- What Are Dave Ramsey’s Baby Steps?

- Baby Step 1: Save $1,000 For an Emergency Fund

- Baby Step 2: Pay Off All Debt Using the Debt Snowball

- Baby Step 3: 3-6 Months of Expenses in Savings

- Baby Step 4: Invest 15% of Household Income Into Roth IRAs and Pre-Tax Retirement

- Baby Step 5: College Funding For Children

- Baby Step 6: Pay Off Home Early

- Baby Step 7: Build Wealth and Give!

- You Are Allowed Do-Overs

Are you ready to take control of your finances and start building wealth? Dave Ramsey’s Baby Steps is a proven plan for achieving financial freedom, but sometimes it can be hard to know where to begin.

We want to show you how to turn those Baby Steps into giant leaps toward your financial goals. From getting out of debt to building an emergency fund and investing for the future, we’ll break down each step of Dave Ramsey’s plan and give you practical tips for taking your finances to the next level. So let’s get started on the path to financial freedom and turn those Baby Steps into financial giants!

What Are Dave Ramsey’s Baby Steps?

Ramsey’s personal finance philosophy is based on seven steps. The steps are meant to help people get out of debt, stay out of debt, prepare for a financial emergency, and plan for their financial future.

The plan is broken down into seven steps so as not to overwhelm people. When we’re in a financial hole and look too far ahead, the situation can be so discouraging that people give up. If you take things one step at a time, any goal is easier to achieve.

How do you eat an elephant? One bite at a time.

Tweet ThisLet’s take Dave Ramsey’s baby steps and run them through the LMM filter, WWLMMD if you will!

Baby Step 1: Save $1,000 For an Emergency Fund

An emergency fund is essential, even more, important than paying off debt. Why? If you don’t have the cash for an emergency, you’ll end up going into more debt to take care of it, either with credit cards, personal loans, borrowing from friends or family, or a payday loan.

If you don’t have an emergency fund, you’re not alone.

Only 27% of Americans actually have the recommended six months of expenses stashed away. Just 15% have enough to cover one to two months of expenses. And nearly one-in-four Americans have no emergency savings at all.

“Your emergency savings is a buffer between you and high-interest-rate debt when unplanned expenses arise,” says Greg McBride, Bankrate’s chief financial analyst. “Nothing lets you sleep better at night than knowing you have money tucked away to cover unplanned expenses.”

You want to sleep at night, don’t you? Me too, let’s do it.

How To Do It

For some of us, $1,000 might as well be a million. But remember, we’re going to break each step down so we can achieve it and move on to the next one. If we do the math, we only need to save $20 a week to save $1,000 in a year. It’s great if we can do it faster, but saving $20 a week isn’t unreasonable, so that’s our goal for Step 1.

If you’re not budgeting, that’s a big reason you don’t have $1,000 for an emergency. Set up a Mint account. It’s free to use and will show you where your money is going. We all have spending leaks, and Mint will point them out so we can plug them.

Food is always a likely source of overspending. We waste a lot of the food we buy in the grocery, and we eat and order out too much. If you’re trying to save $1,000, you cook at home and bring your lunch to work until you do it.

You don’t want this step or any of the steps to be a miserable experience, so you’re allowed to have some fun. There are lots of ways to have fun without spending a lot of money. We have cheap date night ideas and cheap, fun summer ideas.

Set up a Cushion account. Cushion is the easiest way to organize all of your bills, track what’s been paid, and see all of your recurring payments in one dashboard.

Rocket Money instantly finds and tracks your subscriptions. It is there when you need to cancel services you don’t need. Rocket Money also gives a breakdown of your finances to see where your money is going and how to improve. They will notify you of important events that need your attention so you’re never caught off guard.

How much are you paying for things like cable, internet, and phone? Whatever your number, it could probably be smaller. The companies that provide these services are always offering specials because there is so much competition between them.

