If the financial crisis of 2008 left a sour taste in your mouth, you’re not alone. People lost a lot of money. Because of that sour taste, many people are wary about putting their hard-earned money into the stock market.

“It scares the living shit out of me,” you think to yourself. “I don’t know how to build an investment portfolio!”

What if I told you there’s nothing to be scared of? What if I also told you investing doesn’t have to be complicated. Having a well-balanced portfolio is easy.

Don’t be intimidated by the noise.

It’s a good idea to know the basics. It’s like driving a car. If you want to accelerate, put your foot on the gas. Use the brake to stop. Turn the wheel to steer.

Easy.

I’m going to show you:

- Three things to know before building an investment portfolio from scratch

- The three fundamental asset classes

- Various ways to have a balanced portfolio through diversification

- Portfolio models you can apply today

Let’s get to it. I’ve got beer to drink.

Building an Investment Portfolio (or Fine-Tuning Your Existing One)

There are a few things to know before diving into the deep end of the pool:

- Your financial goals

- When you’ll need the money

- Your risk tolerance

The above three are what you should already know before getting started. They’re your road map. You can’t take a trip without a plan. If you don’t know where you’re going, you ain’t getting there.

So, before you create your well-balanced portfolio know your financial goals. For example, is this money going towards a retirement account, a house, or an emergency fund? It makes a difference.

When will you need the money? If it’s for retirement, you won’t need it for a long time. If it’s for a short-term goal, like a downpayment on a home, you’ll need it much sooner. It’s good to know the target you’re trying to hit.

What’s your risk tolerance? Thinking about it and experiencing a market drop are two different things.

Can you handle market swings without hitting the “eject” button? Some folks bail out of the stock market at the first sign of trouble.

Know what kind of investor you are. What’s your money modus operandi? Diving in and out of the stock market is a fool’s errand.

Age matters. If you’re in your 20’s or 30’s, you can afford to be aggressive with a portfolio heavily weighted in equities(e.g., stocks).

On the flip side, if you’re closer to retirement, and in the preservation of capital phase, you’ll want your portfolio to have a larger slice of fixed-income securities (e.g., bonds).

Some use the “subtract your current age from 120” model to determine how much of your portfolio should be invested in stocks. For example, if you’re 33, subtract 33 from 120.

Using the above example, 87% of your portfolio would be invested in stocks. It’s a good rule of thumb, but it’s not an exact science. Also, don’t feel bound by that rule. I don’t.

Consider how long you expect to work.

Just because you’re turning 65 doesn’t mean you have to retire.

Tweet ThisMaybe you’re still earning a great living and don’t need to withdraw from your investment portfolio.

Kill Your High-Interest Debt. That’s a fire that needs to be extinguished ASAP. Before having a well-balanced portfolio, kick your debt to the curb. High-interest rate payments are like being caught in an undertow.

You’re just about to make it to the surface, and then you get sucked down beneath the water – again. And again. And again…

Invest in Your Employer’s 401(k) Match. That’s money on the table. It’s a 100% return on your investment. Regardless of any debt you may have, an employer-sponsored retirement account is an excellent, passive way to build wealth.

There is no one way to design a balanced portfolio because everyone’s situation is different. Your answers to the above questions will determine your investment strategy.

The Three Asset Classes

Fundamentals. They’re crucial for success in everything you do. Whether you’re building a home, learning jiu-jitsu, or whipping up a marinade for your steak, specific criteria must be met.

A well-balanced portfolio is no different. Whether it’s something you constructed yourself or your financial advisor built for you, you’ll most likely see these three asset classes:

- Stocks (equities)

- Bonds (fixed-income)

- Cash

There is usually very little correlation, and in some cases a negative correlation, between different asset classes. This characteristic is integral to the field of investing. – Investopedia

The success (or failure) of one won’t affect the other. For example, if all your money is in the stock market and it tanks, you could lose a lot.

Even worse, it could take years before your portfolio recovers. What if you’re near retirement and can’t afford to lose it?

That’s why diversifying your portfolio with a mix of stocks, bonds, and cash is a fantastic idea – and a core part of most portfolios.

You could even go further by adding real estate investments, futures, commodities, and other financial derivatives. But that’s another article.

Get our best strategies, tools, and support sent straight to your inbox.

Ways to Have A Balanced Portfolio

There are numerous ways you can divide your asset classes. For example, when dealing with stocks, you can keep it simple and buy a total stock market index fund.

