If you’ve ever asked yourself, “Should I invest in stocks?” you’re not alone. Investing in the stock market can be intimidating. But if you want to grow your wealth, investing is a must. We’ll explain everything you need to know to get over your fear of investing.

Stock investing is not as complicated or difficult as you might think. It’s not just wealthy bankers who invest, millions of regular people like you and me invest too. But not enough of us.

Over half of Americans, 55%, say they are not participating in the stock market.

People have various reasons for being afraid of stock investing, and while all of them are legitimate, not all of them are rational.

Most of us don’t have the kind of salary that will make us rich or even give us enough money to retire comfortably. And most of us would like to retire someday, and even if you don’t, your health may not allow you to continue working right up to the end.

Most of us are not going to win the lottery, and most of us don’t have wealthy parents who are going to leave us a vast inheritance. So how will we be able to afford to retire?

The answer is simple; by investing.

We Fear the Unknown

The reason most of us have a fear of investing is that we don’t understand how the stock market works. And we don’t try to find out because we think it’s too complicated for a layperson to understand. Not true!

The TL: DR Version of How the Stock Market Works

We could write an entire book on how the stock market works and plenty of people have. But for most of us, it’s just not that interesting of a topic.

And really, you don’t need to read an entire book on the subject. We can give it to you in a nutshell.

If you are interested, by all means, go out and read everything you can. But you don’t need to read more than this quick summary to stop wondering, “Should I invest in stocks?” and just do it.

What happens when you don't invest should scare you more than the thought of investing.

Tweet ThisWhat Is the Stock Market?

When you see the term “stock market,” it usually means one of the big stock market indexes like the S&P 500 or Dow Jones Industrial Average.

Tracking all stocks is tough, so these indexes represent a segment of the stock market, and how they perform is seen as representative of the whole market.

When you hear that the stock market is up or down, it typically means that the stock market indexes are up or down; they’ve either gained value or lost value as a whole.

When we buy stock, we want to eventually sell it and make money based on these ups and downs in prices. We do that when we pay less for a stock than we later sell it for.

Get our best strategies, tools, and support sent straight to your inbox.

How the Stock Market Works

Public companies use the stock market to raise money, and their stock price is an indicator of how confident or uncertain investors are about the company. The price of a share of stock represents what buyers and sellers consider its’ value to be.

Supply and demand come into play as well. When more people are trying to sell a stock than people willing to buy it, the price drops. If prices drop steeply on most or all stocks, it’s known as a stock market crash.

At the time of writing, the most recent stock market crash was caused by the coronavirus pandemic. If these price drops continue, we can enter what is known as a bear market.

A bear market is when a market experiences prolonged price declines. It describes a condition in which securities prices fall 20% or more.

The opposite of a bear market is a bull market. A bull market occurs when stock prices rise for an extended period.

The longest bull market occurred between 1990 and 2000. Stock prices rose 417% during that period as measured by the S&P 500.

Ideally, you get a great bargain during a sell-off in a bear market and make bank.

What about the Crashes?

Even if you don’t follow the stock market at all, you’re probably aware of some of the major stock market crashes throughout history, and that awareness might be part of what is putting you off buying stocks.

But should it? History tells us no. There has been no shortage of U.S. stock market crashes. Yet the market continues to go up over the long-term.

The Crash of 1929

On the fourth day of the crash, Black Monday, the market fell 12.82%. It took 12 years for the economy to recover from the ensuing Great Depression.

The Crash of 1987

In October of 1987, the second “Black Monday” occurred.

By the end of this crash, the stock market had lost 23% of its value, and people began to talk about implementing a circuit breaker into computer trading platforms that would suspend trading on high-risk trading days.

We’ve seen this deployed a few times during the coronavirus induced panic. Once things stabilized, we saw a bull market that lasted 12 years.

The Great Recession of 2008

The housing bubble burst in 2008 and took the economy with it. The American government provided massive bailouts across multiple industries (something we are seeing again amid COVID-19), and by late 2009, the economy started to come back.

