- What’s a SEP-IRA?

- SEP-IRA Contribution Limits

- Combine IRAs: Maximize Your Savings

- Establishing a SEP-IRA

- Who Can Participate In a SEP?

- Which Provider Should You Choose?

- SEP-IRA Deadlines

- Tax Benefits: A Win-Win for Both Employers and Employees

- Instant Vesting

- Rollovers, Required Minimum Distributions (RMDs) and Withdrawals

- SEP-IRA Rules: A Quick and Dirty Recap

- Final Thoughts

Do you want to save up to $56,000 a year for retirement? Are you self-employed or a small business owner? Do your eyes light up when you hear words like “tax-free growth” or “tax-deductible?”

If you’re looking for additional ways to save for your future, are a high-earner, and are already maxing out your traditional and Roth IRAs, consider opening a Simplified Employee Pension (SEP) IRA.

Today we’re getting into the gritty details of what a SEP-IRA account is and whether it’s the right play for you.

However, this retirement account isn’t for everyone. Know what the SEP-IRA rules are before opening yours.

But first, what are you drinking?

What’s a SEP-IRA?

A SEP-IRA is a retirement account for self-employed and small business owners (0-5 employees). SEPs are an excellent alternative to 401(k)s because they carry low-costs ($25-$50 to open) and are easy to set up while 401(k)s are more complex, tailored to larger organizations, and have higher administrative fees.

SEPs also have higher contribution limits, which make them attractive to high-earners and people looking to maximize their retirement savings on top of what a traditional or Roth IRA offer.

SEP-IRA Contribution Limits

How much higher are the contribution limits? Nearly ten times more! You can contribute up to 25% of your earnings or $56,000, whichever is the lesser amount. The 25% carries a cap at $280,000 of your earned income for the year (2019).

Note: If you’re self-employed, your contributions are limited to 20% of your net income. This is the net profit from your Schedule-C subtracted by the deductible portion of your self-employment tax. For a detailed breakdown on determining your number, head here.

The 25% is also the maximum amount you can contribute for each employee.

Limits are the same for both employer and employee and must be directly proportional – what the employer contributes to her account; she must also contribute the same amount to her employees.

However, SEPs don’t have catch-up contributions if you’re 50 years of age or older. Sorry folks.

SEP-IRA contributions are discretionary and can vary from month-to-month. This makes them appealing to sole-proprietors whose income fluctuates. You’re not responsible for contributing a static monthly amount to your employees.

Unlike a traditional IRA, you can contribute to a SEP even if you’re over the age of 70 ½ (the cut-off contribution age for traditional IRAs).

SEPs are similar to profit-sharing in a 401(k). However, if your business had an awful year, you’re not required to contribute to your employee’s account.

The flexibility of the SEP is one reason why it’s an ideal small business retirement plan.

Tweet ThisCaveat: Only employers can contribute to a SEP – this includes employee contributions. If you’re an employee, you cannot contribute to your plan.

Get our best strategies, tools, and support sent straight to your inbox.

Combine IRAs: Maximize Your Savings

Let’s imagine you’re an employee with an employer-sponsored SEP-IRA, and you have your own traditional IRA account. What gets deposited into your SEP doesn’t disqualify you from contributing to your IRA.

You could potentially put $56,000 into your SEP while maxing out your IRA at $6,000 – $62,000 worth of savings!

Tip: Read the fine print as traditional and Roths have income limits, which can affect your contributions and deductions.

Establishing a SEP-IRA

You can set up a SEP in three steps:

- Create a written agreement showing benefits to all eligible employees

- Distribute to your employees all relevant information about the agreement

- Set up an IRA account for each employee

The written agreement must include your name and establish requirements for employee participation and include your employer contribution with a definite allocation formula. Usually, employers will file a Form 5305-SEP.

Who Can Participate In a SEP?

If you want to set up a SEP-IRA for yourself or your employees, the standard eligible employee requirements are:

- You’re 21 years old

- You worked for your employer for at least three of the last five years

- Received at least $600 in compensation from your employer during the year (maximum compensation is $280,000 in 2019)

You can set up a SEP plan with most banks, insurance companies, or mutual fund companies.

Which Provider Should You Choose?

There are many financial institutions available to create your SEP account. Here are a few we like that offer flexible, low-cost brokerage accounts.