At the time of this writing, Vanguard’s Total Stock Market Index Fund (VTSAX) consists of 3,615 stocks with exposure to many different sectors like technology, financial, consumer services, and health care.

That’s plenty of diversification along with exposure to blue chip companies like Apple, Microsoft, Berkshire Hathaway, and Amazon.

However, you can go deeper. You can further diversify your holdings between different U.S. sectors. For example, you can invest in U.S. value stocks and growth stocks or large cap and small cap stocks.

Betterment tilts their portfolios towards value and small cap stocks while still maintaining a global diversification for their customers.

Speaking of global diversification, you can split your stock between domestic and international to gain exposure to foreign markets.

The MSCI Europe Australia Far East Index (EAFE) is one example of a broad index tracking developed foreign market stocks.

Developed versus emerging markets is another alternative for further diversification. Emerging markets carry greater risk, but offer higher returns.

Bonds are used to shoulder the risk that comes with investing in stocks. They’re less volatile and smooth out the ride in market downturns because they’re not correlated with stock market returns.

Bonds can be divided into three primary groups:

- Government securities (Treasury bills, notes)

- Corporate bonds

- Municipal “muni” bonds

Each carries different risks, rewards, and benefits.

Government securities (like treasury bonds) are considered the lowest risk. You’re loaning the federal government money. If they default, we’ve got bigger problems than cashing in our bond funds.

Treasuries are also exempt from state and local taxes. Yeah!

Corporate bonds carry both credit risk and interest rate risk. They’re slightly more volatile but can have a higher return. Why? Because you’re loaning money to a corporation. Corporations can default.

Municipal bonds are issued from both state and local governments. Depending on the issuing state, muni bonds may be exempt from federal, state, and local taxes. Munis are a great addition to a taxable account.

The maturity date of bonds also determines its yield. Short-term bonds carry less risk with lower returns while long-term bonds carry greater risk with higher returns.

Cash is king…

But not if you’re concerned with building wealth. Why?

Inflation!!!

It’s a good idea to have some on hand in case of emergencies. However, if you’re hoarding $25,000 under your mattress or in your checking account:

- Stop reading this article

- Immediately walk to your bathroom mirror

- Look yourself in the eyes and say:

“I’m a cotton-headed, silly-ninny-muggins.”

Inflation eats your dollar’s value for breakfast.

That’s why it’s a better idea to keep some cash on hand in either:

- An online, high-interest paying savings account or money market account (e.g., one with an APY of 2.0% or more)

- Low-risk investment account

These are fantastic places to house your Emergency, Opportunity, and Sinking funds.

If you do decide to pick individual stocks because it’s fun (and it is), use no more than 10% of your total portfolio value. You don’t want to bet your entire life savings on a “hunch” you had about marijuana stocks.

A great place to play around with individual stock-picking is in your tax-advantaged accounts like a Roth. You sidestep any tax implications.

Buy and sell as much as you like. Be mindful of any trading or transaction costs charged by your broker ( and no more than 10% of your portfolio max!!!).

Replicate These Portfolio Models Yourself

Let’s take a look at a few portfolio models you can use today. I’ll start with the more straightforward examples before getting into the hairy weeds.

The below models can all be easily automated using M1 Finance.

The Warren Buffett Model

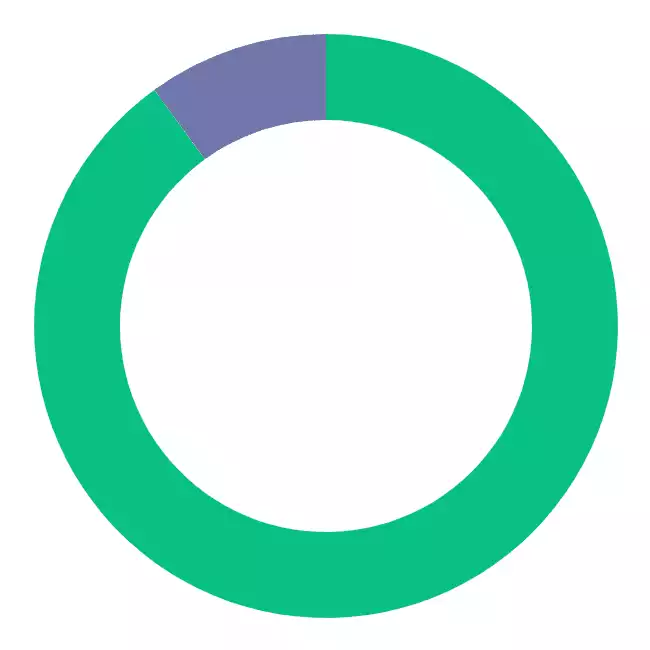

This is the allocation he said he’d want for his wife after he passes. It’s a two-fund portfolio with a 90/10 stock-to-bond allocation.