History Doesn’t Lie

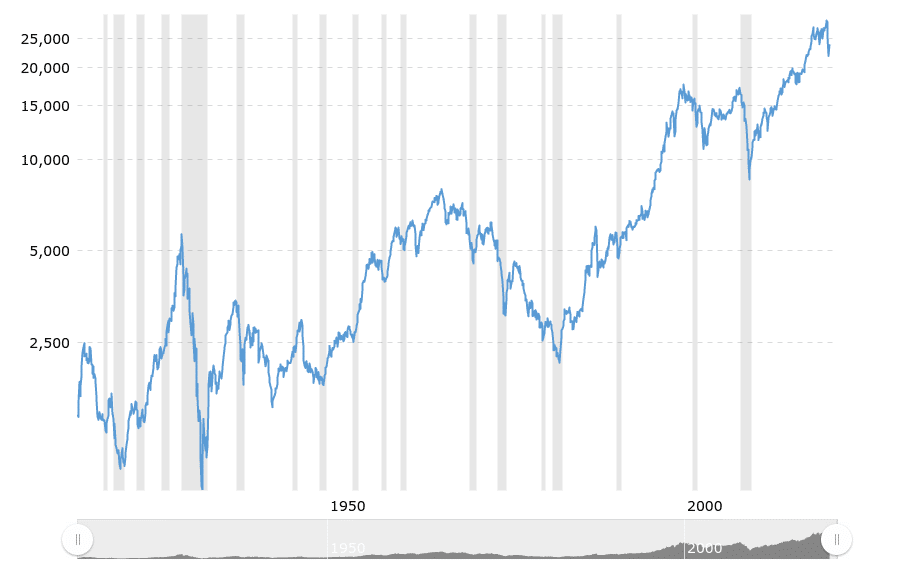

This chart represents the Dow Jones Industrial Average stock market index over more than 100 years, from 1915 to April 2020. It’s been inflation-adjusted using the headline CPI, and each data point represents the month-end closing value.

The market always comes back.

Managing Risk

Investing in the stock market, or anything else is not without risk. There are things you can’t control, but there are still plenty of ways to mitigate the risk of investing.

Time Horizon

Your time horizon means how long it will be before you need the money you’re investing. In general, time horizons look like this and an example of what you might need the money for:

- Short-Term: Five years or less. Buying a home.

- Medium-Term: Five to ten years. A child’s college education.

- Long-Term: Ten years or more. Funding your retirement.

The rule of thumb is that the shorter your time horizon, the safer the investment should be. An online savings account is an example of a safe short-term investment.

Online because they typically pay a slightly higher interest rate than do brick-and-mortar banks.

An example of a good medium-term investment might be a bond index fund or an all-in-one mutual fund, an example of which is a 529 Plan, perfect for parents saving for a child’s education.

Investing in the stock market is considered risky compared to other kinds of investments because of the ups and downs the market experiences.

How can we “flatten the curve” to use a new term that I’m sure we all hate by now. How do you ride out those ups and downs?

By investing long-term, as you do when you invest for retirement or another goal that is at least a decade off.

Because that long time horizon gives your money the chance to ride out market fluctuations, some years you win and some you lose, but over a long time period, you can expect to win.

Risk Tolerance

A few things determine your risk tolerance as it applies to investing.

What your financial goals are, how much research you want to do, how financially stable you are, your level of worry, and, most importantly, your time horizon.

The degree of uncertainty you are willing to take on to potentially achieve greater rewards.

If your financial goal is to retire by 35, you will need to have a pretty high-risk tolerance to achieve that. Retiring at 65 with $1 million and you’re currently 25, your risk tolerance can be lower.

If you have a fat trust fund waiting for you when you turn 30, your risk tolerance can be high. However, if the mere thought of investing makes your palms sweat, your risk tolerance will be lower.

Having a low-risk tolerance doesn’t mean you can’t invest; it just means your investment portfolio will have to be somewhat conservative.

It means you will have a higher ratio of bonds to stocks. Bonds are a lower risk investment than stocks.

