The development of Robo-Advisor tools and online investing platforms has made it possible for people to start investing without the prohibitive costs of traditional brokerage services. Gone are the days of paying 1.5% of your total investable assets to a random financial advisor.

Personal finance tools and services are more accessible and less expensive thanks to low—or even non-existent—management fees, and the internet.

As an investor, educating yourself about these platforms is critical to your financial health. As my old friend, Benjamin Franklin said,

An investment in knowledge pays the best interest.

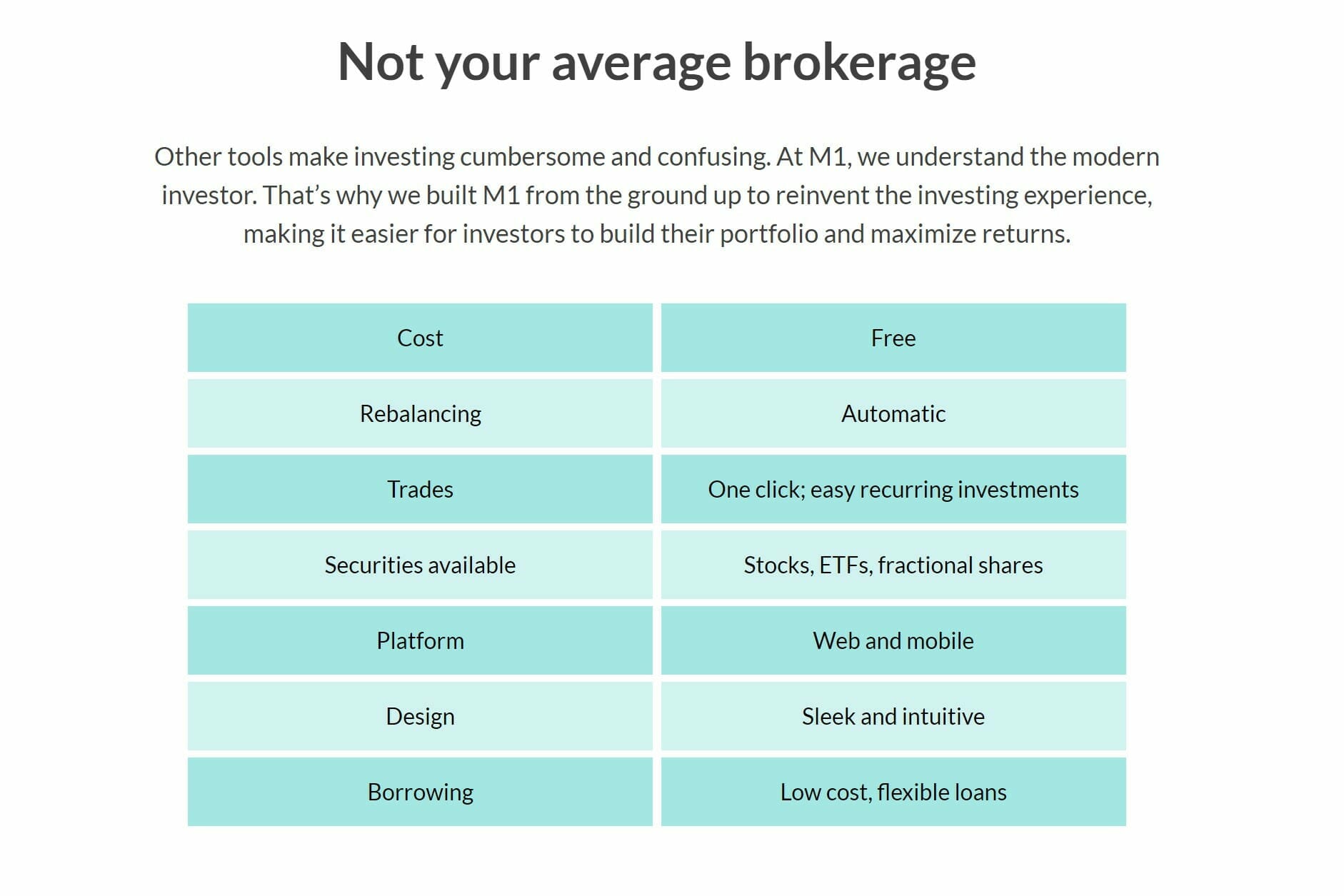

One of the most popular robo-investment tools is M1 Finance. Not only does the platform enable investors to create diversified portfolios and access a variety of financial tools, but it’s also offered completely free to individual investors.

That said, M1 Finance does have some downsides. And, you should be aware of both the good and the bad before you create an account.

What is M1 Finance?

M1 Finance is an investment management platform. The Chicago-based company behind it was established in 2015 by Brian Barnes, Founder & CEO. It has managed to attract an impressive number of investors.

Currently, the financial tool has 250,000 funded accounts and holds over $500 million in client assets. The average user has about $4,000 of assets in his or her M1 Finance account.

The way M1 Finance sets itself apart from other tools and platforms like Robinhood and Wealthfront is by combining elements of traditional online brokerage and existing robo-investor tools.

When you sign up for a standard robo-investor tool, you will be asked a series of questions to determine your risk tolerance and investment goals.

Based on all the information you provide, the tool will recommend a portfolio that includes a variety of investments.

While these tools can be a great place to start for aspiring investors, they can also be limiting because they draw their portfolio recommendations from the same ETF indices.

Generally, investors with a lower risk tolerance will have more bonds, and those that are less risk-averse will have more stocks.

