What is bankruptcy? Well, it’s one of the most serious financial decisions you can make. Bankruptcy can seem like the only way out of a dire financial situation, and it may be. But bankruptcy won’t erase every type of debt, and it won’t solve all of your financial problems.

Bankruptcy also has long-lasting consequences, so it’s not a decision to be made lightly. If you are considering filing bankruptcy read our guide before taking that step. To help you navigate bankruptcy, we have your complete guide.

What is Bankruptcy?

Bankruptcy is a legal process whereby a person or business legally declares themselves unable to pay their debts. Bankruptcy can be a way to wipe the financial slate clean and start over.

Two Types

There are several types of bankruptcy, but the two most common are Chapter 7 and Chapter 13. You often hear news stories about Chapter 11 bankruptcy, but that concerns corporations. We’re going to cover Chapters 7 and 13 which are for individuals.

Chapter 7

Chapter 7 bankruptcy means that certain debts like credit cards, personal loans, and medical bills are entirely forgiven. In exchange for this debt forgiveness, the debtor agrees that a Trustee who is overseeing the case can sell certain assets. The money from those sales goes to creditors according to a priority ranking system.

Some assets are not part of a bankruptcy, things like your home and its furnishings, clothes, and some auto equity. If your house is in or near foreclosure, filing Chapter 7 gives you a stay. The bank must immediately cease foreclosure proceedings.

Not all debts are discharged in a Chapter 7 bankruptcy. Those debts must be paid eventually and include student loans, child support and alimony, past due income taxes, and monetary compensation owed to your victims if you killed or injured someone in a drunk driving incident.

Chapter 7 bankruptcy usually takes three to six months.

Chapter 13

This type of bankruptcy doesn’t eliminate debts but reorganizes them. Filers are required to make monthly payments to a Trustee for 36-60 months. The Trustee uses that money to pay creditors who have filed a claim for compensation.

Debtors don’t have to sell any personal property. If your home is in foreclosure, filing Chapter 13 freezes the process.

Which Begs the Question

Why would anyone file for Chapter 13 when Chapter 7 would require paying back many fewer debts? There are several good reasons. Firstly, not everyone will qualify for Chapter 7. Qualifying for Chapter 7 is means tested.

To pass means testing, a debtor must have little to no disposable income. The means test compares a debtor’s average monthly income for the six months before declaring bankruptcy to the median income of a comparable household in your state. If the debtor’s income is below that median, they qualify for Chapter 7.

It’s crucial to note that the means test is complex and varies by state. Even with a low income, you may not qualify for Chapter 7 if your expenses are considered too low. Consulting with a lawyer familiar with your state’s specific rules is crucial.

Chapter 13 bankruptcy offers a way to manage student loan payments by integrating them into a 3-5 year repayment plan, potentially easing monthly financial burdens without reducing the total debt. It also provides a strategy to catch up on overdue mortgage and car payments by proposing a court-approved repayment plan, although it doesn’t eliminate these debts.

Importantly, obligations like child support and alimony cannot be discharged; they must be paid in full as per the court’s orders, but they can be included in the repayment plan.

If any loans have a cosigner, 13 removes the obligation from the cosigner. It protects assets that Chapter 7 required you to sell. This form of bankruptcy may allow a debtor to pay his or her attorney’s fees over the course of the bankruptcy, not upfront.

Expert advice: As with any bankruptcy-related matter, consulting with a qualified bankruptcy attorney familiar with your specific circumstances is crucial. They can advise you on the feasibility of Chapter 13, the potential impact on your finances,and help you navigate the complex legal process.

It’s Not Credit Cards

According to the Administrative Office of the U.S. Courts In 2023, 434,064 non-business bankruptcies were filed, and the leading reason is not what you might suspect. Loss of income and medical bills, not credit cards are the leading causes of bankruptcy filings.

“According to the Kaiser Family Foundation (KFF), 100 million people in America struggle to pay their medical bills. This includes folks who have insurance, whether independently or through an employer. In fact, medical debt is the No. 2 source of personal bankruptcy filings in the U.S. (after loss of income), and in 2014, an estimated 40% of Americans racked up debt resulting from a medical issue.”

