- What Is Investing and Why You Should Care?

- How should a beginner start investing?

- The Meaning of Portfolio and Diversification

- The Triumph of the Average Investor

- The Average Investor

- Why You Don’t Need a Financial Advisor

- Start Investing Simply

- The Average Investor’s Commandments – Investing for Beginners

You understand that investing is smart and that a lot of people have made a lot of money doing it. The problem is, you never took an investing for beginners class, you’re scared to lose all of your money, and you don’t want to do the work.

The good news is, we’re about to tell you that all of your concerns are nonsense.

You know you need to invest your money if you want to up your personal finance game. It simply doesn’t make sense not to. It would still be worth even if you only invest 5% of your money. This is a beginner’s guide to help you get started.

You can understand investing, and if you read this whole guide, you’ll have the basics you need to get started – you don’t need a financial planning expert to do it for you. You also don’t have to do all the work or give away all of your gains to avoid doing the work. You’ll be relying on automation and letting the computer do it for you.

After you read this guide for new investors, the only thing left for you to do will be to take action. Don’t worry; we’ll guide you through the process in the following articles of our investing series. We also discuss investing for beginners on the podcast:

Consider this your Investing for Beginners 101 cheat sheet. We explain the basics of simple investing and aim to inspire the proper mindset you need to succeed.

Enough chit-chat – let’s get started.

What Is Investing and Why You Should Care?

Investing, at its heart, is trading your money today for a lot more money in the future.

The investing we talk about revolves around the stock market. That said, putting your money into a business you create, or a home you will live in, can also be considered an investment.

Investments by definition are high yield over the long term. Operative word being long term.

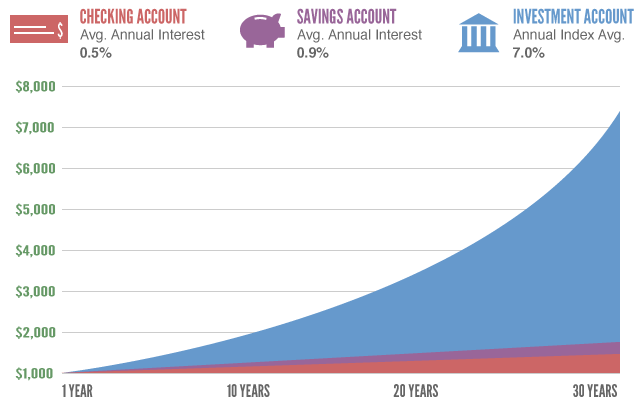

Some beginner investors are afraid of the market. One common approach of people who fear the market is putting most of their money into a combination of checking and savings accounts. I’m sorry, but the joke’s on them.

As it turns out, banks don’t like to give away their money. That mindset shines through in the interest rates of checking and savings accounts.

When you deposit your money in a bank, it turns around and invests that money at 7% a year or more. After the bank collects their profit, they give you a tiny shaving of it.

But wait, that’s the money they are investing; you deserve a bigger cut!

Investing in yourself is the only way to combat the bank taking advantage of you.

The question is, why start investing?

The illustration below shows a $1,000 investment over 30 years and compares it to what you would earn with a checking account and what you would earn with a savings account.

With an investment account on average, you can expect to earn over 19,700% more as compared to a checking account.

Interestingly, over 30 years, you can only expect to gain roughly $175.80 with a checking account and $281.89 with a savings account – a difference that is pretty meaningless when you look at it over such a long period.

Especially when you would gain over $6,000 if you had just invested your money like we suggested.

You would be crazy not to invest, and you would be equally mad to jockey your money between a checking and savings account as the difference is negligible. Personally, I don’t even have a savings account as it just complicates my life.

How should a beginner start investing?

Yes! We know because they are accounts that are locked down, forcing you to invest in the very long term. We’ll go into more depth on this long-term investing idea in the next section.