Meet Cushion - the easiest way to organize, pay, and build credit with your existing bills and Buy Now Pay Later. All your recurring payments — one dashboard, complete control.

Dosh gets you automatic cash back at thousands of places when you shop, dine, or book hotels. No coupons or receipt scanning. Simply download the app. It’s awesome.

Got your $1,000? Good, on to the next step.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Baby Step 2: Pay Off All Debt Using the Debt Snowball

Debt is the reason most people find Dave Ramsey. Millions of us are in debt, and it’s a significant drag on our journey toward financial freedom. Having debt is also mentally and physically stressful so let’s kill this debt.

Pick a Method

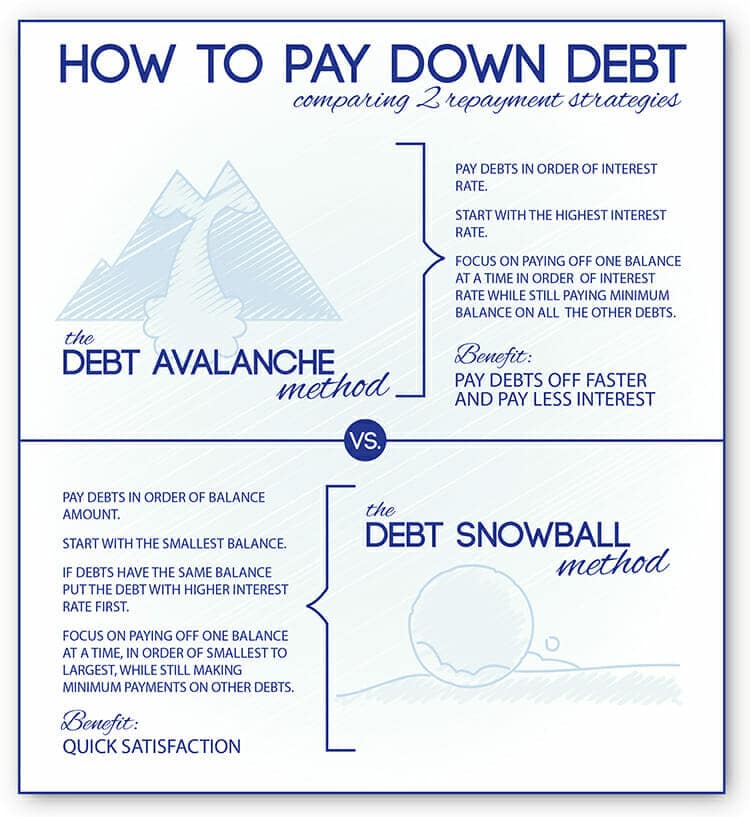

You can’t just throw money at various debts; you have to have a plan to attack them. There are two, snowball and stacking.

Snowball means listing debts by dollar amount, lowest to highest, and paying them off in that order.

Stacking means listing them in order of interest rates, highest to lowest, and paying them off in that order. Ramsey advocates snowball but stacking will save you the most money.

I’m with Ramsey on this. Stacking saves you more money because you pay less in interest, but the snowball is more satisfying. When you see a debt at $0, it gives you a boost and feels like you’re making progress. And that feeling gives you momentum to keep working hard at killing your debt.

Credit Card Debt

Credit card debt is among the worst kinds of debt to have because the high interest rates make it hard to make progress. If your credit score is good enough, apply for a balance transfer card.

Services like Credit Karma and Upgrade can show you a selection of credit cards and make recommendations based on your score.

You transfer the balance of a high-interest card to the new card. During the introductory period, which ranges from six to 24 months, you aren’t accruing interest, all of your payments go towards paying the principal. This lets you make faster progress.

You do need to pay off the balance before the 0% APR period ends though or what remains will be subject to the new interest rate which may be higher than what you were paying on the original card.

Another option, again if you qualify, is to take a debt consolidation loan from Upgrade. You use the loan to pay off your cards. You still have debt, but just one payment and with a lower interest rate than you had on the cards.

