A 401k is an investment account to which most people begin contributing through an employer. The account allows you to dip your toe in the world of investments while saving money toward your eventual retirement. Many employers even offer 401k matches to encourage contributions from employees. But when you leave that company you may need to do a 401k rollover.

How do you stack up?

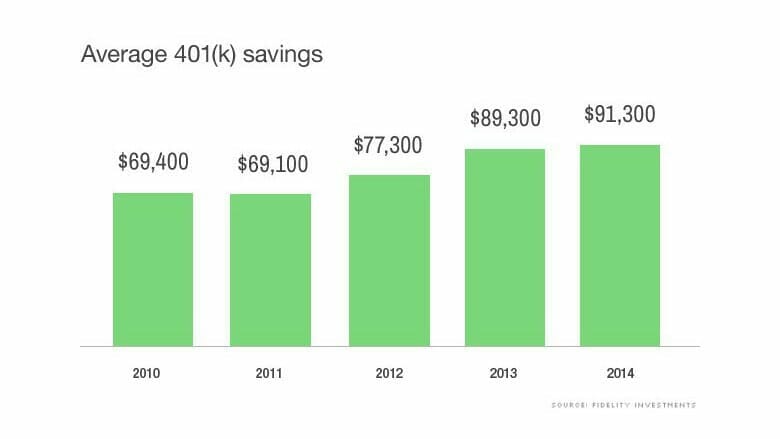

In the U.S., the average 401k balances are as follows:

How does this compare to your savings account?

The challenge is that most people change jobs multiple times in their careers, and it’s likely that you will eventually work for a different employer. Whether you are leaving your current job or are nearing retirement, you will need to make some decisions about your 401k.

It’s important that you know what options are available when it comes to accessing the money in your 401k account and the basics of what is called a 401k rollover into an IRA.

What Are Your 401k Options?

Because 401k plans are employer-sponsored, you will need to decide what to do with your savings when you leave that employer. A few basic options are available, and each has advantages and disadvantages. They include the following:

| Leave your 401k | Perform a 401k rollover | Roll it into an IRA |

|---|---|---|

| Those who have not made significant contributions to their 401k may find it prudent to leave their account with their old employer. If you have less than $1,000 in your 401k account, for example, you may end up paying fees for rolling it over that outweigh the actual value of your savings. | If your new employer offers a 401k option, you may choose to rollover the savings from your old employer to your new one. This might be a good choice if your new employer offers a contribution match and if you plan to stay with your new employer for a long time. | One of the most popular 401k rollover options is to move to an individual retirement account (IRA). Unlike a 401k, it is not sponsored by an employer and you have complete control over money in the account. |

Get our best strategies, tools, and support sent straight to your inbox.

401k vs. IRA

When you are considering a 401k rollover into an IRA, you will want to weigh the differences between these two savings plans. On a basic level, the difference between a 401k and an IRA comes down to who is in control of the account.

A 401k is sponsored by employers and, while they may offer a lucrative contribution match, they are ultimately the ones who make major decisions about the plan. With an IRA, you can choose any bank or financial institution to hold your account — and you are the one calling all the shots.

How IRAs Work

There are literally thousands of different investment options available to you when you start an IRA, but before you make any specific investments, you will have to decide which type of IRA is right for you. Below are two of the most common:

Traditional IRA

With a traditional IRA, you can contribute pre-tax income into your account. This account grows as you contribute to it and all taxes are deferred until you withdraw your money. After you reach the age of 59.5, you can withdraw the money from your account, at which point you will pay the deferred taxes.

This tax deferment will lower the adjusted gross income you report on your taxes, allowing you to claim several deductions and credits that might not have otherwise been available to you.

Roth IRA

A Roth IRA has some of the same characteristics of a traditional IRA, but taxes on contributions are not deferred and get paid upfront. You may also access your money without penalty prior to turning 59.5 from your Roth IRA. Five years after you make your first contribution to the account, you are permitted to withdraw up to $10,000 for qualified expenses, without any penalties.