Betterment

It’s no secret we’re fans of

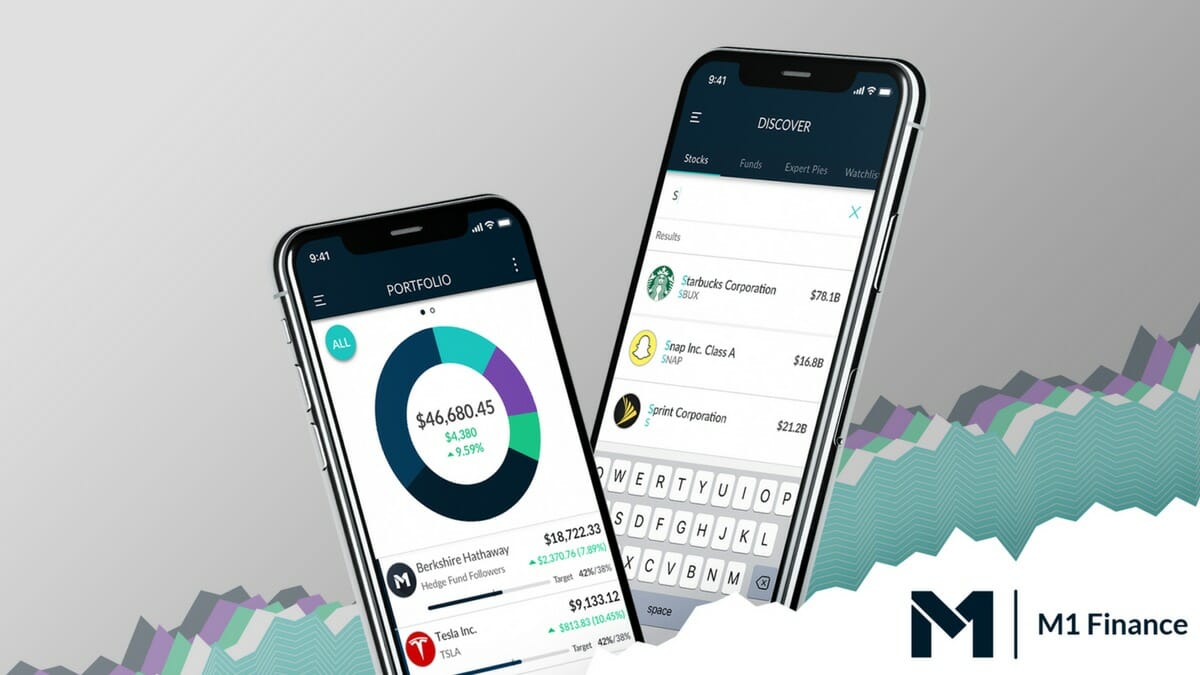

M1 Finance

M1 Finance is a free investment platform where you can set up your account lickety-split. And when we say free, we mean free. You won’t pay any management fees or commissions when creating your portfolio or choosing your investments.

You can pick from up to 80 expertly-curated portfolios or design your own.

Vanguard

The low-cost leader of mutual funds and ETFs, Vanguard, provides you with an ample selection of investment options to fund your SEP account. There’s no fee to create yours and no IRS-required reporting.

Fidelity

Fidelity offers retirement savers several options, including stocks, bonds, annuities, mutual funds, and U.S. Treasuries. Their ample selection even includes zero-expense ratio index funds.

SEP-IRA Deadlines

If you’re considering opening a SEP-IRA, here are a few things to know when opening your account.

Forming Your SEP-IRA. You have up until your tax filing deadline (extensions included) to set yours up. For example, you have until April 15, 2020, to create one for the 2019 tax year.

If you filed an extension, you have until October 15, 2020. That’s an enormous amount of time to decide if you want to pay yourself or the government that hard-earned money.

Tip: Whenever possible, always pay yourself first.

Employee Disclosure. Your employees must be informed of all related disclosures and information about your plan as soon as they’re eligible.

Contribution Deadline. Whether you’re a solopreneur or an employer, you can contribute anytime up until your tax-filing deadline. Using the above example, you have until April 15, 2020, to add to your 2019 SEP-IRA plan.

Note: Allowing yourself to fund the SEP-IRA up until your tax return’s due date gives you an edge because it affords you the ability to realize the tax implications of your contribution amount fully.