M1 Finance Compared to Other Robo-Advisors

Minimum Investment:

$0

Management Fees:

$0

Promotion:

Invest for Free

Tax Loss Harvesting:

No

Portfolio Rebalancing:

Yes

Assets Under Management:

$1 billion

Minimum Investment:

$0

Management Fees:

0.25%

Promotion:

Invest free for up to 1 year

Tax Loss Harvesting:

Yes

Portfolio Rebalancing:

Yes

Assets Under Management:

$21 billion

Minimum Investment:

$0

Management Fees:

$0, $5 Gold monthly subscription

Promotion:

Get a free stock

Tax Loss Harvesting:

No

Portfolio Rebalancing:

No

Assets Under Management:

10 million users, company valued at $7.6 billion

Getting Started: M1 Invest

Portfolio Construction with Expert and Custom Pies

Starting an account with M1 Finance is similar to getting started with other robo-investing tools. First, you will set up your account and establish your portfolio preferences.

You don’t have to transfer any money into your account to get started and customize your investment portfolio.

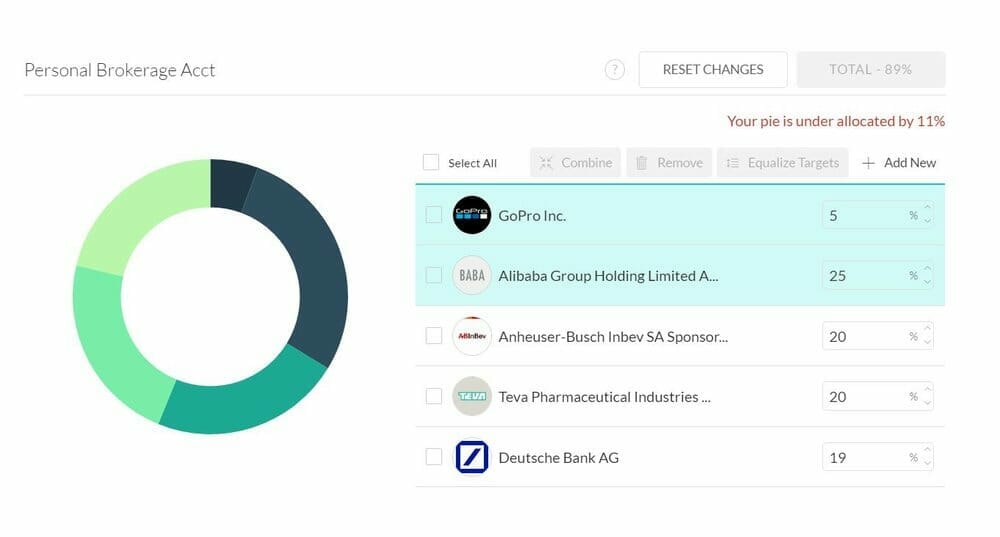

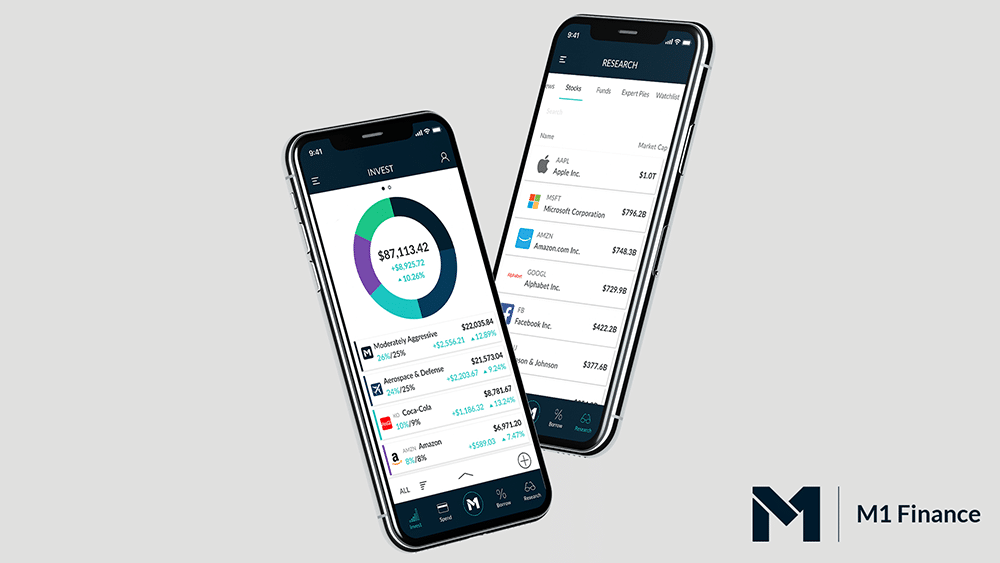

When you begin using M1 Finance, you will notice that the tool is mostly centered on the idea of “pie investing.”

What’s Pie Investing?