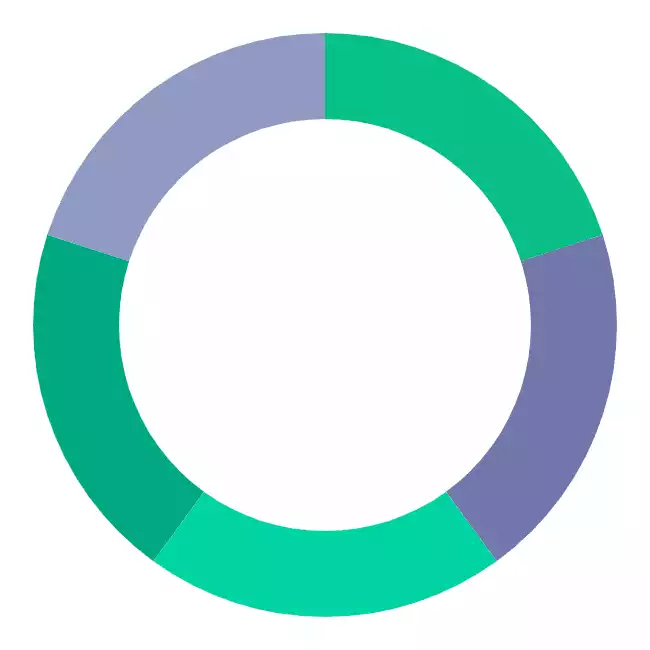

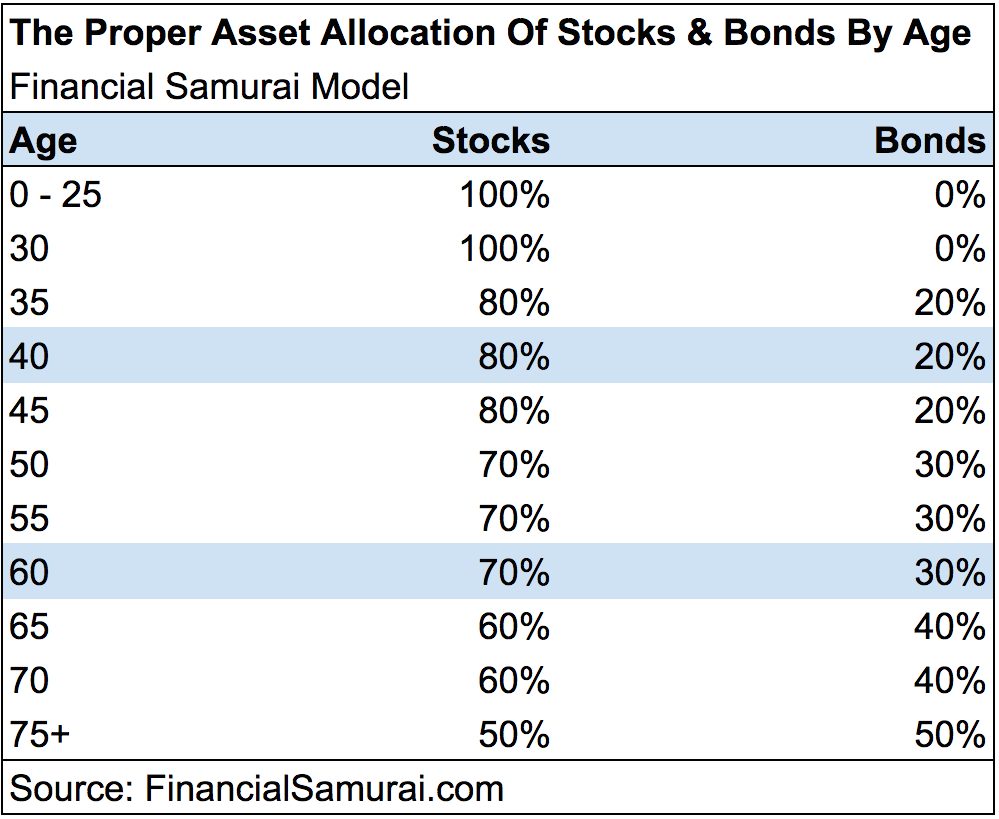

Again, the most crucial factor is your time horizon, and you can see where your asset allocation should be based on age using this chart.

The younger you are, the further you are from retirement and the more risk you can afford to take. As you get closer and closer to retirement, your allocation becomes more conservative.

Dollar-Cost Averaging

Timing the market is one way to mitigate the risk of investing. Timing the market means determining the right moment to invest a chunk of money.

Invest on the wrong day, and you could lose. But timing the market is not easy and no one reading this (nor me writing it) are skilled or knowledgable enough to do it.

And not because we aren’t brilliant, but because people whose job it is to time the market don’t always get it right so what hope would we have?

None, so we don’t do it. We do this instead, dollar-cost averaging.

Decide how much you want to invest, $1,000 we’ll say. You invest that money on a fixed schedule without worrying about share prices.

On the first of each month, you have $100 automatically transferred to your investment account. Over ten months, you will have invested the entire amount.

This has allowed your $1,000 to ride out the ups and downs of the market over those ten months. What if you had invested your entire $1,000 on a day that saw a huge plunge? You timed the market wrong, and your investment lost money.

Diversification

Diversification is a fancy way of telling investors not to put their eggs in one basket. When you have a diversified portfolio, more than one type of asset across various sectors, you can mitigate risk.

Types of assets include stocks, bonds, commodities, real estate, and cash equivalents. Different sectors mean owning stock in different kinds of businesses. Some examples would be energy, pharmaceuticals, and tech.

A very good example of a diversified portfolio is the Golden Butterfly.

This portfolio is a modified version of the Permanent Portfolio with one additional asset class. This is done to incorporate some of the characteristics of a few other notable lazy portfolios.

