When you’re investing, debt is often the less risky asset class. The same way stocks are seen as volatile, bonds (debt) are viewed as a safer alternative. That rule also applies to real estate.

You can assume a greater risk premium and invest capital (equity) into a property, or you can assume the role of a lender and take on another’s debt in good faith. In the event of bankruptcy or default, lenders are first in line to get paid.

PeerStreet seeks to bridge the gap in commercial real estate by bringing borrowers and lenders together.

If you’ve ever thought about investing in the real estate market, you’ll want to consider their platform. In this PeerStreet review, we’re going to break down their service offerings and see whether they make sense for you.

But first, what are you drinking?

Minimum Investment:

$1,000

Management Fees:

1%-4%

Promotion:

Start Investing

Investment Type:

Real estate debt

Investment Model:

Online

Accredited Investors Only:

Yes

Mobile App:

No

Minimum Investment:

$1,000

Management Fees:

One-time 0.5% purchase fee

Promotion:

Open a Free Account

Investment Type:

Single-family rental properties

Investment Model:

Turnkey

Accredited Investors Only:

No

Mobile App:

No

Minimum Investment:

$10

Management Fees:

1% a year

Promotion:

Free Upgrade to Core Plan

Investment Type:

eREITs

Investment Model:

Online

Accredited Investors Only:

No

Mobile App:

Yes

PeerStreet Overview

Account Types:

- Individual Taxable & Self-Directed IRAs

Minimum Investment:

- $1,000

- Residential, Commercial (Retail, Office, and Industrial)

- Real Estate Debt

Fees:

- 0.25%-1%

Investment Length:

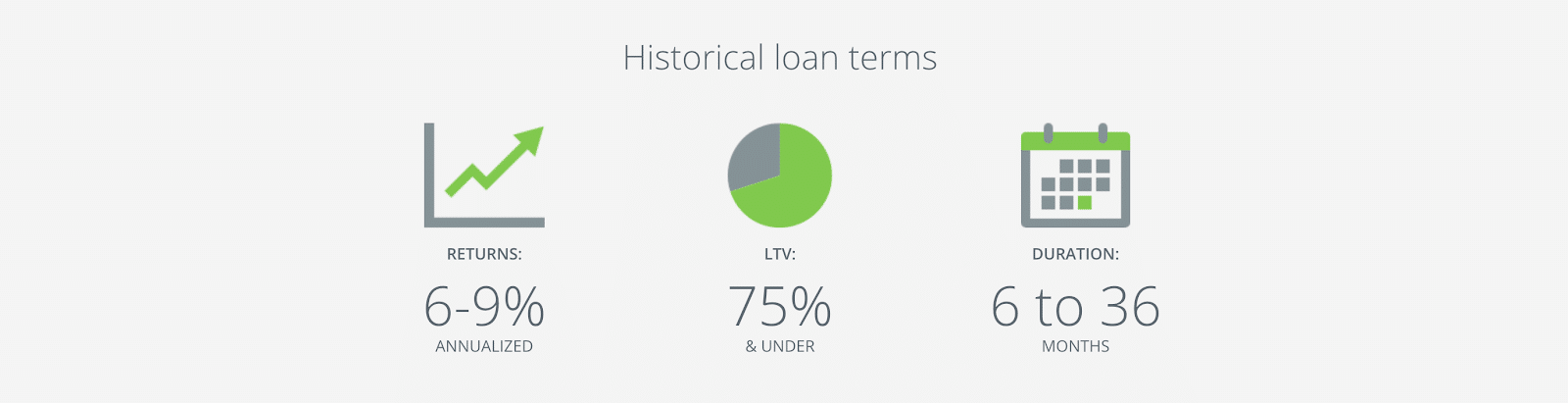

- 6-36 months

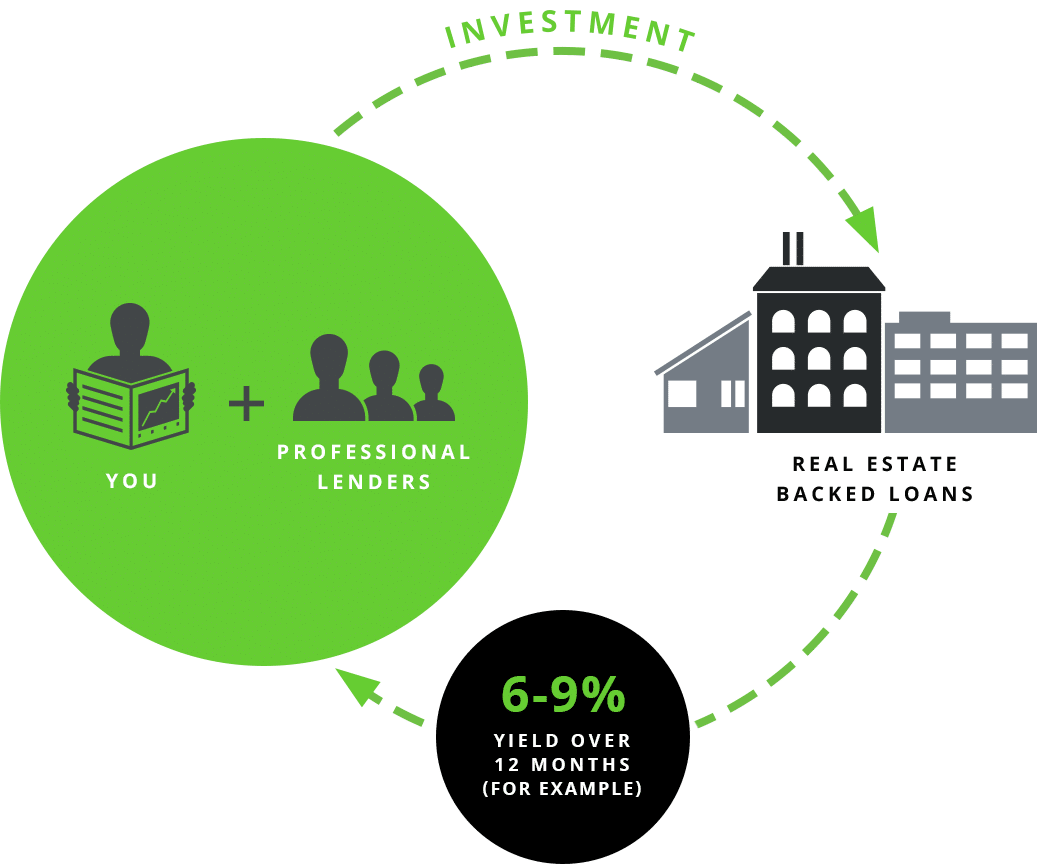

Returns:

- 6%-9% Annualized

Assets Under Management:

- $1 Billion

Distributions:

- Bi-monthly

Who It’s For:

- Accredited Investors Only

What Is PeerStreet?

PeerStreet is a marketplace where accredited investors can invest in high quality, 1st lien, private real estate loans. Before platforms like PeerStreet, this asset class was challenging to access.

Their team provides comprehensive expertise in the form of real estate savvy, manual processes, and big data analytics.

In PeerStreet’s words:

We are a group of cross-industry experts who quit our day jobs to transform real estate finance in a way that creates better deals for everyone.

Co-founder and CEO Brew Johnson started the company to give more people a chance at investments that were out of reach for most people.

Brett Crosby, co-founder and COO with ten years of corporate experience at Google, co-founded Google Analytics, and co-founded, built, and sold Urchin Software Corporation had this to say:

We’re applying lessons learned at Google to a space that’s been almost untouched by technology. And it just so happens to be one of the world’s largest financial markets. The value we can unlock for the entire ecosystem of investors, borrowers, and lenders is staggering.

The platform lets you build a diversified portfolio across lenders, borrowers, asset classes, geography, yield, term, and loan-to-value (LTV). This diversification prevents all of your money from sitting in one loan investment making foreclosures (should one occur) extreme.

Industry’s First Two-Sided Marketplace

In a recent column in Entrepreneur, COO Brett Crosby said PeerStreet is the industry’s first two-sided marketplace for investing in real estate debt.

A single supplier interacting with many buyers is a one-sided marketplace. Two-sided marketplaces connect people with common interests on both sides: merchants and buyers (Amazon), drivers and riders (Uber), hosts and travelers (AirBnB).

It’s not a marketplace lender, nor is it a crowdfunding platform.