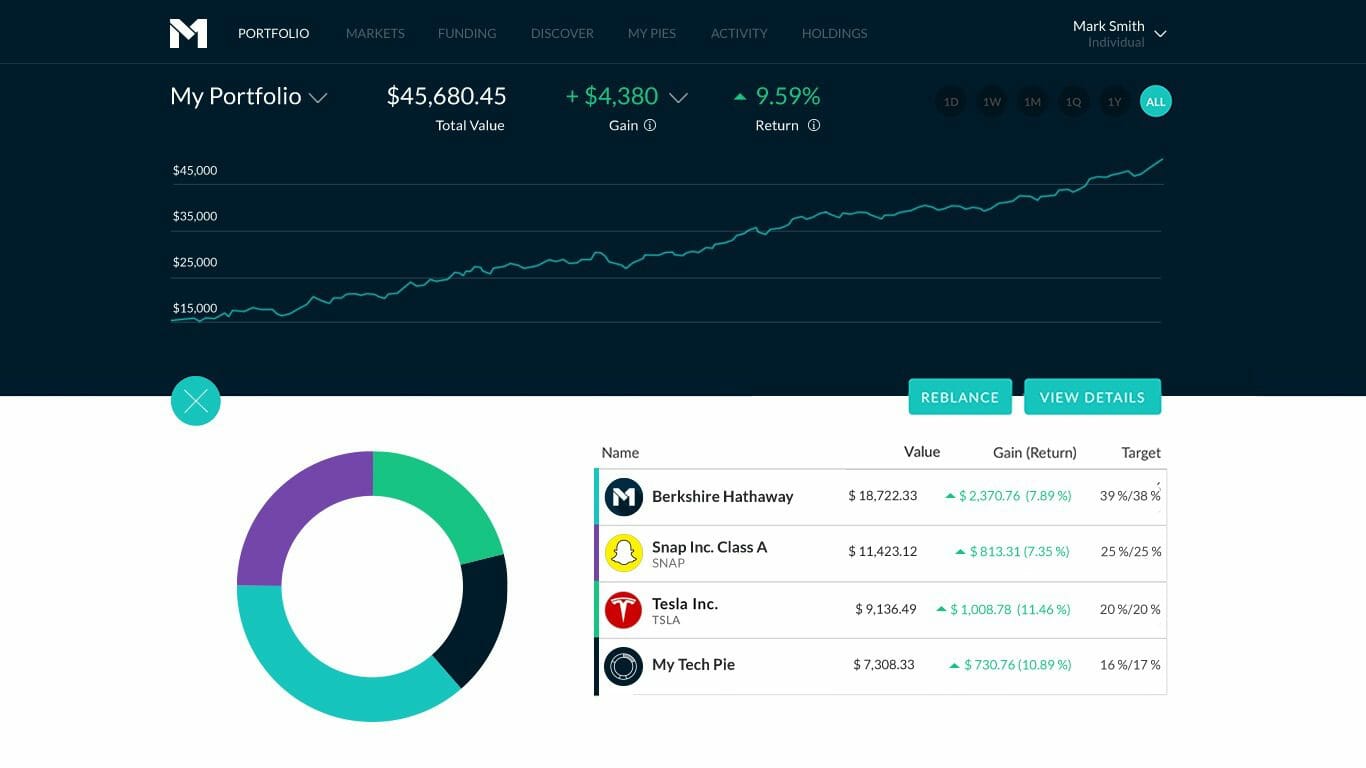

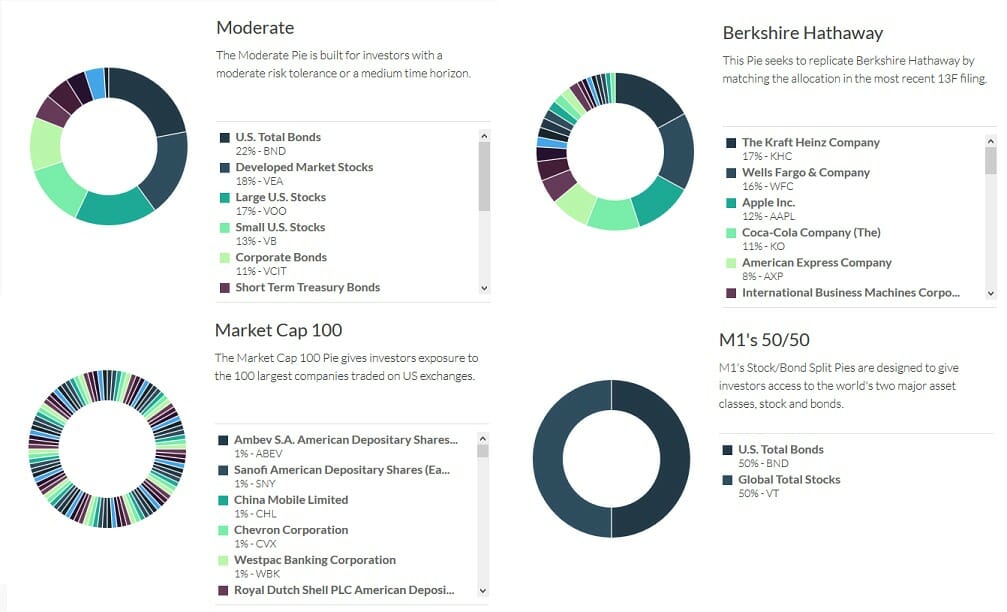

Pies serve as the basis for users’ investment portfolios and demonstrate the distribution of assets and holdings. These pies make up various categories of investments intended to offer the ideal balance for your portfolio.

