If you run your own business, you go to great lengths to make sure that your business is a profitable one. Both Andrew and Matt run their own businesses. They regularly go over their accounting to see if the businesses are spending too much money and if they are, where? Do the profit margins need to be increased? How much money is being held in reserve in case of a period of lower cash flow?

But how many of us do these things and ask these questions when it comes to our personal finances? We watch every penny going into and out of the business’s bank accounts but we’re much more cavalier about our personal bank accounts. It’s the weird dichotomy where we will sometimes say mean or rude things to friends or loved ones that we wouldn’t dream of saying to a stranger.

Perhaps it’s because it’s easier to be objective about our business than our personal life. Ever how much you consider your business to be your baby, a part of you, it’s not you. Your life, which your personal finances are a big part of, is you. Your business is a thing but you’re a person and people have desires. You’ve never treated your business to a new pair of shoes or an expensive dinner out. How about yourself? Exactly!

The question we’re asking is if you looked at your personal finances as if you were running a business, would you still be in business? You already run a profitable business, let’s focus on how to become a profitable person.

There are seven principles to becoming a profitable person. We’ll explain each one.

1. Know Your Numbers

Quick, how much money is in your 401k, your

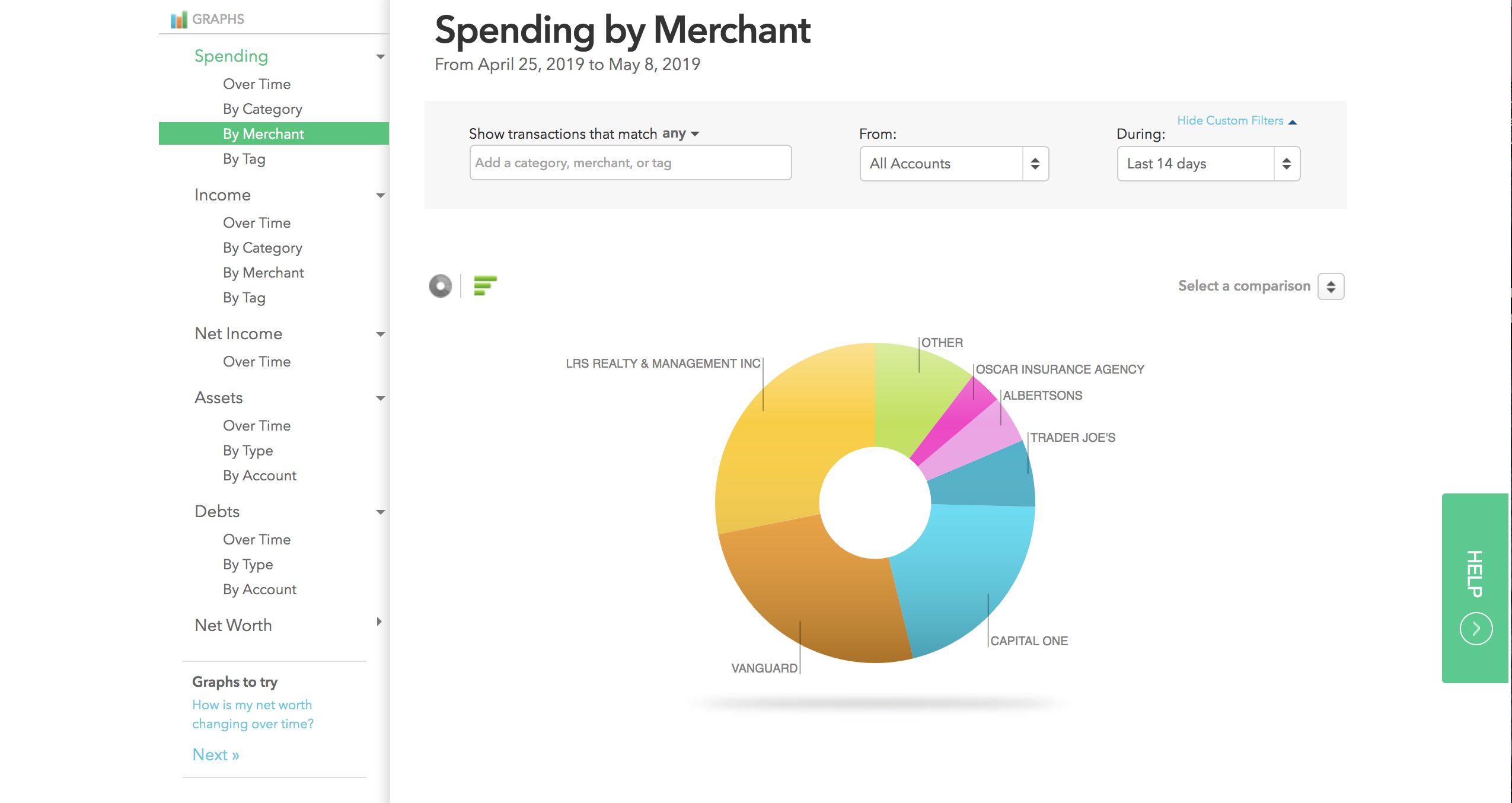

If you can’t answer these questions, you’re a long way from becoming a profitable person. You can find the answers fast though. Set up your budget in Mint and track your net worth in Personal Capital. Both are free to use. Mint will show you where your money is going and Personal Capital will give you the 1,000-foot overview required to know your numbers.

Be aware of where your money is going. As Ramit explained, you’re allowed to spend on things important to you but to afford that, you need to cut spending on the things that aren’t important. If you love to travel, spend money traveling but if all that travel means you’re not home much, you don’t need a big, fancy home.

If your expenses are too high, it’s usually not practical to make one big cut and be done with it. A company could save money by firing the CEO but then who would run the business? You could cut expenses by moving out of your apartment but where would you live? What most businesses and most people have to do is to make several small cuts.