Expensive drugs can be a significant financial burden, even with insurance. Depending on the specific plan and medication, coverage may be limited or absent.

While instances of unethical pricing within the healthcare system do occur, it’s crucial to avoid generalizations. Accusing all doctors, hospitals, and drug companies of “gauging” is unsubstantiated and potentially harmful.

It should also be noted that many pharmaceutical companies and patient advocacy groups offer financial assistance programs to help patients afford expensive medications. It’s important to explore these options to potentially reduce the financial burden.

How Filing for Bankruptcy Works

Filing for bankruptcy is not exactly a straightforward process nor ironically, is it free. There are fees involved, and you will need an attorney.

Filing Chapter 7

Completing credit counseling is a mandatory step for most individuals filing for Chapter 7 bankruptcy. This requirement helps ensure debtors understand the implications of bankruptcy and explore alternative solutions before proceeding.

Filing for Chapter 7 bankruptcy requires the completion of various forms and the provision of comprehensive financial details. This process can appear daunting, particularly to those not acquainted with bankruptcy proceedings.

You or your attorney must file your bankruptcy paperwork, ensuring all details about your assets, income, and debts are accurate and complete. This information allows the court to evaluate your bankruptcy eligibility and decide on your case.

Filing for bankruptcy typically triggers an “automatic stay” that prohibits most creditors from taking certain actions against you. Remember not all debts covered. The automatic stay applies to most, but not all, types of debts. For example, child support, alimony, and criminal fines are not covered.

Once the paperwork is filed, the court will appoint a Trustee to oversee your bankruptcy. The Trustee will schedule a meeting between you, your lawyer and your creditors. You will be required to answer financial questions.

Once the Trustee has reviewed your paperwork, he or she will determine your eligibility. If you are deemed eligible, the Trustee will then decide what assets you must sell to pay your creditors. Most Chapter 7 filers are considered “no assets” cases, meaning there are no non-exempt assets worth selling.

If you have secured debts, the collateral used to secure them may have to be returned to the creditor. You may be able to redeem the collateral, pay the creditor what it’s currently worth, or reaffirm the debt, meaning exclude the debt from the filing and continue paying it off.

You are required to take another financial literacy course.Three to six months after you filed your petition, the case will be discharged, and your eligible debts are forgiven. Shortly after, the case is closed.

Filing Chapter 13

As of October 2023, there is no specific limit on unsecured debt for Chapter 13 bankruptcy. The new limit for an individual’s combined secured and unsecured debt in Chapter 13 filings is $2,750.000.

Many of the steps to file are the same to file Chapter 7. You must receive bankruptcy counseling. While highly recommended, hiring an attorney is not strictly mandatory for filing Chapter 13 bankruptcy. You can technically file pro se (representing yourself). However, the process is complex, and legal guidance can significantly increase your chances of success and avoid costly mistakes.

A Trustee is appointed, and you must submit a repayment plan within 15 days of filing the petition. You typically don’t need to start payments until the court confirms your plan, usually within 30-45 days after filing.

You and your attorney will meet with your creditors 21-50 days after filing the petition and your creditors will be able to ask you any questions they have about your payment plan and overall finances.

Within 45 days of that meeting, the Trustee and any creditors wishing to attend will meet in court to confirm your payment plan.

You have the next three to five years to pay off your debts as agreed upon under your payment plan. And before the end of the bankruptcy period, you typically must complete another financial literacy course.

This free course outlines a proven framework that thousands of people have used to eliminate their debt, develop better money habits, and start building a secure financial future.

Pros of Bankruptcy

Pros of Chapter 7

Chapter 7 is the closest thing to a clean slate those with a lot of debt are going to get. It doesn’t discharge every type of debt but does discharge the most burdensome types like credit card and medical.

Regardless of your past, your tomorrow is a clean slate.

Tweet ThisIf you are facing foreclosure, Chapter 7 will freeze the process.

There is no cap on the amount of debt discharged under Chapter 7 and no minimum either. That said, if your debt is relatively small, Chapter 7 is too “nuclear” an option to be considered. It’s crucial to weigh the pros and cons carefully before deciding.