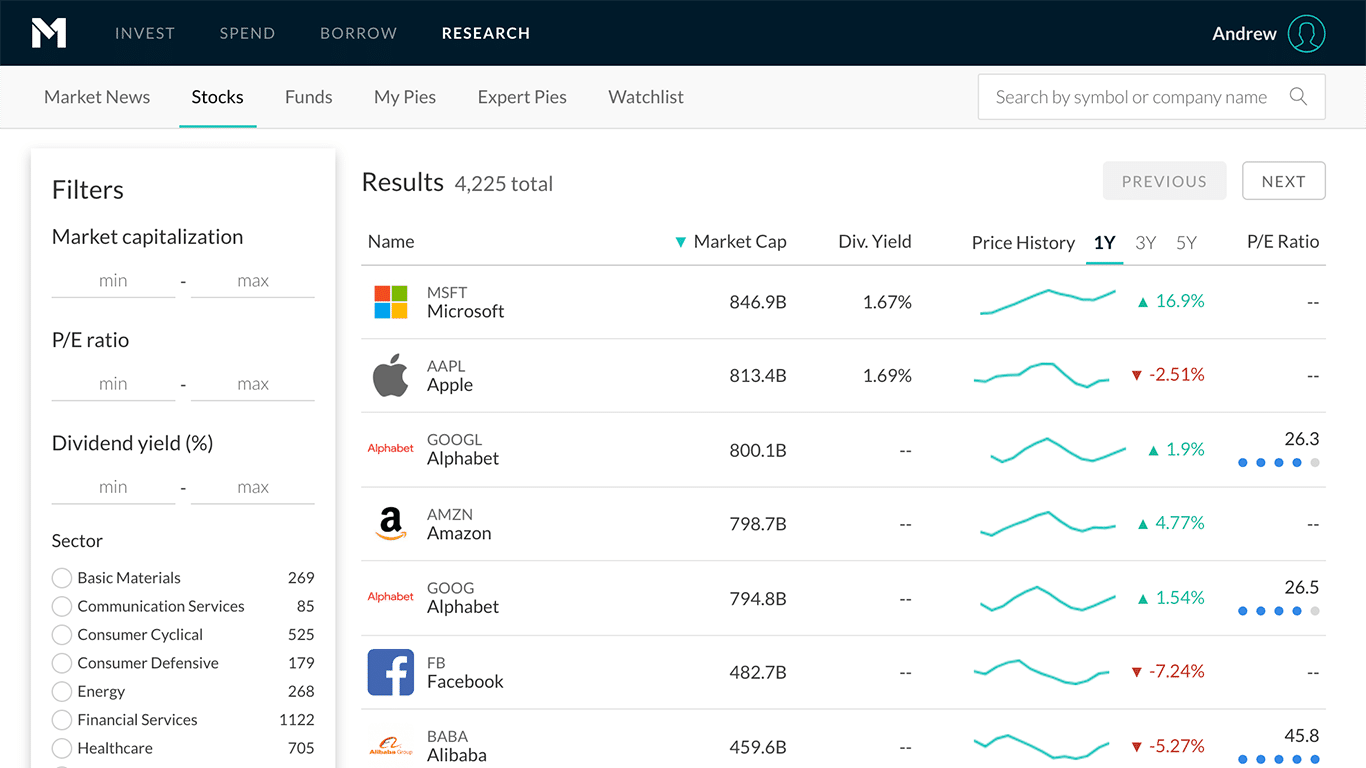

M1 Finance allows you to view a security’s performance, price history, expense ratios, and more.

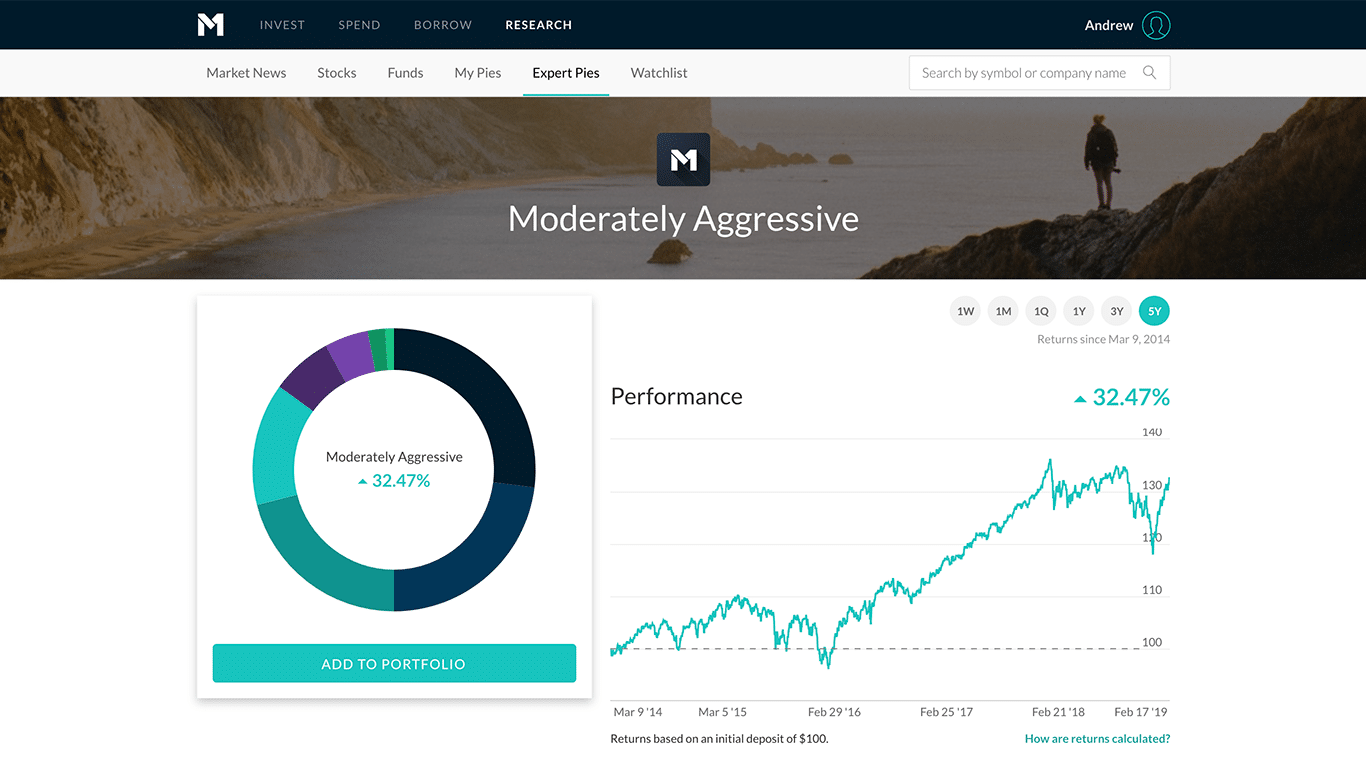

After signing up and creating your account, M1 Finance will suggest a pie that has a distribution of preselected investment categories that are suitable for your specific profile.

The platform has a selection of dozens of prebuilt pies from which you can choose. You can also personalize your pie by making adjustments to your portfolio and reallocating some of your investment categories.