Warren announced that after he passes, the trustee of his wife's inheritance has been told to put 90% of her money into a stock index fund and 10% into short-term government bonds.

The Warren Buffett allocation for his wife entails 90% in a low-cost, exchange-traded fund (ETF) of the S&P 500. A low-cost option could be the Vanguard S&P 500 ETF (ticker VOO).

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 90% | U.S. Large-Cap Equity | Stock |

| 10% | Short-Term Treasuries | Bond |

The remaining 10% goes into short-term government bonds. An inexpensive option could be iShares Short-Term Treasury Bonds (ticker SHV).

Read his biography, The Snowball: Warren Buffett and the Business of Life, to learn the guiding principles that turned him into one of the world’s greatest investors.

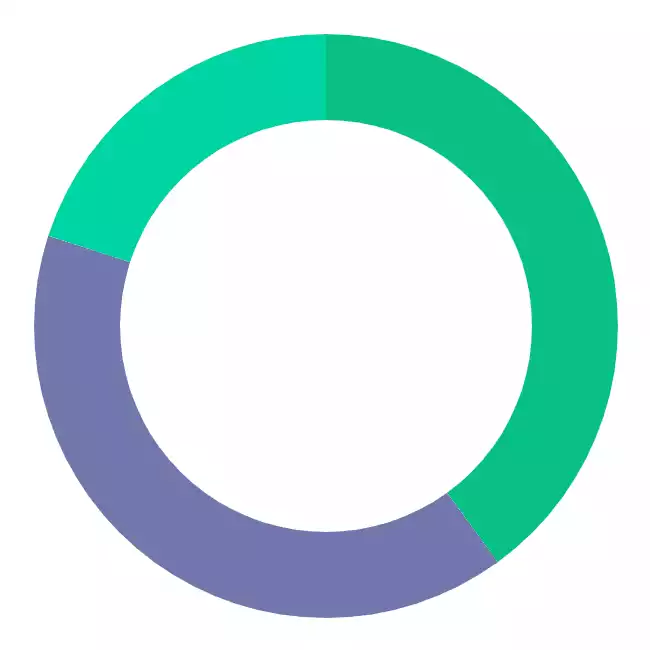

Rick Ferri Three-Fund Portfolio

Famed personal finance author and columnist, Rick Ferri, suggests this as his three-fund model:

| Weighting | Portfolio Components | Asset Class |

|---|---|---|

| 40% | Total U.S. Stock Market | Stock |

| 20% | Total International Stock Market | Stock |

| 40% | Total U.S. Bond Market | Bond |

For a detailed exploration of Mr. Ferri’s investing approach, read his books All About Asset Allocation and All About Index Funds.

Typically, three-fund portfolios hold a combination of U.S. stocks, international stocks, and U.S. bonds. Rick Ferri allocates 40% to U.S. stocks, 20% to international stocks, and 40% to U.S. bonds.

The above shows how your three-fund portfolio could look when using Vanguard funds.

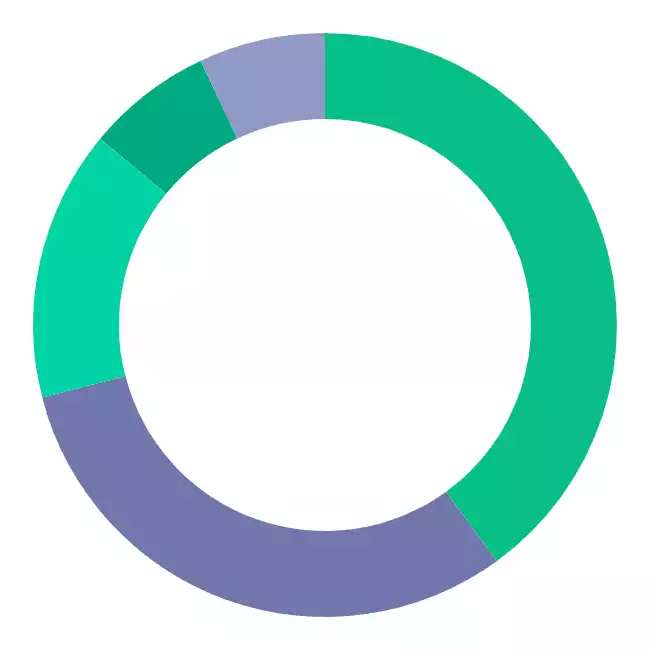

The All-Weather Portfolio

Ray Dalio is the Obi-Wan of the investing world. He’s up there with Warren Buffett. His book, Principles: Life and Work is a must-read and an LMM favorite.

