling to free up capital.

Due to its restrictive nature, decreased GDP, and rising unemployment, more people are selling.

Harry Browne recommends holding the cash portion of your portfolio in short-term government debt – specifically, U.S. Treasury bills with maturity dates of one year or less.

You can also choose to place your money in either a money market mutual fund (short-term debt investments) or fund a money market account at your bank.

All of the above are liquid, low-risk options.

Harry Browne and the Variable Portfolio

If you’re not keen on the portfolio weightings, these can be adjusted (and perhaps alternative strategies attempted) in a variable portfolio.

Mr. Browne suggests executing these strategies here because the variable portfolio is the money you can afford to lose.

It’s a place where you experiment with different asset classes or investing styles.

Think of it as allocating 5%-10% of your portfolio to fun money. Suffering a loss here won’t jeopardize your financial goals.

While the Variable Portfolio is the money you can afford to lose; the Permanent Portfolio should be viewed as a retirement account; once the money goes in, you don’t take it out.

As Mr. Browne mentions, “Once you set it up, you’ll never need to rearrange the investment mix–even if your outlook for the future changes. The portfolio should assure that your wealth will survive any event.”

A Fund of Funds

There’s a managed multi-asset Permanent Portfolio (aka a fund of funds; PRPFX), which is slightly more complicated than Browne’s traditional 25% x4 asset model.

The fund of funds holds this allocation:

- Gold 20%

- Silver 5%

- Swiss Franc Assets 10%

- Real Estate and Natural Resource Stocks 15%

- Aggressive Growth Stocks 15%

- Dollar Assets 35%

For those unwilling or uninterested in a DIY investing style, this could be an alternative. Its ability to survive extreme market volatility is why it’s enticing.

However, you’ll pay more in fees for portfolio management. The above fund has an operating expense of 0.84%.

Compare that to 0.12% when building it yourself using M1 Finance. More on that below.

Methodology: Putting It All Together

Each portfolio ingredient responds to economic events in different ways. That factor is what drives portfolio returns and why Mr. Browne saw this strategy as a good fit.

It’s similar to a minimum variance portfolio where you use a combination of asset classes (or individual securities) that don’t move in tandem.

If all of your assets lose value simultaneously (e.g., only investing in a total stock market fund), you’re exposed to massive downside risk.

The Permanent Portfolio seeks to eliminate it.

Permanent Portfolio Returns

The ride will be less bumpy if using this asset allocation. For example, during the 1987 market crash, a 60/40 portfolio dropped 13.4% while the Permanent Portfolio dropped only 4.5%.

Another stat showed a backtest from 1976 to 2016, which generated a hypothetical 8.65% annual return for the Permanent Portfolio while a 60/40 generated 10.13%.

Visiting the Bogleheads forum, you’ll see the Permanent Portfolio built with iShares funds having an 8-year, compound annual growth rate (CAGR) of 7.72%.

William Bernstein wrote an article reviewing the PP’s performance using raw index data from 1964-2010. It showed the portfolio generated 8.5% annually with 7.7% volatility.

A portfolio composed of 60% stocks, 20% long-term bonds, and 20% in Treasury bills, returned 8.8% with 11.3% volatility in the same test.

When comparing the two portfolios, Mr. Browne’s returned slightly less but carried less risk.

Replicating the Permanent Portfolio

Fund Selection

You can use a combination of funds from Vanguard, iShares, Charles Schwab, or SPDR. It depends on your preferences.

You only need four portfolio components to build it. For example, using BlackRock iShares would look like this:

- 25% iShares Core S&P Total Market ETF

- 25% iShares Gold Trust ETF

- 25% iShares 1-3 Year Treasury Bond ETF

- 25% iShares 20+ Year Treasury Bond ETF

You can even buy gold directly from a reputable dealer as opposed to investing in a gold fund.