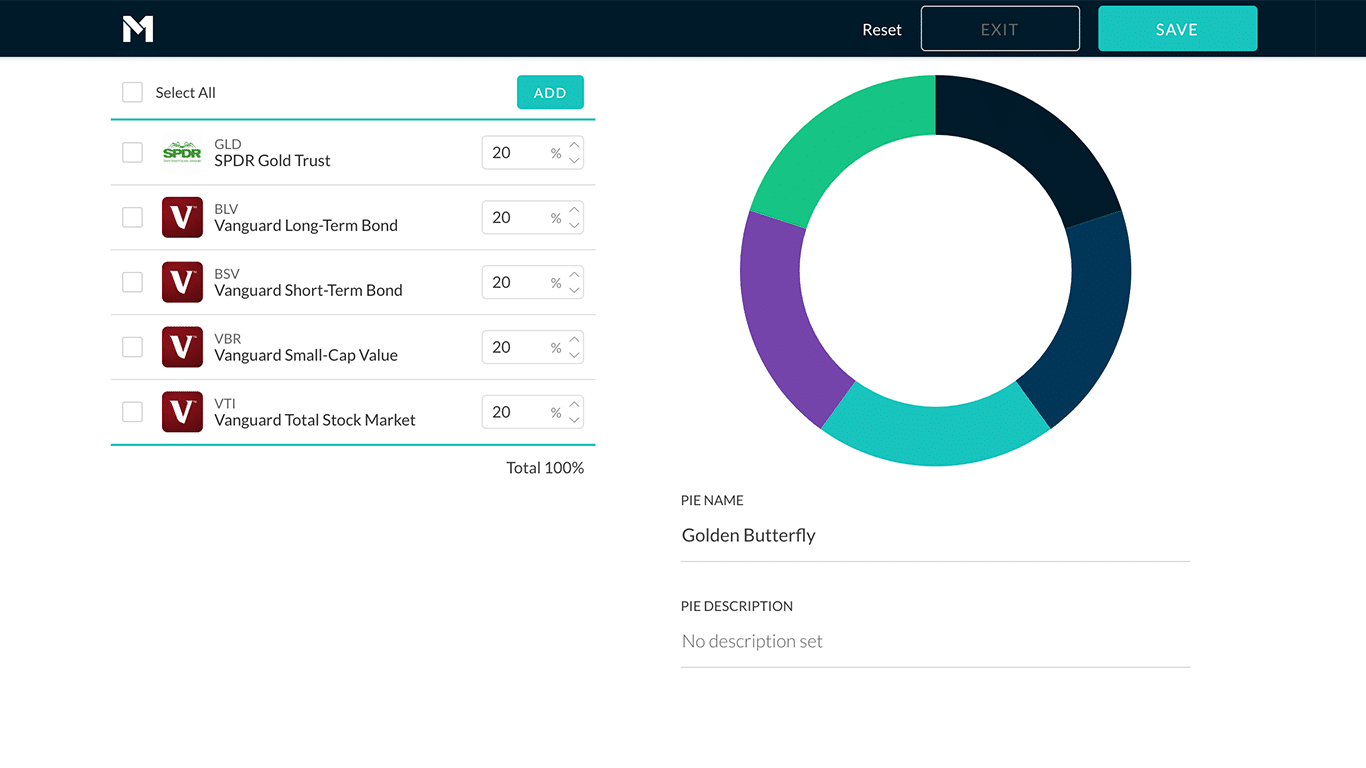

Customizing Your Portfolio: The Golden Butterfly

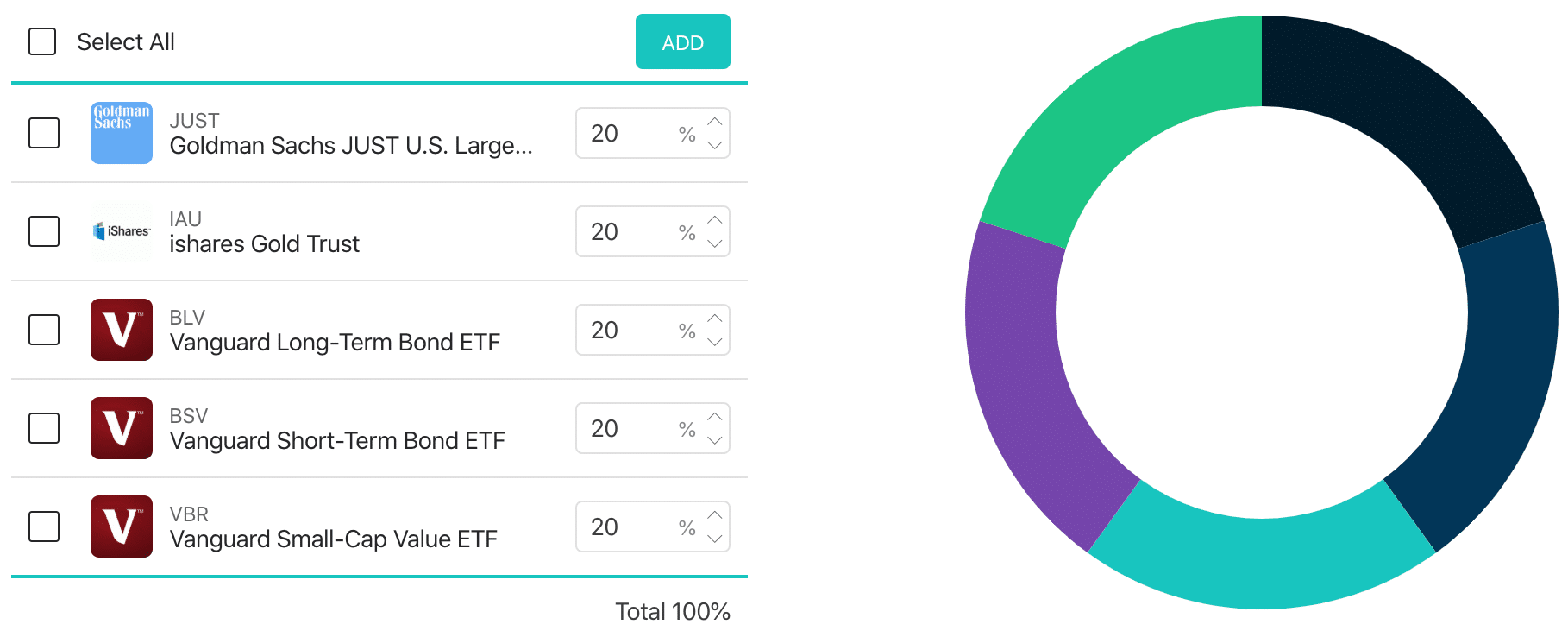

Because M1 Finance lets you build a portfolio that mirrors some of the world’s leading brokerages and advisors, my wife and I used M1 to curate a customized version of the Golden Butterfly.

Below is a picture of our personal automated setup using M1 Finance.

Ours tilts towards Socially Responsible Investing (SRI) by swapping out Vanguard’s Total Stock Market Fund (VTI) and replacing it with the Goldman Sachs JUST U.S. Large Cap Equity ETF.

This portfolio is a socially responsible version of the Permanent Portfolio with one additional asset class. This is done to incorporate some of the characteristics of a few other notable lazy portfolios.

We wrote a detailed post examining the Golden Butterfly portfolio vs Ray Dalio’s All Weather portfolio model which you can read here.

Choose Your Investment Account