You’ll also notice that we have

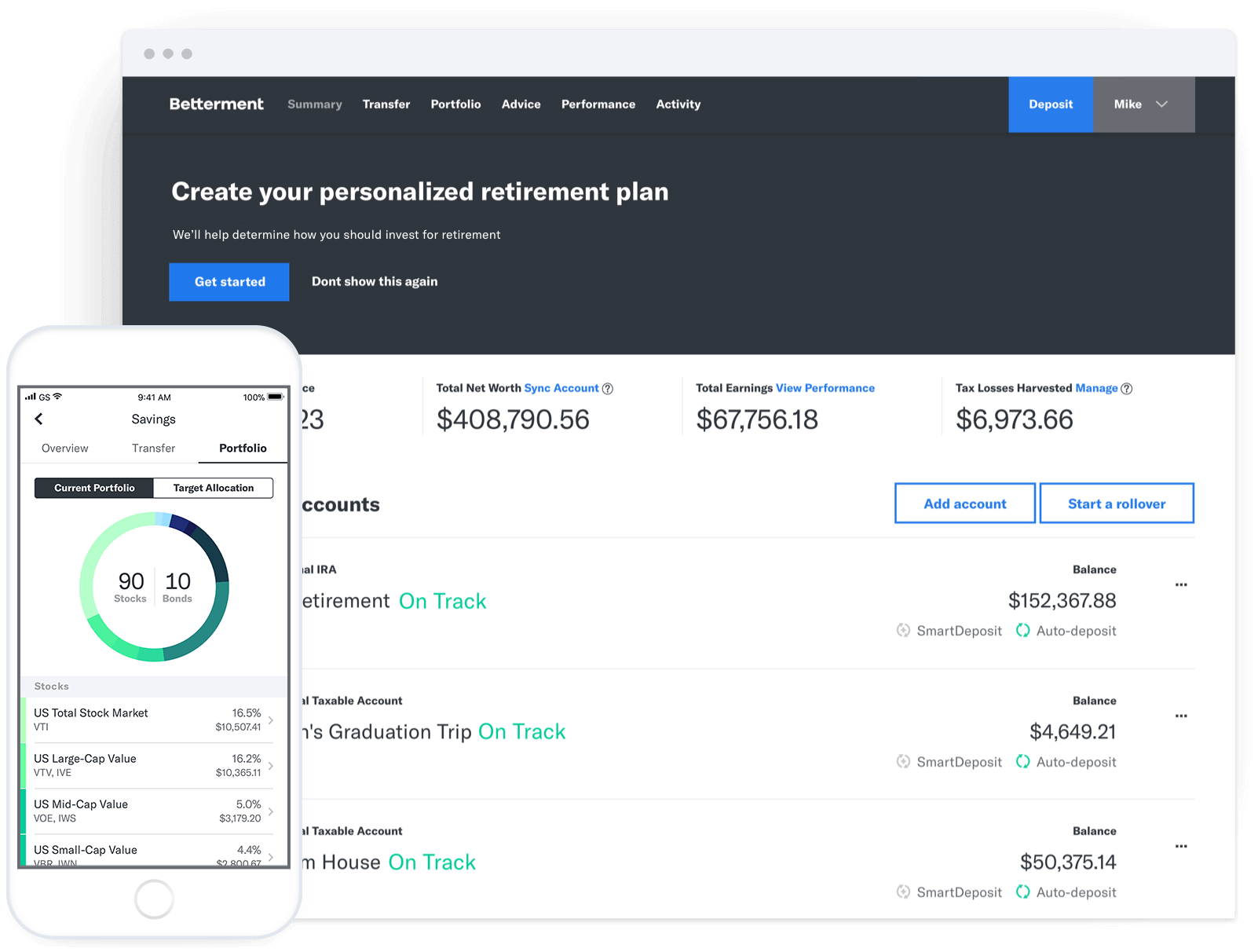

Their easy-to-use platform and investment app are great for new investors. Their retirement guide will tell you exactly how much you need to save to meet your future investment goals. Take a look.

M1 Finance is an online broker and investment manager hybrid. Unlike most services, they allow for both self-managed and robo-directed investing. They are perfect for investors who don’t want to be largely hands-off but still have the ability to pick a handful of individual stocks.

