Moving into your first apartment is both thrilling and overwhelming. Suddenly, you’re faced with a long list of necessities, all while juggling a tight budget for furnishing and living expenses. To help you navigate this exciting chapter, here are some essential tips for saving money in your first apartment.

Know Your Limit

When beginning your search for an apartment, it’s important to be realistic about what you can afford. While it might be tempting to stretch your budget for a more expensive place, you could soon find yourself regretting that decision.

An additional $100 a month may not seem significant at first glance, but it adds up to an extra $1,200 a year. That’s $1,200 less for other expenses or luxuries, such as a vacation. Prioritizing affordability from the start can prevent financial stress and ensure you’re able to enjoy a balanced lifestyle.

There are plenty of rules out there about budgeting for rent – like the 30% rule (30% of your gross or net income on rent). Some say to include utilities in that 30%, others don’t. Find what works for you.

Seeking a clear-cut answer can be frustrating! Every situation is unique, and there’s no one-size-fits-all solution. While some rentals include all utilities in the rent, others may not include any utilities at all.

Some people have credit cards and student loan debt, and some people don’t.

“I never realized how short a month is until I started paying rent.”

Aiming for 25-35% of your gross income as a guideline for rent is a solid starting point. However, it’s wise to lean towards caution when determining what you can afford, especially considering extra expenses such as utilities and any existing debt.

If you’re managing additional debt, aim for the lower end of the range, around 25%. Should utilities not be included in your rent, allocate a few percentage points for these costs and strive to keep your total housing expenses under 30%. This approach helps ensure you maintain a balanced budget while accommodating essential and unexpected expenses.

If you are an increasingly rare unicorn with no debt, you can go up to 35% without breaking the bank.

When searching for a place to live, rent shouldn’t be your only consideration. Opting for a modestly less upscale apartment in a superior area is often a wise choice. Prioritize finding a safe and walkable neighborhood, which becomes even more crucial if you don’t own a car. This approach enhances your living experience by ensuring both security and convenience.

Most places will have a crime map that shows what crimes were committed in what neighborhoods. Google the name of your city followed by the words “crime map,” and you can find out this information.

Walkscore is a neat site that will give you a “walkability score” for some cities. It has information about how close things like grocery stores, restaurants, and coffee shops are to an address you’re considering.

The Rest Of Your Budget

You can tinker around for ages with budget categories, and that’s what some people do in Mint on Friday nights. You don’t want to spend your Friday nights like that, so we’ll make it simple.

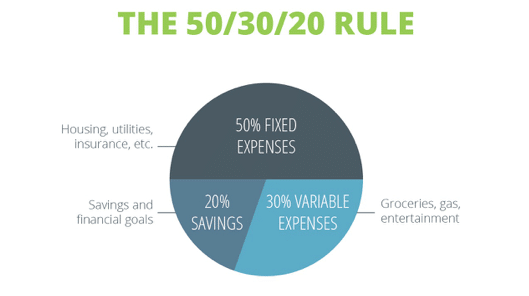

You can get your budget started with the 50/30/20 rule. The 50% is for fixed expenses like rent, insurance, car, and student loan payments.

Those expenses don’t vary a lot from month to month. We already have our rent somewhere between 25-35%, so use the additional room to budget for these fixed items.

The 30% is for saving. This money goes to your emergency fund, your 401(k), IRA, or HSA, wherever you are stashing cash for the future.

This savings percentage may appear ambitious, but adapting to setting aside this amount early on will significantly advance your financial position. Currently, you’re not accustomed to numerous luxuries, which means you’re not missing out. Maintaining this simpler lifestyle for a few more years can be greatly beneficial.

The final 20% is for fun, socializing, eating out, vacations, and clothes. Things that aren’t always a necessity but whose absence would make life grim fast.

This is why we make a budget to have room for these things. As long as you’ve budgeted for them, there is no need to feel guilty about spending on them.

An excellent free budgeting tool. I use it, and if you're getting started, you should too. If you don't track your spending, you'll never know where you're wasting money.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Lower Your Bills

We are all probably paying more than we need for utilities and other service providers. Depending on your providers, you might be able to negotiate your bills over the phone – you’ll be surprised what you can get if you ask.

If you’re not into being on hold for 20 minutes at a time or don’t want to talk to people (I get it), you can have Rocket Money do it for you.