Student Loan Debt

If you have student loan debt, the first thing to do is to find out if you’re eligible for any of the forgiveness programs available. If not, consider refinancing with companies like Credible or Lenme. You can lower your interest rate which can save you thousands of dollars over time.

Baby Step 3: 3-6 Months of Expenses in Savings

Saving $1,000 for your emergency fund was a great accomplishment, but it’s not enough. Not to worry! You killed your debt, so you have freed up some money that you can use to grow your emergency fund.

But no matter how frugally you live, three to six months’ worth of expenses is a hefty chunk of money so we’re going to buckle down so we can do it fast.

How Much Is That?

Living expenses mean bare-bones expenses like rent or mortgage, utilities, car payments, etc. You don’t need to factor in things you pay for every month but could live without like cable, dining out, and entertainment expenses.

Add up those numbers and multiply them by three, that number is your first goal. Double it to have six months of expenses, and that’s the ultimate goal. No one expects you to do this overnight. Accumulating this much in savings is going to take a while for most of us.

That doesn’t mean you should leave things open-ended, having a date looming can motivate us. Do the math like we did to get to $1,000. For simplicity’s sake, let’s use a round number as an example.

To have a six-month emergency fund, we need to save $20,000. That means we need to save $384 a week for one year. Not realistic for most of us. If we make it our goal to save $20,000 in three years, we need $128 a week. I think we can do it!

Your Budget

In our first step, we just asked you to set up a Mint account, not to make a budget. We didn’t want to overwhelm you, just to show you where your money was going. Now we’re going to budget for real. Set up your budget categories.

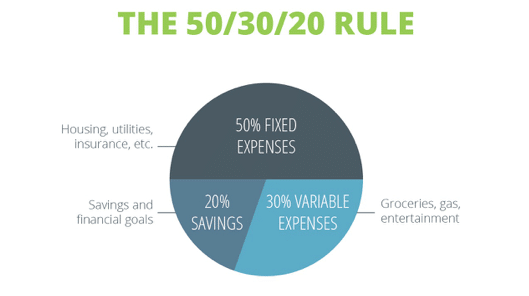

Use the 50/30/20 method to budget your money. 50% goes to essentials; no more than 35% should go to your rent or mortgage. 30% goes to non-essentials like clothes, vacations, and meals out. The remaining 20% is for investing or if you still have debt, paying that off.

Mint is excellent but it won’t stop you from going over budget. There is a more extreme budgeting method if you have a hard time sticking to your budget. It’s the envelope method. Mark an envelope for each category that you can spend cash on, gas, food, entertainment, etc.

You can’t pay cash for your rent or mortgage, but those aren’t the categories we overspend on. You can budget weekly or monthly. At the beginning of the period, you take out the amount of cash you have budgeted for each category and put it in the designated envelope.

Once it’s gone, you’re done spending on that category, even if the budgeting period hasn’t ended. This is not the most convenient way to budget, but it can help those who have tried and failed to stick to a budget.

Make a budget and stick to it.

Make More

When the average American spends five hours a day watching TV, there is no excuse not to have a second stream of income. That’s what this blog started as, a way to make extra money.

If you want to achieve financial independence, things like shopping with Ebates and using Seated to make dinner reservations are great ways to save money, but saving is not enough at some point. You need to make more.

Ask your boss for a raise. Drive for Lyft on evenings and weekends. Sell stuff on eBay or Amazon. Teach English with VIP Kid, sell your lesson plans on Teachers Pay Teachers, and sell a course on Udemy. Answer surveys on Survey Junkie, become a Task Rabbit.

Want to get paid for your opinion? Survey Junkie lets you share yours to help brands deliver better products and services. After creating your profile, they'll start matching you to online surveys you can take anywhere.

In the past, making money outside of your regular job often meant a traditional part-time job like retail or serving. The problem with those kinds of jobs was that they came with a schedule and maybe it didn’t fit with the time you had free.