Treasury bills can also be acquired the same way. Buying through the U.S. Treasury doesn’t incur any fees (with the added benefit of sidestepping broker costs).

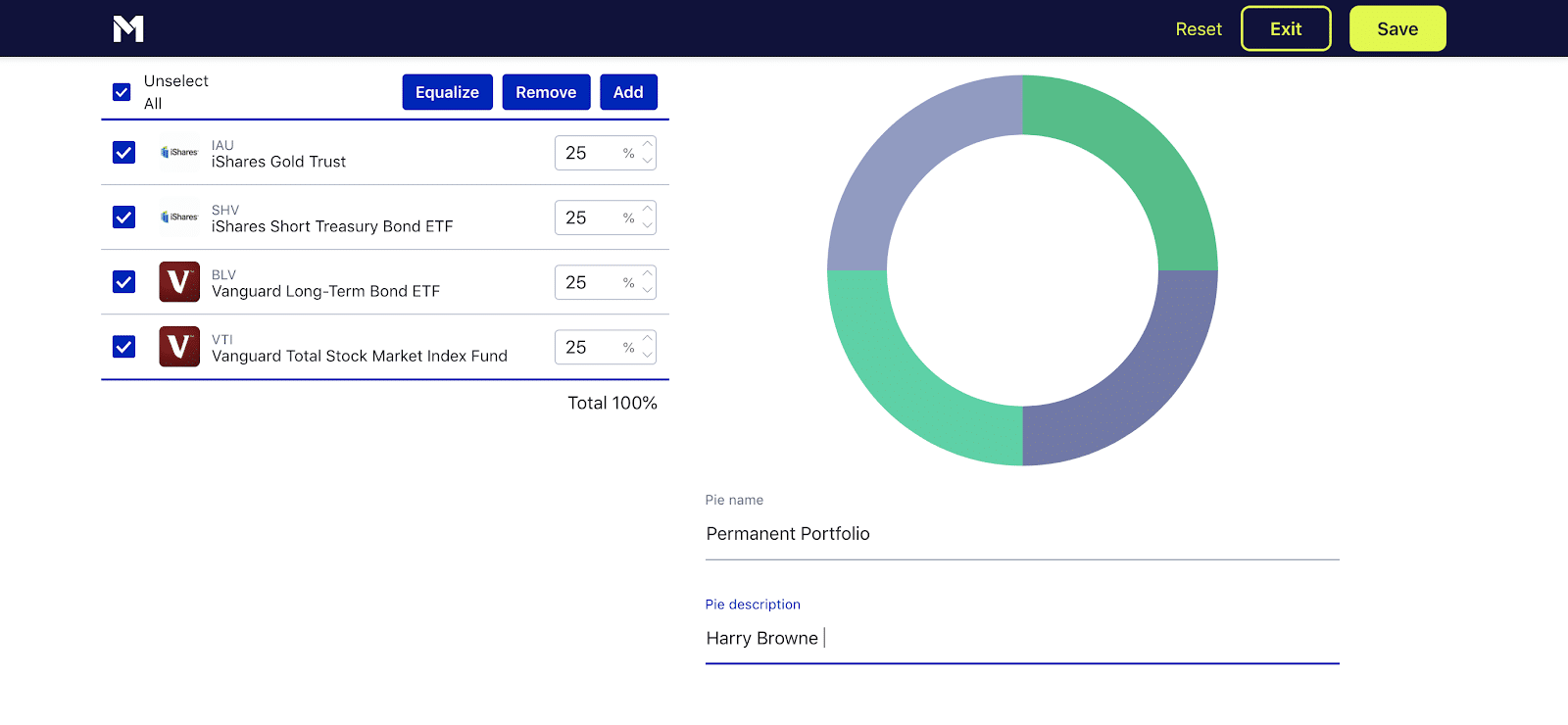

Creating the Permanent Portfolio Using M1 Finance

Replicating Harry Browne’s Permanent Portfolio on M1 Finance provides you with options. I built a simple model using a combination of Vanguard and iShares ETFs.