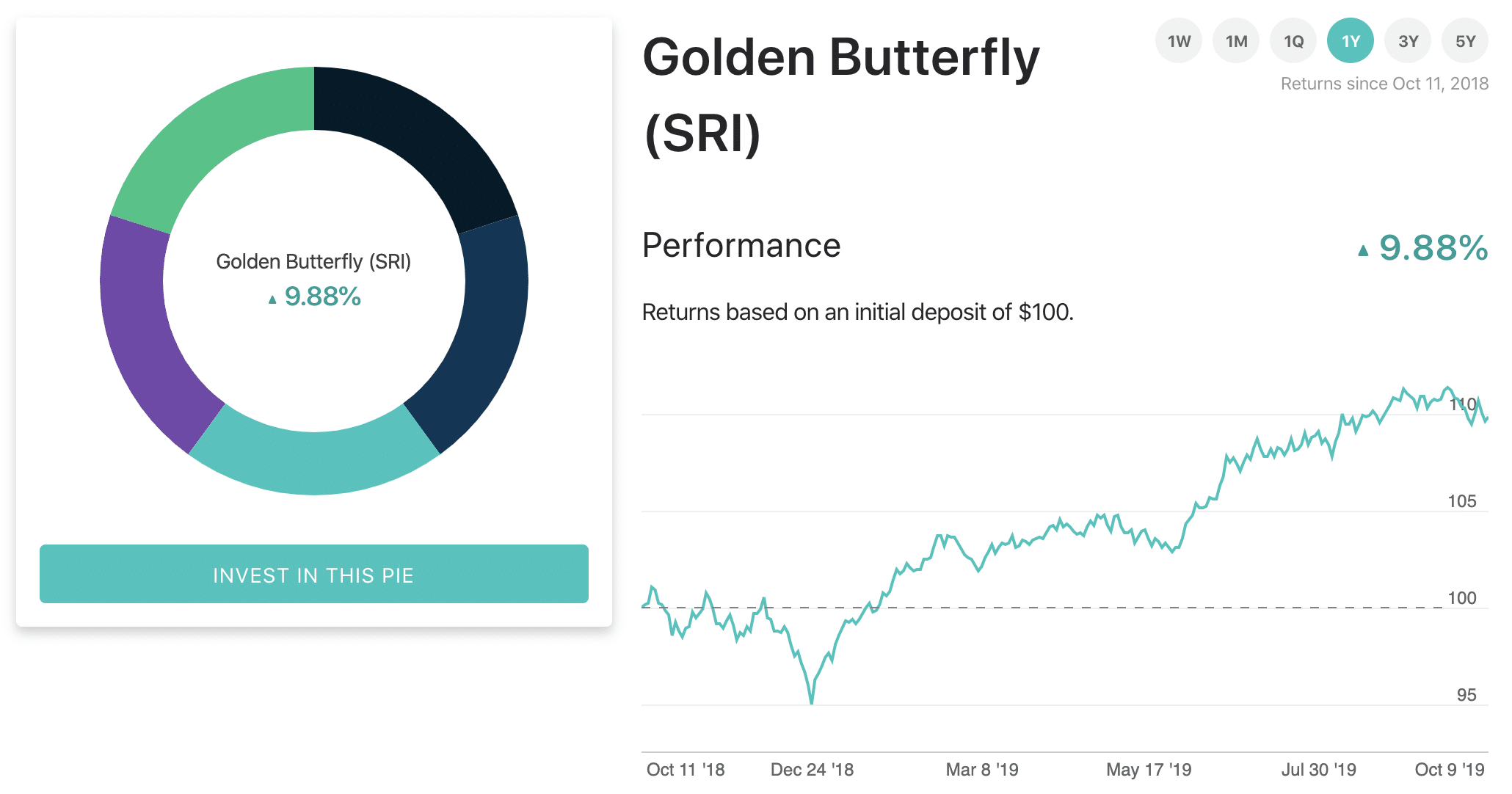

Because M1 Finance lets you build a portfolio that mirrors some of the world’s leading brokerages and advisors, my wife and I used M1 to curate a customized version of the Golden Butterfly.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

In your Brokerage account, you can take risks on companies like Apple or Tesla or invest in high performing Mutual Funds or ETFs (exchange-traded funds) that we discuss on the blog. Why do this?

Maybe because you’re interested and want to see if your gut instincts can help build your wealth faster. This is something we encourage but only under the umbrella of diversification.

