A healthy savings account should be a pillar of your personal finance toolbox. But letting your money sit around for a rainy day can be frustrating. That’s why we’re always looking for ways to keep our money working for us. CD ladders are an easy way to get a return on your savings without sacrificing security.

You don’t have to sit on your thumbs while big banks keep making money on your savings account. This post will walk you through the basics of creating a CD ladder and help you decide if a CD ladder is right for your portfolio.

What is a Certificate of Deposit?

A Certificate of Deposit – commonly called a “CD” for short – is a type of savings account that comes with a fixed interest rate in exchange for a fixed term length. CDs essentially lock your money away for a set period and reward you with a higher interest rate than a typical savings account.

The catch is, unlike a savings account, you’ll be hit with an early withdrawal penalty if you need to take your money out before your term is up.

Banks typically offer variable interest rates known as Annual Percentage Yields (or “APY”) that fluctuate with the market. CDs are unique by allowing you to lock in a fixed APY rate. Typically, the longer the term you choose, the higher the interest rates you can get for your money.

Your potential for returns isn’t huge compared to the stock market, but they’re safe and reliable. And anything is better than letting your money sit around earning zilch in a standard savings account.

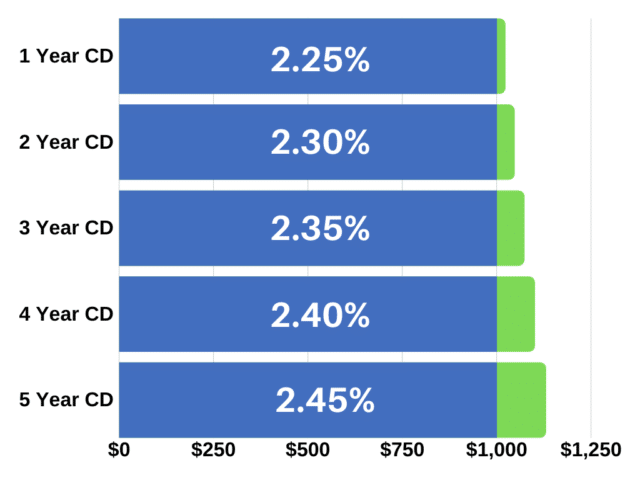

Current rates for CDs vary between 2% and 2.6% depending on your term. Banks can also vary rates based on your deposit amount and other factors.

CDs are offered by most financial institutions including online banks and credit unions.

What is a CD Ladder?

A CD ladder is an investment strategy where you invest in a variety of CDs all at once. Your investment is divided into equal amounts and placed into CDs staggered at different term lengths. Longer-term CDs provide you with higher returns while shorter-term CDs keep your cash (relatively) liquid.

The key to successful CD laddering is keeping your CDs at equal term lengths – typically one year. You’ll find the beauty of CD ladders when the shortest termed CD comes to maturity: accessibility. You can cash out if you need the money or extend your ladder by rolling it over into a longer CD.

The best returns on CDs typically escalate between one and five years, but you can get CDs for as short as three months (albeit with smaller interest rates).

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

How Do I Make a CD Ladder?

Let’s keep it simple with a $5,000 investment over five years. First, we are going to split up the $5,000 into five chunks – $1,000 apiece. Each $1,000 investment will then go into five separate CDs staggered at different term lengths.

The highest returns are typically found in long term CDs, so we recommend selecting maturity dates with one-year intervals to keep things simple.

Five different accounts? It may seem like some burdensome paperwork, but CDs are hands-off once they’re set up. Simplicity is one of the CD ladder’s best virtues. Sit back and watch your fixed APY interest rates accumulate.

Keep Your Ladder Growing

After the One-Year CD reaches maturity, you have two options:

- Access your cash for a different investment (or unanticipated expense) or

- Extend your ladder and reinvest the funds into a new Five-Year CD.

This rollover effect keeps your first CD working and, meanwhile, the next rung of the ladder is now available within a year (and with a higher return at that).

Using regular intervals between CDs gives you predicatable access to your cash – and interest payments.

And you can always add new CDs to your ladder based on your priorities.