Mine looked like this:

- 25% Total Stock Market ETF (VTI) Vanguard

- 25% Long-Term Bonds ETF (BLV) Vanguard

- 25% Short-Term Treasuries (SHV) iShares Short Treasury Bond

- 25% Precious Metals – Gold (IAU) iShares Gold Trust

The above is one example of how you could do it. Look for inexpensive funds. M1 Finance doesn’t charge any fees, so you’re only paying the operating costs (expense ratios of each fund).

The Permanent Portfolio (PP) is a portfolio evenly split between stocks, bonds, gold, and cash. It’s best suited for risk-averse investors wanting to minimize losses while still receiving modest returns.

Your portfolio page also displays the total expense ratio for the fund. This fund’s expense ratio is 0.12%

Is the Permanent Portfolio a Good Investment?

It depends on your goals. Risk-averse investors may find comfort in sacrificing returns for less volatility.

Critics of the Permanent Portfolio

One argument is it’s too conservative. If you’re using it as a retirement savings vehicle, your returns could be higher using a different allocation (e.g., one with more stocks).

It also suffers from tracking error regret, or as William Bernstein put it, “attracts assets and adherents during crises, then sheds them in better times.”

Investors concerned with high-performance will most likely not enjoy this portfolio (and most likely sell when noticing how well the S&P is performing).

It’s negatively correlated with interest rates. The macroeconomic trend tilts to inflation. If you’re living on a fixed income during retirement, the price of goods and services increases, which favor a portfolio with a positive correlation to interest rates.

The high percentage of gold is another criticism.

The investment growth rate of gold hasn’t increased much over the past 2,000 years. In their paper The Golden Dilemma, Claude Erb and Campbell Harvey said gold has positive price elasticity, meaning the more people buy gold, the more the price goes up regardless of market conditions.

Because the U.S. no longer uses a gold standard, inflation has been easier to control, making gold irrelevant as an inflation hedge.

An alternative inflation hedge strategy is to use Treasury Inflation-Protected Securities (TIPS).

Note

Roman soldiers’ wages expressed as gold are similar to what the U.S. military gets today.