Stop buying lunch out, bring it from home. Get rid of cable and watch one of the many free TV apps available. Let Trim cancel all those subscription services you pay for every month and don’t use or need. Progress by 1,000 cuts.

2. Set Aside Money as Profit

What we mean by this is something we’ve told you often, pay yourself first before you pay expenses. Your profit is your savings.

“Paying yourself first means saving before you do anything else,” says David Blaylock, “Try and set aside a certain portion of your income the day you get paid before you spend any discretionary money. Most people wait and only save what’s left over—that’s paying yourself last.”

Strive to be as profitable as Apple which means saving 30-40% of your income per month. If you’re not in a high paying job, that can be tough but you can make it a goal and work your way up until you reach that level of profit.

The problem when you ignore this rule is that if you don’t make paying yourself your priority, there is nothing left at the end of the month, no profit. Take that cash out of your budget before you can spend it anywhere else.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

3. Lower Your Operating Costs

Becoming a profitable person means lowering your operating costs, your monthly expenses, so you can boost your profits, your savings. What does it cost to run your life? We don’t mean what are your expenses every month, we mean what does it cost to run your life? What are your bare bones expenses, the things you must pay every month?

Make a list of those expenses and then a list of everything else you spend money on each month. Now add up the total for each list. This might be very eye-opening. Even if you’re pretty good about checking in on Mint every month, all of the expenses are on the same screen so they all look like regular monthly expenses but there is a probably a lot of fat there you could cut.

Where are expenses high but returns low? There is an apartment in the Pierre Hotel in NYC that rents for $75,000 a month. But there are three other apartments in the same building that rent for even more. The expense is high clearly. And the return is low because you could live in dozens of equally nice places for way less and there are still people, your neighbors, doing better than you so that baller apartment isn’t even that much of an ego boost.

We’re not saying you’re only allowed to spend on necessary expenses. That’s ridiculous and no one would do it anyway. You work for your money and you’re allowed to enjoy it but a lot of the fat in your budget is just that, fat that could easily be trimmed without you even noticing. So get the knife.

