If you have debt, it’s time to tackle it. When it comes to methods of debt reduction, there are many options to consider. Everyone has debt, it’s how we reduce and manage it that sets us apart. But which should you use to get out of debt snowballing or stacking?

Some of the more popular debt reduction strategies include debt snowballing and stacking. But, which is better?

I’m going to tell you right away; monetarily speaking, stacking wins. But nothing is ever that simple. Both methods have their merits and their drawbacks. We’ll take a detailed look at each so you can decide what method will work best for you.

Forty million of us have student loan debt to the tune of $1.2 trillion dollars. Seven million of us are in default on those loans. Credit card debt isn’t much better. We have nearly $1 trillion in credit card debt outstanding, an average of $5,700 per household. Your debt is an emergency, but you can pay it off. There are two ways to do it.

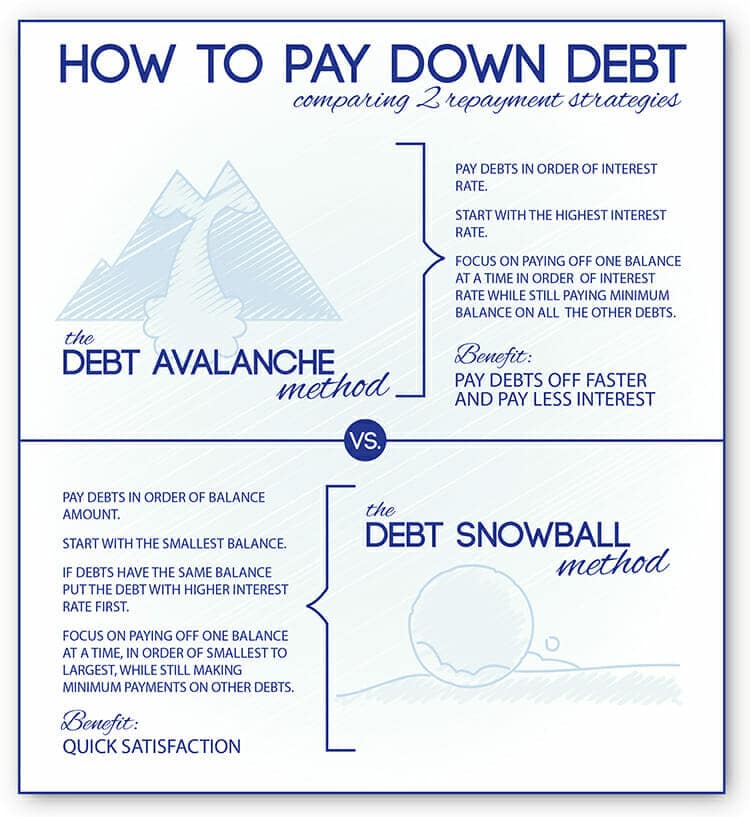

Snowballing Method

Snowballing means listing all of your debts in order of smallest to highest dollar amount and then using any extra money to pay off the smallest balance while only paying the minimums on the others.

If you have a $5,000 student loan at 4% interest, a credit card balance of $6,000 with 17% interest, and a $10,000 car loan with 9% interest, you pay off the student loan first, followed by the credit card and finally the car.

Once the smallest debt is paid, you move to the next smallest using the same strategy and include the amount you were paying on the first debt into your monthly payment on the next.

You continue to do this until all of the debts are paid, the largest being last one to go.

Snowballing Pros

A big pro for this method is the psychological win it provides you. It’s so satisfying to cross a debt off your list. That boost can also give you momentum; you killed that one, you can kill all of these debts! This kind of boost is no small thing.

Snowballing also makes your life just a little bit easier. Each debt paid off is one less payment you have to remember to make, one less check to mail or electronic payment to schedule.

This method is also likely to be faster. Paying off the smallest debt first might mean you can get rid of it in just a couple of months.

Snowballing Cons

It’s a big one; it costs more money, in the end, using the snowballing method. Interest is powerful, and when it’s working against you, it’s working hard.

It also takes discipline to use this method. You free up money more quickly because you’re killing off those smaller debts faster than with the stacking method. What you’re supposed to do with that money is put it towards the next debt on the list.

But you didn’t get into debt because you have steel clad discipline. You might see those extra dollars in your checking account and think it’s more money to spend.

No! Bad! Put it towards the next debt.

Avalanche Method

To use the avalanche method, you list your debts in order of highest to lowest interest rate, regardless of the dollar amount of the debt. You throw as much money as you can at the debt with the highest rate of interest.