Tech is down? That’s okay because pharmaceuticals are up. A pandemic is causing people to panic and the stock market to plunge? That’s okay; you have gold.

Ways to Invest

We hope we’ve convinced you that you don’t have to fear investing and you’re raring to go. Here are a few ways to invest.

Robo-Advisor

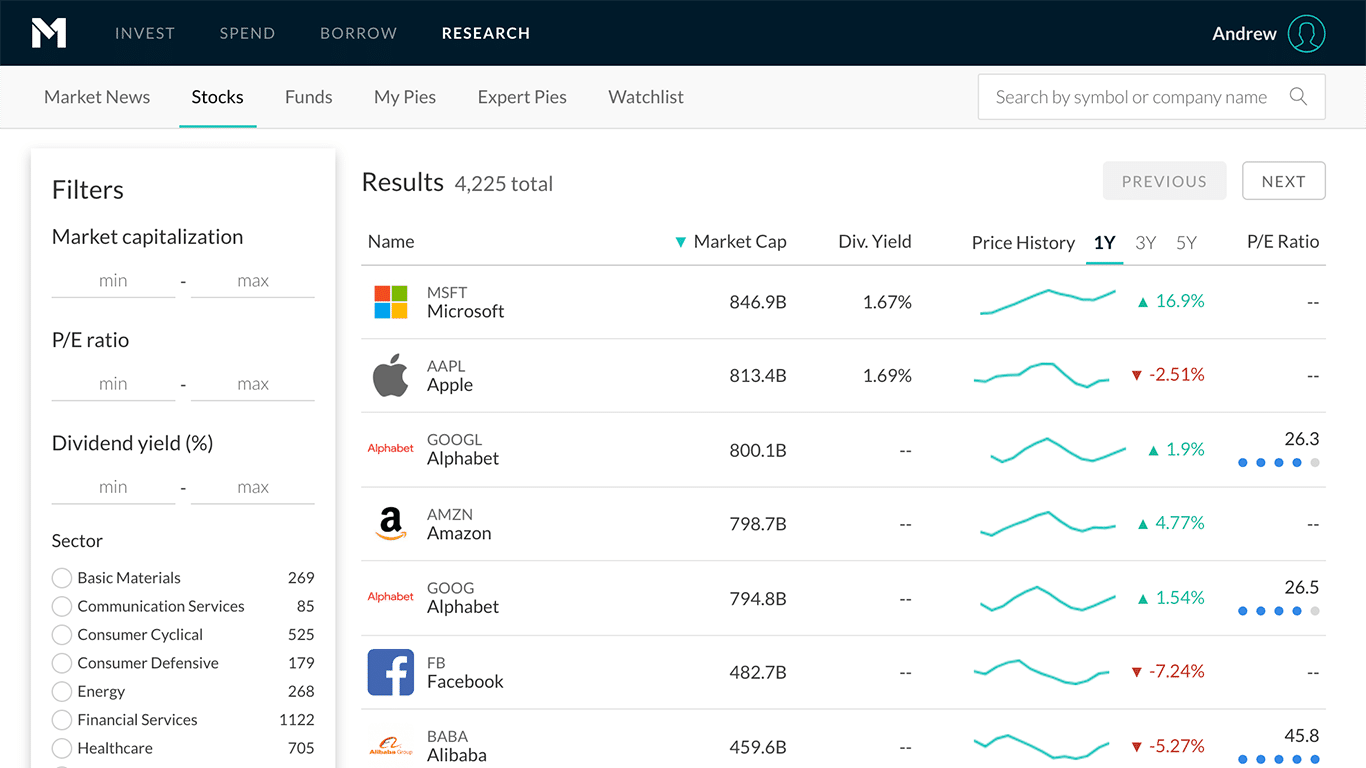

Using a robo-advisor like M1 Finance is investing in easy mode. Open your account, deposit money (there is no minimum), answer a few questions that will help determine your asset allocation, and

You don’t have to research which companies to invest in, read the Wall Street Journal, or anything else.

The fees to invest this way are low because it’s not financial advisors making the investment decisions, it’s software.

Your portfolio will contain a diverse range of investments that meet your target asset allocation.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

Most robo-advisors construct their portfolios using low-cost index-based ETFs. You are buying tiny pieces of lots of different stocks in one transaction.

Many robo-advisors offer IRAs as well for those who want a retirement account without the hassle of choosing individual stocks.

Mutual Funds

A mutual fund is another simple way to invest. You and thousands of other individual investors pool money and use it to invest in securities like stocks and bonds. The investors share in the profits or take the losses of the fund.

Unlike an ETF, a mutual fund is actively managed, which means a fund manager decides how to allocate the assets within the fund. That fund manager is the reason mutual fund fees are higher than ETF fees.

