If you are interested in personal finance, you’ve probably heard the term timing the market. There is some debate about whether market timing is a good investment strategy or something impossible or nearly impossible to do. You probably can’t time the stock market unless you’re Warren Buffett which you are not.

Is timing the stock market a good idea?

Even if you’re just a casual observer of economic news, you hear a lot of questions about what’s happening with the stock market or the housing market. These questions create a lot of speculation, but what should the average investor, which most of us are, be doing with our investments based on this speculation and crystal ball gazing?

By not timing the stock market, are we losing out on price movements that could net us significant market returns? If we’re on the brink of another Great Recession does the buy-and-hold strategy that LMM has been preaching from the beginning still stand? Should we stick to our index fund or should we all become day traders? It’s enough to make even the soberest long-term investors second guess themselves.

We’ve attempted to address some of these issues with our Golden Butterfly, Recession Fire Drill and Investing in the Age of Anxiety episodes. But those episodes have generated additional questions from listeners about investment decisions and market timing. We’ll tackle those questions for you.

What is the downside to the timing market?

Certainly! The downside to timing the market lies in the inherent difficulty and unpredictability of accurately predicting short-term market fluctuations. Attempting to time the market often leads to missing out on significant gains, as it’s challenging to consistently identify the best entry and exit points.

Moreover, investors who try to time the market may incur higher transaction costs and taxes due to frequent trading. This approach also involves increased stress and the potential for emotional decision-making, which can negatively impact long-term investment success.

Many experts recommend a long-term, buy-and-hold strategy instead, as it’s generally a more reliable and less risky approach to investing.

Get our best strategies, tools, and support sent straight to your inbox.

Question 1: Timing the Stock Market

How to protect one’s retirement savings and overall investment portfolio? Should we sell or ride it out? If selling is the way to go, what do you recommend holding in place of equities?

Your retirement savings are long-term investments meaning they should remain invested for at least ten years. As such, they have time to ride out the ups and downs of market prices.

Don’t touch long-term investments, no matter what the market is doing. Buy and hold, set it, and forget it. The answer is always to ride it out and to use dollar-cost averaging to drip additional contributions into your investment accounts. A much better market timing strategy.

However, an opportunity fund is a perfect way to take advantage of market price dips, whether a one-day event or a sustained bear market.

The way to make money is to buy stocks low and sell stocks high.

That’s what an opportunity fund is for. When there is a drop in market prices whether it’s the whole Dow or a few individual stocks you’ve had your eye on, you and your opportunity fund can swoop in and scoop up some bargains.

Question 2: WWAD?

Andrew, how are you treating your portfolio in this market? Given where we are in the market and the unknowns of where it’s going, how do you look at timing?

WWAD? What Would Andrew Do? It’s not a bad question to ask yourself when it comes to portfolio management or anything to do with personal finance! Or your love life. Andrew gives really good advice on that too.