Yes, Rocket Money We automatically scan your bills to find savings. Upload or connect and let our negotiators go to work for you to get the best possible rate and save you money on these bills.

Rocket Money charges a 30–60% fee on the savings they achieve for you. So, if they reduce your phone bill and save you $175 for the year, you’d owe them $50 to $105 upfront—something you might have managed by yourself!

80% of people save money by using Rocket Money to find and cancel unwanted subscriptions! With Rocket Money, you can also effortlessly track your spending, easily lower bills and track your net worth.

You Need Some Stuff

Even if you have all you need, getting some new stuff for your new digs is always nice. If you like shopping online from your couch in sweats, you need to try services like Dosh.

You simply link your debit or credit card, and allow Dosh to handle the monitoring. It reviews your transactions to identify those eligible for cashback offers and then directly deposits the cash into your Dosh wallet.

Dosh gets you automatic cash back at thousands of places when you shop, dine, or book hotels. No coupons or receipt scanning. Simply download the app or find us in your favorite ways to pay, like Venmo or Jelli. It’s awesome.

When you’re decking out your new apartment, focus on the stuff you need. Don’t just grab a plain coffee table from Target when you might stumble upon an awesome old cedar chest at a flea market. It could be a cooler coffee table with secret storage!

Tell your friends and family you’re moving into your place. You won’t believe the cool free stuff they might offer.

Loads of folks have too much stuff cluttering up their homes and would rather give it to someone who can use it than try to sell it or toss it out. It feels good to rehome their old treasures.

Check out sites like Freecycle or the free section of Craigslist.

Not everything in your apartment needs to be brand new. While picking up a mattress from the side of the road might not be ideal, consider exploring thrift stores for other items before opting to buy new ones. This approach can uncover unique finds and save money.

You’ve Gotta Eat!

Whether you’re an accomplished cook or someone who considers beer, wings, and pizza the components of a three-course meal, your approach to food matters. Regardless of your culinary preferences, food expenses can quickly add up if not managed wisely. However, with a few savvy strategies, you can enjoy delicious meals without spending a fortune.

Get a Slow Cooker: Even if you can’t cook, you can cook something delicious in a slow cooker.

Saving money while eating at home is both practical and achievable with the right strategies. Here are some effective ways to reduce your food expenses without sacrificing quality or variety:

- Plan Your Meals: Planning your meals for the week can help you buy only what you need, reducing waste and unnecessary purchases.

- Cook in Bulk: Prepare large portions of meals that can be easily frozen and reheated later. This not only saves time but also reduces the temptation to eat out.

- Shop with a List: Always shop with a grocery list and stick to it. This helps avoid impulse buys that can inflate your grocery bill.

- Buy Generic Brands: Opt for store or generic brands instead of name brands. The quality is often comparable, but the cost is significantly lower.

- Use Coupons and Discounts: Look for coupons, discounts, and grocery store loyalty programs that can save you money on your purchases.

Other Ways to Save on Food and Groceries

To save on groceries, strategic shopping is key. Shopping solo helps avoid impulse buys, and hitting the stores during quieter times allows for thoughtful comparison shopping.

Opting for more affordable meat options and generic brands can lead to significant savings, as can buying hygiene products from discount retailers. Sticking to the store’s perimeter where fresh, unprocessed foods are located can also help keep costs down.

Max out those grocery rewards cards, tally up your cart with a calculator and hit up sales to save some serious cash.

These easy tricks can help you cut down on your food bills.

Laundry

Yes, laundry may feel like a chore, but it doesn’t have to be a major hassle! There are strategies not only to reduce the cost associated with laundry but also to extend the lifespan of your clothing.

Especially if you’re relying on coin-operated machines, these tips can significantly reduce the amount of change you need to dig out from under your couch cushions.

Choose the Right Time: Visit the laundromat during off-peak hours to avoid waiting for machines and potentially find lower rates.

Pre-Sort Laundry at Home: Save time and money by sorting your laundry into lights, darks, and delicates before you go. This way, you can immediately use available machines without needing extra sorting space or time.

Use Concentrated Detergent: Opt for concentrated detergents that require less per load. They’re more efficient for transport and can save you money over bulkier, less concentrated options.