Banks typically provide a grace period – two weeks or so – to withdraw and reinvest your money when your term is up. Be sure to read the fine print because some may automatically invest it in the same CD if you don’t act. That can mess up your cash flow and your ladder.

We recommend opening a savings or money market account with whatever bank you choose to host your CDs. Having access to one of these accounts usually makes it easier to deposit and transition funds into your different CDs. Just make sure there are no fees or account minimums.

Different CD Options

The ladder examples we’re discussing here are related to standard or “traditional” CDs, but you might see a variety of CD labeled products when searching around for the best rates. No-Penalty CDs and Jumbo CDs are two common options you’ll likely come across.

A No-Penalty CD absolves you of those pesky early withdrawal fees (a hallmark of traditional CDs) in exchange for lower interest rates. Using a No-Penalty CD requires you to consider the trade-off of liquidity for lower returns. It may be more convenient to simply use a high-yield savings account if you are worried about accessing your funds (see CD Ladder Alternatives below).

Jumbo CDs are for investors with lots of assets on hand. In exchange for a larger deposit, you can access fixed APYs above what’s available for traditional CDs. Jumbo CDs typically start at $100,000 (!) and are frequently used by large institutional investors.

(I don’t know if I’ll reach the Jumbo CD Ladder phase of life, but I’m working on it).

Always keep your money working for you

Tweet ThisWhy Use a CD Ladder?

CD laddering is a great strategy to earn higher interest rates for your savings while still preserving some measure of flexibility and liquidity in your portfolio.

CDs provide a reliable hedge against unpredictable interest rates and markets.

Placing your money into a CD ladder facilitates access to higher growth over time. Longer terms give you a better return for your money, but could also mean early withdrawal penalties if you’re in a pinch, so it’s all about determining your priorities.

Consider Your Financial Goals

CD ladders are a great tool to grow your savings, but because they lock away your money for a specific time frame, you should never have all your savings in CDs. Long term financial goals like saving for a mortgage down payment are great ideas for a CD ladder…or even just a chunk of your regular savings you may have set aside for an Opportunity Fund.

It’s always important to have some assets liquid, so never use a CD ladder for your Emergency Fund. It’s also a good idea to keep some long term savings invested in the market (even if investing seems scary). Some banks tout CDs as a strategy for retirement savings. We recommend against using CDs as a strategy for retirement savings.

The relatively small returns over time aren’t worth it compared to the stock market. Retirement is a long term investment (think 30 years), and history has shown the highs and lows of the market over time will return at a higher rate than the returns of a CD ladder (which is more in the range of five years).

CD Ladder Alternatives

High yield savings accounts can provide a reasonable alternative to CDs depending on your priorities. Online banks are now providing savings accounts with interest rates between 1.5% and 2% (before you judge, remember the best savings account rates at most brick and mortar banks hovers at .09% APY).

The good folks at

While it’s nice to see online banks providing higher interest for savings accounts, they are still affected by the Federal Funds Rate. Essentially, the federal government can limit the money banks can loan. This, in turn, affects the variable rates banks can offer savings account and money market accounts.

Betterment and other online banks are providing solid returns now, but aren’t a guarantee. CDs, on the other hand, are an effective tool to hedge against interest rate risk. This is can also provide some stability from any looming recession.

Where Can I Start a CD Ladder?

I know what you may be thinking: surely, only a hotshot from Goldman Sachs can pull off a personal finance strategy this effective. You’re wrong, my friend. CD laddering is super easy to get started. Start checking for the best CD rates at online banks like Ally Invest and CIT Bank.

Some banks may require a minimum deposit or will fluctuate rates based on how much you deposit. Keep that in mind in addition to the rates you receive for the various term lengths.

You can always compare them to what’s offered at local credit unions (where they’re often called “share certificates”) to see what makes you feel most comfortable.

Start Climbing Your CD Ladder Today

You can’t time the market (generally speaking). CD ladders are a nice balance between stock market volatility and the frustration of a regular old savings account.

Consider a CD ladder to mitigate interest rate risk and lock in a predictable rate of return for your savings. Don’t let the banks keep your hard-earned money with no returns. Start climbing a CD ladder today and add a nice boost to your savings!