But so many of the ways we listed to make extra money have flexible schedules! It’s easier to make money on the side than it ever was so there is simply no reason you shouldn’t be doing it. Remember, we’re only looking for an extra $128 a week, and part of that can be money you saved.

Baby Step 4: Invest 15% of Household Income Into Roth IRAs and Pre-Tax Retirement

Woo! You did it! The first three steps were the hardest by far. Everything from here on out is going to be a piece of cake!

We Say 20%

Dave says you should invest 15% of your income, but we say 20%. People are living longer than ever, and medical costs are higher than ever so while 15% is good, 20% is better.

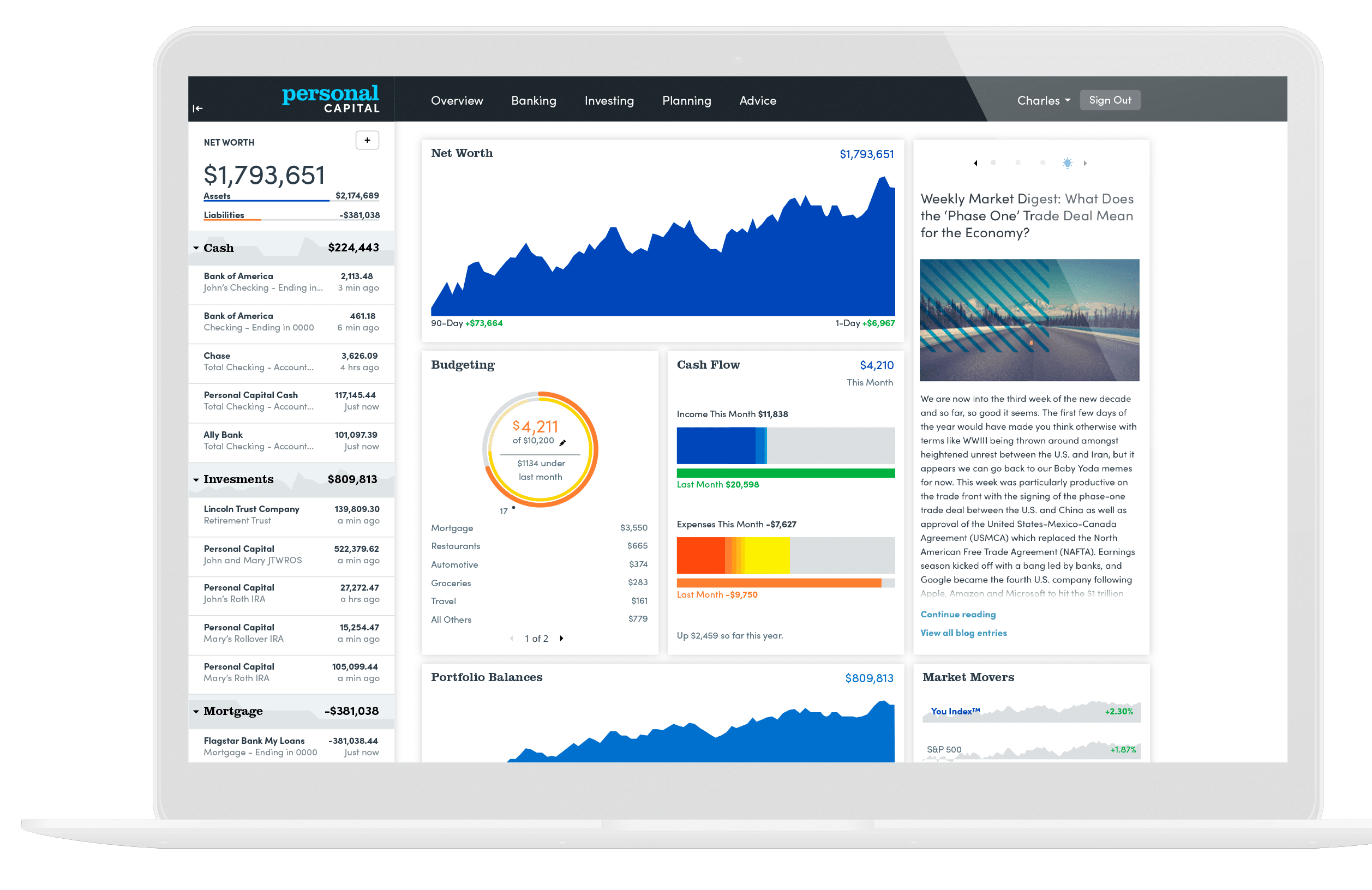

We also want to retire early, and you probably do too. Saving that extra 5% will allow you to retire earlier. Not sure how much you’ll need to retire? No fear, Personal Captial has an awesome retirement calculator that will tell you that.

The Gateways

If you’re brand new to investing, the easiest ways to get started are M1 Finance and your employer’s 401k if they offer one.

We like M1 because there is no minimum and the fees are low. It’s also easy. You just answer a few questions, set up an automatic deposit each month and you’re investing.

401ks are great for the same reason. You opt in, the money comes out of your paycheck before you get a chance to spend it and it’s tax-advantaged. The money goes in tax-free and grows tax-deferred. Upon withdrawal after age 59 1/2, the money is taxed as ordinary income.

Real Estate

We love real estate as a means of investing because it’s passive. If you want to own rental property, you don’t have to be a hands-on landlord.