He created this portfolio as one to withstand the ups and downs of the market – hence the name All-Weather.

This one adds a couple of asset classes into the mix that we didn’t talk about – gold and commodities.

| Weightings | Portfolio Components | Asset Class |

|---|---|---|

| 30% | Total U.S. Stock Market | Stock |

| 40% | Long-Term Treasuries | Bond |

| 15% | Intermediate-Term Treasuries | Bond |

| 7.5% | Gold | Commodity |

| 7.5% | Diversified Commodities | Commodity |

Here’s what the All Weather portfolio looks like.

This portfolio's single goal is to make money in all market conditions regardless of interest rates, deflation, what new pandemic is threatening our shores, or who the POTUS is. It does this by focusing on growth and inflation cycles.

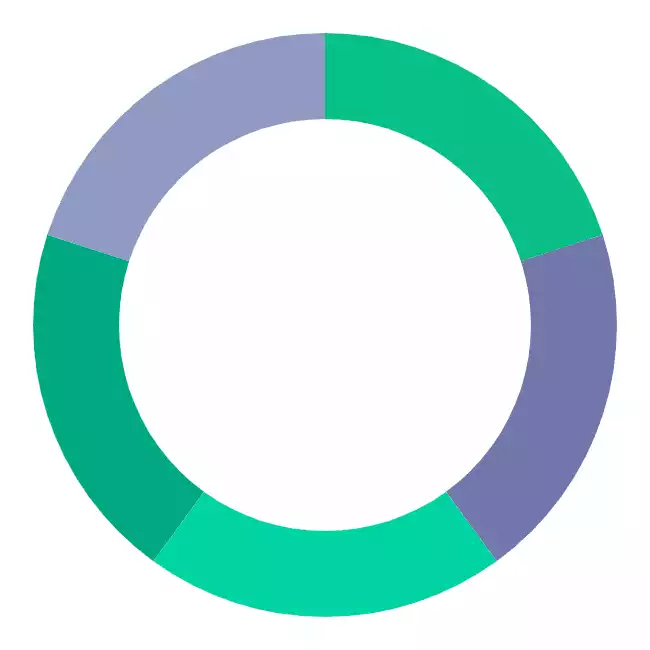

A popular variation of the All-Weather portfolio is the Golden Butterfly.

Both portfolios hold five securities, but, the Golden Butterfly replaces the diversified commodities and intermediate treasuries with small-cap value stocks and short-term treasuries.

This portfolio is a socially responsible version of the Permanent Portfolio with one additional asset class. This is done to incorporate some of the characteristics of a few other notable lazy portfolios.

The above is another variation that uses a Socially Responsible Investing tilt. Instead of using a total stock market fund, you’d replace with the Goldman Sachs JUST U.S. large-cap equity fund (or other SRI-equivalent).

If you’d like to see the original Golden Butterfly allocation, head here.

