The question “How much rent can I afford?” is a straight forward one but sadly there isn’t a simple answer. There are several factors that go into formulating the answer. Things like your monthly income, monthly expenses, and your overall financial situation.

We know that you’re desperate to get out of your parent’s basement though and we want to help. But we don’t want you to spend so much of your annual salary on rent that you can’t make any progress on your financial goals.

The standard rule used to determine “How much rent can I afford?” revolves around the 30% rule, which says your housing costs shouldn’t be more than 30% of your household income. If you earn $50,000, you shouldn’t pay more than $1,250 a month. You can use a rent calculator to get your number.

But the 30% rule isn’t always practical for those in high cost of living areas like Los Angeles, New York City, or San Francisco. In those areas, the 40% rule is more realistic.

Investopedia has an easy method for calculating this:

One rule of thumb involves dividing your pre-tax income by 40. This means that if you make $100,000 a year, you should be able to afford $2,500 per month in rent.

After many an apartment search, I’ve come to some realizations that will help you avoid many of the mistakes I made. Because no one wants to live on ramen at the end of every month.

The Rent is Too Damn High!

What that old guy said is true. The rent is too damn high. Rents are increasing at higher rates than we’ve seen in the past. As inflation increase, so too does rent. But— rents have risen far more than inflation-adjusted values. At the same time wages are lagging behind.

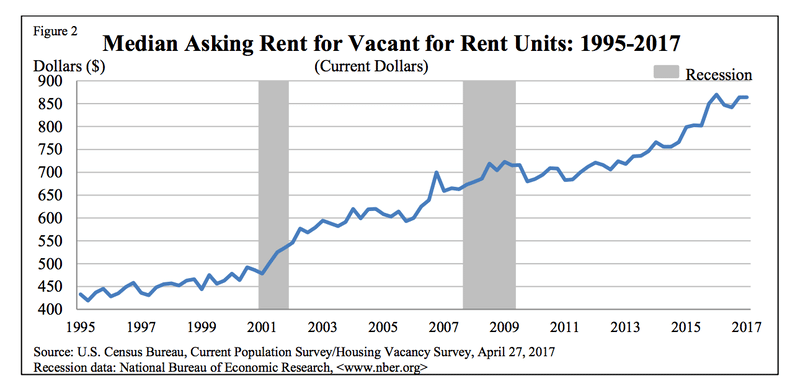

The median rent in the US for 2017 was $864 per month according to data from the US Census Bureau.

Consider that the median rent during the 1990s stood at $425. If we calculate the impact of inflation alone then $425 should have had become $680 in 2017, but that isn’t the case. It’s $864. The median rent has doubled in 20 Years. According to a report from Apartment List, rent growth hit a plateau in 2016 but rose consistently between .5% to .7% in 2017.

Rents in a metro city are a function of the available space. If space is limited, demand goes up and the rent goes with it. High rent is the norm in most metro areas.

And Wages are Too Damn Low!

Wages haven’t risen proportionately to rent increases. Or Wall Street bonuses.

Wall Street bonuses jumped 1,000 percent since 1985. The federal minimum wage has increased by about 116 percent during the same period. If the minimum wage had grown at the same pace as Wall Street bonuses, it would be $33.51 an hour.

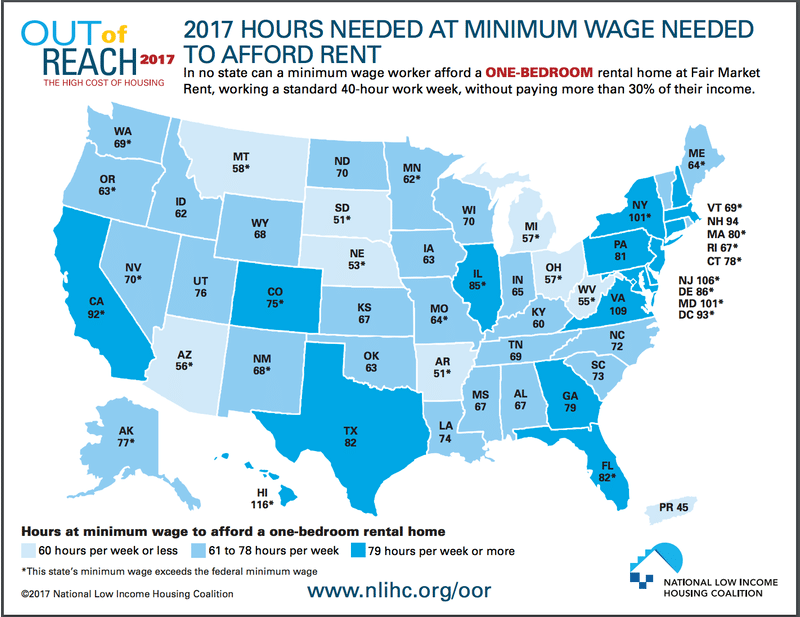

There isn’t a single city in the U.S, where someone working a full-time minimum wage job can afford a one bedroom apartment.