Chapter 7 is over fast, usually within six months. That short time frame allows you to start rebuilding your credit quickly.

Pros of Chapter 13

Perhaps the most significant pro is the possibility of saving your home from foreclosure. The filing doesn’t erase the past due mortgage payments but it does freeze the process, and you have up to five years to get current.

You are generally not required to sell any assets under this filing. While some debts will never be discharged, you can lower monthly payments under your payment plan by restructuring your debt. If you have cosigned loans, the cosigner is generally not on the hook for the debt. However, if you fail to comply with the plan or default, the cosigner could still be held liable for the remaining debt.

You can declare again immediately (with certain requirements) after your previous case discharges, so there are no waiting periods as there is with Chapter 7 (a waiting period of 8 years).

Cons of Bankruptcy

While bankruptcy can help you get out from under a mountain of debt, it does have severe and long-lasting consequences.

Cons of Chapter 7

While most filers do not, there is a possibility that you will be required to sell some assets. Chapter 7 does not discharge every type of debt, most notably for most of our readers, student loan debt. Sorry guys.

Chapter 7 is no guarantee you won’t lose your home. At best, it gives you a reprieve from foreclosure, but if you can’t come up with the money to pay your overdue mortgage payments, the bank will almost certainly repossess it.

If you have cosigned loans, your cosigner can be made to pay the debt. You will lose all of your credit cards. That might not seem like a con if credit card debt is a big part of the reason you filed, but there are some legitimate reasons why having a credit card is good for you financially.

Chapter 7 is going to severely damage your credit and will remain on your credit report for ten years. Any loans you can get in that ten years and maybe for many years after are going to be at a higher rate of interest than they would be for a borrower with no bankruptcy on their report.

A high-interest rate will make those loans thousands of dollars more expensive over their lives.

If you are the type that prefers to learn the hard way and get into an even worse financial situation in the future, you cannot file Chapter 7 for another six years.

Cons of Chapter 13

Under your debt repayment plan, all of your disposable income must go towards repaying your debt. Five years is a long time to live under this kind of restriction.

Because this filing is more complex than Chapter 7, the legal fees are more expensive. There is a cap to file, currently $465,275 for unsecured debts and $1,395,875 for secured debts. This is a long process; it can last as long as five years.

Filing is also going to negatively affect your credit score. It stays on your credit report for seven years.

Alternative to Bankruptcy

Depending on the amount of debt you owe and how much income you have coming in currently and in the near future, there may be alternatives to bankruptcy.

