Opportunity cost sounds ominous. Like you are really going to be missing out or possibly making a big mistake if you choose wrong. Without realizing it, we make minor decisions in our lifestyle choices that involve calculating opportunity cost.

Opportunity cost is basically considering what you can’t do as the result of each possible decision you make. Don’t worry. We are here to teach you how to calculate opportunity cost and how it works so you always make the best decisions.

Our professor on the show today is Dan Egan from

What is Opportunity Cost?

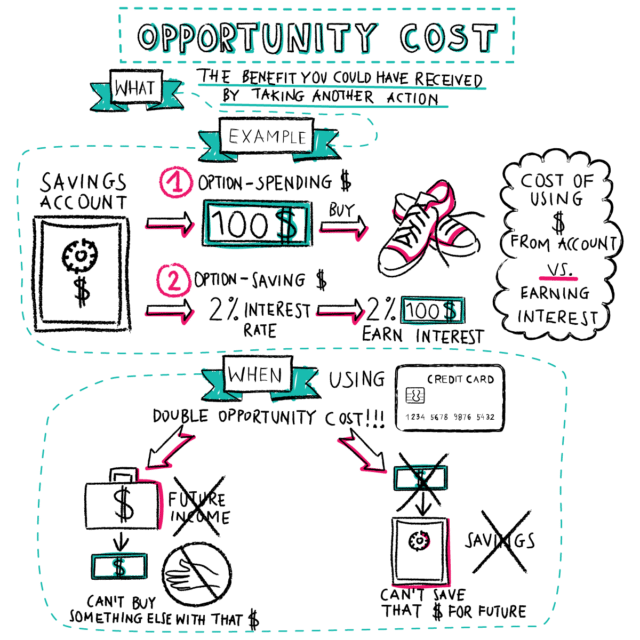

Opportunity cost is what you give up when you choose between options. No matter what we choose, there is a next best choice that we give up or an opportunity forgone, that is the opportunity cost. We want to minimize our opportunity cost by choosing the option that benefits the most.

Considering that almost every decision you make has a potentially beneficial alternative, you will never be able to eliminate opportunity cost entirely. The important thing is not to brood over “what ifs” and “should haves”. Rather be pragmatic and responsible each time you are decision making.

“One of the most important concepts of economics is ‘opportunity cost’ – the idea that once you spend your money on something, you can’t spend it again on something else.” Malcolm Turnbull

Decision making typically involves constraints such as time, resources and rules – risk vs reward, cost vs quality, salary vs quality of life. Opportunity cost is considering what you can’t do as the result of each possible decision.

Opportunity Cost = Return of Most Lucrative Option – Return of Chosen Option

Scarcity

We have to weigh opportunity costs because of scarcity. Scarcity means limited resources.

All of our resources, time, money, effort, are not infinite and could be used in a variety of ways. You may be able to allocate the time you spend earning a new certification or degree into advancing within your current position, for example.

In this situation, you would have to decide what the most valuable allotment of your time is and what would have the greatest potential for the greater return on your chosen investment. So we have to carefully consider our decisions to make sure what we are gaining by making one choice over another is more valuable than what we are foregoing.

Get our best strategies, tools, and support sent straight to your inbox.

Simple Examples of Opportunity Cost

Even simply deciding where you want to eat comes with unavoidable missed opportunities. You want to go out to dinner. You decide to go to the French place over the Italian place. The enjoyment of an Italian meal is the opportunity cost of that decision.

Although you might thoroughly enjoy your meal at the French restaurant, even more so than you would have at the Italian place, you will still have missed out on the good food and enjoyable experience.

And the baguettes. Oh, the baguettes!

Opportunity cost can apply to your everyday purchases, as well. You want Netflix for the month and a new book. You don’t have money for both. You choose the book. Watching Netflix is the opportunity cost.

Investing Examples

Of course, there are situations where the opportunity cost of a decision is much higher than eating steak tartar instead of pasta. Choosing an investment vehicle is one area where opportunity costs must be more carefully considered.

Any time you invest your money in the stock market, there are certain trade-offs that you must expect. Even the most experienced traders and financial investment professionals have experienced the disappointment of a stock that took a sharp downward turn, despite initially favorable projections. In other cases, a stock could shoot up out of nowhere, with no one predicting its success.

Ironically, the unpredictable nature of the stock market is one of its most consistent characteristics.

This is part of the reason why it is so important to consider the trade-offs you make when you invest in one stock over another. Factoring opportunity cost into your investment decisions allows you to make calculated decisions on where to put your money.

Do you put that extra $5,000 you got from your tax return into Facebook after a small dip, or do you put it into Kodak? No comment.

However, the real cost is not just about the differing returns you will get from a given selection of stocks—it’s also about timing and how long you will have to wait to see your investment pay off. You have $10,000 worth of stock you can sell now for $15,000 but if you wait three months, the stock value is expected to increase even more. But you decide to sell now.

The opportunity cost is going to be the difference between the $15,000 you got when you sold early and the price the stock would have sold for three months later. With investing, time is money.

Maybe you would have made even more money, maybe you would have lost money. Opportunity costs aren’t always readily apparent.

Even investment decisions aren’t always just about how much money you stand to make or lose. In the above example, it’s possible that taking the $5,000 gain now rather than waiting for three months for a greater percent return is the more fiscally sound decision.

