What exactly are dividends, and how do they work? When you invest in a company, you get paid a portion of the company’s profits as a way to compensate you for your investment. They call these payments dividends, and they are a form of passive income.

What Are Dividends?

When you own stock in a company directly or through a fund, you may receive dividends. A dividend is a distribution of a portion of a company’s profits. They are decided by the board of directors and issued as cash payments, as shares of stock or other property. It’s an opportunity for a company to reward shareholder loyalty.

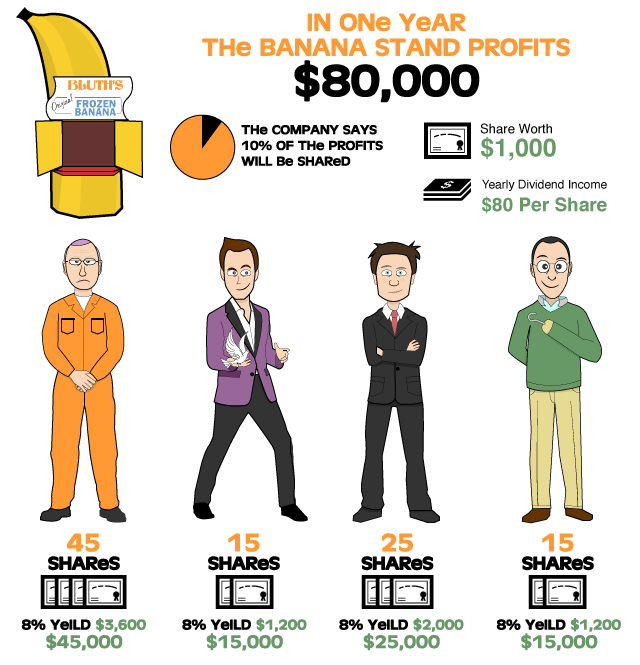

The amount you receive depends on how much stock you own and how much profit there was to divide.

Why Buy Dividend Stocks?

Investors, particularly retired investors, like the steady income that dividend stocks provide and also like the option of reinvesting dividends to buy more shares of stock.

Most companies don’t offer dividends, and if they do, they can cancel them if it’s an inappropriate time to make a payout. However, companies can increase them if times are good.

Startups and high-growth companies in specific sectors like tech and biotech usually don’t pay dividends because all of the profits are plowed back into the company so they can maintain higher than average expansion and growth.

If a company wants to increase its value (which increases the share price), it may opt to reinvest earnings rather than pay out dividends. Some companies choose to use that money to fund new projects, buy new assets, buy back some of its shares, or acquire another company.

Well-established companies are more likely to pay out regularly. Companies in distinct sectors, including oil and gas, financial, healthcare and pharmaceuticals, historically have had some of the highest dividend yields.

Get our best strategies, tools, and support sent straight to your inbox.

Why Do Companies Pay Dividends?

A bird in the hand is worth two in the bush. Investors are less sure that they’ll receive capital gains at a later date when earnings are reinvested as retained earnings than they are of receiving current dividend payments. In other words, better the sure thing now.

There are tax reasons too. In some countries, income derived from them is taxed at a lower rate than regular income. This is mainly an incentive for investors in high tax brackets. We’ll cover taxes below.

If a company has a long track record of paying dividends, eliminating them or reducing the amount is seen as a sign by investors that the company is in trouble.

The reliable income that they can provide is appealing to many investors, so they’ll be more tempted to buy stock in a company that pays them. Paying dividends is also typically a sign that a company is healthy and that management expects future earnings.

Should you buy before or after the dividend payment goes out? The bird in hand theory means you buy before the amount goes out while the stock price is more expensive because you can expect payment soon. Once the payment goes out, the stock will, in the short term, be worthless. For a more significant yield, buy after the payment has gone out.

And for your daily dose of the sophomoric, a share is said to be “cum dividend” when it is offered for sale with an entitlement to the next dividend payment attached.

When Is the Payout?

If a company is going to pay dividends, shareholders are notified by a press release sent to the big stock quoting services. The record date is set. All investors who own stock as of that date will receive payments.

The ex-dividend date is the day after the record date, the day the stock starts trading “ex-dividend.” Anyone who buys the stock on the ex-date is not entitled to receive the most recent dividend payment. The payable date is usually a month after the record date.

On that date, the money is deposited for payout to the eligible shareholders with the Depository Trust Company.

Cash payments are then sent out from the DTC to brokerage firms where investors hold their shares. These dividends are paid quarterly.