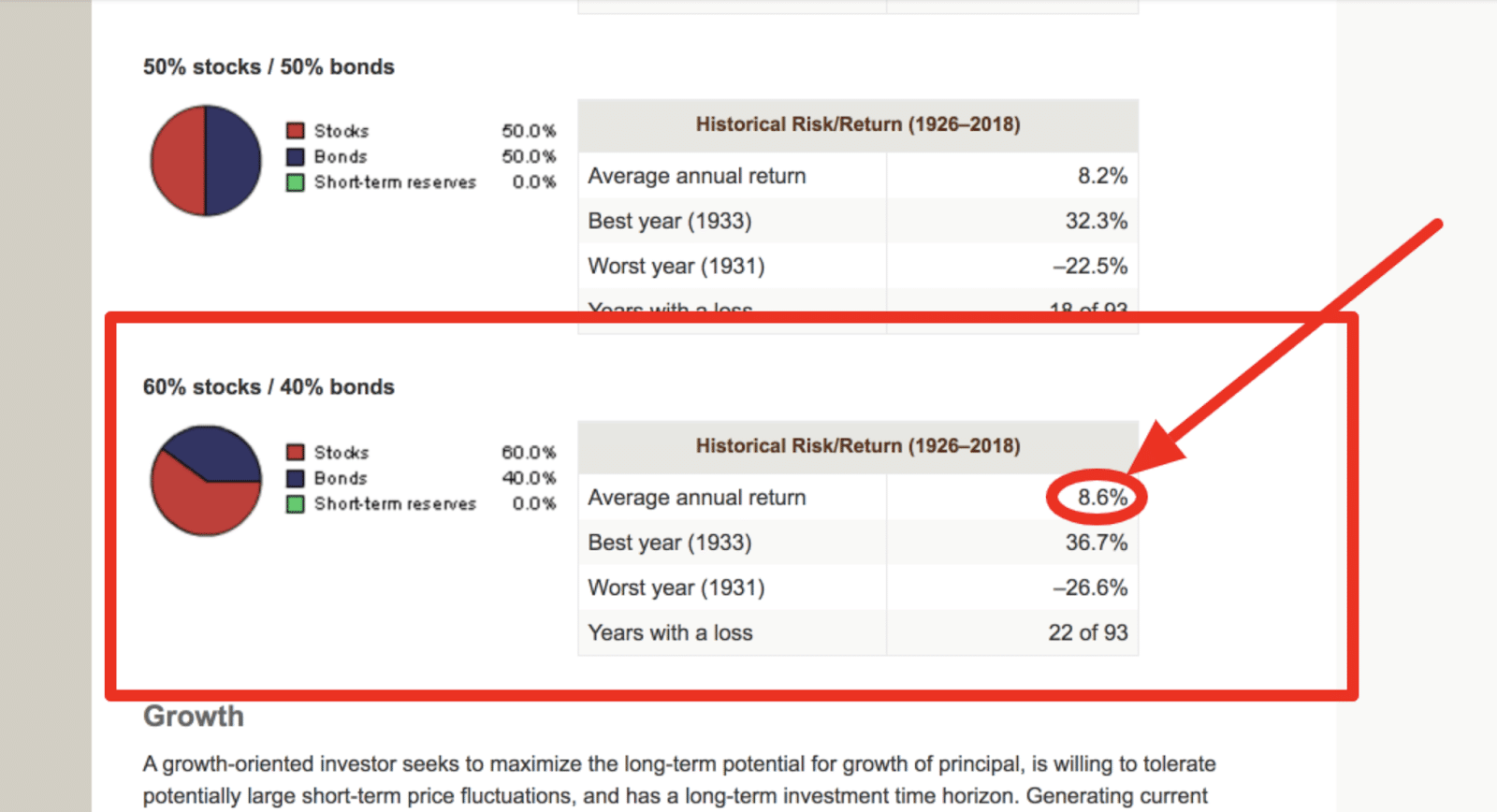

What Is the Average Return On a 60/40 Portfolio?

The average annual return on a 60/40 portfolio is 8.6%, according to Vanguard. This data runs from 1926 – 2018.