After you finish building your pie, you’ll need to decide which kind of investment account you want. As long as you’re a U.S. resident with a current domestic address, you can select from several IRAs and brokerage accounts.

When you are finally ready to complete your account, you must provide some personal information, such as your Social Security number and birthdate. Financial institutions are required to gather this information as part of the USA Patriot Act.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

Because of Securities and Exchange Commission rules, you will also be asked some additional questions about your income and assets. The Patriot Act or SEC rules require all the questions asked by M1 Finance—you won’t be asked anything more than what’s required by law.

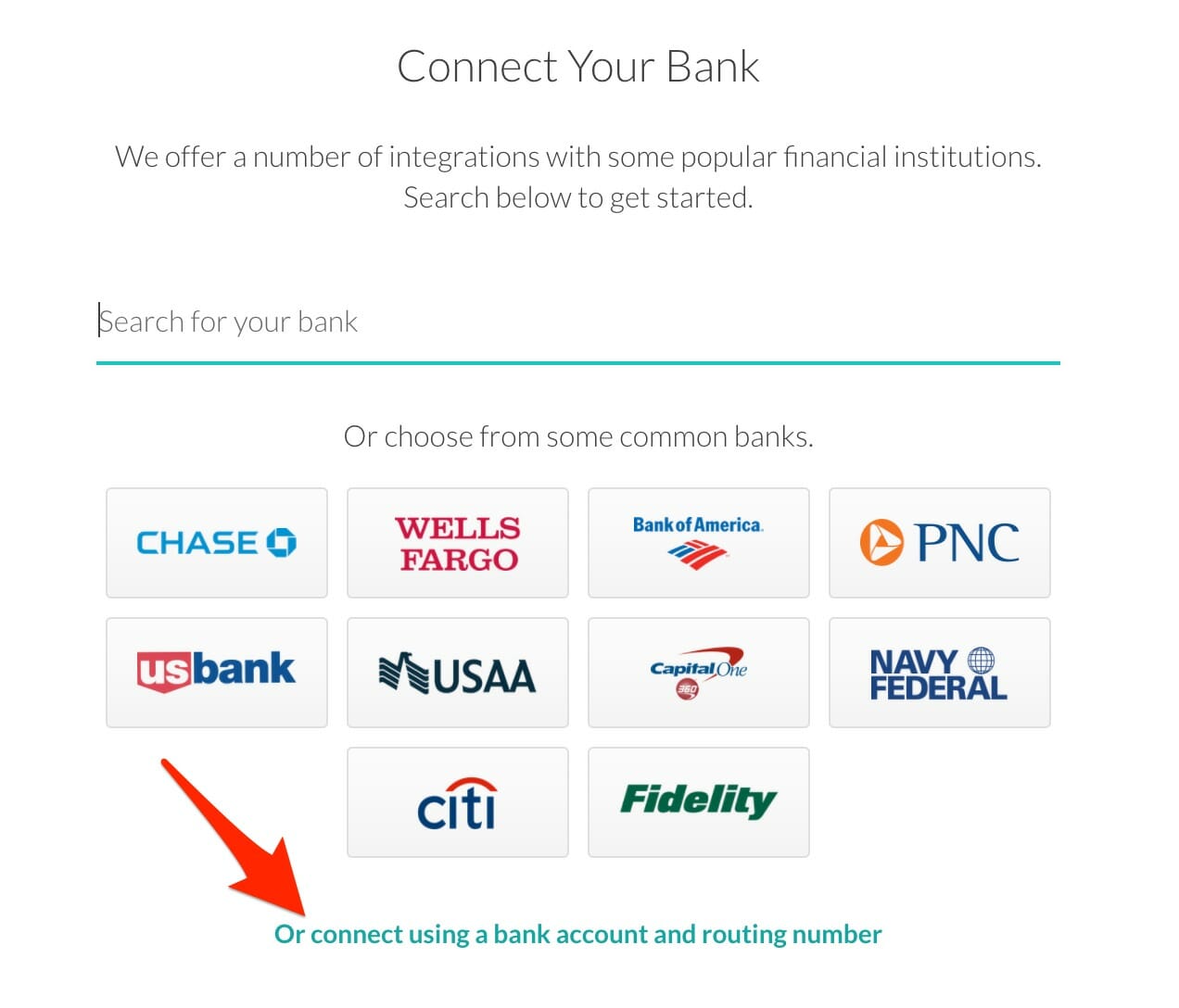

Funding Your M1 Finance Account

Finally, you’ll fund your account. You can do this by linking your M1 Finance account to your bank account. This is done via a third-party tool that ensures the encryption of your login credentials and account information.