You can buy a turnkey property using a company like Roofstock. Roofstock is a platform designed to simplify the process of buying turnkey properties, particularly for investors interested in single-family rental homes.

With LMM’s Rental Properties for Passive Investors course, you’ll learn the criteria for finding (and closing) the right property, the foundations of a successful rental business, the advantages of shielding your assets with an LLC, and more.

Our proven, data-driven approach to building a portfolio of income-producing rental properties that perform in the long-term.

If you don’t have the money (yet) for a

IRA

Because part of any retirement strategy should be to legally avoid taxes as much as possible, a 401k isn’t enough. You can only invest $22,500 in a 401k for 2023 (and $23,000 for 2024). Once you max that, you can open an IRA.

You can choose between a Traditional IRA and a Roth. A Traditional IRA is not taxed upfront but at the point of withdrawal. The money grows tax-deferred. Upon withdrawal after age 59 1/2, the money is taxed as income. A Roth IRA is taxed upfront and not upon withdrawal after age 59 1/2. The contribution limits for both are $6,500 for 2023 and $7,000 for 2024 ($7,500 for tax year 2023 and $8,000 for tax year 2024 if you’re age 50 or over).

To see other tax advantages, you should check out advanced IRA strategies.

Baby Step 5: College Funding For Children

Raising a child can cost close to a quarter of a million dollars, a figure that might make you either shed tears or consider sterilization. And keep in mind, this estimate doesn’t even include the cost of a college education.