If you have the same debts we listed above, they would be ordered this way; the $6,000 credit card, the $10,000 car loan, and finally the $5,000 student loan.

Once each debt is paid, you move down to the next highest interest rate one, again, using the money you were paying towards the last debt, and do the same. So on and so on until all the debts are paid.

This free course outlines a proven framework that thousands of people have used to eliminate their debt, develop better money habits, and start building a secure financial future.

Avalanche Pros

As I’ve written, the stacking method makes the most sense financially. You will pay less in interest if you choose this method. We pay 34% of the money we make over our lifetime to interest. Minimizing that as much as possible is a big cornerstone of being financially healthy.

Avalanche Cons

Stacking’s biggest con is snowballing’s biggest pro. It can take awhile to pay off debts with the stacking method, and it can be discouraging. You don’t get the quick gratification of paying something off relatively fast.

Head To Head: Snowballing Versus Avalanche

Let’s do a real numbers example to show the difference between the two methods:

Our smallest debt is $1000 with an interest rate of 19%. We pay $100 a month. By the time the debt is paid off, we will have paid $97.28 in interest.

Now let’s use the same numbers but this time, $1000 is not our biggest debt, but it does have the highest interest rate at the same 19%. Because we’re throwing everything at this one, we up our payment to $200 a month.

At the end of this debt, we will have paid $50.33 in interest. That’s a big difference; you will be paying nearly twice as much interest if you use the snowballing method versus the stacking method.

But We’re Humans, Not Computers

So if you have debt, which method should you choose to pay it off? Clearly, the stacking method is superior. But that sort of black and white question doesn’t take emotion into account. The psychological victory of banging out a debt is a big deal.

The method that is best is the method that will work for you. The method that you will stick to. You don’t need our approval or Dave Ramsey’s approval.

And choosing one method to get started doesn’t mean you can’t change methods down the road. If your debt seems overwhelming, start snowballing and bask in the satisfaction of killing off a debt or two.

After a few months of this, switch over to stacking for a little while and see if you can keep the same momentum. Chart out how much interest you will be saving in the long run. There is satisfaction in seeing that too. If you start to stall out, go back to snowballing.

There is Help

Whatever method you choose, be sure that you are not adding to your debt. Bailing water out of a boat with a leak isn’t going to keep it from sinking. Now that there is room on those credit cards, leave it there. You must stop using them. You must make a budget and stick to it. Mint can help you with budgeting.

We have designed money mixtapes that will teach you to grow your income, cut your expenses, budget your money, and destroy your debt.

Living with constant money worries is terrible for your mental and physical health, your relationships, and your future. No one has to live that way. There is so much help out there. Just ask for it.

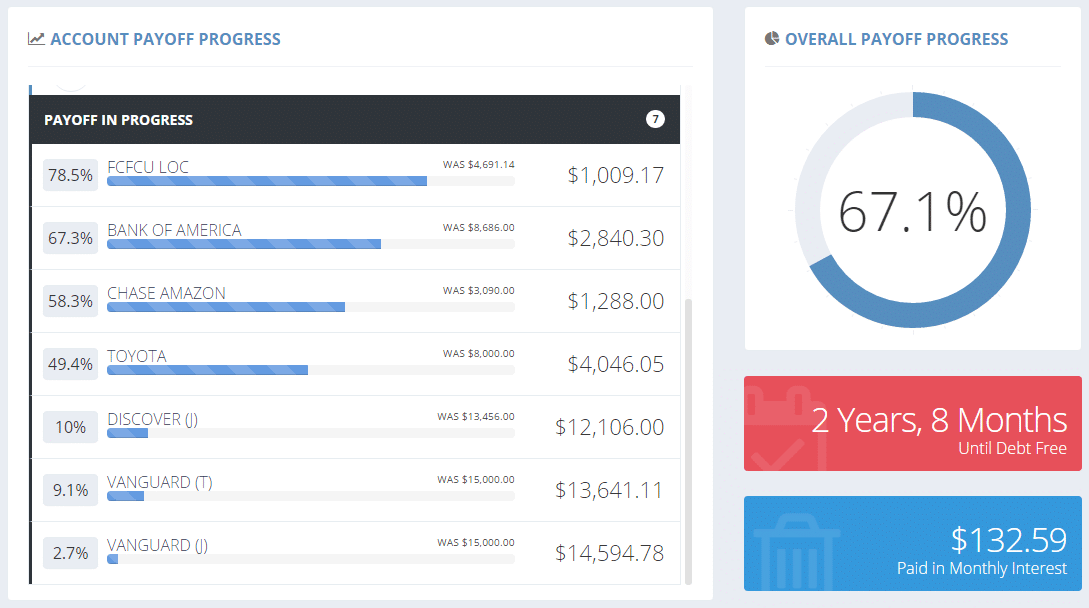

The Many Faces of Debt Reduction

If you feel like you need some extra help to get out of debt, a debt reduction tool may be the best choice for you. These tools can help you track and account for all your debts in one location, and even provide advice on important topics like debt consolidation.

