Credit card debt will cripple your financial goals. When you have credit card debt, it’s hard to do the other things that will grow your wealth like buy a home, a rental property , or invest. Even if you faithfully make the minimum payment each month, the interest rate, typically in the mid-teens and higher, means you never make any progress.

It can be frustrating. Compounding that frustration is the anger you feel about getting yourself into all this credit card debt in the first place. It doesn’t matter if you lost your job and had to put all of your living expenses on a credit card (because you didn’t have an emergency fund) or you just bought a bunch of stuff you didn’t need and couldn’t afford.

The fact is, you’re in credit card debt hell.

But you can escape credit card hell. It won’t always be easy, and it won’t always be fast, but if you take the right steps, you can do it more efficiently and more quickly than you might imagine. Whether you have a little credit card debt or a lot, whether you have a high credit score or a poor one, there are proven ways to pay it off and get out of credit card debt hell once and for all so you can move on and start growing your wealth.

You’re Not Alone

It’s probably small consolation, but if you have credit card debt, you’re not alone.

According to the Federal Reserve, Americans owe a record $1.04 trillion in credit card debt – up from less than $854 billion five years ago. On average, Americans owe $6,354 on bank-issued credit cards.

The amount of credit card debt in America isn’t quite as high as the amount of student loan debt which is at $1.5 trillion, but it’s up there. Let’s pour one out for the poor bastards who have both credit card and student loan debt.

But credit card debt is worse than student loan debt because of the high-interest rate on credit cards. If I told you I had an investment that would give you a 19.24% return you would jump on it. Well, 19.24% is the average interest rate on new credit cards. So as excellent a profit of more than 19% would be is just how much paying more than 19% in interest sucks.

Yeah, it sucks a lot, so we’re going to pay off these high-interest rate debts.

First Thing’s First

If you have credit card debt, you might not even know exactly how much you owe. We don’t blame you. That number is scary. But you have to know it so we can move forward and start paying it down and off.

So make a list of all of your credit cards and include the balance and interest rate for each. Keep this list handy because you’re going to need it.

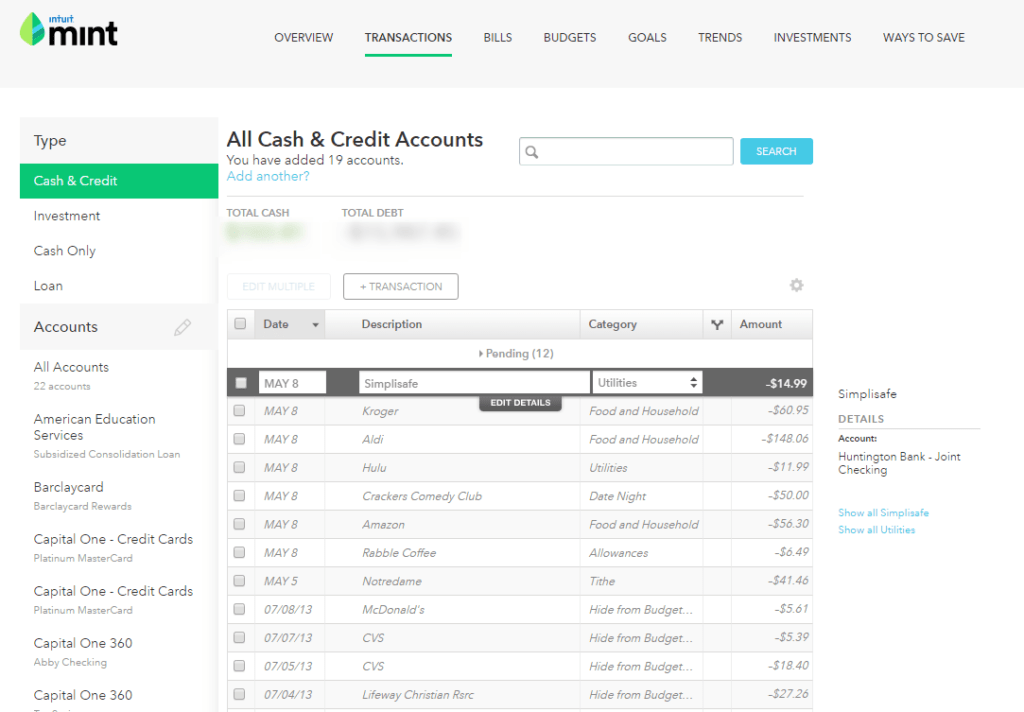

Next, set up a Mint account if you don’t already have one. Mint is free and easy to use. You’re going to create a budget within Mint. This budget is how you’re going to know how much money you have to pay off your credit cards and how you can find extra money to pay them off faster.

Mint will also provide you with motivation. Once you have your account set up and all of your credit cards linked, you’ll be able to see exactly how much you owe and you’ll see those numbers steadily dwindle as you pay them down.