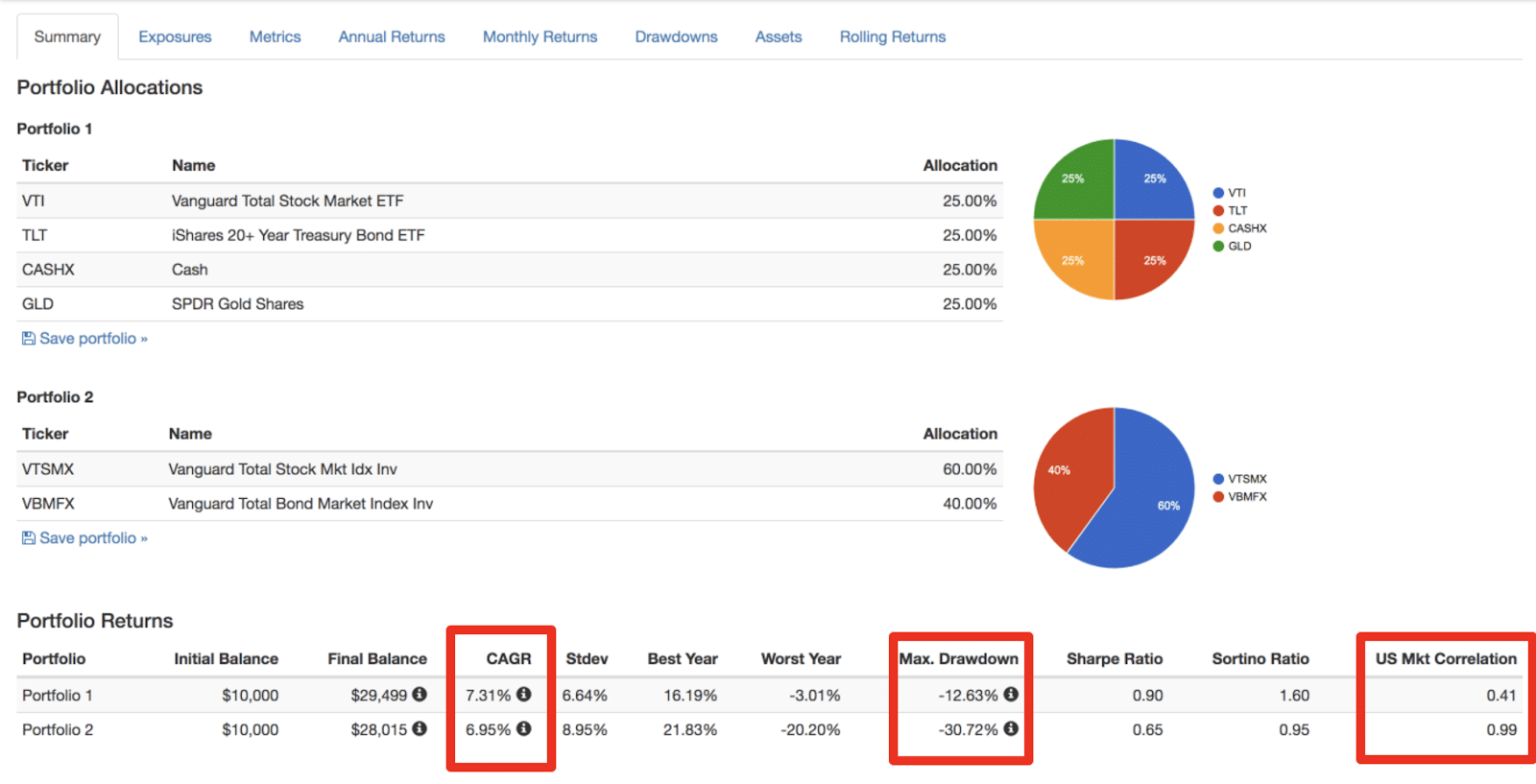

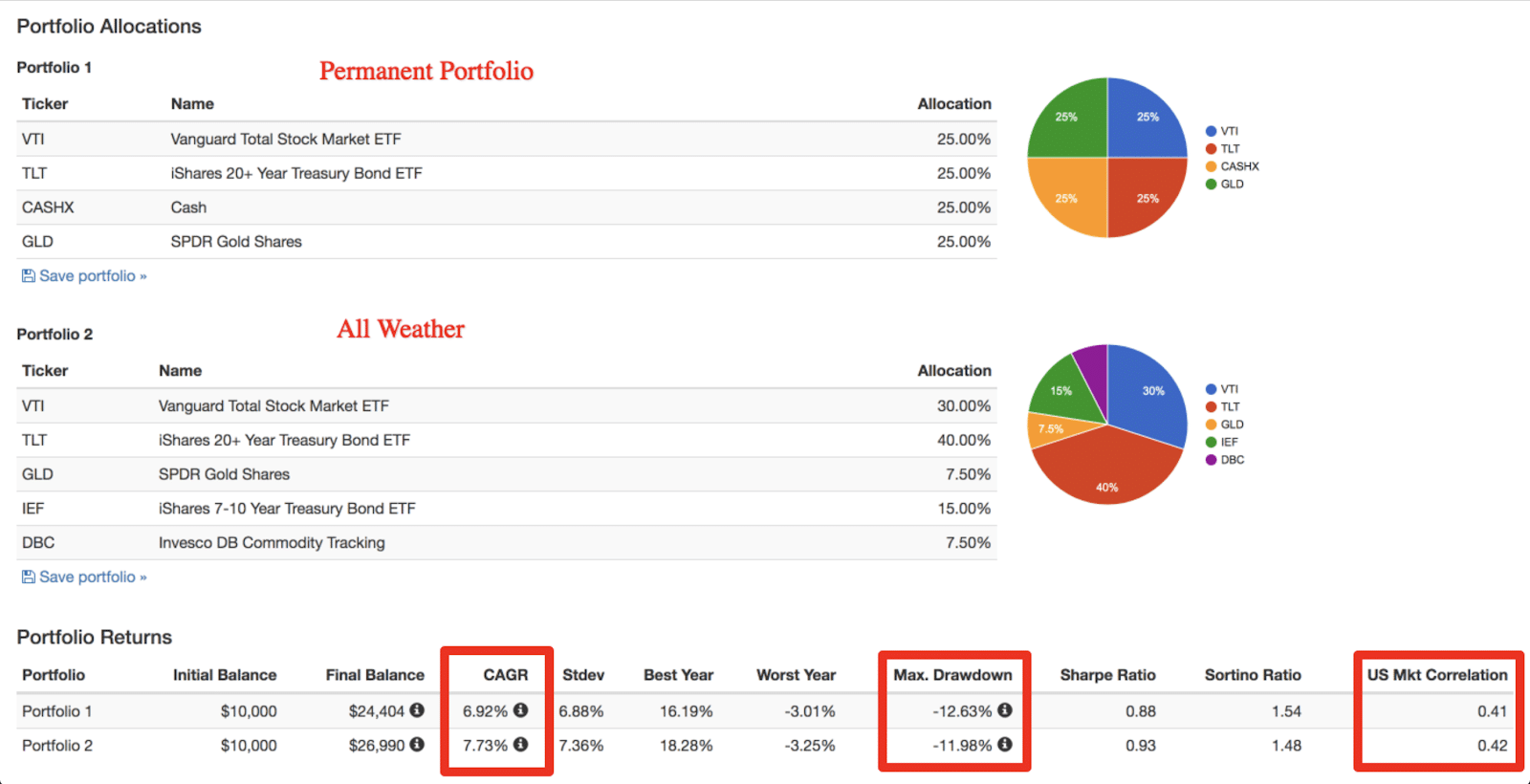

I ran a similar backtest using Portfolio Visualizer comparing the Permanent Portfolio (PP) to a 60/40 allocation (the data only went back to 2004 when using SPDR Gold Shares).

The PP beats the 60/40 portfolio slightly while being less correlated with the U.S. stock market and having a lower max drawdown.

Investors using this portfolio need to realize it’s not a high-growth portfolio and shouldn’t expect 20+% returns similar to what you’ll see in the S&P 500 (but you should expect not to lose 30% when the market gets bad).

Permanent Portfolio vs. All Weather

What about against the All-Weather? In this test, the All-Weather beats the PP slightly (the data here only goes back to 2006 because of using Invesco DB Commodity Tracking).

Both are highly uncorrelated to the U.S. stock market.

These two portfolios are similar in that they’re designed for the risk-averse. Each provides modest returns with less volatility.

The All-Weather carries an extra fund, so depending on the service you use, you may pay slightly more in expense ratios.

Building the All-Weather on M1 Finance carries an expense ratio of 0.1%.

Final Thoughts

There’s no perfect portfolio, but everyone seems to be searching for it. If you’re a risk-averse investor and concerned more with preserving capital, Harry Browne’s Permanent Portfolio might make sense.

The stock market is a wild ride. We all need a little comfort.

As always, consult with a certified financial planner or fee-based fiduciary before executing any critical financial decisions. Data always wins. It pays to know the numbers.