Debt consolidation combines all your debts into one single debt that’s often set at a lower interest rate. Debt settlement tools can help you negotiate with creditors to secure a lower rate for what you owe.

For many people, using a debt reduction tool offers them peace of mind and helps them stay organized. Most people are unaware that you can actually work with creditors on your own to negotiate and settle your debts.

There are several things about debt reduction tools—and debt reduction in general—that you should consider before you decide to get out of debt through restructuring or creditor negotiation. Think about the following:

The effectiveness of debt reduction

When it comes to the effectiveness of snowballing, debt stacking and other debt reduction methods, there are several factors that come into play.

At first glance, it may seem that the lower interest rates that typically accompany debt stacking or debt consolidation are better. However, you will also have to take the duration of your debt into account.

It’s important to decide whether you would prefer lower payments over a longer period of time or higher payments that enable you to pay off your debt in a much shorter time frame.

For most individuals, the prospect of being debt-free is more appealing than having slightly smaller payments that continue for years—or even decades.

Debt reduction and your credit score

If you are struggling with debt, you are probably already aware of the toll that delinquent payments and outstanding debts can take on your credit score. When you begin working on debt reduction, you may be curious about how your credit score might change.

Generally, you don’t have much to worry about when you’re working on debt reduction, but negotiating with creditors for a lower rate could actually have an adverse impact on your score.

On your credit score, this will show up as an account that’s classified as “settled,” a status that indicates that you paid back less than the full amount of the debt.

What You Can Do in the Meantime

Aside from debt stacking and snowballing, there are some other steps you can take to limit the amount of debt you accrue and gain greater financial stability. Unless you are able to put a hold on the debt you are accumulating, you will likely struggle with how to get out of debt effectively.

Focusing on debt reduction is a responsible thing to do, but it is most effective when it’s paired with other changes to your budgeting, spending, and saving. Below are some tips:

Emphasize savings

Even though you may want to put as much of your extra money as possible toward paying off your debts, you should make sure you set aside assets for your savings.

You never know when you might need a little extra cash for a home repair or a medical expense, and having something saved for emergencies will allow you to handle these unpredictable events without going into more debt.

Make a budget and stick to it

Almost anyone who has ever managed to eliminate their debt and get their finances under control has had to take a disciplined approach to their spending and saving habits.

One of the best ways to go about making a budget is to start with all of your essential expenses like car insurance, groceries, mortgage payments and phone bills.

Once you’ve listed all your bills, you can take a look at how much leeway you have, considering your monthly income. Write out your monthly debt payments and your monthly saving targets.

Allocate discretionary spending to debt

Depending on the scope of your debt, you may wish to consider a bare-bones budget that cuts out all discretionary expenses.

Consider shopping at a discount grocery store, pack your lunch instead of eating out and choose low-cost or free recreational activities. Any money you might have spent on discretionary expenses should instead be spent on paying off your debt or saving up.

Although this may be challenging, you will reap the benefits when you finally get out of debt and don’t have to worry about high monthly payments.

Freeze your use of debt and credit

When people contemplate how to get out of debt, they often ignore the obvious: freezing their credit and debt use. You won’t be able to get out of your financial hole if you are still digging yourself deeper into debt.

Store your credit cards somewhere safe or get rid of them entirely to avoid the temptation of making impulsive purchases. It can be helpful to pay for groceries and other expenses using cash so you can visually see exactly how much you have available for a given purchase.

Keep Your Eyes on the Prize

Nobody wants to deal with mountains of debt, and there are things you can do now to tackle it. Whether you choose debt stacking, snowballing, or a combination of several debt reduction tactics, the most important thing you can do is to stay focused and disciplined.

If you don’t know how to get out of debt without losing some of your motivation, you can get help from friends, family members, or financial advisors who can encourage you and keep you on track.

Whenever you feel discouraged about the pace of your debt reduction, keep in mind that you are moving toward financial stability and freedom from debt—and that’s an incredible feeling.