Next, go to Credit Karma, create an account and see what your credit score is. Credit Karma is also free to use. You want to know your credit score because some of the methods of paying off credit cards that we’re going to explain require a credit score above a certain number. Not all of these methods will be available to those under that number, but there are still things you can do to pay off your credit cards more quickly.

This free course outlines a proven framework that thousands of people have used to eliminate their debt, develop better money habits, and start building a secure financial future.

Getting Down to It

There are several things you can do to pay off your credit cards. Let’s get into it.

Ask for Lower Interest Rates

Anyone can try this regardless of credit score and everyone reading this should do it. Call each of your credit card issuers and simply ask them to lower your interest rate. Explain that you are really trying to tackle your debt and you can do it more quickly if they will agree to this simple request. If you’ve never missed a payment or you’ve been a loyal customer for many years, say so, you’re trying to sell yourself here.

You can also use the fact that there are so many credit cards out there. Tell the customer service rep that if they won’t agree to lower your interest rate that you’re going to get a balance transfer card (more on this coming up) from a new credit card company.

If you get a “No,” wait a few days and try again. Those call centers employ thousands of people so the odds that you’ll speak to the same person twice, or that they would remember you if you did, are astronomical.

Any concession you can get will help you pay off your credit card debt faster.

Get a Debt Consolidation Loan

If you have a good credit score, this is the best way to pay off your credit card debt. You take out a personal loan from a peer-to-peer lender like Prosper or a more traditional lender like Credible and use it to pay off your high-interest credit cards.

Yes, you still have debt, but again, depending on your credit score, the loan is at a lower rate of interest than you were paying on the cards. Both Prosper and Earnest allow you to answer a few questions and see your loan offer including the interest rate in about two minutes and with no impact to your credit score.

A debt consolidation loan is ideal for those who have a good credit score and several thousands of dollars in credit card debt. Depending on the amount of the loan you’re offered, you may be able to pay off all of your credit card balances. A debt consolidation loan also simplifies your life. Rather than having to keep track of multiple due dates across multiple credit card accounts, you’ll have a single monthly payment to keep track of.

Get a Balance Transfer Card

This one too is for those with good credit. Balance transfer credit cards are credit cards with an introductory 0% APR period. The period usually ranges from 6-24 months, although 24 month cards are hard to find. You can look on Credit Karma for a list of current balance transfer offers including all the terms and conditions.

Be sure to look for things like a balance transfer fee and annual fee. A balance transfer fee is not necessarily a bad thing; it’s usually 3% of the balance you’re transferring or $5, so not a lot of money but an annual fee could be $100 or more. It’s usually waived for the first year but not always.

Apply for the card, get approved and the new card will take care of transferring the balance or balances from your old high-interest credit cards to the new card. During the 0% period, every payment you make goes toward paying down the principal because the balance is not accruing interest charges.

For this to work, you must buckle down and pay off the entire balance before the introductory period ends. If you don’t, the remaining balance will be subject to the new APR which could be higher than what you’re currently paying on your credit card. And do not charge any new purchases to the card!

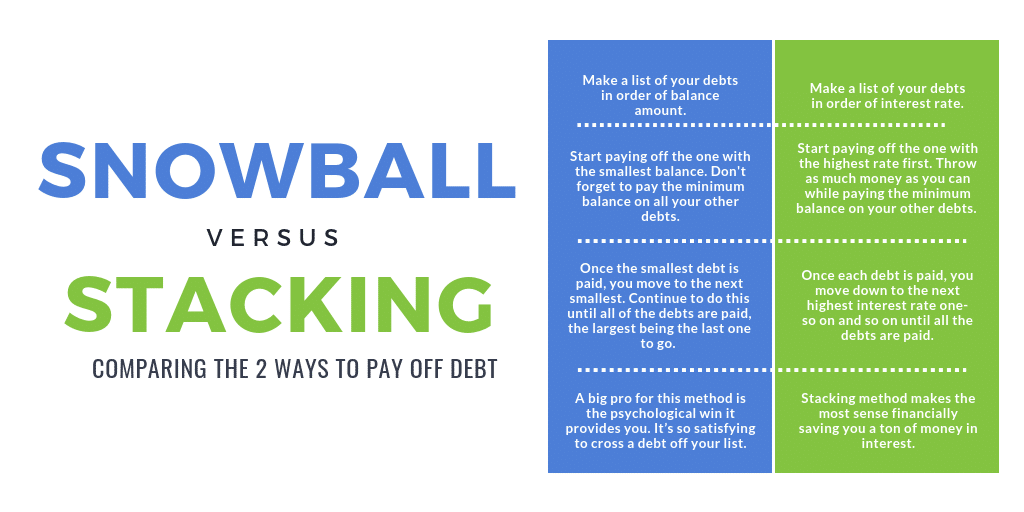

Debt Snowball and Debt Stacking

If your credit score isn’t good enough for the above methods or you have more debt than those methods covered, the snowball method or stacking method.

