We often talk about long-term investing but what about investments when the clock is ticking? Long-term money can’t be treated the same way as short-term money.

You have to strike the right balance between being safe and making money. We’ll show you how to get the balance right with the best low-risk short-term investment options.

Short-Term vs. Long-Term

Just what do “short-term” and “long-term” mean regarding investing?

When it comes to evaluating market risk, your time horizon is a crucial factor to consider. As a general rule, shorter time horizons require more caution than do longer ones.

Short-Term

Short-term investments mean money you will need in five years or less.

Because you’re going to need this money relatively soon, you need to look at safe investments. No investment is without some level of risk, but some investments are indeed safer than others.

Long-term investing has gotten so popular, it's easier to admit you're a crack addict than to admit you're a short-term investor.

Tweet ThisWhile you can expect to make an average return of 9.00% (historical return of the S&P 500 from 2004-2023) in the stock market, short-term money won’t be invested long enough to average out through the market’s ups and downs.

Short-term money is typically for things like a down payment for a home, a planned renovation, or a wedding.

Long-Term

Long-term money is money invested for five years or more. This longer time horizon does allow for your money to ride out market fluctuations. Long-term money is invested for things like retirement or paying for a child’s college education.

The Best Short-Term Investments

You might think that the best thing to do with short-term money is to stick it in your checking or savings account.

While your money is undoubtedly safe there, it isn’t growing at all in your checking account and growing very slowly in your savings account.

Most of the top banks, including Chase, Bank of America, Citibank, and Wells Fargo, none of them offer an interest rate above 0.20% on their checking accounts.

Here’s an illustrative example: imagine having $1 million in a savings account earning a 0.20% interest rate. In one year, you would earn only $2,000. Conversely, if you invested that same $1 million in the market and achieved a 7% return, your earnings would be significantly higher, reaching $70,000 in a year.

You can get a slightly higher interest rate with a savings account but not much higher. Of 21 well-known banks, including some online banks, the best rate is 1.45%.

So no, leaving short-term money in a checking or savings account is not among the best investment options. Let’s take a look at some better places to park that money.

Betterment

You might be surprised to see

But you can minimize that risk by setting a conservative allocation. The higher your percentage of stocks versus bonds, the more money you can make but the riskier your portfolio.

A conservative allocation of 50/50 stocks and bonds would allow your money to grow while still protecting short-term investors from a dip in the market.

A

Roth IRA

Yes, a Roth IRA is meant to be a retirement account, but you can use it as a short-term investment vehicle. Most retirement accounts penalize you for early withdrawal, but the Roth IRA doesn’t (see next paragraph).

The account is funded with after-tax income so you can withdraw contributions, but not any earnings on those contributions, at any time, for any reason, and without penalty.

It’s not typically recommended because money in a Roth is meant to be used during retirement, but you may consider it worth it as a short-term investment because of the likely higher rate of return you’ll get from most other short-term investments. You can open a Roth IRA with

Online Savings Account

Online banks often have higher interest rates than brick-and-mortar banks. If you’ve been to New York City in the last five years, you might suspect that half of Chase and Citibank’s profits go to rent.

Online banks don’t have brick-and-mortar locations, so they don’t have expenses associated with office space. This is why they can offer better rates.

That said, the rates still aren’t high, they don’t even beat inflation, but they are better than what physical banks are offering. Online banks often charge fewer fees too which is another bonus.

Two high-yield savings accounts are Synchrony and CIT Bank (check their sites for the latest interest rates).

An online savings account is best for the money you’ll need in two years or less and accounts are FDIC insured up to $250,000 (per depositor) as they are with a traditional bank.

Money Market Funds

A money market account is sort of a cross between a checking and savings account. These accounts offer a higher interest rate than typical checking or savings accounts, and you can write checks from them. They usually have a high minimum balance requirement, usually around $2,500. If your balance drops below that, you may face a fee (see this article for low minimums).

Synchrony and CIT are standouts for money market accounts. Synchrony has no minimum and the CIT is just a $100 minimum.

A money market account is best for the money you’ll need in two years or less. These accounts are FDIC insured up to $250,000 if offered by a bank or credit union.

Certificate of Deposit

A CD locks your money up for a pre-determined length of time that ranges from three months to five years. The longer the time frame, the higher the yield. If you withdraw money before the date of maturity, you’ll be penalized. The penalty is typically the equivalent of three months’ worth of interest.

Check out CIT Bank’s offerings.

If you’re okay with your money being locked up for a period, certificates of deposit can offer higher yields than some of our other short-term investing options.

This investment is best for the money you’ll need in five years or less. Certificates of deposit are FDIC-insured.

Treasury Securities

A Treasury Security is a U.S. government-issued bond. Treasury bills have the shortest maturity periods, ranging from about a month to about a year. Treasury notes mature from two to ten years.

The yields on these bonds are lower than on every other type of bond because they come with almost no risk, making them a very safe investment. The rates vary by the length of the maturity period.

These investments are best for the money you’ll need in five years or less. While you can buy Treasury notes for ten-year terms, ten years is well outside our definition of short-term.

Short-Term Bond Funds

A short-term bond fund invests in bonds that mature in five years or less. The bonds can be issued by any entity including the U.S. government, companies, and corporations. You’ll need a brokerage account, with Charles Schwab or Fidelity, for example, to invest in these funds.