On average, for a minimum wage worker to afford a one bedroom, they have to earn at least $21.21 an hour working full time. That’s almost three times minimum wage!

In San Francisco, a two bedroom costs $5,043. The median household income in San Francisco is $78,000, which means if belong to the median you would have to shell out over 77% of your income for an apartment.

A two-bedroom in New York City is $3,692 a month, on average. The median household income in the city is $50,000. That means people earning the median income would spend 87% of their income on rent. Doesn’t leave much for the rest of your monthly bills, does it?

Okay, those two cities have some of the highest rents in America but the numbers aren’t much better in other cities.

In 2014, tenants spent 35 – 40% of their income in the top 10 metros on rent.

|

Top Ten Metros |

Highest Share of Income Spent on Rent |

|

Miami, FLA two-bedroom in New York City is $3,692 a month, |

39.9% |

|

Detroit, MI |

35.4% |

|

Los Angeles, CA |

35.3% |

|

Fort Lauderdale, FL |

35.2% |

|

Riverside-San Bernardino, CA |

35.1% |

|

West Palm Beach, FL |

34.3% |

| Long Island, NY |

34.0% |

|

Orange County, CA |

33.9% |

| Orlando, FL |

32.8% |

| Sacramento, CA |

32.6% |

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

The 30% rule

Most experts agree that rent or housing expenses incurred, shouldn’t be more than 30% of a person’s total gross income. The 30% rule of thumb that has become so widespread, but it’s a vestigial leftover from an older era.

Where Does the 30% Rule Come From?

In 1937, the Senate brought forth the National Housing Act, during the New Deal Era that stipulated that for those with an income, not more than 5 or 6 times than their rent would be eligible for housing subsidies.

In 1969, the Senate passed the Brooke Amendment that stipulated that the rent should be a maximum of 25% of a tenant’s income. This was later revised to 30% in the 1980s. The rates were determined on average income at the time.

Since then, these benchmarks have become widely accepted and later successfully morphed into the popularized rule of thumb. Like many old wives tales, most of these benchmarks are not based on reality.

The 30% rent affordability benchmark was established 81 years ago. Since then, we’ve seen drastic changes in people’s lifestyles, spending habits, and the overall financial landscape.

If in the 80s people were concerned with car payments. Today they’re concerned with student loans and credit card debt and the skyrocketing cost of healthcare. There are over 37 million student borrowers with more than $1 trillion dollars in debt. Student debt has exceeded even credit card debt.

The debt levels among Americans has fallen but 35% of a Money Rates survey respondents are still worried about being able to meet their non-debt financial obligations like a mortgage, bills, or rent payments.

75% of those surveyed already feel stressed about money, and have gone through periods of “great distress” during the past month. The feeling of financial insecurity looms large in the minds of every 4 of 5 Americans.

What to Consider When Determining How Much Rent You Can Afford

Despite the cliche, there is more to choosing a home than location, location location.

Basic Needs

You should rent a home that ticks all your basic needs. And needs are very different from wants. All those people on House Hunters insist they need a big open kitchen for entertaining but given that they’re all completely insufferable, how many friends can they possibly have to entertain?

It’s nice to have a backyard but unless you have a dog or two, how essential is a backyard? An extra bedroom for guests would be nice but who likes having houseguests? I have very deliberately never lived in anything but a one bedroom because I don’t like having house guests.

If you do like house guest, how often do you have them? Often enough to make it worthwhile to pay a couple of extra hundred dollars a month in rent? Probably not. Buy a pull out couch and let them sleep there! The money you save can go towards other living expenses.

If you live in an area without laundromats, a washer and dryer can be considered basic needs. When you’re honest with yourself, basic housing needs will be a very short list. Don’t get carried away because all of those things on your wish list come with a price tag.

Be Flexible

Often people settle for a costlier home to save on commute times. If they find a home that is near their place of work, they’re willing to pay more.

But times are changing. Data from a survey conducted by Upwork and Freelancers Union says that 57.3 million Americans are freelancing. Most of these freelancers are location independent. This figure has increased by 30% compared to last year and comprises of 36% of the US workforce.

The same survey also predicts that the majority of the workforce will be freelancers by 2027, or sooner. Being location independent gives you the freedom to choose a home with cheaper rent.