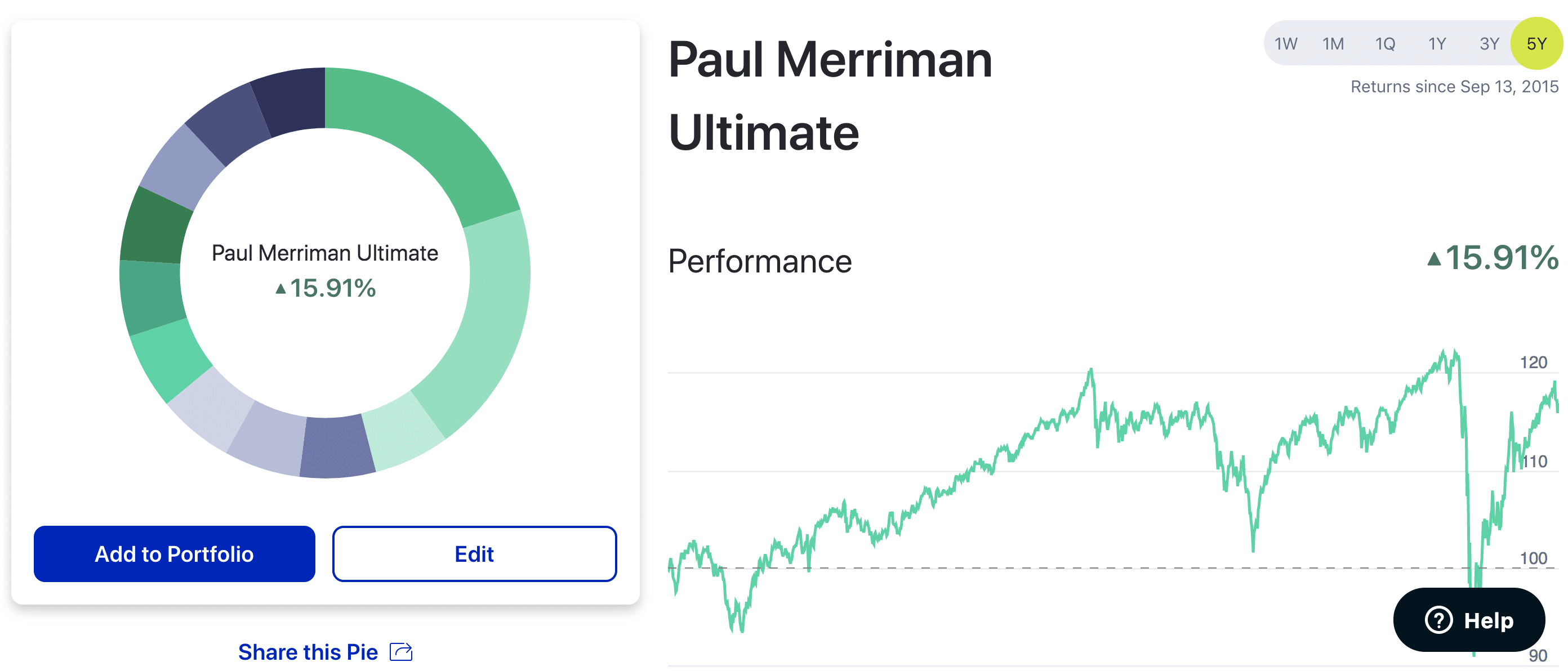

The Paul Merriman Ultimate Buy and Hold Strategy

This one shows how far you can diversify a traditional 60/40 portfolio of stocks and bonds if you’re willing to do the extra work.

The Merriman Ultimate is an enhanced version of a traditional 60/40 stock/bond portfolio. It's based on academic research and a proven track record of outperforming the S&P 500 Index, generating higher returns with less risk.

Mr. Merriman based this portfolio on the conclusion that long-term investment success depends on your choice of asset classes.

| Weightings | Portfolio Components | Asset Class |

|---|---|---|

| 6% | U.S. Large-Cap Blend | Stock |

| 6% | U.S. Large-Cap Value | Stock |

| 6% | U.S. Small-Cap Blend | Stock |

| 6% | U.S. Small-Cap Value | Stock |

| 6% | International Large-Cap Blend | Stock |

| 6% | International Large-Cap Value | Stock |

| 6% | International Small-Cap Blend | Stock |

| 6% | International Small-Cap Value | Stock |

| 6% | Emerging Markets | Stock |

| 6% | REITs | Real Estate |

| 20% | Short-Term Treasuries | Bond |

| 20% | Intermediate Treasuries | Bond |

The above allocation works best in tax-sheltered accounts (e.g., IRAs). If using a taxable account, it’s recommended removing the REITs and dividing that portion equally among the four U.S. stock asset classes.