The average expense ratio for actively managed mutual funds is between 0.5% and 1.0%. For passive index funds, it’s about 0.2%.

You might think there isn’t much difference between a 0.5% or 1.0% fee and a 0.2% fee, but when we’re talking about large sums of money over decades, it is a huge difference and can really eat into your retirement savings.

You also might think that a professional fund manager makes better investments than a computer. But that’s wrong too. Only 23% of managed funds topped the average of their passive rivals.

If you have a 401k through your employer, it’s likely to be a mutual fund. Should you not participate because of the fees? Not necessarily.

Especially if your employer offers matching funds or if you would otherwise not invest. Matching funds are literally free money. Even if the fund has high fees, it’s worth contributing the minimum required to get the match.

When you leave the job, you can take the money with you and find a better investment. And if you can’t seem to put money aside to invest, a 401k is a method of “forced saving.”

The contribution is taken out of your paycheck before it hits your bank account.

Buying Individual Stocks

Buying individual stocks is the hardest way to invest of those listed, but it’s not beyond anyone reading this. The process of buying stocks is straightforward. It’s knowing what to buy that’s harder.

You don’t have to buy individual stocks.

You can be a successful investor and never do it. And it’s the riskiest way to invest on this list.

When you invest in an ETF or mutual fund, your money is buying lots of different investments, so if one is down, others are up, and your money is somewhat insulated.

But buying individual stocks means that all of the money in a particular stock is at risk if the value goes down. Of course, the value can go up too. And most people who buy individual stocks buy several.

To be honest, buying individual stocks is fun. It’s what I’ve been doing to fend off the boredom of being under coronavirus house arrest.

But it takes a lot of research.

I use M1 Finance to do my research because I’m no expert, and the site has tons of tools that not only provide you the information you need but make it understandable to a layperson.

And because I’m trying to make money, not spend it, I use M1 Finance to make my trades too because it’s free.

Here’s how to buy stocks:

- Open a brokerage account and transfer money into it from your bank account to fund your trades. You can open an account with companies including M1 Finance, E-Trade, and TD Ameritrade.

- Choose the stocks you want to buy. If you have no idea where to start, start with what you know. If you use and love Apple products, start there. Do your research on Apple and decide if that is a good buy for you.

- Decide how many shares to buy. If you’re new to investing, start small. Only buy a few shares of one stock or even only one share.

- Decide what kind of order to make. There are several choices.

That’s all you have to do to buy individual stocks.

How Much Should You Invest In Stocks?

Now that you’re convinced you should be investing, how much should you invest?

There are many different answers regarding the question of how much people should be investing. Our go-to answer is 20%, which sounds like a lot, but that 20% encompasses several things.

Firstly, it’s 20% of your net income, not gross. And any money you’re not spending counts whether you’re saving that money in a savings account for your emergency fund, contributing to your 401k, 529 Plan, or HSA, or buying individual stocks.

If you have high-interest debt, like credit card debt, this doesn’t apply to you. Over time, on average, you can expect to make conservatively, 7% a year on your investments.

The average interest rate on a credit card is in the mid-teens. So when you carry credit card debt, you’re paying more in interest than you could make by investing.

Focus on paying off that credit card debt, then invest. The exception is a 401k if your employer offers to match. Again, that’s free money, so you should contribute the minimum to get the matching funds.

Max Out Your Retirement Accounts

You will have different goals for the money you invest, and those goals will help determine your investing priorities.

But the most important goal of investing is to save for retirement because you might not be able to work forever, and most people probably don’t want to.

The most significant aspect of retirement investing is time, the longer your money has to grow, the more it will grow.

Invest for retirement as early as you can.

The other benefit of retirement investing is tax benefits. When you’re in a position to do so, max out your retirement accounts, so you have more money with more time to grow.

For 2020, these are the contribution limits:

- 401k: $19,500, and an additional $6,500 for those aged 50 and older.

- Roth and Traditional IRA: $6,000 and an additional $1,000 for those aged 50 and older.

All Investments Come With Risk

There is no such thing as a 100% risk-free investment. But there are more significant risks to your money than investing wisely.

The biggest risk a person can take is to do nothing.

You might think your money is nice and safe sitting in your checking or savings account, but it isn’t.

Because the amount of interest those accounts pay is smaller than the average rate of inflation, your money is losing value, languishing in those accounts.

You might make a good salary and save lots of money, but when that money is earning no interest and being nibbled away at by inflation, your savings won’t be enough to see you through retirement.

You will be at considerable risk of outliving your money. Start investing, take the calculated risk, and grow your wealth.