- 7 Hacks to Pay Off Your Student Loans Fast

- HACK #1: Make Advance Student Loan Payments to the Principal

- HACK #2: Refinance and Pay Less for the Same Amount of Debt

- HACK #3: Payoff the Smallest Balances First and Attack Each One Individually

- HACK #4: Use Real Estate to Wipe Away Debts in Your Mid-20s

- HACK #5: Other Debt is…

- HACK #6: Get a Side Hustle

- HACK #7. Save Automatically

- And When You’re All Paid Up…

Every month you make that dreaded student loan debt payment. A reminder of the fun you had during your “four-year break from reality” that was college. It’s the price that millions of American graduates (and millions that didn’t graduate) are paying to pursue that prized slip of paper that you were told was “your ticket to the good life.” Or is it?

The amount of outstanding student loan debt is staggering. As of 2023, the total outstanding student loan debt in the U.S. is 1.6 trillion dollars. To put that into horrifying perspective, the entire Gross Domestic Product (GDP) of the United States, the world’s biggest economy, is $25.50 trillion.

7 Hacks to Pay Off Your Student Loans Fast

Spending 15-20 years of your life paying off these debts at a few hundred dollars a month is frustrating. And is distracting you from your true calling. No matter if you have federal loans or private loans, you need to learn how to pay off your debt faster. It’s preventing you from making progress towards your other financial goals like buying a home, a rental property, and saving for retirement.

However, the good life is not that far off if you understand how to hack the student loan system. Each factoid below is followed by one or more hacks to show you how to pay off your student loans fast.

HACK #1: Make Advance Student Loan Payments to the Principal

Factoid: INTEREST IS FRONT-LOADED AND ACCRUES DAILY

Most students don’t realize it, but as soon as the money is borrowed, the interest begins accruing (on non-subsidized loans).

That is why the amount you owe is so much more significant than what you remember borrowing – it includes ALL of the interest from while you were in school on multiple student loans.

A recent graduate was frustrated that of the $250 monthly payment they sent in, only $90 of it went to his principal balance. In reality, close to 40% of all of your student loan payments for the first few years go to pay down the principal; the rest goes to cover the interest. You can calculate your Federal Student Loan repayment options with this simulator.

Because the interest accrues daily, lowering your principal balance is paramount to shortening both the length of your loan AND the amount you pay in interest. Interest is calculated based on the following equation:

Interest rate × current principal balance ÷ number of days in the year = daily interest

By sending in extra payments, you lower the current principal balance, thereby reducing the daily interest charged. If you’re in a position to send additional money with your loan payments, make sure you do the following:

Rule One:

Ensure that your advance payments are being applied to the principal of your loans AND NOT to future loan payments. Student loan debt services are notorious for doing what is in their best interest, not yours.

Therefore, they will apply any extra amount you send in towards offsetting when your next monthly payment will be due. You will more than likely have to call the student loan servicer directly and make sure they apply for the payment you send in where you want it. Call your loan servicer and tell them to apply it to principal reduction.

Rule Two:

When sending in additional monthly automatic payments, direct the servicer to apply the additional principal to either the loan with the higher interest rate or the loan with the smallest loan balance (just pick one).

By paying down the loan with the highest interest rate, you’re automatically charged less in interest because of the above equation. Keep reading to find out why you’d choose the smallest balance.

This free course outlines a proven framework that thousands of people have used to eliminate their debt, develop better money habits, and start building a secure financial future.

HACK #2: Refinance and Pay Less for the Same Amount of Debt

Factoid: PAYDOWN SPEED IS HIGHLY DEPENDENT ON INTEREST RATES

The easiest way to pay off your student loans fast is to refinance. Student loan refinancing is the quickest way to pay less interest and reduce your student loan balance. If you have undergraduate unsubsidized student debt (highly likely) that originated before 2013, then you’re likely paying a fixed interest rate of 6.8%.

Companies like Credible can dramatically reduce that rate. Depending on how aggressively you want to pay down your loan you can refinance to something as low as 2.5% depending on your credit score.

These sites let you check your rates in less than two minutes, and a new loan could easily shave years off of your student loan repayment plan, and you can get new repayment terms that work better for your situation.

Let’s say you have a $25,000 student loan with a 6.8% interest rate and ten years left – your payment would be $288 a month. If you refinanced at 4.62%, your new payment would be approximately $261 a month, you could save $3,259 over the life of your loan. Not too bad for a few minutes of work.

HACK #3: Payoff the Smallest Balances First and Attack Each One Individually

Factoid: CONSOLIDATION ISN’T ALWAYS A GREAT OPTION

Consolidation is excellent if you’re able to lower your interest rate substantially. Lowering the interest rate will reduce the overall amount you’re paying over time.

However, as the name suggests, when you consolidate, you’re taking multiple loans and putting them together into one big loan that can never be adjusted again.