Investors make better decisions on their platform because of transparency, a streamlined data pool, and greater investment options. They’re like your real estate investing middleman.

They’re also different from a REIT because you can pick the investments and build a portfolio of individual loans that match your criteria.

Humble Brags

PeerStreet has been featured in many reputable publications, including The Wall Street Journal, Bloomberg, Forbes, and The Huffington Post.

And let’s not forget the film, The Big Short starring Christian Bale and Brad Pitt. Remember Christian Bale’s character? Let me refresh your memory: Mr. Bale played the role of Dr. Michael Burry.

Dr. Burry was one of the first to recognize the subprime mortgage crisis. Why am I mentioning this?

Because Dr. Michael Burry serves on PeerStreet’s board of advisors!

Other advisors include former CEO of Wealthfront Adam Nash and founder and CIO of Ritholtz Wealth Management, Barry Ritholtz.

They also have distinguished venture partners Andreessen Horowitz, Scion Asset Management, and World Innovation Lab (WiL) on their team.

PeerStreet has done over $2B in transactions and has $1B in assets under management (AUM as of 3/22/2019). Their public launch was on October 30, 2015. They’re headquartered in El Segundo, California, outside of Los Angeles.

How PeerStreet Works

You can create a custom portfolio of real estate loan investments in one of two ways:

- Manual Investing

- Automated Investing

Automated Investing lets you secure a spot in line with other investors. When a loan comes across your account matching your criteria, and it’s “your turn in the queue” you’re automatically put in that loan. Choose a few parameters and they’ll handle the rest.

PeerStreet informs you of each investment reservation and gives you 24 hours to cancel. There’s no guarantee you’ll get every loan as they reserve space for manual investing.

Manual Investing is a better fit if you’re more hands-on and want to select each loan that becomes available personally.

Tip: If you choose the manual investing option, you’ll need to be quick as those loans get bought faster than Olympic gold medalist Usain Bolt running a 100-yard dash.

They’ve got a team of finance and real estate experts underwriting each loan using advanced algorithms, big data analytics, and manual processes for the best high-quality investments.

Loan Servicing

PeerStreet has master servicing rights on loans. What’s that mean?

All borrower payments are received and distributed promptly. Their Servicing Team monitors the entire process from the purchased time down to the loan payoff, and you get your distribution.

Meticulous Vetting Process, Terms, and LTV

PeerStreet sources loans from existing lenders who know their local real estate market.

They vet all originators and only let the experienced private lenders with exceptional track records in.

No stone is left unturned as PeerStreet reviews financials, licensing and adherence to state usury laws, runs background checks, and examines legal and underwriting processes.

They also perform independent underwriting of all loans using a combination of manual processes along with big data analytics, review independent valuation (BPO/Appraisal), makes sure each loan complies with their specific underwriting guidelines and reviews legal documentation.

The originators also run due diligence of their own and hand-select borrowers to whom they’re willing to lend. Why?

Because this process presents investors with higher quality loans.

The loan profiles you’ll find at PeerStreet are secured by first liens. They’ve partnered with top-tier originators across the country and examines each loan before they’re made available to investors.

As they put it:

PeerStreet teams with regional loan originators who make loans to borrowers who are often real estate developers and investors.

The loans are short, lasting between 6-36 months with LTV below 75%.

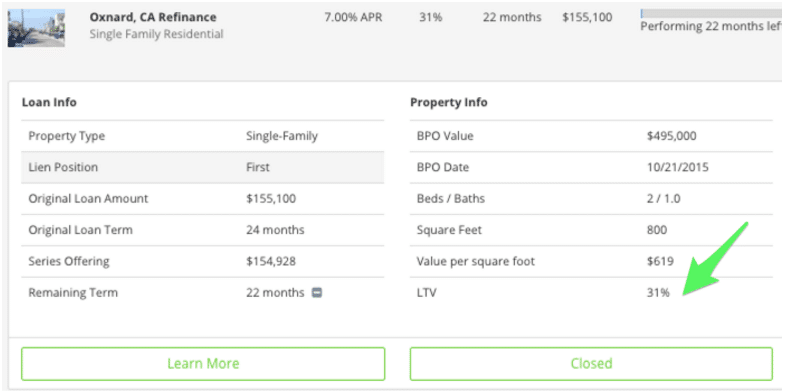

A Word On Loan-to-Value (LTV)

In real estate, LTV is the calculation of the loan amount divided by the value of the property. It’s a metric that lets you see how much skin in the game the borrower has invested and how the deal is structured.