There are benefits and downsides to both traditional and Roth IRAs, so it’s important that you carefully consider which type is best for you and your family.

However, you should also keep in mind that you could be prohibited from contributing to a Roth IRA, depending on your income level. If you make $129,000 or more per year as a single person or $191,000 or more as a married couple filing taxes jointly, a Roth IRA will be off limits to you.

401k Rollover: Step by Step

The following are the steps you must take to conduct a 401k rollover:

Step 1: Select a type of IRA

Before you can do a 401k rollover into an IRA, you will need to decide which type of plan is best for you. If you make more than the income amounts listed above, you will have to go with a traditional IRA.

Otherwise, you can decide which plan is most appropriate for you based on when your savings will be taxed and whether you want to access your funds before retirement age.

Step 2: Find an IRA account provider

The great thing about an IRA is that you can make all the decisions regarding your account and investments.

On the other hand, this can also be overwhelming. Take as much time as you need to weigh the different IRA providers available to you.

Betterment is one of our favorite investing platforms; however, the options are almost endless. You should consider whether you want to be closely involved with each of your investments or prefer hands-off investing.

There are different services that are appropriate for each investment style.

Step 3: Secure a direct rollover

Having your 401k given to you personally by your employer and then putting the money into an IRA will stick you with excessive fees and penalties. Avoid these by specifically asking your 401k account holder to send a check directly to your new IRA account provider.

Step 4: Make investment decisions for your new account

Once the money from your 401k rollover has been successfully transferred to your new IRA, you will need to decide what to do with it. You can work with your IRA account provider to determine where to start and which investments are best for the portfolio type you’d like.

Rolling Over a Traditional IRA to a Roth IRA

You might benefit from a rollover even if you already have an IRA. Moving from a traditional IRA to a Roth IRA may give you more flexibility with your investments. Because a traditional IRA taxes you upon withdrawal and a Roth IRA taxes you upon contribution, you will have to pay taxes immediately upon rolling over from a traditional IRA to a Roth IRA.

Five years after this rollover, you can withdraw your principal without being saddled with large penalties and fees. However, you will not be permitted to withdraw the growth you have accrued until after you turn 59.5.

So, why not just start with a Roth IRA and avoid the hassle of rolling over your traditional IRA? There is a strategic advantage to this kind of account transition.

When you first begin your career, the option to defer tax payment and reduce your reported adjusted gross income with a traditional IRA or 401k plan can be very advantageous.

You can grow your retirement savings through IRAs or 401ks to save on fees and taxes — and work toward an early retirement. Chances are that you will owe more in taxes now than you will when you reach retirement age, so it makes sense to defer the tax payments.

Once you have reached retirement age, you can perform a graduate traditional IRA or 401k rollover into a Roth IRA.

Doing this slowly is important, as your rollover will count as regular income on your taxes. To avoid excess penalties and fees, try to roll over an amount that’s equal to the deductions, credits, and exemptions you claim on your tax return.

As you complete this rollover, you can live off of capital gains and dividends, which incur zero taxes as long as you fall within the 10 to 15 percent tax bracket.

Five years after you roll over your accounts into a Roth IRA, you will be able to access your savings without any taxes or penalties assessed.

This is a great option for individuals and couples who are able to take early retirement.

Retiring with Confidence

Saving enough money to support yourself through retirement may seem daunting, but the important thing is to start saving early. You don’t want your retirement savings to feel like a marathon.

As the great Harry Emerson once said, don’t simply retire from something, but have something to retire to.

Small contributions early on in your career can grow exponentially by the time you are ready to retire.

The most important step you can take is to be mindful of your investments. Crunch the numbers and figure out how much you are losing in penalties and fees to your 401k account. Consider whether you might benefit from contributing to an IRA and determine whether moving ahead with a 401k rollover is the right option.

The good news is that you’re not alone — there are millions of people just like you who are trying to navigate the intricacies of retirement planning. What’s more, there are savings and retirement specialists out there to help guide you through your retirement savings process.

Take advantage of the resources available to you and don’t be afraid to ask for help when it comes to planning for your retirement.