There are things we need, and there are things we want. But there’s also a whole lot in between. Sometimes we fool ourselves into thinking that something we only want is something we need.

Sometimes to alleviate the guilt of making a purchase (especially a large one), we feel the need to justify it. But if you have to explain something, it usually means that it can’t stand on its own as being the right thing to do.

You don’t need to justify things like retirement savings or an emergency fund.

So does this mean that we can never buy expensive things unless we’re swimming in cash? Not necessarily. Turn your desire for something nice into motivation for responsible spending practices.

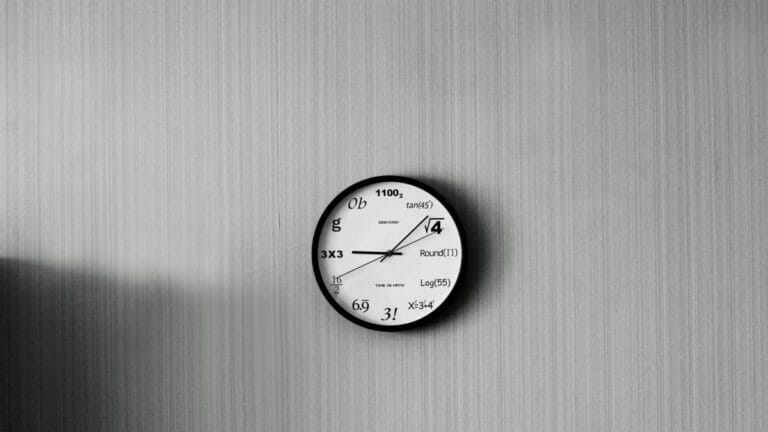

Money Is a Tool

My father had a saying: “Money is for spending.”

We grew up modestly, and my father worked very hard, doing manual labor to support our family. And though we were frugal, we were never in severe want, and sometimes we’d even splurge.

Oddly, knowing that money didn’t come easily, all of the kids in the family were always a little more concerned about our personal finances than the grown-ups. It’s when my father would break out his above saying.

He didn’t mean it in a way to justify being careless with money. He knew that money was a tool to get the things we needed.

And like with any tool, identifying the optimal way to use it will take you a long way. Abuse it, and it’s useless for when you need it.

Money is a tool. Knowing the optimal way to use it will take you a long way.

Tweet ThisWhen Is the Extra Expense Worth It?

There are times when the additional cost of something is worth the price tag. Provided you have the funds available, and you’re not going into debt over it.

When It Will Last Longer Than the Cheaper Alternative

Some things are more expensive because they are quality products. The materials may cost more, or the people making it may be more skilled.

Truly quality clothing can last a lifetime. Some of the things you get at big box stores won’t last the season. A lot of “fast fashion” is this way because they know that people won’t wear it longer than a couple of years before it’s hopelessly out of style.

I have a dress shirt that I had tailor-made.

It gets professionally laundered, which is harsh on the fabric. I probably paid three or four times what you’d pay for something that wouldn’t fit as well at a nicer clothing store off the rack.

It still looks as new as the day I bought it – twenty years ago.

When It Will Save You More Money than You Spent

Some things that will save you a lot of money in the long-run have a pretty high initial cost. It’s because it takes money to save money.

Solar panels are a great example of this. There is a high up-front cost, but over several years, you will save much more money, primarily if you sell your excess power back to the grid.

By the way, this is not the case if you lease the panels from a company because they’re putting up the initial cost and reaping the benefits from you.

When It’s the Only Option

There are expensive things that have no alternative. Yet if they’re necessary, you’re stuck. Unfortunately, some medications or medical procedures fall under this category.

The key is to prepare for those things. Knowing that they exist, you should keep some money in savings for those unavoidable costs. You never want to be caught in a situation, forcing you to make a challenging and highly consequential choice.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

When Are You Just Fooling Yourself?

Then there are times when your justification is only an excuse (and not a very good). There are things we tell ourselves to make us feel better about an unnecessary expense.

You’re Getting Reward Points

Whoever invented credit card reward programs deserved that corner office they probably got. This one thing has perhaps made credit card companies billions of dollars over the years.

Editor's Note

Points are imaginary things that cause people to spend more than they can afford and they usually wind up paying extra for it (in the form of high interest rates and fees).

It’s true even if you pay off your entire balance every month.

Vendors are paying the credit card companies a percentage of each of your purchases in transaction fees, which eventually get added by the vendors to the price of everything you buy.

You Only Live Once (YOLO)

Variants of this are “You can’t take it with you when you die” or “You’re only young once!” While these statements in and of themselves are right, they’re not necessarily great rules for living.

This mode of thinking assumes that the older you get, life isn’t as valuable, or that frugal living is the equivalent of a wasted life. That is toxic thinking.

While you shouldn’t be afraid of experiencing life to the fullest, free-spending is not necessarily the best way to do it. Living out the remainder of your life in perpetual debt and insecurity is usually the consequence.