Maximize Washer and Dryer Loads: Ensure you’re filling machines to their recommended capacity without overloading. This optimizes your cost per load and reduces the total number of cycles you need to run.

Bring Your Own Supplies: Avoid purchasing detergent or fabric softener at the laundromat, where prices may be higher. Bring your own from home to cut costs.

Screw The Cable Company

Consider how much TV you watch and what content you’re interested in. Until cable providers offer à la carte options, you’re stuck paying for numerous channels you have no interest in.

With sites like Hulu, Amazon, and Netflix, a lot of the content provided by cable companies is now available online – we managed to ditch cable entirely and not have a problem.

The downside of cutting the cord is that it dramatically reduces access to sports. Consider how important that is to you before making a decision. You can still cut down your bill if you need cable to watch the game.

Be More Eco-Friendly

1. Drafts?

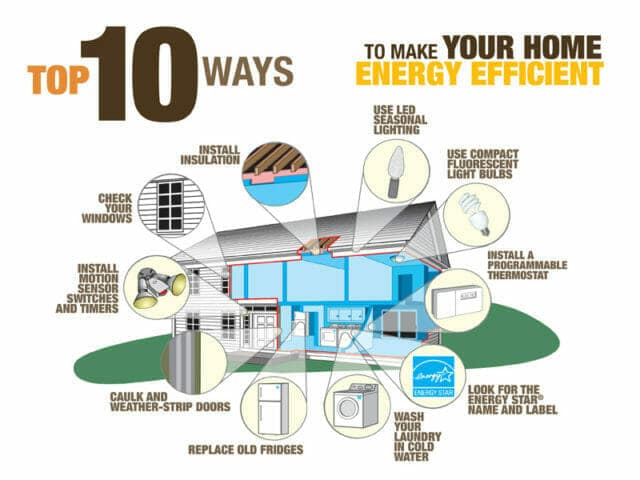

Inspect your windows and doors for drafts; if you find air leaks, consider using bubble wrap to insulate your windows—it’s not only more cost-effective than store-bought kits but also offers superior insulation.

For drafts sneaking in under your doors, either make or purchase a door snake or as a makeshift solution, a rolled-up towel can suffice.

Save money sleeping – Use an electric blanket at night and turn down the thermostat. It’s so cozy, and you can turn it on a few minutes before you go to sleep, so you don’t have to get into a cold bed.

Run a humidifier in winter – It makes the apartment feel a bit warmer, and it’s good for your hair, skin, wood floors, and furniture and can help prevent colds by keeping your airways moist.

Scatter Rugs – They will help insulate your place, and it’s nice to get out of bed in the morning and put your warm feet on a rug rather than a cold floor.

It’s expensive to run air conditioning. Budget your AC dollars for nighttime when you’re sleeping. It’s hard to sleep when it’s hot; use a fan during the day.

2. Lighting

Switch the old incandescent bulbs in your new place to LED or CFL bulbs, at least in the lights you use the most.

The newer bulbs are more expensive but last a long time and are more energy efficient, saving you as much as $65 per year. If you can get a south-facing apartment, even better.

3. Off-Peak Hours for Utilities

Many utility companies have off-peak hours, typically after 8:00 pm. Wait to run the dishwasher and do the laundry during these hours because the electricity rate will be cheaper.

Open the door and let your dishes air dry rather than using the drying setting during the cycle.

Throw Yourself A Party

Throw a housewarming party. But not until you’ve been in your place for several weeks and have a better sense of what you still need.

You have to make it clear that this is a housewarming party; you have to call it that. Otherwise, people won’t know they should buy you a gift for your new place.

If the people getting married and the ones having babies can do it, why not you? You can’t ask for great big stuff, like a new mattress. You have to ask for little things like dish towels and placemats.

Enjoy It!

Moving into your first place is an exciting milestone, but it’s important to be fully aware of what you’re getting into. The last thing anyone wants is to taste independence only to find themselves needing to move back in with their parents a few years later.

Living on your own comes with its set of challenges, so it’s crucial to take the necessary steps to ensure that affording rent isn’t one of them.

Discover the best gifts so you're always on the guest list.

Finding great gifts for your family and friends year after year is tough. It can take hours of scrolling and googling to find the perfect thing to delight the ones you love. Giftlab makes it easier.