The higher the LTV, the higher the risk.

PeerStreet loans have no more than 75% LTV and determine it with the help of a broker’s price opinion (BPO) or third-party appraisal.

Loan amounts come in two flavors: “as-is” or after repair value (ARV). PeerStreet usually reports on an as-is basis.

The “as-is” basis uses the value of the property in its current conditions and doesn’t factor additional repairs or renovations. ARV estimates what the value should be after repairs.

PeerStreet’s investments have similar yields to Lending Club but are backed by real estate and carry very attractive loan-to-value ratios. – Dr. Michael Burry

LTV Math

For example, if you had your eyes on a property valued at $2M and the borrower took out a $775,000 loan, the as-is LTV would be 38%.

If using ARV in the above example and it’s believed the property’s value will increase to $3.75M after renovations, the LTV would be 20%.

PeerStreet prefers using the as-is metric as it’s tough to predict the future value of a property accurately. If they do use the ARV calculation, they aim for a conservative one.

Fees

PeerStreet does apply a servicing fee for each loan invested. The cost is a spread between the interest rate payable on a loan and the interest rate you receive as an investor.

PeerStreet only gets paid when you get paid.

Tweet ThisBecause of this structure, PeerStreet only gets paid when you get paid. Fees vary between 0.25%-1%.

Creating an Account, Minimum Investment, and Investing Qualifications

You can get started on their website in a few easy steps. You must be 18 years old and live in the United States to invest with PeerStreet.

Once on their website, you’ll choose your account type (individual or IRA), enter your address, proof of income, and create your investor profile.

The minimum to invest with PeerStreet is $1,000 per loan. You must qualify as an accredited investor in the U.S. to be eligible. Creating an account is free, but you must be accredited. What does this mean?

You meet specific criteria under SEC regulations, including:

- You’re an individual earning greater than $200,000 annually or $300,000 with a spouse

- You’re an individual (or have a spouse) with a net worth greater than $1M (your primary residence doesn’t count)

- A partner, executive officer, or director for the issuer of the offered securities

- A bank, insurance company, registered investment company, business development company, or small business investment company

- Part of a business in which equity owners fall under the category of accredited investors

- An employee benefits plan, trust, charitable organization, partnership or company with total assets higher than $5M

Recently Added Features: Lowered Minimums, New Asset Class, and API

PeerStreet recently lowered its minimum investment requirement to $100 for small balance reinvestments when you’re using automated investing. Before this adjustment, investors were required to re-invest at least $1,000.

This puts all your cash to work instead of letting it sit on the sidelines. As PeerStreet put it, “turn your interest payments into active investments.”

Their lenders’ network of institutional investors gains access to a new asset class, Residential for Rent loans, for borrowers renting out single-family residences to tenants.

One-Click Fund and API. You’re now able to integrate with a lender’s Loan Origination System offering greater transparency.

Automated Loan Document Generation lets you generate documents starting with single-family residential loans.

There’s also a Lender Loyalty Program in the works based on how involved you are on PeerStreet’s platform.

Enhanced Customization

You’re able to choose Cash Offer Loans and 30-Day Notes as part of your specific criteria when searching for a loan.

Cash Offer Loans are appealing to both sellers and homebuyers because it lets the homebuyer make an all-cash offer to the seller and lifts the need for the homebuyer to carry two mortgages simultaneously.

Bottom line: Faster move-in/move-out process for both parties.

30-Day Notes are short-term investments that give you even more liquidity. Terms last 30 days and it doesn’t matter if it’s an existing loan. It’s like you’re buying a smaller piece of a larger debt.

Principal and interest are repaid to you at the end of 30 days.

Caveat: 30-Day Notes are only available on the Manual Investment option

Bridge Loans got their name because they “bridge the gap” between lenders and borrowers. These loans are ideal for fix and flips, fix to rent, and buy to rent opportunities. They carry a faster application, funding, and approval process because private lenders and not traditional banks make them.

