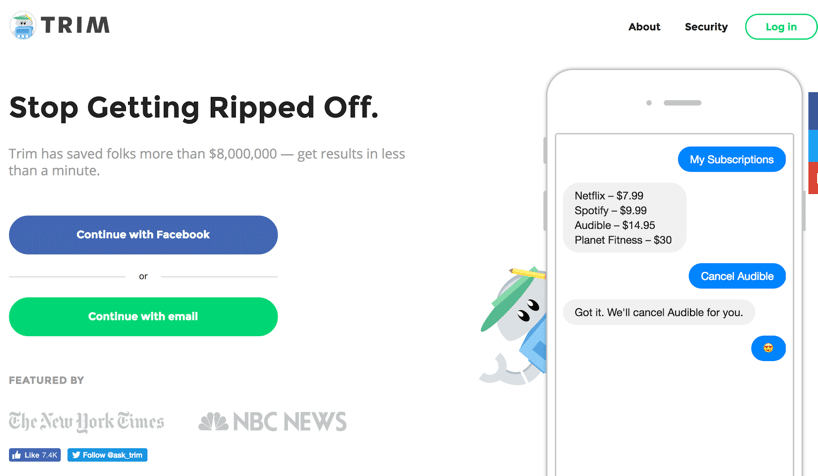

Do you ever wish you had a personal assistant to do things like find and cancel old gym memberships you don’t use or to negotiate a lower cable and internet bill for you? Well, now you have one. Read our Trim Review and see how they can go to work for you.

Do you go through your credit card and bank statements each month and scrutinize every charge? Probably not, many of us don’t. And if you don’t, you just kind of forget that you signed up for Pandora or Hulu, or Netflix.

And really, because those charges are so small, not only are they easy to forget about, they’re easy to just ignore. The $4 a month for Pandora just really isn’t worth the trouble it takes to cancel the account.

Or maybe you signed up for a free 30 day trial of something and forgot to cancel it. Even if you did cancel it, sometimes something happens and you’re still being charged. Because you don’t go through your statements each month, you miss it.

Or worse, some things have to be canceled with a phone call. If that’s the case, even fewer of us will bother. But those little expenses add up and you could be doing better things with that money.

Cable and internet companies are regularly listed as one of the worst companies for customer service and if you’ve dealt with them, you know why.

If you don’t know why Google “Comcast Horror Stories.” You’ll get nearly 700,000 results. But you don’t have to deal with their nightmare customer service, Trim will negotiate a better cable and internet rate for you!

What is Trim?

Americans spend up to $14 billion a year on these kinds of forgotten, recurring charges. Trim is here to help us change that. Trim is like having a personal finance assistant who goes through all of your transactions and finds recurring ones.

But that’s not all Trim does.

They also give you cash back on certain purchases, send you account and transaction alerts, give you an overview of your bank and credit card accounts, help lower your cable bill and internet bill, help you find cheaper auto insurance and even price patrol your Amazon purchases.

Signing Up

Trim is compatible with more than 15,000 banks and credit card issuers so it’s likely whatever bank or cards you use Trim will be able to connect to.

You can sign up using your Facebook account or by making a username and password. You can choose to get your alerts through Facebook Messenger or via text messages. They also use two-factor authentication when you register so you will be sent a code to Messenger or by text with a code. Enter the code to verify your account.

You can now link all of your bank and credit card accounts. Doing this is just like linking your accounts to Mint. Trim has read-only access so it has bank-level security

How it Works

There is a lot more to Trim than canceling subscription services.

Recurring Transactions

Once you’ve linked your accounts, Trim combs through all of your transactions for the past 90 days. Trim has an algorithm that already knows the names of merchants who charge payments on a recurring basis, like Pandora and Dollar Shave Club.

Beyond the likely suspects, Trim searches for the same amount of money going to the same merchant on the same day of each month.

Trim does not confuse our spending patterns with recurring charges so if you go to the same bar on the same night of the week for happy hour, it won’t flag that as a subscription payment that you might want to cancel.

Trim will send you the subscriptions they’ve uncovered via text and ask you if you want to cancel them.

If you would, simply text back “Cancel Audible” and they will take care of the rest. This is usually fairly straightforward. Trim sends the merchant an email requesting an end to the subscription.

If that fails, they will start making phone calls and will even send a certified letter if the merchant is making things difficult.

Price Negotiations

Comcast was Trim’s first foray into bill negotiating. Comcast customer service has an online chat feature and the customer service reps stick to a limited script when chatting to customers.

