If you’re at all familiar with the world of personal finance, you’re likely familiar with Dave Ramsey. In case you haven’t heard, Dave Ramsey is a well-respected financial guru. He hosts a radio show and has written numerous books. His most popular book is The Total Money Makeover.

He has a website, daveramsey.com, and offers classes called Financial Peace University to help people eliminate debt, learn to make and stick to a budget, and save for future goals.

We don’t agree with all of Ramsey’s solutions, but there is no question he has helped millions of people struggling with their finances. For instance, Ramsey suggests the snowball method of debt repayment, but the stacking method is superior when saving money on your debt. But if you follow the snowball method, you will pay off your debt. So we say potato, and Dave says potato, but we both get you debt free in the end.

Ramsey’s investing philosophy leaves a lot to be desired. His investment philosophy is conservative. We’ll break down the Dave Ramsey investing strategy and see where it comes up short.

A Very Short Guide

Dave Ramsey’s Guide to Investing is a free PDF available online. It’s not exactly a weighty tome, just 17 pages, two of which are the cover page and table of contents. However, Dave’s investing strategy consists of just three steps:

- Ask yourself specific questions—things like when you want to retire, what kind of lifestyle you want to live, etc.

- Diversify. This section is just four sentences long, and two speak of eggs and baskets.

- Stay focused.

This is the sum total of Dave Ramsey’s investment advice. It is heavy on cliches (I counted four) and light on advice or even basic information like explaining different types of investments. Dave’s advice won’t tell you much if you don’t know anything about investing.

At LMM, we want our listeners and readers to be fully informed. That’s why we produce things like the investing blueprint, investing for beginners, our what the f**k series, and a ton of other stuff you can find on this site.

The Rule of 72

The rule of 72 is a method Dave recommends as part of building your investment strategy; it identifies your investing timeline. You divide 72 by the rate of return you get on an investment. That number is about how many years it will take for your investments to double in value.

There are a few problems with this. First, numbers and averages aren’t the same things. The bigger problem is that Dave uses 12% as the average annual return you can expect to earn. This number is exaggerated. At LMM, we use 7%, a little lower than the average annual return you can expect in the market over the long term.

He posits that if you invest $100 a month from age 25-35 with a return of 12%, you will retire with just over one million dollars. The backlash was immediate. Dave’s defense was that his advice was “inspirational and instructional.” He continued, “…if you save money over time, you’ll have some.”

Well, no shit Dave. I get the moving part. One hundred dollars a month doesn’t sound unreasonable, and a million dollars sounds like a lot. But I think most of us could do with a bit more of the instructional bit. But you don’t need instructions because Dave will hand you off to one of his ELPs! More on that to come.

Get our best strategies, tools, and support sent straight to your inbox.

Buy and Hold

Dave encourages long-term investing. To play the long con, you must tune out much of the coverage about the stock market and the economy. The good news doesn’t sell as well as doom and gloom, and if you jump every time you hear scary economic word, you will never be a successful investor.

We agree with this. That’s why we’ve shown you how to take the emotion out of investing so that your decisions are based on data, not the latest scaremongering headlines you see on CNBC. Timing the market rarely pays off. Dollar-cost averaging does.

Put your money into M1 Finance and leave it alone for a few decades. Buy and hold.

ELP

An ELP is an endorsed local provider. This is a financial advisor. Dave can recommend financial planners to you virtually anywhere in the country. And Dave makes a pretty good living doing that. For each referral, he makes $80. He sells financial services.

Dave recommends getting a recommendation for an advisor from family and friends. That’s great! I hear Bernie Madoff got a lot of clients via word of mouth. He suggests making sure the advisor has the appropriate credentialing and certification. But what do you know about that? I mean, this little PDF is less than 20 pages. You’d think he could have thrown a few acronyms in there to give you a hint.

But he hasn’t taught you anything about investing. So how would you know a good financial planner from a bad one? He seems to think using one of his ELPs takes care of that. But how well are they vetted?

His tips on avoiding fraud reiterate what he wrote about choosing an advisor. Ask questions. If you don’t know anything about investing, you won’t know what questions to ask. Even if you googled a couple, you wouldn’t understand the answers or see if they were true.

No one will ever care more about your money than you, and an advisor will not do anything for you that you can’t do for yourself for free with a bit of education. Okay, not all of us love dealing with money.

In that case, you might choose to hire an advisor. But you still need to understand investing to choose a good one and ensure they aren’t ripping you off and charging you outrageous fees.

401ks and IRAs

Part of Dave’s investment strategy is to invest in your employer-sponsored 401k. And we agree with that, especially if your plan offers to match. That is free money! It’s also an easy way to invest because it’s automated. The money is deducted from your paycheck before you even see it. And what you don’t know, you can’t spend.