By NOT consolidating, you can direct additional loan payments to one loan at a time, the loan with the smallest balance first, and knock them each out sequentially, relatively quickly. This is known as the snowball method. Here’s why that’s important:

Let’s say you owe $40,000 total and your payment is $300 a month. You more than likely have some smaller loan balances that are part of the overall payment you’re sending in.

If the loan balance on one of the smaller loans is $1,000 for instance, and you’re on a 15 or 20-year payback schedule, the amount of your payment that’s going to the principal might only be $8-12 per month (on that loan).

But, if you have an additional $200 a month in extra cash that you’re throwing towards your payment, you could have that one student loan knocked out in 5 months or less.

What would you rather toast a piece of bread with – a flashlight or a laser beam?

When you blast away one debt at a time, you’re taking a laser beam to each individual debt. And that my friends are how to pay off student loans fast.

Pay the minimum on every other loan except the one you have your sights on. It creates a tremendous emotional win each time you get to cross one off the list!

HACK #4: Use Real Estate to Wipe Away Debts in Your Mid-20s

Factoid: APPROXIMATELY 20% OF STUDENT LOAN BORROWERS ARE STILL PAYING BACK LOANS IN THEIR 50s (source Morningstar.com)

If buying a home is in your future, consider a strategy that will help you build cash flow, and equity, AND knock out your student debt. Here’s how:

Duplexes can be purchased using an FHA loan when the person buying it is also living there as their primary residence. This requires 3.5% down on the purchase.

Consider finding a duplex that may require a bit of fix-up work so that you can get a great deal. Contact a realtor and let them know that you’re looking for a duplex to buy owner-occupied that’s below market because of its condition, knowing that you’re going to put in some elbow grease to fix it up.

If you buy it under market value, you’re walking in with a bit of equity. By renting one side of the duplex and the other room on the side where you reside, you’ll create some cash flow (probably enough to offset the mortgage payment).

What you would normally spend on rent/mortgage is freed up to blast away debt!

But it gets better.

Assuming you bought the right house and it’s grown in value over the year, you can get the place re-appraised after 9-12 months and borrow from the equity in your home to pay off some of the debt.

By using cash-out student loan refinancing, you’ll transfer some of the equity from your duplex into paying off the loans.

Because mortgage interest is deductible, is generally at a lower interest rate, and is amortized over 30 years, the result on your personal finance situation is positive – lower overall payments, more interest deduction, and less interest paid.

HACK #5: Other Debt is…

Factoid: STUDENT LOANS ARE NON-BANKRUPTABLE

This hack comes with a caveat: it is purely an observation, NOT a recommendation!

After several years of paying back his nearly $300,000 in student loan debt, a dentist applied for every credit card that was available to him and did cash advances on each one pulling out well over $250k.

With the money he… you guessed it, paid off his student loan debt and then promptly declared bankruptcy.

In 2005, the bankruptcy laws changed protecting creditors from borrowers declaring bankruptcy and wiping out student loans. Everything else is still fair game. So, technically, while you can’t bankrupt student loans, other loans could be bankrupted.

In 2023, the Private Student Loan Bankruptcy Fairness Act of 2023 was enacted and modified the treatment of certain student loans in bankruptcy.

Since Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, both federal and private student loans are more difficult to discharge in bankruptcy than other types of debt. However, they can still be discharged if the borrower can prove the loan causes undue hardship.

Why you shouldn’t do it: It screws up your credit for a solid 7 years.

The bottom line is there are ways around, over, and through student loan debt. It requires the borrowers to be proactive, to live on less, to accept responsibility for taking care of their debt, and a great deal of perseverance!

Don’t forget to investigate student loan forgiveness programs. Depending on what kinds of loans you have, federal student loans or private student loans, and what field you are in there are lots of forgiveness programs like the Public Service Loan Forgiveness Program that might be able to help you out.

There are also income-based repayment programs. Under an income-based repayment plan, you can reduce your monthly payment to as low as 10 percent of your monthly income.

HACK #6: Get a Side Hustle

Every extra dollar you earn is a dollar you can put toward your debt. You’re already busting your ass in your 9-5, working 40 hours per work or more. You don’t have time for a part-time job. But that’s what’s so great about a side hustle; many of them can be done according to your schedule, unlike a part-time job in retail or hospitality.

You can drive for Uber or Lyft for a few hours each week. You can rent out your home or apartment a few nights a month on Airbnb. While you’re killing time watching TV or commuting (by public transit), you can answer surveys online.

Depending on your main skill set, you can find some pretty lucrative gigs in things like writing, graphic design, and website building on freelancer sites like Upwork and Guru. All on your schedule.