Perhaps you could use that $5,000 to pay off a loan or debt early, and avoid fees and compound interest payments. Maybe that $5,000 could be used to invest in another up-and-coming stock that’s expected to rapidly increase in value.

Opportunity Costs: Considerations

When it comes to opportunity cost, these are all factors that you will have to assess. You are faced with two investments that would both give the same return but one would require your money to be tied up for five years versus two years.

The opportunity cost is losing the liquidity of that money for an additional three years.

Perhaps you have to pass up a good investment opportunity during that time because you’re unable to access that money. Maybe you need to pay for something unexpected like a major home repair but that money is tied up and you have to take out a loan to cover it. You need to think about that the next best alternative use of the money.

In these cases, it would likely have been a more financially judicious decision to have liquidated your investment so that those funds were available to use. Otherwise, you could have to assume unnecessary debt.

Having the money and being able to access that money are two different things. If you can leave your money invested in a stock that is slated to perform well without assuming an additional financial burden, that may be the best opportunity for you to get the greatest return.

Implicit and Explicit Costs

There are two kinds of costs that we factor in when looking at opportunity cost: implicit and explicit costs.

Let’s use attending college as an example. The explicit costs of that decision are things like tuition, room and board, and books, things that require a payment.

The time required to attend college is an implicit financial cost. Implicit costs don’t cost us in terms of having to pay for something and is not always easily calculable. Another implicit cost is the money foregone by choosing attending college overworking.

Many people forget about the implicit costs of the decisions they make and instead focus on explicit opportunity costs. Unfortunately, this line of thinking tends to neglect some of the important consequences of financial decisions.

Take a professional training course, for example. It may cost you a few hundred dollars up front, but it may also provide you with the leverage you need to secure a raise or a better position in your professional life.

Over your working years, this may translate into tens or even hundreds of thousands of dollars more than you would have earned otherwise. In this example, the explicit cost is relatively insignificant, while the implicit cost is dramatic.

It’s Personal

How to calculate opportunity cost is usually measured in dollars, but your feelings and values should play a part in all of your decisions, including financial decisions. Because of the complexity of the market and all the various factors that affect your professional and personal life, an opportunity cost formula approach will not always yield the best outcomes.

Throughout your life, you will have to make decisions that affect your financial situation and your overall happiness and personal growth.

It’s been shown that those with college degrees make more over their lifetime than those with only a high school diploma. But what if you really don’t want to go to college? What if the only way you can afford it is to take out a lot of student loan debt (it’s not the only way).

Should you still do it, even if it will make you miserable? Probably not. There are plenty of well-paying careers that don’t require a college degree.

On the other hand, it’s possible that you have a great professional trajectory, but you have always wanted to take some college classes or earn your degree. In this case, you will have to take on the cost of tuition and expenses, but you will gain life experience and a sense of accomplishment that you may value more than the capital you will need to invest.

Doing Nothing

Doing nothing is a choice too. Sometimes we are so overwhelmed by choices and information, we are paralyzed and can’t decide so we just stand pat. This can have terrible consequences. We all know how valuable time is when it comes to investing. Doing nothing has an opportunity cost. Not investing early leaves a lot of money on the table.

Unfortunately, people who are faced with complicated and multifaceted investment decisions often choose to do nothing. By not acting, they can avoid the risks altogether, even though they also forfeit the benefits of a calculated investment.

This may be advantageous in some situations.

If you find yourself in a financial bind, it’s a bad idea to commit a significant portion of your limited resources to a market investment. The investment can go south. Still, if you have the resources necessary to assume some relative risk, you should take advantage of opportunities to make gains.

Careful consideration of options, opportunities, and risks are important. However, don’t get so wrapped up in research that you never act.

In the investment world, timing is crucial—and hesitation can cause you to miss out on great opportunities. It is easy to become so aware of the potential risks that you become afraid to make an investment and put your money on the line.

So how do you get over that paralyzing feeling? Ask yourself three questions.

Three Questions

The number of opportunity costs is almost limitless, a game you could play for hours if you like really boring games. This can be paralyzing and you don’t need to think so deeply about it. You just have to consider opportunity costs in three areas:

Money

What else could you do with this money? Perhaps you could allocate your funds to training or education rather than an immediate investment opportunity and maximize your long-term financial gains.

Time

What else could you do with this time? In some cases, your time is even more valuable than your financial capital. Make sure you understand how you will have to spend your time and the value of time management when you make a personal or professional decision.

Effort

Where else could you spend this effort? If a certain stock is likely to provide you with a significant return, but it will require immense effort to monitor trends and patterns, it might not be worth it in the long run. You might decide that your energy is better spent on your current professional endeavors.

By answering those three questions, you can make the best choice and minimize the impact of opportunity cost.

The Basics

We hope this little economic concepts lesson, chock full of real-world examples helped fill in the gaps left by our crummy educational system.

As with any major decision, it can be helpful to consult people who you trust—such as a financial advisor, a close friend or a colleague—who can help you walk through the potential outcomes of a financial decision.

Remember that nobody who routinely invests will always come out on top, so don’t write off investing entirely after one bad experience. Instead, use your failures to inform your future decisions. Eventually, increase your financial gains and make your money work harder for you.

Show Notes

River Horse Belgian Freeze: A dark Belgian ale.

Betterment: Invest here and get up to six months of free investing.

Flying Fish Red Fish: A West Coast style hoppy ale.