These funds typically pay lower interest rates but potentially higher yields than money market funds. Given the extra hassle of going through a brokerage account coupled with interest rates that aren’t much better than a standard savings account, I’ve only included short-term bond funds as an available option, but it’s certainly not the best choice on this list.

But if you insist! Short-term bond funds are best for the money you’ll need in one to two years.

Municipal Bonds

Municipal bonds are sold to finance state and local infrastructure projects. One of the most attractive features of these investments is that the interest income from them is exempt from federal taxes.

If you buy bonds in your state of residence, the interest may be exempt from state and local taxes as well.

While investing often benefits from a longer timeframe, municipal bonds present a unique case. Compared to longer-term options, bonds with 1-2 year durations experience less volatility in price due to interest rate fluctuations. However, they are not entirely immune to these changes.

Ultimately, the ideal investment duration depends on individual risk tolerance, investment goals, and current market conditions. Consulting a financial advisor can help navigate these complexities and personalize an investment strategy for your specific needs.

You can buy municipal bonds directly from the municipality or through a bond broker.

You should also consider bond mutual funds or ETFs as they offer a convenient and well-diversified way to access the bond market. By holding a basket of various bonds, they spread risk and offer professional management. Their tradability throughout the day ensures easy buying and selling, appealing to investors seeking a balanced approach to bond investing.

Peer-to-peer Lending

Lending Club is an example of a peer-to-peer lender. It’s the company we chose to focus on as Andrew has direct experience investing with them.

The platform pairs lenders with borrowers. By providing investors with the ability to purchase consumer debt, Lending Club can offer better rates for borrowers as well as higher returns for investors.

In addition to being able to buy individual loans in chunks as small as $25, investors can also have their funds automatically invested based on their unique specifications.

Lending Club investments range from three to five years. Your rate of return depends on how much risk you’re willing to take when choosing loans to fund.

This short-term investment option, while being one of the riskiest, offers higher yields, embodying the inherent nature of investing (risk versus reward). It is most suitable for funds you anticipate needing within three to five years, balancing the pursuit of higher returns against the potential for greater risk.

Pay Off Debt

If you have a high-interest credit card or student loan debt, you should focus on paying that debt off. No money you can make on any short-term investments or long-term investments is going to be more than you’re paying on high-interest debt.

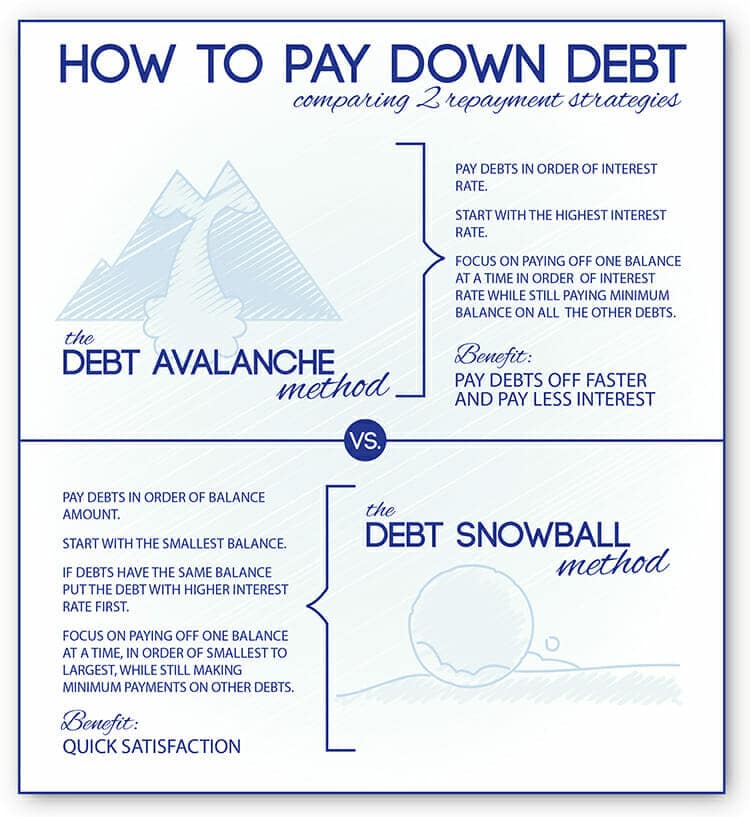

Credit card debt is the most urgent. Credit card interest rates are impacted by the Fed’s target interest rate. The current average rate is 20.75%. Make a plan to pay down credit card debt.

Use the snowball or stacking method to pay it off efficiently. If your credit score is good enough, you may be able to qualify for a balance transfer credit card. This will allow you to pay off the principle more quickly because it’s not accruing additional interest.

Again, if you have decent credit, you may qualify for a loan with Upgrade. You can take out a single loan with a lower interest rate than your credit cards have and use it to pay off the balances.

Student loan debt interest is typically relatively low, but if you can make it even lower, you can pay the debt off more quickly and start investing. Even a 1% reduction in your interest rate can save you thousands of dollars over the life of the loan.

You can refinance your debt using a personal loan from Upgrade. You can check your interest rate in two minutes and doing so won’t affect your credit score.

Get our best strategies, tools, and support sent straight to your inbox.

You Have Choices

LMM gets at least one email a week from a listener who is torn between safe investments for their short-term money and leaving it sitting in a savings account where it’s safe but making less than 1% interest.

While there is no safe short-term investment that is going to match an average market return, you do have better options now than that crummy savings account.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.