But before you invest in a 401k, Dave wants you to complete his baby steps 1-3. They are:

- Save a $1,000 starter emergency fund.

- Pay off all debt using the debt snowball.

- Save 3-6 months of expenses for a fully funded emergency fund.

Step One should be completed before you do anything else, even pay off debt.

Step Two is to pay off debt with the snowball method, but the math doesn’t work out. The stacking method is superior if you want to save money by paying interest on debt.

Step Three is 3-6 months’ worth of expenses saved. We believe that 2.5 times your monthly expenses are enough money to leave sitting in your checking or savings account, earning nothing.

Our idea of an emergency fund is $25,000 invested in a low-risk investment fund like Vanguard’s Admiral Fund (if you have at least $10,000) or Vanguard’s Lifecycle Fund, which has a minimum of just $1,000.

If that’s too risky for you, several other short-term investment options are good places for a large emergency fund.

Dave also recommends IRAs. We have covered both Traditional and Roth IRA’s and show you advanced strategies to maximize the tax benefits of your IRAs.

Dave suggests investing 15% of your income (much more than $100 a month). We recommend 20%. Dave means paying your house off early; we think that money should be invested. If you need cash fast, selling a home is not the way to get it. A home is not a liquid investment.

Picking a Mutual Fund

Dave recommends doing your research and not just trusting your advisor’s recommendation (does that apply to his hand-picked ELPs?). You should base your decision on the fund’s past performance over at least the last five years and not invest in funds that have been around for only a few years.

He also wants you to research the fund manager; the longer they have been around, the better. He warns you to beware of excessive fees, but he doesn’t tell you what constitutes excessive. To the uninformed investor, a fee of 1.25% sounds small. Unfortunately, we regularly pay more than that when we use an out-of-network ATM to withdraw cash.

The average fee charged by an actively managed fund charges is just that, 1.25%. In the realm of fund fees, it’s a lot! According to Securities and Exchange Commission calculations, if you invest $100,000 in a fund with a 1% annual fee, which is less than average, it will cost you nearly $28,000 over twenty years. If you had that $28,000 to invest, you would have earned another $12,000.

But do you know what has lower fees than most mutual funds? Index funds like M1 Finance. And the investments in an index fund are chosen using an algorithm that takes humans primarily out of the equation. Index funds regularly outperform actively managed mutual funds, and the fees are lower. So we say skip the high-fee mutual fund and invest in an index fund instead.

Late Starters

The best time to start investing was when you were 18; the second best time is now. It’s rarely too late to start saving for retirement, but you have some work to do if you’re late to the party. Dave recommends delaying retirement by two years.

Even if you’re 40 or 50, Dave claims you can put just $2,000 into a mutual fund a year and retire with more than $300-400,000. But he’s using that magical 12% return which we know is exaggerated.

Retirement is a numbers game, but you need to know your number. How much money do you need to retire? One way to get that number is to use the 4% rule. You can withdraw 4% of your retirement money for at least 30 years and not run out of money. For example, if you have $500,000 saved, you would withdraw and live on $20,000 a year.

Once you have a number, it’s easier to know what you need to do to ready yourself for retirement. For example, you may need to work longer than you would like to cut expenses, so you have more money to throw at investments or find a way to bring in side income.

Protecting Your Wealth

This part of the investment strategy is making sure you have adequate insurance coverage. Most of us have a home owner and auto insurance, but most are limited liability policies and only provide coverage up to $500,000. Dave suggests an umbrella policy that will provide additional coverage and protect your wealth if you were to be sued.

He also recommends long-term care insurance to cover the cost of things like nursing homes and in-home nursing care. Medical bills are one of the leading causes of bankruptcy, so ensuring you have adequate coverage matters.

We don't buy our insurance like our grandparents. We get it in an online marketplace where prices are highly competitive and signing up doesn't require high levels of stress or time. Got a quote in under 10 minutes without talking to anyone - just how we like it.

If you’re insurance shopping, PolicyGenius will make it easy to compare different rates in one place.

Give it Away

Money isn’t just something to be pursued until you have the most enormous pile possible. That kind of mindless accumulation doesn’t make us happy. You can’t take it with you and all of that. Dave veers into religion here as he often does, and I’m not going to touch that.

But he’s right that being charitable has been proven to make us happier. Using your money to buy experiences rather than things also makes us more comfortable. You worked hard for your money, and you are allowed to spend some of it on things that give you and other people happiness.

What About Real Estate?!