Refinancing

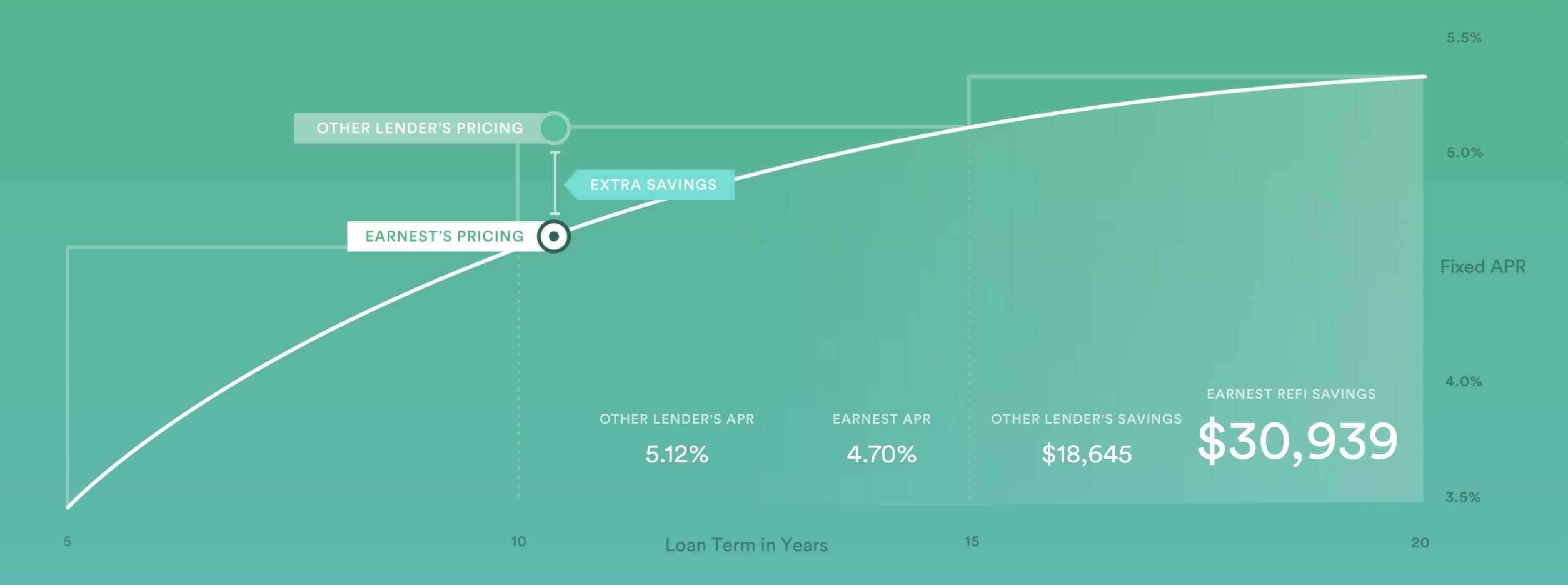

You may be able to take out a new loan that will pay off existing loans. The new loan can have a lower interest rate or a longer term meaning you have more time to pay it back.

A 0% APR balance transfer card may be an option to get out from under credit card debt. You transfer the balance on your current high-interest cards to the new card. For a limited amount of time, sometimes up to 18 months, you can work on paying off the balance while not paying interest.

But you must be sure to pay it off before the 0% APR period ends.

If you have student loan debt, you can refinance with Credible. Lowering your interest rate can make the cost of your loan thousands of dollars cheaper over its life.

Upgrade can give you a new loan to pay back things credit cards and medical debt.

You may also be able to work out your own informal bankruptcy by calling up each of your creditors and working out a payment plan. It’s intimidating to do it, but you might be surprised how many are willing to work with you.

Debt Consolidation

Another option is debt consolidation. Companies like National Debt Relief can help you significantly reduce your existing debts.

Did you know that credit card companies will forgive some of your debt if you’re in trouble? Imagine reducing a $10,000 bill to $4,000 just by asking.

Not only is this a real thing but billions of dollars get forgiven every year. If you aren’t comfortable negotiating forgiveness than you can always bring on a company like Freedom Debt Relief to negotiate on your behalf – they take a percentage of what is forgiven so it’s pretty low-risk.

Who Should Consider Bankruptcy

Deciding to file for bankruptcy is nothing to take lightly. It’s a serious decision with lasting impact. That said, there is a stigma around bankruptcy that stops many people who would genuinely be helped by filing. Do you think Trump had any guilt or shame when his businesses filed six times?

No, it was a business decision.

Our healthcare system is criminal. If you have medical debt that you have no hope of repaying, file. It’s disgusting that anyone should lose everything due to an illness or injury so take any way available to get rid of that kind of debt.

If your home is in foreclosure, filing can freeze the process. Under Chapter 7 you will probably still lose the home, but for the time the proceedings are frozen, you can save money for a deposit on an apartment, so you and your family aren’t made homeless.

If you have gotten into a situation where your home is in foreclosure due to a temporary downturn in your finances, you lost a job but have found a new one; making a payment plan can give you time to make up those late payments.

If you have been out of work for a long time or your wages are being garnished, Chapter 7 is probably your best option.

Who Should Not Consider Bankruptcy

If your situation is temporary and there your home is not under threat, bankruptcy is too drastic. Maybe you were unemployed and put living expenses on credit cards for a few months, but you have a good job now.

In a situation like this, you need to make more money and spend less while throwing every extra penny at the cards using the snowball or stacking method.