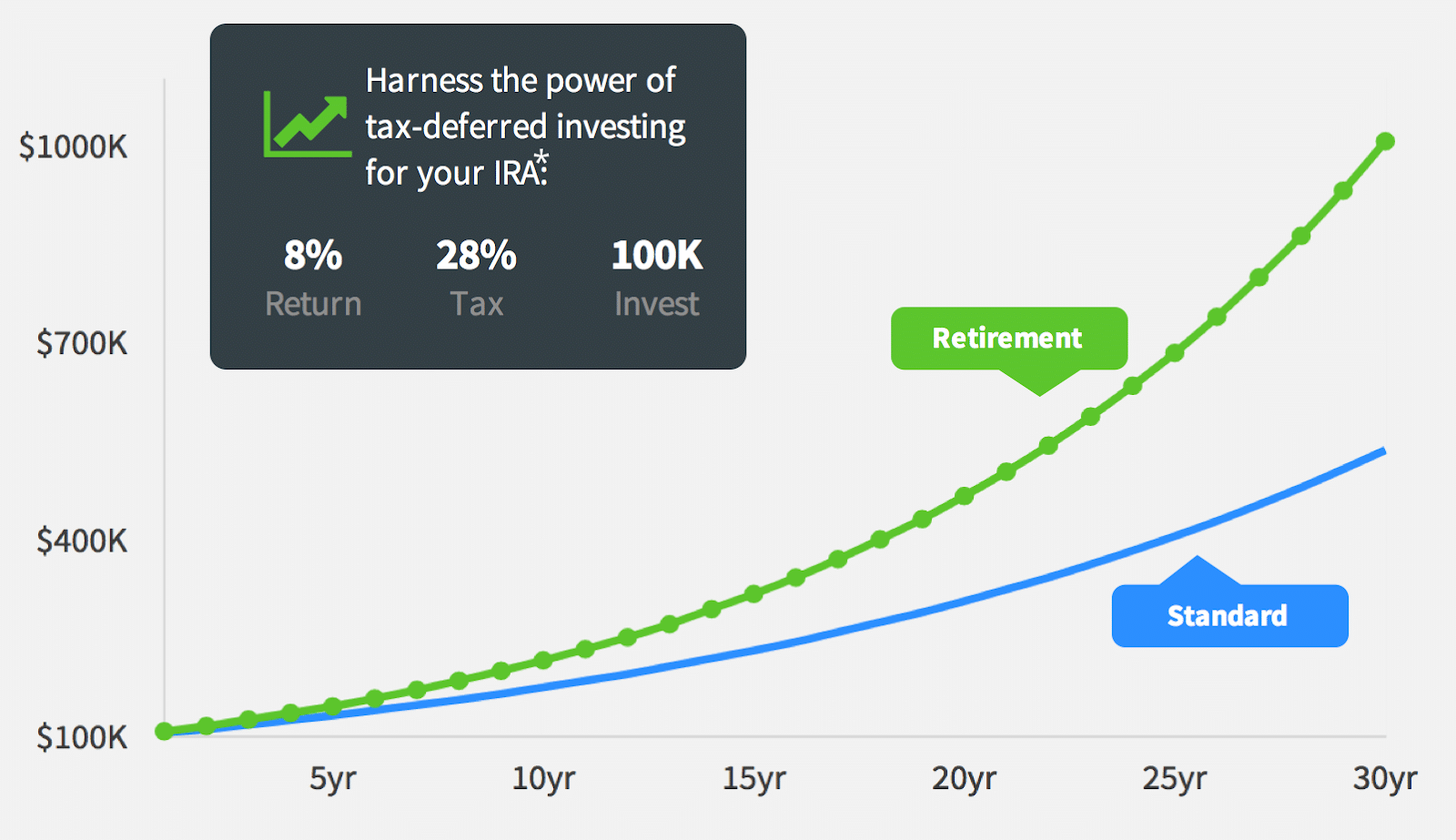

Account Types Supported: Taxable and Tax-Advantaged

You can invest in an individual taxable account or a tax-advantaged account. PeerStreet supports both Self-Directed Traditional and Roth IRAs. Multiple accounts are allowed as long as each account has its own email address.