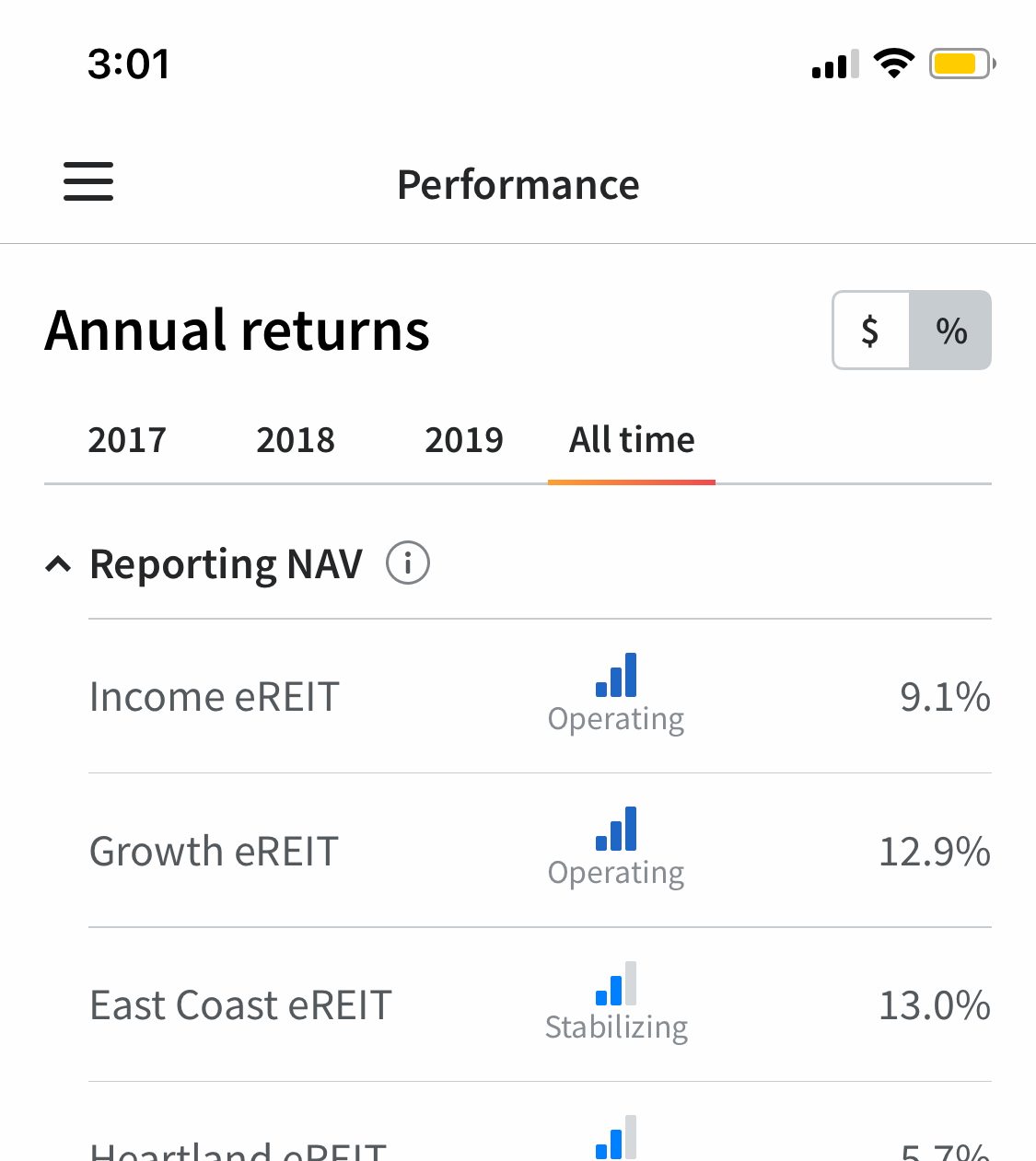

Did you notice anything missing from the Dave Ramsey investing strategy? Where in the hell is real estate?! Apart from the home you live in, there is no mention of real estate, which is a shame because real estate is one of the best ways to earn passive income.

Part of the glaring absence is Ramsey’s seeming allergy to all debt. Okay, for most people, that will rule out a

The right rental property is good debt; it’s an investment that puts money in your pocket each month. Something you can’t say for the house you live in, which costs money in maintenance and property taxes even when it’s paid off.

Okay, fair enough, I guess. No debt is part of his philosophy; most people can’t afford to buy a

Decide for Yourself

Dave Ramsey does some good things, but he’s not the be-all end-all in the personal finance world, nor is he infallible. He’s an industry. Read his strategy and our Investing Blueprint and see which is better.

Show Notes

LMM’s Investing Blueprint: Our much more detailed financial plan.

Dave’s Investing Philosophy: Seven easy steps, you guys!

Betterment: A user-friendly investing tool. Use this link and get six months free.