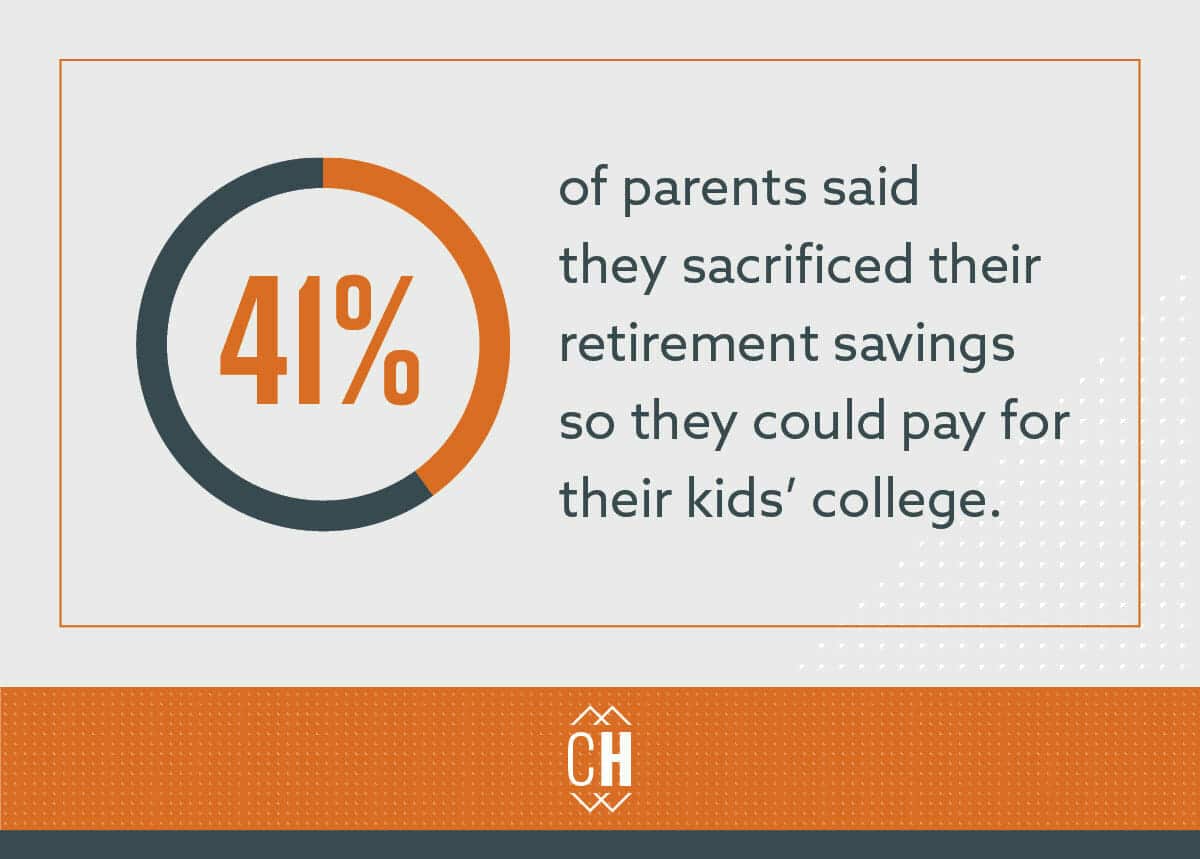

Why Should You Pay?

There’s no legal requirement for parents to cover their child’s college education costs. Understandably, parents naturally desire the best for their children and aim to support them. However, it’s important to consider that your child has significantly more time to manage and repay student loans than you have to prepare for retirement.

If you do want to help with your child’s education costs, the best thing to do is start saving early. You can do that with a 529 plan. A 529 Plan is like a retirement account for college (see “What is a 529 Plan“).

Contributions to a 529 plan are after-tax, but many states provide tax breaks for these contributions. Withdrawals for qualified education expenses like tuition and room and board are tax-free, allowing investment earnings to grow untaxed. While you must designate a beneficiary, changes are usually allowed once a year, subject to state-specific rules. However, if the new beneficiary isn’t a qualified family member, earnings could become taxable.

529 Plans are a flexible education savings option, available for direct purchase or through an advisor. They cover a wide range of educational expenses, from community colleges and four-year universities to trade schools and eligible study abroad programs, offering a versatile solution for funding diverse educational paths.

CollegeBacker helps you save for college through a 529 plan. They don't take commissions and let you choose your monthly fee. They're also a fiduciary, recommend low-fee investments, and put your interests first.

Why Should Anyone Pay?

There are lots of ways to go to college without going into debt for tens or hundreds of thousands of dollars. We know you’re proud when your kid gets into the best school they applied to, but it’s no longer realistic for most of us to attend the best (read: most expensive) college that will have us.

Choose the Right Major

Ultimately the final decision on what to major in is your kids’ to make, but you can certainly let them know they need to get a good ROI if they are going to take out loans. Getting a $100,000 degree in a major that is never going to pay more than $50,000 a year can have lifelong financial consequences.