Once declared, they must be paid within 30 days.

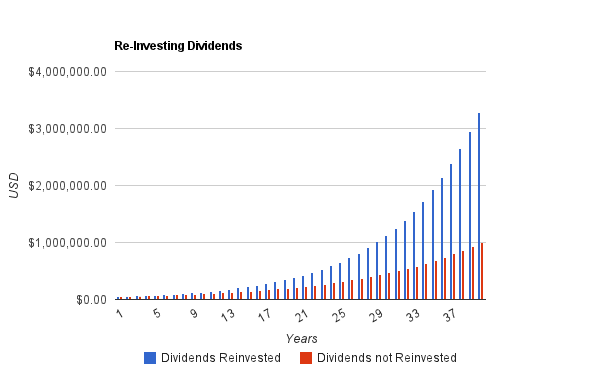

However, the best way to make more money in the stock market is by reinvesting your earnings. Remember the game here is to buy and hold.

Buy quality stocks and hold onto them for the long haul. Take full advantage of your long-term investment strategy by reinvesting your dividends.

Companies like

How Is the Number Decided?

The target payout ratio is the fraction of net income a company pays to shareholders in the form of dividends. The number is calculated by dividing the dividends distributed by the net income for that period.

The share of that number each investor receives is based on how many shares you own. If you own 100 shares of Company X, 100 is the number your dividend distribution will be based on.

Yield calculation matters too. If the company agrees to pay $1 per share and you bought your shares at $50, your yield will be lower than if you had bought at $25. At $50 the yield is 2%, at $25 it’s 4%. An average-to-good yield is 2.5-3%.

The amount to payout can be chosen using a few methods:

Stable Dividend Policy: Even if earnings have been inconsistent, the dividend payments remain steady. They are a set fraction of the company’s yearly earnings. This policy lessens uncertainty for investors and provides them with income.

Constant Dividend Payout Ratio: A company pays out a certain percentage of its earnings every year as dividends. The amount paid varies with the earnings.

Residual Dividend Model: These are paid based on a company’s earnings minus any money the firm keeps to finance the equity portion of its capital budget. The remaining profits are paid out as dividends.

They are distributed as stock shares of a company, property, or cash. Cash dividends tend to be the most common distribution method.

Dividend Yield Calculation

Simply put, the dividend yield is a company’s annual dividend divided by its share price:

Dividend yield = annual dividend/share price

Do You Have to Pay Tax on Dividends

Dividends are considered taxable income. There are two categories, qualified and non-qualified.

Qualified dividends are tax-free if your earned income doesn’t exceed $40,000 (for single filers in 2020).

If that money does push you into a higher bracket, the amount is taxed at 15% for incomes falling between $40,001-$441,450 (single filers) and 20% on incomes above $441,450. Most regular dividends are qualified.

Nonqualified dividends are taxed at regular income tax rates. Investors will receive a tax form at the end of the year that shows how much dividend income they received.

What Is a Dividend Aristocrat?

A dividend aristocrat is a company that has continuously increased the number of dividends it pays to its shareholders. To be categorized as such, a company must typically have increased dividends for at least 25 years.

Coca-Cola and McDonald’s would be two examples. The S&P 500 has a fund called The S&P 500 Dividend Aristocrat Fund that has, on average, outperformed the S&P 500 by 2.93% – even amongst the S&P 500’s worst drawdowns.

You can invest in The S&P 500 Aristocrat Fund through some ETFs. The list is composed of 50+ companies spread across eleven sectors. Some of the companies are 3M, AT&T, Chevron, Hormel, and Target.

You can also buy individual stock in dividend aristocrat companies.

Dividend Aristocrats have a place in every portfolio. They provide steady income and give you the security of bonds with a better payout.

Modeling a Dividend Aristocrat Portfolio Using M1 Finance

This section will highlight how you can get started investing in the S&P 500 Dividend Aristocrat portfolio with M1 Finance. If you prefer the simplicity of investing in a single fund versus individual stocks, read on!

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

As mentioned earlier, you can invest in The S&P 500 Dividend Aristocrat Fund using ETFs. M1 Finance has a pre-made Dividend Aristocrat Portfolio already in place. More on that below…

This single fund can represent a stock portion of your portfolio. You’ll see why after looking at the asset allocation table below (spoiler – it’s all stocks and a REIT).

The upside here is you don’t need to research the companies and hand-select them yourself.