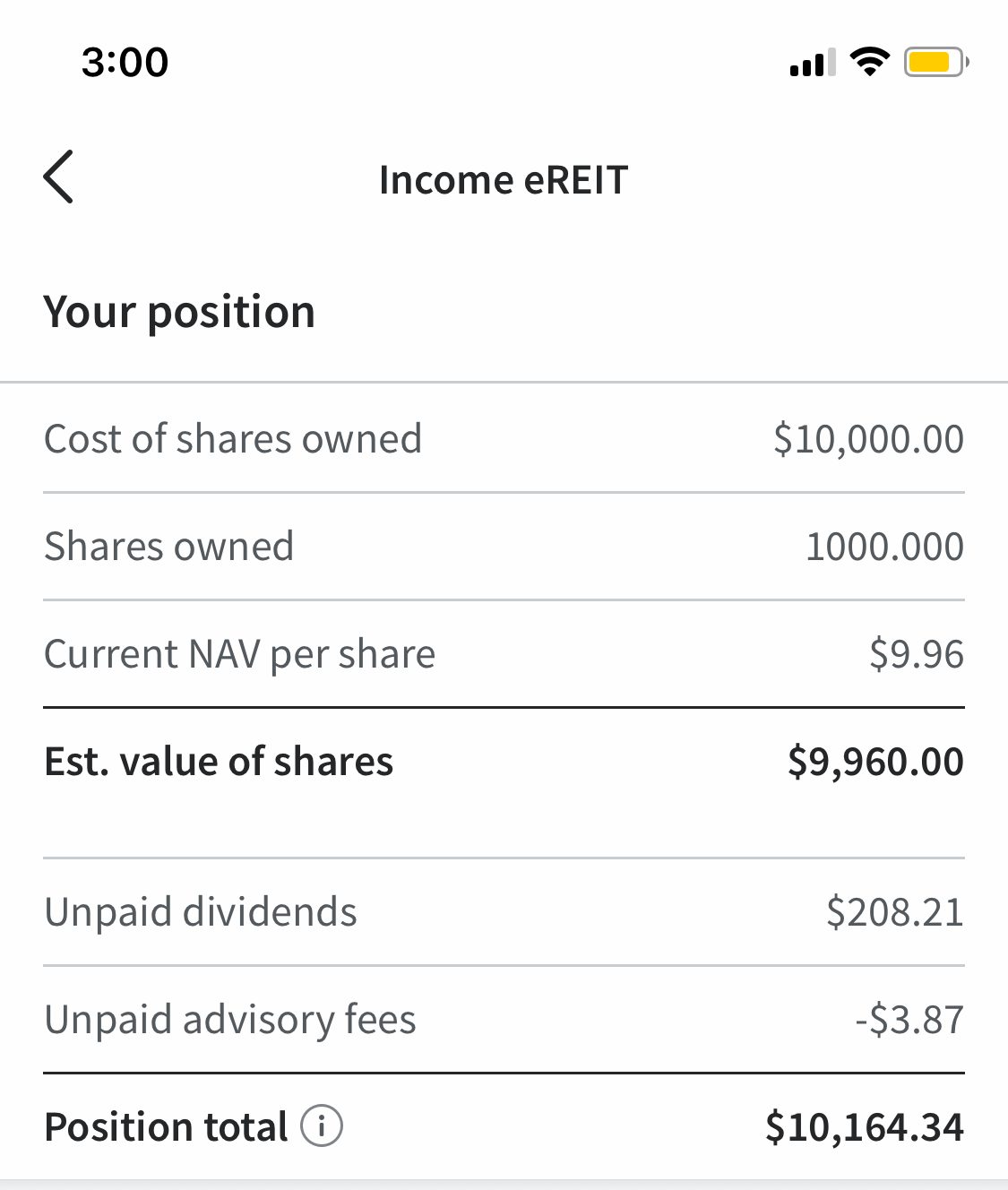

Andrew and Laura are putting money into their Golden Butterfly portfolio and Fundrise. This isn’t short-term money; they won’t be touching this money for 20 to 30 years.

While mortgage interest rates are good right now and they would like to add some more rental property to their portfolio, they just haven’t found any really great deals. They have a set of criteria a deal must meet, and there aren’t any houses available right now that meet them.

Question 3: Buying Individual Stocks

How do you invest in companies you’re interested in? What kind of research should you do so you can get in early?

Well, not based on what Howard Stern is doing as Matt famously did when he invested in Sirius Satellite Radio based only on the fact that Stern was moving there from terrestrial radio. He bought the stock when it was hot and then it tanked. Lesson learned.

The first rule of making money is not to lose it

Tweet ThisCurrently, the only individual stocks Andrew and Laura own are Apple and Tesla. Apple because they know, like, and understand the products and Tesla because Andrew has a man-crush on Elon Musk. Why? I thought Matt put it well. “I believe in this guy and the vision of the company. I’m going to take the risk with him.”

Warren Buffett does invest in individual stocks, and he has a team of market timers behind the scenes doing a crazy amount of research, something the average investor doesn’t have nor do they have the time to do it themselves.

For Buffett, a company has to have a certain valuation, to have income-producing assets that generate a certain amount of cash. When such a company has a dip in market price, maybe it’s Tesla, and one of their cars caught fire, Buffett would swoop in and get a good deal.

But a company has to meet his criteria; if it doesn’t, he won’t buy stock in it no matter how good the deal looks.

Any average investor wanting to invest in individual stocks should have a set of criteria all companies must meet. If the don’t, there isn’t a question of should I or shouldn’t I? It’s simply a hard “No.”

Question 4: Timing the Real Estate Market

I was wondering if you could go into more detail on how to view your first house purchase? Timing, preparation, etc.

Understand that buying a home to live in is not an investment. An investment is something that makes you money, not something that costs you money. A house costs you money in repairs, maintenance, property taxes, etc even after you’ve paid off the mortgage. The only time a house makes money is when you sell it and sometimes not even then.

There are plenty of good reasons to buy a home that doesn’t have anything to do with money but just understand, a home to live in is not an investment.

To mitigate this somewhat, buy the worst house in the best neighborhood your budget allows. Put $15,000-$20,000 worth of renovations into new siding and the kitchen.

Siding replacement recouped 92.8 percent of its cost, according to the study. The only home improvement likely to return more at resale was a minor (roughly $15,000) kitchen remodel, which returned 92.9 percent.

This is becoming a bit of theme in this episode but before you start spending hours drooling over Zillow, come up with a set of criteria that a house must meet before it makes it to your “maybe” list. It an emotional thing buying a house, you want what you want. But that’s no justification for spending hundreds of thousands of dollars or more.

Just Say No

To timing the market. You can’t time the market. We understand that the potential to underperform the market is exciting but understand the risk you’re taking.

When you only invest in an index fund or mutual fund, you underperform the market by the expense ratio on those funds and any transaction fees you have to pay. For the average investor, that is an acceptable return.

Speculation, timing the market, is taking more risk but the potential to outperform the market means the potential of bigger returns. Can you afford to lose money on an investment?

Timing the market also costs you money, even if you don’t lose money. Every time you buy and sell a stock, it costs you money because brokerages charge clients for that.

We don’t want your personal finances to be exciting. We want them to be nice and boring, just chilling in the background of your life, doing their thing. Making you a little richer every day. Buy and hold. Set it and forget it. Just say no to timing the market.

Show Notes

Alien Church: A New England style IPA.

Cheap Cologne: Matt’s own Kolsch.