The benefit of a self-directed IRA is that it lets you invest in alternative assets like real estate, commodities, and privately-held companies while capitalizing on all of the tax benefits that come with an IRA.

There are fees involved when setting up your tax-advantaged account (IRA) including:

- $50 account setup fee

- $100 annual account fee

- $50 processing fee

However, PeerStreet does offer a one-time reimbursement for those fees when funding an account with $5,000 or more.

Rollovers Welcome

You can transfer funds from your 401(k), 403(b), 457 or another retirement plan into their Self-Directed IRA. PeerStreet also lets you roll over a partial amount from your existing retirement account.

Once you invest your money into a loan and it closes you’re committed for the life of the loan – you can’t sell your investments once you’re locked in.

Funding your account through an ACH transfer takes 3-4 days. If you opt for a wire transfer, PeerStreet will reimburse fees up to $50 on transfers of $25,000 or more.

Distributions: How You Get Paid

Interest payments are distributed on the 1st and 15th of each month. You’ll receive principal and other income once PeerStreet gets them.

You can reinvest or withdraw your funds once they’re paid out with a bird’s eye view of your portfolio across your dashboard. See all of your updates, including loan payments and if the loan is current or delinquent.

How PeerStreet Handles Defaults and Foreclosures

Their in-house Asset Management Team has more than 97 years of experience in residential and commercial real estate, 52 years of law, and 12 years of regulatory compliance. They handle the entire process for you.

They first pay legal fees, foreclosure-related costs and then distribute principal, interest, and any default interest payments to you based on how much you invested (aka pro-rata basis)

The potential cost of foreclosure varies from state-to-state. PeerStreet estimates in a “non-judicial state” foreclosure costs run between 3%-7% of the loan balance. That percentage increases in judicial foreclosure states.

For more details on the differences between non-judicial and judicial, read this link.

Defaults by the Numbers

According to their website (as of 3/21/2019) PeerStreet has transacted on 4,775 loans, and 136 of them went into default (less than 3%). Of those 136 loans:

- 55 were paid off before completing a foreclosure and investors got a “positive cash-on-cash return” on all of them. 42 of the 55 carried a payment higher than what was initially expected.

- 57 are currently in the foreclosure process

- They’ve foreclosed on 20 properties

- Of those 20, they sold five and paid off investors

- Four of the foreclosure sales had positive returns while the fifth resulted in a loss (-10.5%)

Is PeerStreet Safe?

They use industry-standard security technology with SSL/TLS data encryption. Your data is housed using the latest in public-key encryption technology.

In case PeerStreet goes out of business, your money is held in a bankruptcy-remote entity that’s separate from their corporate body, and a third party handles all pending loan investments making sure you get paid.

Your funds (while held in your cash account and not invested) are FDIC-insured up to $250,000 and held in a trust account at Wells Fargo.

Customer Support

You can reach PeerStreet by email, chat, or phone (1-844-733-7787). I reached out via chat while writing this review, and I heard back the same day answering all of my questions.

Integration with Other Apps and Mobile Option

PeerStreet does integrate with Mint and lets you view your account through Mint’s platform. At this time, PeerStreet doesn’t offer a mobile app of its own. You’ll have to manage your account through your desktop.

Is PeerStreet for You?

If you’re looking to expand your portfolio, real estate makes a welcome addition. PeerStreet’s platform makes it easy for ordinary, accredited investors to gain access to the party. However, they’re not the only option available.

Fundrise, Equity Multiple, and Titan Invest are significant players and offer competitive rates worth a look.

Pros

- Investing in real estate debt carries less risk

- 1st lien loans offer greater protection in case the loan defaults

- Low minimums

- Bi-monthly distributions

Cons

- Accredited investors only

- No mobile app

- $100 re-invest option only available when using automated investing

Final Thoughts

Real estate investments offer greater diversification in times of stock market volatility. The advent of peer lending makes it easier for individual investors (like you) to put your money to work.

PeerStreet’s lending platform offers complete transparency, superior diversification through hand-select loans, and low-interest rate risk (because of the short loan maturity dates).

The only downside is you have to be an accredited investor. I’d like to see them open their program to non-accredited investors like stREITwise. There’s plenty of us who are knowledgeable, seek higher risk, and can handle a $1,000 minimum.