You don’t need to be Warren Buffett to start investing and you don’t need thousands of dollars either. In fact, you can get started for $5.

Does the thought of getting started investing seem like something unattainable?

“That’s for rich, CEO banker-types. I’m not an investor,” you think to yourself.

Or what about this?

“I don’t have enough money to invest. My budget’s stretched out like a gymnastic gold-medalist.”

Fortunately, there’s hope. Thanks to companies like

Small investments add up over time and you’ll be surprised how much wealth you can accumulate – even with spare change.

I’m going to show you how easy and simple it is to start investing – even on a shoestring budget.

But first, there’s something you need to be mindful of…

The Time Value of Money

Have you ever thought to yourself, “Man, that’s so far off into the future I’m not even going to worry about it right now.”

We’ve all done it. I’ve done it.

“I’ll start investing when I’m making more money.”

Right.

Time discounting is when the perceived value of something decreases the farther off into the future it is.

Or in the words of BehavioralEconomics.com:

Present rewards are weighted more heavily than future ones

$50 today is worth more than $50 in a year. Given the choice, most of us would take the $50 now.

If you have to wait a year for your reward, it’s got to be worth your while.

What if you had the choice to take $50 today or $5,000 in a year. I’m sure you’d wait a year if it meant getting $5k.

Time discounting is one of the biggest reasons we don’t save money, eat healthily, or exercise regularly.

We’re more concerned with immediate gratification over the long-term pay off and we’ll rationalize, fight for, and defend our choices tooth and nail to anyone who questions them.

It’s so important to us that we’ll put off doing things we know are good for us at our own peril.

I’m a closeted time discounter in the personal finance world – but I’m improving. I like to think of it as my present self is taking care of my future self.

It’s a fun game. It feels kind of like time-traveling. Although, I’ll never meet my future self (perhaps under the influence of a mind-altering substance but that’s another story), I know I’m taking care of 60-year-old me.

And it starts with baby steps. Or in this case, small investments.

Where To Start With Small Investments

Now that you know about the time discounting trap, let’s talk about some easy ways to get started investing. New accounts at brokerage firms with the small investor in mind are ideal.

Ones offering low minimums and low fees make good investments. Whether it’s individual stocks, a Roth IRA (retirement plan), or an emergency fund for extra money, don’t let your financial situation dictate a good time to start investing. Just start – even if all you’ve got is $5.

Here are a few investment ideas that will kickstart your wealth-building journey.

Get our best strategies, tools, and support sent straight to your inbox.

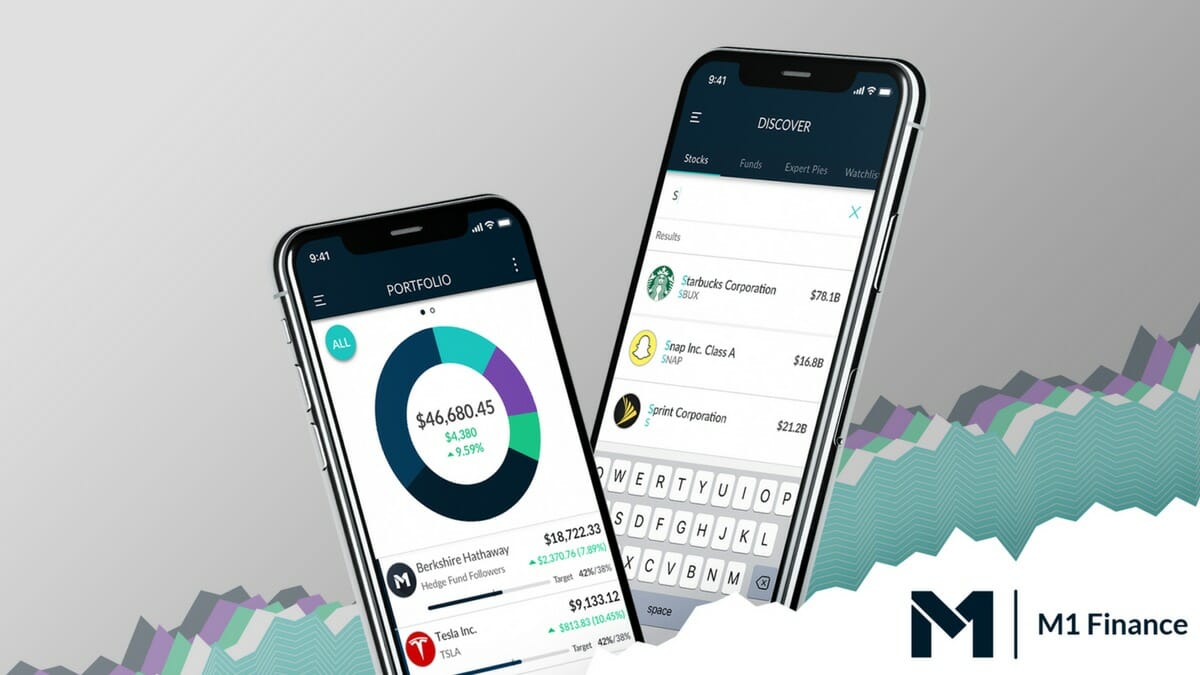

M1 Finance

Like

You can choose between their suggested portfolios, create your own, or combine them.