No one ever gets into their golden years saying, “Gee, I’m sure glad I spent all my money in my 20s”

It’s an “Investment”

Some people believe that if you purchase something that has some noble purpose, it’s considered an “investment.” Examples of this would be a computer for school or a car for getting to work.

And while few would deny that these are good things, to elevate it to the status of “investment” is a weak attempt to justify the cost. Investments are always prudent and don’t need justification.

These are tools, and like all tools, they need justification. Investments need no explanation because they have a clear expectation of growing in value.

The Value of Planning Ahead and Budgeting

Planning comes a lot easier if you have a solid budget that you know you can adhere to or one that you’re already following. With a reasonable budget, you know how much you’re saving and what your cash flow is each month.

If you don’t have the cash on hand for the large purchase, you’re going to have to do some forecasting. Going into credit card debt or taking out a massive loan to get something bigger, shinier, or cooler is not a good plan.

If your budget is good enough, you can even purchase the item now with a 0% APR credit card and pay it off before the interest rate kicks in. But be careful.

There are a lot of caveats and exceptions in most 0% APR offers, and being late on a payment or carrying a balance after the 0% period is over could be quite painful.

Read and understand the fine print.

Practical Tips for Your Personality and Habits

People have very different views about spending. Add to that particular hang-ups or habits you may have, and it’s hard to find a universal method of developing smart spending ideas that will work for everyone.

Here are some more specific ways to not only justify your big-ticket item but to create good financial habits in the process.

If You’re Impulsive

The problems with impulse purchases are that you feel that you must make a decision now or else an opportunity will pass you by, or afterward, you regret making a terrible decision.

Editor's Note

Usually, impulsive spending decisions are emotion-based. So how do you take emotions out of the equation? Implement the use of time.

Given enough time, most everything will wane. And how do you harness the power of time? Layaway and rent.

When you get the urge for instant gratification, take a timeout. Put the item on emotional layaway. Table the purchase for a few weeks and see if the desire is still there. The more expensive it is, the more time you should take.

Often, you’ll find that the wanting will pass or you’ll just forget about it. Either way, you saved some money and possibly some regret.

If you find that you still tend to purchase things hastily and regret it later, perhaps you should consider renting. I don’t mean habitually or as a new lifestyle, but it gives you a window of time to back out of things if you really can’t help yourself in the heat of the moment.

Renting, in the long run, is not budget-friendly. You’re sacrificing long-term financial goals for short-term satisfaction.

If You Like High-End Things

“There’s no accounting for taste,” or so the saying goes. And for some things you just want the best-of-the-best.

There’s nothing fundamentally wrong with that. But that desire should not lead you down an irresponsible path with your money.

Sometimes it’s fine to splurge – occasionally. That applies to everyday things as well as big-ticket items.

For example, you can buy a pint of Ben & Jerry’s ice cream for about the same price as a half-gallon of some cheaper brands. That’s four times as much for the same amount.

But the enjoyment I get out of the premium ice cream is such that I eat less and get more satisfaction out of it.

Sometimes the difference in cost is only because of its name. And that difference carries a long-term opportunity cost.

If you know you need to invest more and spend less on expensive things, one thing you can try is to get that same thrill from seeing investment growth. Purchase the less expensive item and invest the difference in dollar amount.

Recognizing the value growth could be incentive enough to keep doing this. Instead of just looking wealthy with your flashy stuff, be wealthy with your prudent investments.

When You Should Be Saving

No one is born with a love of saving. The most diligent savers probably started as massive spenders like me. But, like many good habits, sometimes it takes a little push in the beginning.

Why not use your love of spending as a motivator?

Saving money can seem like a chore. At least it’s not nearly as fun as spending it. But that nagging thought of putting away your money just can’t seem to go away.

Most will tell you that if you want something, save and pay for it in cash. That’s good advice, but it won’t help you build your savings.

If you also want to build your savings account, resolve to create two savings piles – one for the thing you want to buy and the other only for savings.

Every dollar you put into your spending pile, put one in your savings pile. Only once you reach the full cash value of that thing you want to buy are you allowed to withdraw from your spending pile to buy it.

The impressive part is that you will not only get that thing you want guilt-free, but you will also grow your savings. After a few times of doing this, look at your savings account and then those things you bought that are probably already starting to show their age.

Which makes you feel more secure? Do this right, and you might turn into a super-saver.

Less Guilt, Not Guiltless

If you’re looking for a free ticket to spend whatever you want whenever you want, you’re never going to get it without a healthy dose of fooling yourself. The key is to put yourself in a situation where spending on things you want doesn’t trip up the rest of your financial plan.

A healthy amount of guilt is not a bad thing if it motivates you to be more fiscally responsible.

You don’t see a carpenter feeling guilty about using a hammer. With some foresight and planning, even hefty purchases can be okay.

While you’re at it, it doesn’t hurt to consider donating to a charity. If you’re going to go hog-wild with your money, why not direct it to a good cause? Sometimes the feeling of just doing something good can scratch that lavishness itch. As a bonus, it’s guilt-free.