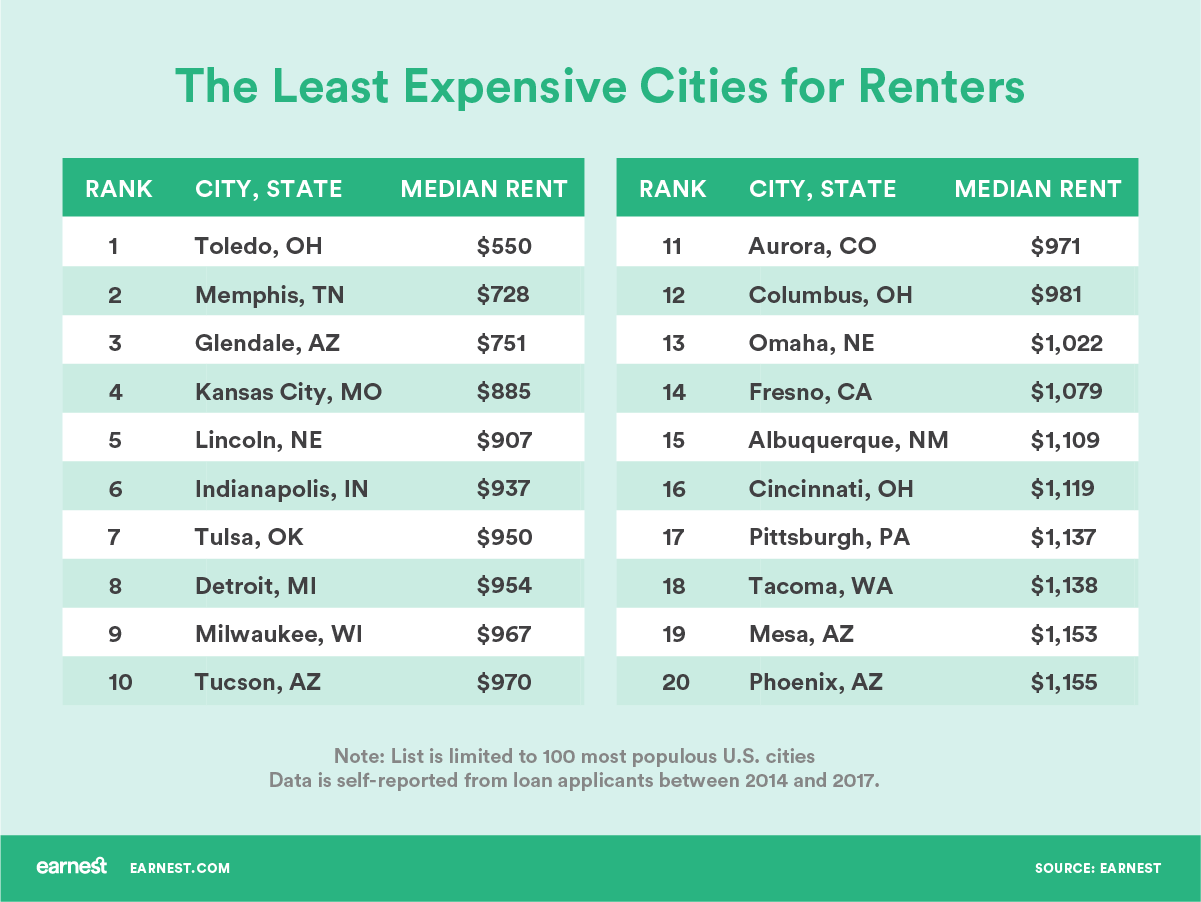

A CNBC report lists the following cities as the least expensive in terms of rent in the US.

If you choose to rent at Toledo, Ohio you only need to pay $550 for monthly rent. Memphis or Glendale aren’t too shabby either.

Being in a good school district used to be a major consideration when choosing a home too but that’s changing as well.

Online charter schools make remote instruction possible. Brick and mortar schools are no longer the only options.

Being close to basic services like groceries and drug stores or to public transportation that could take you to them is no longer that important either. Almost no matter where you are in this country, almost anything you need can be ordered online and delivered right to your door.

So, How Much Rent Can I Afford?

Before you start saving Zillow searches, ask yourself, “How much rent I can afford?” Go through your budget and take a good look at all of your living expenses. Total up all of your numbers and don’t forget things like debt repayments, investment contributions, and renters insurance (something that is non-negotiable and some property managers will require). Now compare that number to your monthly income.

If you were to keep your housing expenses at 30% or less, what’s the number? Don’t forget to factor in the security deposit that will be required when you sign a lease. If you don’t have much debt, 40% isn’t out of the question.

Now you can start your apartment search. You may not be able to comfortably afford your dream apartment but can you find a place that needs your basic needs in a safe area? That’s all anyone really needs.