They offer portfolio rebalancing with no minimums to open an account and no account management fees. Yep. M1 Finance offers its services free of charge to individual investors.

However, your account will need $100 before M1 Finance starts investing.

M1 Finance even lets you borrow up to 35% of your portfolio’s value to purchase more shares and payback when you’re able.

Read our comprehensive M1 Finance review here.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

Acorns

Acorns is a micro-investing app that invests your spare change, has no account minimums, and is free for students.

Micro-investing deposits your spare change with every purchase by rounding up to the nearest dollar. Create an account, link an external funding source and you’re on your way.

Like

Small deposits add up over time. After one year, you may have invested several hundred dollars – or more – without even thinking about it.

If small change sounds too… well… small, Acorns lets you make lump-sum deposits as well as recurring deposits from your bank.

Acorns offers three platforms:

- Core – Their starter investing platform

- Later – IRA retirement savings

- Spend – Digital checking account combined with Acorns Core and Acorns Later

They charge a fee of $1, $2, or $3 depending on which account you open.

There’s no minimum to open an account but you will need $5 before Acorns starts rounding up your spare change and investing for you.

Read our full review here.

Robinhood

Robinhood is ideal for the first-time investor. If you’ve ever wanted to get started trading in the stock market, Robinhood may be a great fit.

They offer no commission stock market trading from the convenience of your smartphone. Try your hand at stocks, exchange-traded funds (ETFs), or cryptocurrency.

Active traders find no-fee trade commissions an attractive offering. You can create an account in minutes with no minimum required.

Investors with a $2,000 account balance can upgrade to RobinHood Gold which allows investors to trade on margin and provides extended trading hours.

For the skinny on RobinHood, click here.

Betterment

You answer their questions about savings goals, time horizon, and risk tolerance and they’ll create your custom portfolio.

Their annual account management fee is 0.25%. That’s $2.08 per month on a $10,000 account balance.

It’s a fully automated service offering features like tax-loss harvesting, RetireGuide, and portfolio rebalancing.

While they don’t invest your money in mutual funds, their use of exchange-traded-funds makes them one of the best investment options for folks with small amounts of money.

They even do cool things like fractional share purchases which means all of your money is working for you – and not sitting on the sidelines.

For example, if a stock costs $100 per share and you can only afford $25,

There’s no minimum to open an account which makes the barrier to entry zero. $0. Nada. Zilch. If you’re on a paper-thin budget,

Read our detailed Betterment review here.

Fundrise

Think investing in real estate requires lots of cash? Not anymore thanks to Fundrise.

Your investment will get you started in the world of commercial real estate. It’s a crowdsourced model that removes the middleman, allowing regular investors to take part in deals that are normally reserved for the super-rich.

Why the higher returns?

They’re focused on deals with less competition, running in the low millions.

Diversify into income-producing real estate without the dramatics of actual tenants. Fundrise eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy.

Disclosure: When you sign up with this link, we earn a commission. All opinions are our own. I am investing with Fundrise

Investing in real estate is an excellent way to increase your cash-flow and diversify your investment portfolio. There’s more to investing than just the stock market.

Read our detailed Fundrise review here.

Automate

Make investing a no-brainer by automating your finances. In his kick-ass book, I Will Teach You To Be Rich (don’t be fooled by the title, his book is a New York Times bestseller for a reason), Ramit Sethi lays out a solid framework to put your finances on autopilot.

If you’re terrible when it comes to saving, automation is the easiest way to start building wealth. Set up recurring weekly or monthly deposits and put that ball in motion.

Remember Newton’s First Law:

An object at reast stays at rest and an object in motion stays in motion.

Anyone of the above-mentioned platforms can help you squirrel away your spare change.

At the end of the year, you’ll be surprised by the amount in your bank account.

Mind The Hedonic Treadmill

You might be fooled into thinking that you don’t have enough money to spare because of all the money you’re already spending.

The hedonic treadmill (aka lifestyle creep) is like the devil whispering in your ear about how much sweeter your life would be if you would upgrade already.

All those cool things you could buy with your hard-earned money.

Fancier wardrobe. Pricier condo. New car. These are the things that keep the average person shackled in debt, working forever, and never building wealth.

Mindless spending is the primary difference between being wealthy and being rich.

Tweet ThisMindless spending. The wealthy are conscience about what they spend money on.

Final Thoughts

Imagine that investing is like Newton’s First Law – you need to get in motion. It doesn’t take much money to set up an investment account.

Start with baby steps. Once you start building momentum, it will snowball. Your nest egg will increase with time.

There are plenty of arenas to house your cash with little money required.

Index funds, retirement accounts, and real estate are all great investment vehicles. The playing field doesn’t matter – just get in the game.

And don’t feel like you’re stuck once you commit to one institution. You can adjust your course as you go. Investing isn’t only for the rich and you don’t need to break your bank account.

Getting started has never been easier thanks to low-costs and little to no investment minimums.

Thinking about investing and doing it are two different things.

The best time to start was yesterday, the second best time is right now.