You can then directly transfer funds in and out of your account by linking your bank.

M1 Finance = More Liquidity

One of the perks of using M1 Finance instead of other investment platforms is the fact that assets managed by the platform tend to be more liquid, which makes for quicker processing times when it comes to transfers.

Typically, the funds you transfer through M1 Finance are available in one business day.

Fractional Shares

To start your investment account, you will need to add a minimum of $100 to it. Because M1 Finance uses fractional shares, the application can purchase stocks and bonds in the exact proportions that you specified when you initially built your investment pie.

What Is a Fractional Share?

A fractional share is a portion of a share. If you’re buying a single stock and its share price is $50, but you only have $35 to spend, you can buy $35 worth of that stock.

Another impressive element of M1 Finance’s use of fractional shares is that you don’t have to worry about money sitting idle in your account without being invested. Every dollar you use to finance your account will be allocated accordingly.

Once you’ve tweaked your pie to suit your preferences, M1 Finance will purchase your investments based on the proportions of the preselected categories. As you add money to your account, the platform will automatically adjust your investments.

It maintains your selected pie’s proportions.

M1 Finance Details and Features

As you set up your account, you can read descriptions of various investment categories to help you build your investment pie. There are several different investment categories you can choose from, including:

- General investing

- Socially responsible investing

- Retirement investing

- Sector-specific investing

- Hedge fund-based investing

- Stocks

- Bonds

M1 Finance offers many account options, including traditional and Roth, rollover and SEP IRAs, as well as trusts and joint accounts.

The platform takes care of automatic portfolio rebalancing and offers features like socially conscious investing, fractional shares, and automatic deposits.

You can access M1 Finance online, from an iPhone mobile app, or an Android app. It enables you to check in on your investments from just about anywhere.

If you encounter an issue with the platform, you can get in touch with a customer service representative by phone or email.

Benefits of Investing with M1 Finance

| Benefits | Drawbacks |

|---|---|

| No fees for trades | No tax-loss harvesting |

| No annual fee | Investment vehicle restrictions |

| Automatic rebalancing | No outside holdings—such as employer 401(k) or other investment brokerages |

| Low barrier to entry ($100) | U.S. only platform |

| Automated investing | |

| Many risk profiles | |

| Fractional shares | |

| More liquidity |

After you fund your account, you can continue making new contributions and transfers through the app. Continually investing, even small sums, will grow your portfolio and build your assets.

M1 Finance will invest new funds whenever the cash balance in your account is $10 or more. All of the trading done through M1 is conducted within a trading window.

This window is at 9:00 a.m. Central Time on days when the New York Stock Exchange is open. If you transfer your funds to your account outside this window, they won’t be invested until the next trading window.

There are no commissions or fees associated with trading and selling your securities within your investment pie.

Dynamic and Automatic Rebalancing

As your portfolio grows and your investments begin fluctuating in market value, M1 Finance will automatically correct and rebalance your portfolio.

Let’s say you have a pie that’s evenly divided between four different investments: Stock A, Security B, Stock C and Security D. If you fund your account with $400, each piece of the pie will get a $100 investment.

Now, if Security D loses value while Stock A, Security B, and Stock C gain value, M1 Finance will prioritize the underperforming assets and purchase more. This will keep the distribution of your portfolio in line with your preferences.

When you want to withdraw assets from your investment portfolio, M1 Finance will sell the assets in your portfolio that are overweight to maintain your desired asset allocation.

Another distinct aspect of M1 Finance is the strategy the platform uses when it comes to selling shares and assets within your specific investment categories.

While other platforms generally sell shares in the same order they were purchased, M1 Finance uses a different strategy that’s designed to minimize your tax liability.

It sells assets that have no taxable gain first. Then, M1 will sell long-term capital gains equities and then those that have short-term capital gains.

M1 Borrow

M1Finance’s flexible portfolio line of credit lets you borrow up to 35 percent of your portfolio and payback on your schedule. It’s a simple, low-cost way to borrow money. However, you must have a taxable brokerage account with at least $10,000.