Rather than having Trim employees spend time on these chats, the company built a bot that responds to the Comcast script with the responses most likely to get a reduced monthly rate or at least a statement credit for some transgression committed against you.

Very recently the service has been expanded and works with all cable and internet providers.

To take advantage of this feature, download Trim’s Chrome extension and follow the steps listed. The service has been available for just a year but Trim has been able to reduce 70% of the accounts they negotiated with Comcast, saving those customers an average of $10 a month.

When I first started using Trim, they were only negotiating Comcast bills and I have Cox. In the meantime, I used Rocket Money to negotiate down my rate.

Amazon

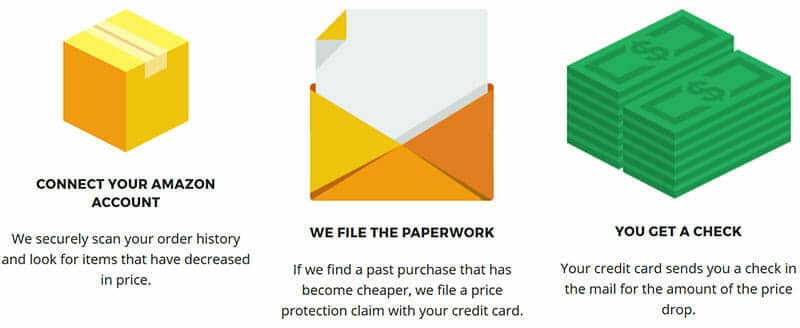

Amazon doesn’t offer price protection anymore but some credit cards do. If you make a purchase and the price goes down with a certain amount of time, the card will refund you the difference. I buy a lot of stuff on Amazon and I’m not going to search all those transactions and compare prices.

But Trim will!

You link your Amazon account and the cards you use on the site. Trim goes through the purchases you made over the last 90 days.

If there has been a price drop, Trim will file the necessary forms with your credit card company and the credit card company will issue you a check for that amount.

Auto Insurance

You can fill out some information on your car and location and Trim will help you find a cheaper insurance rate than what you currently have.

Notifications

You can receive text notifications for things like a low checking account balance, overdraft fees, late fees, balance updates and more. You can also set bill paying reminders.

Account Information

Trim gives you an overview of your bank and credit card accounts and a list of transactions with various search options like “Most Recent” and “Largest.”

Bonus Savings

Trim gives you cash back when you spend money on groceries, dining, and movie tickets. When you activate the offer you receive a credit on your card within 5-7 days.

The next time you spend at least $5 on groceries or dining out, you get a $1 statement credit and when you spend at least $20 at a movie theater, you get a $10 statement credit.

You can use the grocery and restaurant offers ten times each currently and the movie offer once so you can get $40 cash back in all.

All you have to do is link an eligible Visa card (no MasterCard or American Express at this time) and use that card to pay for the transactions. I don’t go to the movies but in the month I have been using Trim, I have saved $7 so far buying groceries and dinners out.

The Cost

There is no cost to use Trim’s main service, finding and canceling subscriptions which is pretty great considering how much time and money it can save you.

If Trim negotiates a lower bill or statement credit with your cable or internet provider, they charge you 25% of the amount you saved in one year.

Is it Worth It?

Of all of the money savings apps I’ve used, Trim is my favorite. I knew I had subscriptions I wasn’t using. I just never got around to canceling them.

So far Trim has saved me $65.42 a month.

I had them cancel my Pandora Premium account which I rarely use as I prefer podcasts to music which saved $4.99 a month. I occasionally used Audible but not enough to get my $16.45 a month’s worth.

To watch cycling, I signed up for Fubo TV for a whopping $43.98 a month. But cycling runs from January to September and the races I’m willing to pay money to watch don’t start until the spring. I’m happy(ish) to pay $44 a month to see great racing but there is no need to pay that much per month during the offseason. I had Trim cancel it and I’ll re-up in the spring.

I ran my Amazon account through Trim but so far there have been no price drops. Might get lucky after the holidays though. I order most of my gifts from Amazon and prices often drop after Christmas.

You can use Trim to manage your finances. I will never stop using Mint but I do use Trim to check my transactions when I’m away from home since I don’t use Mint’s app. I can look up whatever I need through Facebook Messenger on my phone which is convenient.

Trim hasn’t cost me a cent but has saved me $65.42 a month and I’ve earned $7 in bonus offers.

I highly recommend Trim. They have saved me a few hundred dollars a year. See what they can save you!