Are you budgeting? If you aren’t, you may have more money than you think. You just don’t know where it’s going. Mint can tell you. By patching your spending leaks, you may be able to pay back your debt.

Do you know how much you owe, I mean down to the penny? Some people don’t because they are too afraid to open their bills and find out. It might be more than you think but it might be less. If you’re going to file for bankruptcy, you have to face these numbers anyway so do it now, and you may be able to handle it on your own.

Don’t Call It a Comeback

When this is all over, or even before it’s all over, you need to do three things; make sure you never get into this situation again, rebuild your credit, and clean up your credit report.

Don’t Go There

It may seem like an inconvenience to take the court-mandated financial literacy courses, but they can help you. Take advantage of them and learn everything you can. Bad financial habits may be part of how you ended up in bankruptcy, so you need to replace those bad habits with good ones.

Make a budget and stick to it, start an emergency fund, learn what triggers you to overspend and either avoid those things or develop strategies that will help you stay on track when you can’t avoid the triggers like stress or sadness.

Surround yourself with information about proper financial habits by regularly listening to financial podcasts (this one!), reading financial blogs (this one!), and personal finance books.

Surround yourself with financial friends too. Financial friends are people who have the same goals and behaviors concerning money as you have or would like to have.

These are the people who won’t encourage you to buy tickets to that concert you can’t afford and will understand when you turn down a dinner invitation because going out is not in your budget for the month.

Hopefully, bankruptcy is a lesson you only need to learn once. Do what you need to do so you don’t go there again.

From the Ground Up

Your credit is shambolic, but even before your bankruptcy is over, you can start to rebuild it. Go to Credit Karma and see your score.

A significant factor in your credit score is on time payments so do what you must to make sure you never pay a bill late.

You want to get some form of credit to start to rebuild. You can do this by getting a loan or a credit card. No one is going to give you a conventional loan or credit card, but there may be a way.

You may be able to get a secured loan or credit card.You put down a deposit, and that is the amount of your loan or credit limit. You will have better luck getting a secured loan from a credit union or community bank than a conventional bank. Many companies offer secured credit cards.

![]()

The credit cards may come with an annual fee and a high-interest rate, but that’s the price you pay after bankruptcy. The interest rate shouldn’t matter because you are paying the balance in full every month.

Put small, frequent charges on the card, like gas, and pay them off in full every month.

When inquiring about these options, make sure that the lenders report to at least one of the major credit reporting agencies otherwise they won’t improve your score.

You may also be able to get a loan or credit card with a co-signer. I’m not a fan of this. It’s a lot to ask of someone. You miss a payment; the co-signer is responsible. Rebuilding credit is not worth destroying a relationship.

Keep an eye on your credit score and watch it climb. It won’t happen fast, but it will happen and seeing it can help keep you motivated.

It’s a Mess

Your credit score is impacted by what is on your credit report, so you need to monitor it too. But it’s going to be a mess, and this may take some work. There may be all kinds of errors and things that should fall off your report that are still showing up.

Add to that the fact that there are three major credit reporting agencies, TransUnion, Equifax, and Experian, you need to check each of them, and you can see this is going to be a job.

First of all, keep every scrap of paper relating to your bankruptcy notably the petition and discharge papers issued by the Court. These will show all of the debts discharged and that you no longer legally owe them. If there are errors in a report, you need to dispute them, and you need documentation proving that the information is incorrect.

You can get a free copy of your report from each of the three agencies one time a year.The best way to monitor your score is to get one report from a different agency every four months. Make sure that all debts that were part of Chapter 7 are marked as discharged and have a $0 balance.

If there are errors send a dispute letter to the reporting agency with documentation backing up your claim. The agencies are obligated to correct the information, but you may have to stay on top of them to make sure they do it.

A Hard Lesson

Deciding to declare bankruptcy and going through it is tough for anyone. But after it’s all over, you can rebuild your credit and your life. Use the lessons you learned to not only make sure you are never in such a dangerous position again but to become the building blocks of a stable, prosperous life. Because you don’t want to go through this again.

Get your rate from every platform, for free, and it doesn't affect your credit. Rates as low as 3.99% APR with autopay.