Here’s how it works.

Remember that list of all your credit card debts including balances and interest rates you made? Get it.

The debt snowball method has you list all of your debts according to dollar amount, smallest balance to highest. It might look like this:

- Home Depot: $400

- Visa: $1,100

- American Express $1,500

- Discover $2,000

You pay every penny you can find towards the Home Depot debt while paying only the minimums on the others. Once the Home Depot card is paid off, you take the money you were paying on it and every other penny you can find and pay it towards the Visa, again, while paying only the minimums on the rest. You continue this way until all the debt are paid.

The debt stacking method works exactly the same way with one important exception; rather than paying off the debts in order of lowest dollar amount to highest, you pay them in order of interest rate, highest to lowest. So our list above would look like this.

- American Express Interest rate 21%

- Visa Interest Rate 19%

- Home Depot 16%

- Discover 15%

Pay the American Express first and work your way down the list.

Which method is better? Strictly from a dollars and cents standpoint, stacking is superior because it saves you the most money in interest payments. Then why did we include the snowball method?

Because humans aren’t always rational. The snowball method works when you have one or a few small dollar amount debts because it allows you to pay them off quickly. And that makes you feel good! Gives you motivation and a feeling of accomplishment.

Make Extra Money

Whatever method you use, you should also make some extra money to throw at your credit card debt. The easiest way to do this is to ask for a raise at your 9-5 job. You can’t just ask; you have to go in prepared. Or better yet, get a new job. The average raise at a current job is just 3%, but when you start a new job, with good negotiating skills, you can bump that up to as much as a 20% raise.

Once you get a little more money in your paycheck, start a side hustle. We’ve covered dozens of ways to make money on the side, both in the real world and online. Drive for Uber or Lyft, care for children or animals, rent out your place on Airbnb a few times a month. Answer surveys online, teach English as a second language or do some freelance writing.

Marie Kondo your house and your life. Take all of those things that don’t spark joy and sell them on Facebook, Nextdoor, eBay, Poshmark, Gazelle, and Craig’s List.

Every extra dollar you earn gets you a dollar closer to being debt free.

Find Extra Money

Go through your budget and see where your spending leaks are. Food is always a good place to start because almost all of us spend too much on food whether it’s buying lunch out every day or spending too much on groceries.

Let Trim, um trim your expenses. Trim will go through your monthly transactions and look for recurring expenses like your gym membership or subscription services. When Trim spots these expenses, you’ll get a notification asking if you want to cancel them. If you do, simply reply “Yes,” and Trim does the rest. Of all the money-saving apps we’ve covered, this is my favorite.

Billshark will negotiate a better rate on your cable, cell phone, satellite TV, internet, satellite radio, and home security bills.

What Now?

Woo, you did it! You paid off your credit card debt! We’re proud of you. What now though?

About Those Cards

You might think we’re going to tell you to cut up all of your credit cards, call the credit card issuers and cancel them. Not necessarily. First of all, doing that will hurt your credit score which if you haven’t noticed, has made a nice rebound and is now possibly dozens and dozens of points higher than it was when you started.

Secondly, a credit card is a tool, and like any tool, you can use it well or use it poorly. Well used, a credit card can give you lots of benefits like cash back and travel rewards. Learn to use your credit cards like a responsible adult.

But if you can’t, don’t cancel the cards but do cut them up. Just put a small, recurring charge on each card, like your Netflix bill, set it to autopay and forget you have the cards. This will keep your account open so you don’t damage your new and improved credit score but you won’t have those cards in your wallet tempting you with their siren song.

Invest, Invest, Invest!

The really crappy thing about being in credit card debt is that it inhibits your ability to grow your wealth. And what’s the best way to grow your wealth? Investing. But now you have potentially hundreds of freed up dollars to invest with.

If you have access to a 401k, invest at least enough to get the match because that match is free money. Check out the fees in your 401k and if they’re good, go ahead and max it out. If they’re not good, just do the match and open an IRA.

These are tax-advantaged retirement accounts and retirement investing is important because of those tax advantages. The two most expensive things in life are interest (as you’re well aware!) and taxes. Retirement accounts allow for legal tax avoidance.

Once your retirement accounts are maxed, look to an index fund like

Consider adding some real estate to your investment portfolio. You can invest with Fundrise which is a good option for those looking to diversify but who don’t want to or can’t afford to buy a rental property.

You Have No Idea

I have been in credit card debt, and it’s terrible. It’s so stressful, and you’re so angry at yourself for being so dumb and irresponsible. You have no idea how good you feel, how free you feel when you pay off the first balance, never mind the whole balance across all the cards.

I’ve been there, and if I had a magic fairy wand, I would wave it over your head and Poof! I would make your credit card debt disappear. I can’t do that, so I wanted to give you the next best thing. Make me proud.