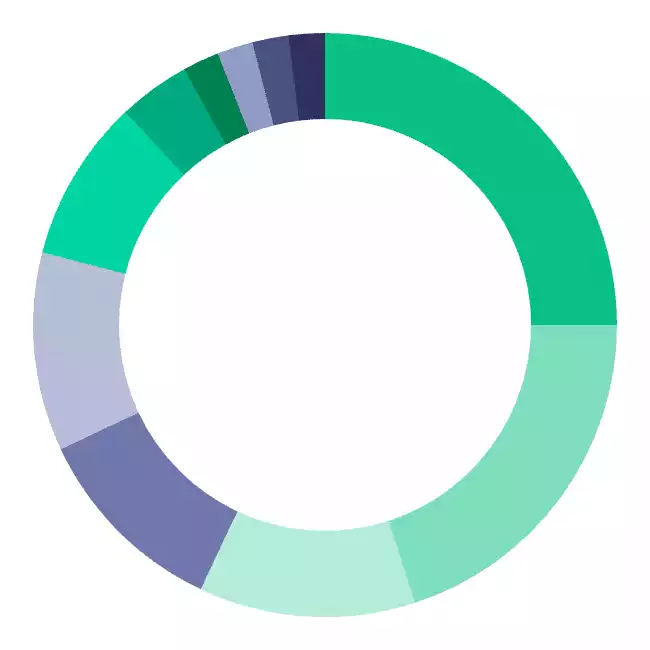

Dividend Aristocrat Asset Allocation

Here’s a look at the portfolio weightings, components, and sectors found in this fund. It currently has 53 holdings across eleven sectors.

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 25% | Consumer Staples | Stock |

| 20% | Industrials | Stock |

| 12% | Consumer Discretionary | Stock |

| 11% | Materials | Stock |

| 11% | Health Care | Stock |

| 9% | Financials | Stock |

| 4% | Energy | Stock |

| 2% | Utilities | Stock |

| 2% | Telecommunications | Stock |

| 2% | Information Technology | Stock |

| 2% | REITs | Real Estate |

There is a 30% weighting cap imposed on the portfolio that ensures sector diversification. Traditionally, many benchmarks have high exposure in the financials and utilities sectors.

That’s not the case here.

You can see this portfolio doesn’t exceed 25% in any category. When adhering to this principle, the portfolio also avoids single stock concentration risk.

Portfolio Performance and Risk/Return Profile

The Dividend Aristocrats’ historical yield averages 2.5%, outperforming its S&P 500 benchmark (the S&P 500 has a 1.8% yield).

It also manages to do this with less volatility and lower drawdowns.

The S&P 500 Dividend Aristocrats outperformed the S&P 500 over 70% in down months and more than 44% in up months.

This outperformance comes largely from its security selection. There’s a rigid criteria for making it onto this list.

Aside from being a member of the S&P 500 and increasing its dividends every year for 25 consecutive years, a dividend aristocrat must also:

- Have an average minimum of $5 million in daily share trading value

- Have a float-adjusted minimum market cap of $3 billion

Note

“Float-adjusted” is the market capitalization calculation you get when multiplying the price per share times the number of shares available to the public (instead of the number of shares outstanding).

The number of outstanding shares includes shares held by founders, promoters, and governments – these shares aren’t available to the public.

The above criterion is a substantial indicator of why Dividend Aristocrats have an excellent track record.

This is an index fund of the most consistent dividend-paying companies in the S&P 500. It has historically outperformed the S&P 500 long-term. Over the past 10 years, it has returned 10.98% on an average annual basis whereas the S&P 500 only returned 10.53% during that same period.

One reason we like M1 Finance is they’re free to use and you pay zero in management fees. For many investors, they’re the low-cost option when starting to invest.

You can click the box above for a detailed breakdown of the S&P 500 Dividend Aristocrats portfolio (or get started with M1 here).

Last Words

As mentioned earlier, dividend aristocrats provide a steady income stream with the added security benefit similar to bonds.

Because these companies have performed consistently for a substantial period, it makes them a safer equity bet than holding a portfolio of high-growth stocks.

Depending on your investment goals, this fund might have a place within your overall investment strategy.

If you’re not sold on the security of the dividend aristocrats fund and looking for something more conservative, read our article 16 Safe Investment to Guide You In the Storm for alternatives.

Or if you’re looking for another portfolio to model, read our post, The Permanent Portfolio – it was built to weather all economic conditions!

Show Notes

Unita Brewing Sum’r Ale: A citrusy and refreshing golden ale.