HACK #7. Save Automatically

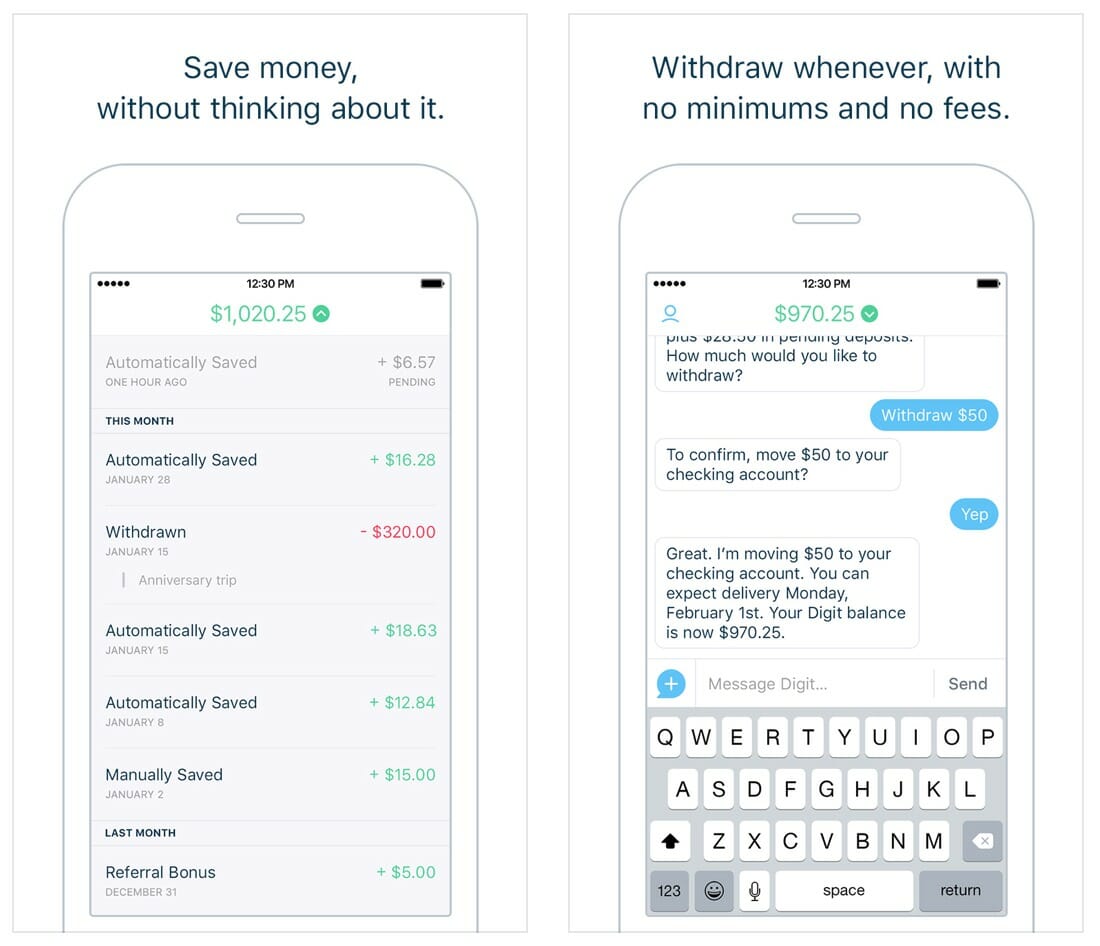

Save more money automatically. Sign up for Opportun and save money. Every few days, they transfer some money (usually $5-50) from your checking to your savings account based on your spending habits.

They never transfer more than you can afford, so you don’t have to worry about over-drafting your bank account. They have a no-overdraft guaranteeI’ve been using them for a few months now and have saved over $200.

The best part is everything is done over text messages. Digit texts you when it’s saving you money, and you can text it when you want to withdraw. If you text questions to Digit that it can’t automatically handle, a real person responds. It’s like a concierge for your bank account!

And When You’re All Paid Up…

You can start working towards your financial goals by investing. Once your student loans are paid off, you’ll have at least a few hundred dollars of extra cash floating around each month.

Your first priority should be maxing out your retirement accounts because of the tax advantages they bestow. Max out your 401k if you have one available. Once you’ve done that, max out your IRA.

Once your retirement accounts are fully funded for the year, open an M1 Finance account. There is a penalty to withdraw money from retirement accounts before age 59 1/2 (with some exceptions), so it is the ideal place to invest for more medium-term goals (5 to 10 years) because you can withdraw the money at any time without penalty.

And hopefully, that fancy degree you got enabled you to get a job that pays enough to invest enough to make up for lost time!

NOTE: Check out our full hour-long interview with Adam on the Listen Money Matters Podcast. We talk about all these hacks and more information about tackling your student loan debt.

Credible's online marketplace connects borrowers with lenders in minutes. Refinance federal, private, and ParentPlus loans. Compare student loan refinancing rates from up to 7 lenders without affecting your credit score for free! Rates range from 5.24% to 12.44% APR