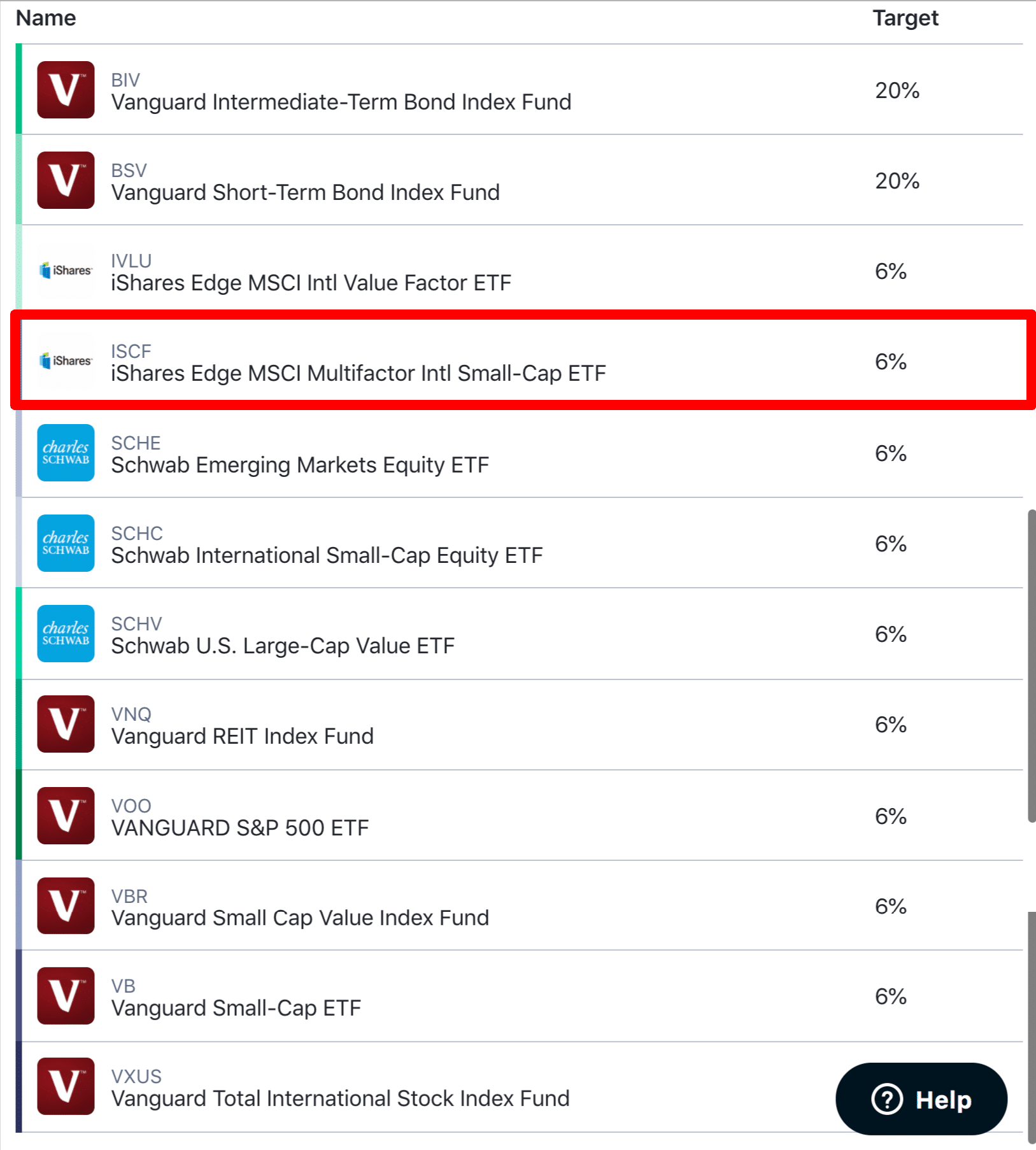

But if you wanted to build this portfolio using M1 Finance, here’s one way to go about it.

I highlighted the iShares Multifactor International Small-Cap ETF in the above screenshot because this is a substitution.

I highlighted the iShares Multifactor International Small-Cap ETF in the above screenshot because this is a substitution.

Currently, international small-cap value funds aren’t available on M1’s site (at least none that I saw).

The two common funds I encountered for this asset class are DFA Intl Small Cap Value (DISVX) and Avantis Intl Small Cap Value (AVDV), however, neither exist on M1.

For some, this approach might be excessive; sometimes simpler is better.

If the above portfolio looks like too much work, try a target-date fund or a robo-advisor. They do all of the heavy lifting for you. Investing should be simple – let’s not complicate it.

Final Thoughts

There are many ways you can construct a well-balanced portfolio – international stocks, real estate, mutual funds, government bonds.

Simplicity is key. What’s important is having one with a few non-correlated asset classes and going from there.

Different investments carry different risk. Do your homework. High expense ratios (the cost to operate the fund) eat away your returns so look for low-cost ones. Your retirement date will determine how your investment portfolio is allocated. There is no one-size-fits-all approach.

The above examples serve as a blueprint for executing your investment strategy. Customize them to fit your personal finance goals. Now, about that beer…

Show Notes

Personal Capital: The investing version of Mint.

LMM Ultimate Investment Strategy: Andrew lays out a blueprint for you.