Tax Benefits: A Win-Win for Both Employers and Employees

SEPs are tax-free for employees and tax-deductible for employers. If you’re an employee, you won’t be affected by your employer’s contribution and will pay no extra income taxes on those contributions. Why?

Because the IRS doesn’t view that as a taxable event! Much like a traditional IRA, your money grows tax-free until you withdraw in retirement when it’s taxed as ordinary income.

A SEP plan makes retirement saving easy both for yourself and employees. When you establish a SEP agreement, contributions are made directly into a traditional individual retirement account.

Self-Employed Solopreneurs

If you’re self-employed and contributing to your SEP account, it reduces your adjusted gross income and taxable income, potentially placing you in a lower tax bracket.

Your self-employment tax isn’t affected in this scenario because your income is determined before your SEP calculation. Another commonality between SEPs and traditional IRAs – SEPs are funded using pre-tax dollars.

Another tax-sheltered strategy is to run your business as a corporation to avoid both federal income tax and self-employment tax on your SEP contributions.

Employers

For self-employed business owners, contributing increases your business expenses because you’re paying out of pocket to your employee’s retirement accounts. This lowers your net-profit, self-employment tax, and income tax.

For example, you earned $100,000 but paid $30,000 to your employee’s SEP plan, that $30,000 is a deductible business expense.

$500 Tax Credit

You’re also eligible for up to a 50% ($500 maximum) credit of all startup costs per year. This covers the necessary fees to administer and educate your employees about the plan.

You can claim your credit for the first three years only, and it may be carried backward or forwards to alternate tax years (if you’re not using it for the current year).

For example, you could claim the credit in the tax year before your plan goes into effect. You can also deduct trustee fees if contributions to the plan don’t cover them.

Caveat: You can’t claim both the tax credit and deduct your startup costs.

Instant Vesting

SEP-IRAs are 100% vested (owned and controlled) by the employee. The employer’s job is to find a provider (e.g.,

Once contributions are complete, the employee can invest the money at their discretion.

Rollovers, Required Minimum Distributions (RMDs) and Withdrawals

If you’re thinking about switching providers or merging accounts, SEP contributions and earnings may be rolled over tax-free to other IRAs and retirement plans.

You’re not allowed to sit on your nest egg indefinitely(even though some of us would like to) A SEP does require you to begin withdrawals (aka RMDs) when you reach age 70 ½.

If you choose, you can withdraw more than the minimum, but your withdrawals will count as taxable income at the ordinary tax rate. And in true IRA fashion, if you make a withdrawal before age 59 ½, you’re subject to a 10% penalty.

A SEP-IRA Might Be Worth It If…

- You’re a self-employed or a high-earning business owner (e.g., an independent contractor or freelancer) looking for a larger tax shelter than what a traditional or Roth IRA provides.

- You operate a business with less than six employees and want to establish a retirement plan without the hefty administrative costs of a 401(k). Your business may also experience inconsistent profits, which makes cash flow an issue (e.g., you can contribute more when business is good and less when it’s bad because contributions are based on a proportional percentage of profits).

![]() You Might Also Consider A SEP-IRA If…

You Might Also Consider A SEP-IRA If…

- You have multiple LLCs with different functions. Depending on how it’s used, your LLC could potentially be used as a tax shelter for applicable earned income.

SEP-IRA Rules: A Quick and Dirty Recap

- It’s an employer-sponsored plan funded only with employer contributions

- Eligible employees are automatically enrolled (employees have the option to revoke their account)

- Equal (proportional) contributions to yourself and all employees. Your employee’s compensation is equivalent to yours

- Employees are 100% vested. The employer’s only job is to find a provider (e.g., Vanguard) and make contributions. The employee may invest it as they see fit.

- Contributions are tax-deductible and grow tax-free

- High $56,000 contribution limit (compare to $6,000 with a Roth or traditional IRA)

- Withdrawals are taxed as ordinary income in retirement (like a traditional IRA)

- Low administrative costs with simple set up

Final Thoughts

Retirement planning doesn’t have to be complicated. Knowing the SEP-IRA rules already puts you ahead of the herd.

Despite having RMDs, no catch-up contributions, and no Roth version, the SEP-IRA still carries many retirement benefits for the self-employed or small business owner. If you’re looking for additional tax shelters or higher contribution limits, a SEP-IRA is worth a look.