It’s Not For Everyone

You understand your child better than anyone else. While you might hope for them to attend college, it’s important to acknowledge that college isn’t the right path for everyone. This doesn’t detract from their intelligence compared to others, nor does it doom them to a future of low-wage jobs.

There are lots of alternatives to college and plenty of interesting, well-paying, prestigious careers that don’t require a college degree.

Pushing every child into college right after high school might not always be the best approach. The Australian method offers an appealing alternative. Many Australian youths embrace a gap year, dedicating time to travel, work, and explore their interests, which helps them make more informed decisions about their future paths.

Baby Step 6: Pay Off Home Early

Debt can be categorized as either good or bad. Good debt typically comes with a low interest rate and is incurred to generate higher income in the future, such as purchasing an affordable home.

Bad debt is high-interest debt that you took out but has nothing to show for it. Like credit card debt that you racked up buying clothes, you don’t wear.

Dave disagrees, he thinks there is no good debt and all debt should be paid off ASAP.

Okay, First Of All

Why are Americans so obsessed with buying a house? It’s a big part of the American dream. It’s not just about having a place to call your own, but it’s also seen as a smart money move. Plus, owning a home is like a badge of adulthood and financial independence, and who doesn’t love the idea of decorating their own space and having a spot where they belong?

There are, of course, valid reasons for buying a house, but it’s essential to have solid justifications before committing, as it’s not always the best investment. Be aware of the numerous hidden costs and the significant responsibility that comes with homeownership.

But If You Did It…

Is Dave correct in suggesting you should aim to pay off your mortgage as quickly as possible? It hinges on your personal views towards debt. Over time, it’s reasonable to anticipate an average annual return of about 7% from your investments (the average return of the S&P 500 is 10.26% from 1957 through 2023).

Depending on current interest rates, you may be able to make more in an investment than you are paying in interest. And time is everything when it comes to investing. The longer your money is invested, the more it grows.

If the thought of debt makes you extremely uncomfortable, to the point of sweating bullets, it’s understandable why you lean towards paying off your mortgage quickly. For those who prefer this path, focusing on a rapid payoff is advisable.

Baby Step 7: Build Wealth and Give!

You’re at the last step, and things can pretty much go on autopilot. You did the hard work, and now you can relax and reap the rewards.

Continue to Build Wealth

You just need to keep doing what you’ve done to build wealth. Continue to stay out of debt. Replenish your emergency fund if you’ve had to dip into it.

Max out your 401k and Roth accounts. Contribute regularly to your

Start planning what your post-work life will look like. Retirement no longer means playing golf and sitting in the rocking chair on the porch. You want more than that for the next phase of your life.

Give It Away

Give it away if you want to use your money to buy happiness. Being generous has been shown to make us happy. That might mean gifting your children the downpayment for a home, giving money to a charitable or political cause you care about, or just buying the guy next to you at the bar a drink for no reason in particular.

You Are Allowed Do-Overs

Whenever LMM shares advice like this, I worry it might come across as overly simplistic. The truth is, managing finances or getting out of debt is akin to losing weight—it’s straightforward in theory but challenging in practice. Following these steps should lead to success, yet we acknowledge the difficulty, particularly when it comes to eliminating debt.

Drawing from personal experience, I understand that the journey isn’t straightforward, and mistakes are part of the process. It’s perfectly okay to regress from Step 3 back to Step 2. What’s important is allowing yourself the grace to start over when needed, but giving up is not an option. Attaining financial freedom is indeed challenging, yet the path is clear-cut. I look forward to celebrating with you at the finish line.

Personal Capital is Now Empower - Track your entire portfolio for free.

All your accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

![Spending Leaks: Plug Yours and Stop Hemorrhaging Cash [Updated]](https://www.listenmoneymatters.com/wp-content/uploads/2013/03/LMM-Cover-Images-75-768x432.jpg)