4. Manage Cash Flow with the Right Accounts

We aren’t advocates of having a dozen different financial accounts but a checking account alone isn’t enough. When you set things up properly, you only need a few accounts.

Operating Account: This is your checking account, the account you pay your bills from. We recommend only keeping 1.5 to 2 months worth of expenses in this account since it’s paying you almost no interest.

Profit Accounts: These are the accounts your profits are sent to. A short-term savings account like Upgrade High-Yield Savings account is for your emergency fund which should contain 3 to 9 months’ worth of expenses. Your investment accounts are your long-term savings accounts, things like your M1 Finance or Vanguard account, and your retirement accounts, 401ks, and IRAs.

Part of becoming a profitable person is using the Profit First Model. You set up the right accounts and funnel money into specific accounts automatically. Don’t send the money to those accounts manually because life gets in the way and some months it won’t happen. Instead, set up automatic deposits from your operating account to your profit accounts. This way you don’t forget or spend the money before you can save it.

5. Plan for Fluctuations

Profits can ebb and flow in your business and your personal life. This is especially true if your income is seasonal. Matt runs SwimU which teaches people how to take care of their swimming pools. Obviously, a business like this earns more in the summer months when people are in need of advice on taking care of their pools.

These fluctuations whether caused by a seasonal slump, an unexpected and large expense, or a job loss, can be smoothed out with an emergency fund. A side hustle is a good hedge too so if you have a fluctuation in your regular income, the unrelated side hustle can pick up at least some of the slack.

6. Watch Where You’re Getting Funding

Are you borrowing money or using a credit card hoping that you’ll become profitable enough in the future to pay that money back? This is widely regarded as a bad move. Never spend money you’ve yet to earn.

Don’t buy things you can’t afford with money you don’t have to impress people you don’t like.

Tweet ThisNow, it’s not uncommon for a business to get funding before it becomes profitable. The similar situation in your personal life is taking on debt in order to earn a return. The obvious example of this is taking on student loan debt in order to get a college degree. And with the right degree, this plan works.

Taking out a bunch of credit cards to pay for a lifestyle you can’t afford is a bad personal practice. But you can take on different debt and turn it around. If your credit score is good enough, you can take out a personal loan through a peer-to-peer lender like Prosper or a more traditional lender like Credible at a lower interest rate than you’re paying on the credit cards. Use the loan to pay off the cards which will give your credit score a big boost and reduce the amount of interest you’re paying.

7. Plan for Growth

Once you become a profitable person, you need to set things up to make that profit grow. You need to invest back into the business (you!) to make more profit.

Is your asset allocation appropriate to your risk tolerance and age? Do you have some real estate in your portfolio? What about gold?

Growth isn’t all about money though. What can you do to grow yourself as a person? Have you been stuck in the same position in the same company for years, just stagnating? Once a job is no longer challenging, it no longer allows you to grow. If you like what you do, that’s fine but move up or on within the same industry and take on some new challenges.

Maybe you hate your job and your field. Consider going back to school and doing something else entirely, something you’ve always wanted to do.

Or maybe it’s the place you’re in that you’ve grown tired of. I uprooted my entire life at the age of 41 and left the city I had lived in for the past 15 years to move to a totally different place where I didn’t know a soul. Since doing that, my life is better than I ever imagined it could be. Making this move is literally the best thing I have ever done.

You, Inc

I like this approach! It really gives you a different perspective on your finances. I know I’m always way more conscious of my business finances than I am my personal finances like how I’m always way more choosy and careful about what I buy with a gift card that I am with cash. It’s weird and I don’t know why I do that. Maybe I should just buy a bunch of gift cards for myself and use them to pay for everything!

Looking at yourself as a business can help you decrease operating expenses and boost profits.

Show Notes

Ten Fidy: A Barrel-aged Imperial Stout

Northwestern University CFP Program – Prepare for a career as a financial planner