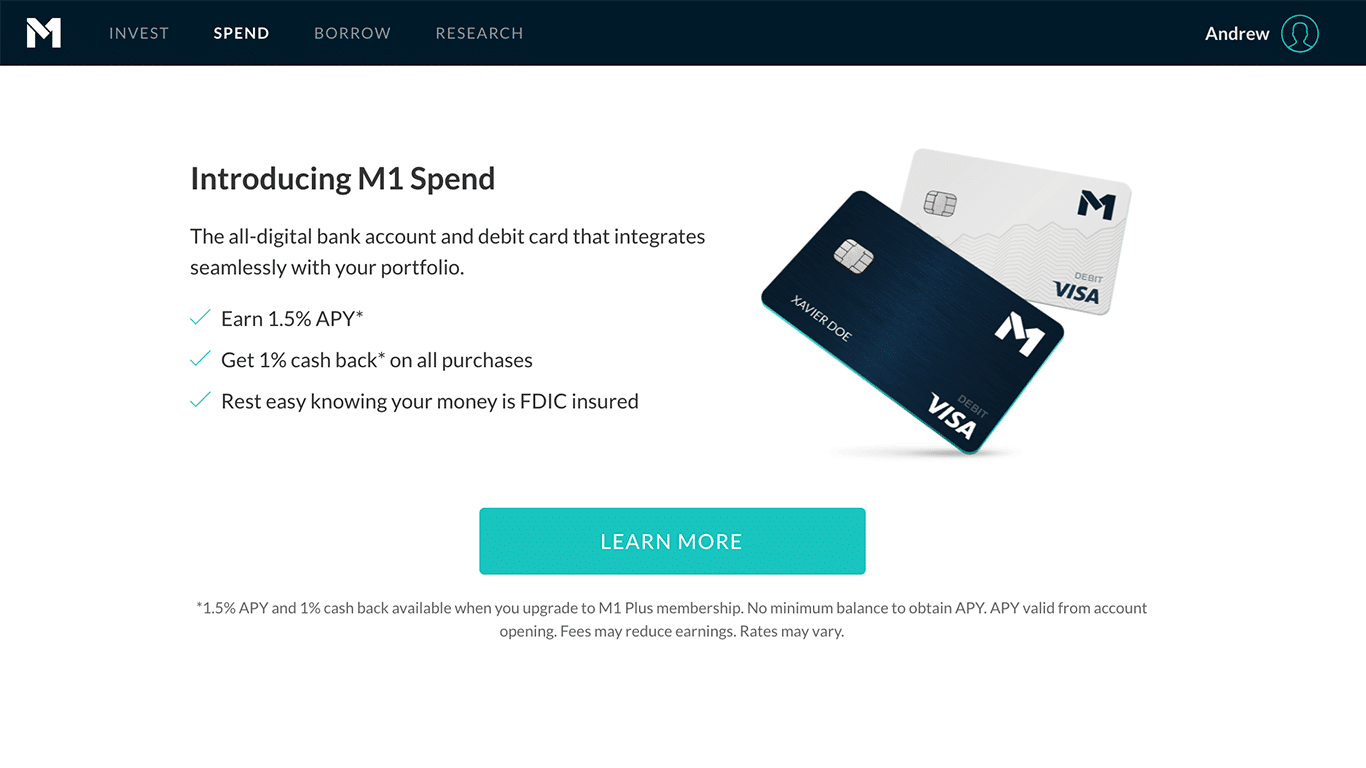

M1 Spend

M1 offers a digital checking account that integrates with your investments and portfolio line of credit. It comes with a plastic debit card and is free to use. However, you’re only reimbursed once per month on ATM fees.

If you use ATMs to access cash often, this might be a dealbreaker. You can also transfer money instantly and set up direct deposits.

M1 Plus

Plus is their Spend account on steroids. M1 Plus offers a 1.5% APY checking account, 1% cash back on all debit purchases, and comes with a tungsten metal debit card. It also reimburses you up to four ATM fees per month.

You’ll get a 0.25% discount on borrow rates when tapping their extended portfolio credit line, M1 Borrow, along with an extended afternoon trading window beginning at 2 pm CT.

Note: M1 Plus members with a balance of $25,000 or more may trade during both windows while members with a balance of less than $25,000 may trade at either window.

Both M1 Spend and M1 Plus are FDIC-insured up to $250,000. However, M1 Plus carries an annual fee of $125.

Drawbacks to M1 Finance

M1 Finance certainly has a lot to offer people who are looking for a

One of the most pressing concerns among investors is tax loss harvesting (TLH). In essence, TLH is a practice used to offset income and gain taxes without any significant shifts in a portfolio.

Platforms that offer TLH will sell securities that have sustained a loss and replace them with similar options to keep a portfolio balanced while minimizing taxes.

Because of the value of TLH, many

Unfortunately, M1 Finance does not. The platform does use strategies geared toward minimizing users’ tax liability. However, the fact that it doesn’t offer TLH is a dealbreaker for some investors.

Another factor to consider before signing up for M1 finance is that its investment options are limited. Although you can invest in ETFs and individual stocks through the platform, you cannot purchase any mutual funds.

M1 Finance still allows you to maintain a diverse stock portfolio, but not other investment classes.

If you currently have an employer-sponsored investment portfolio, like a 401(k) retirement account, M1 Finance won’t recognize it.

The platform does not take your current outside holdings into account when creating an investment portfolio. Because M1 Finance doesn’t recognize external accounts, your portfolio will be balanced based solely on your M1 Finance investments.

In other words, you cannot manage external investments with the M1 Finance platform.

Is M1 Finance Right for You?

There are a lot of people who may benefit from using M1 Finance to establish an investment portfolio. The tool is an excellent fit for those who are just getting their feet wet with investing.

If you don’t have any active investment portfolios, it might be just what you need to get started. The platform will help match you with an investment pie that suits your circumstances, preferences, and goals.

And, M1 Finance will automatically maintain a proportional investment allocation.

You may also benefit from choosing M1 Finance if you want more control over your investments.

The bottom line is that M1 Finance offers the right balance between completely automated investment platforms and personally controlled and completely customized portfolios.

M1 Finance Is Best for New and Hands-Off Investors

You can make choices about the allocation of your funds. But, M1 Finance takes care of a lot of the work for you. You don’t have to spend all your time worrying about moving investments around or balancing your portfolio.

But, at the same time, you still get some say in how your portfolio gets structured and allocated.

Not for Super Active and Complex Trading

Unfortunately, M1 Finance tends not to be very suitable for active traders. If you’re a day trader interested in consistent investment trading, then you may want to look elsewhere.

M1 Finance is best for individuals who are interested in a passive investment strategy. You need to be OK with waiting for a trading window to allocate your funds.

When thinking about the merits of M1 Finance as an investment tool, keep in mind that it’s a free platform.

There may be some downsides. Like the fact that it doesn’t offer TLH, but you can also get a lot of value from the platform. And, you don’t have to pay to use it.

For that reason alone, M1 Finance is worth a try.