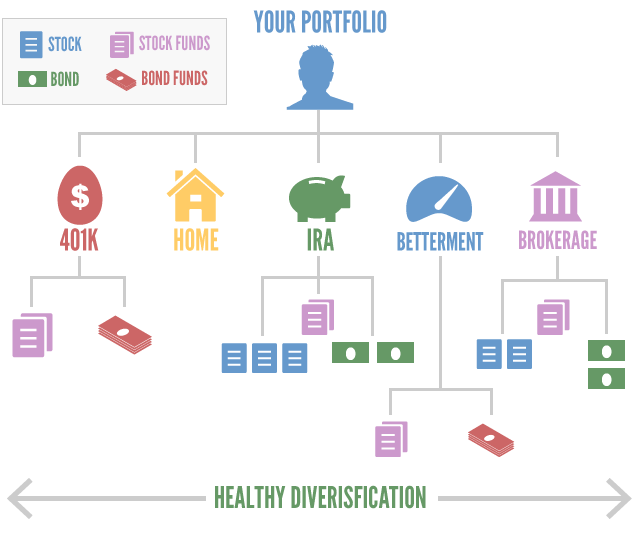

See, on the illustration above, the brokerage account amounts to at most 1/5th of your overall portfolio.

Diversification is smart because you both protect yourself from failure and position yourself to take advantage of multiple robust methods for building wealth. To not diversify is just stupid.

Get our best strategies, tools, and support sent straight to your inbox.

The Meaning of Portfolio and Diversification

Whenever you read about Investing 101 you’re bound to hear the words Portfolio and Diversification.

In the picture below, you can see a silhouette of you at the top of the tree. Everything you own is considered part of your portfolio.

Your retirement accounts, your investment accounts, even your home are types of investments.

What you don’t see in this image is a checking account, savings account, or debt.

Why? Because none of those are investments, they are all short-term assets. Your portfolio reflects your long-term wealth-building investment strategy – not the short term.

You’ll notice that we describe four general types of investment vehicles: Individual Stocks, Stock Funds, Bonds, and Bond Funds.

Sure there are many more investment mixes, but we didn’t want to distract from the ultimate point of the illustration. To show what diversification looks like.

Diversification is, at its simplest, a way to describe owning multiple types of investment assets.

To go a bit further, diversification describes a whole slew of investment categories.

For example, one of the most significant investments people make in their lifetimes is purchasing a home. However, a home is but a single piece of property with a precise geographic location in a single city/town.

This could be considered very risky because what if the area floods or becomes less popular or the home collapses. This is especially important if you own real estate in the future.

The best way to account for these scenarios is not to worry yourself sick but to diversify.

This means contributing to a tax-advantaged account like a 401k and IRA. These accounts will both save you money now and earn you higher returns in the future.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

The Triumph of the Average Investor

The beauty of the market is that it’s anything if not consistent.

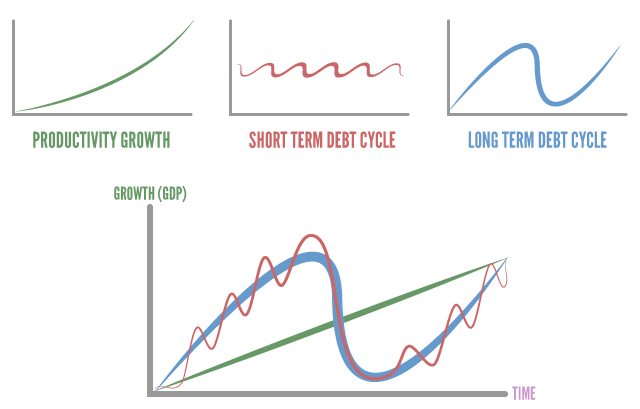

When you ignore the things the media blows out of proportion daily, the movement of the market can be explained by its three base components.

Productivity growth, the short-term debt cycle, and the long-term debt cycle.

Productivity Growth

This is equivalent to technology getting better, faster, and that we continuously learn from our mistakes. We will always be able to do more with less time and resources than we were able to in the past.

That is productivity growth in a nutshell.

Short-Term Debt Cycle

This cycle is defined by a growth period and then a recession period. These cycles last about 5 – 8 years and should explain why you always feel like the market is booming and busting (because it is).

The short-term debt cycle peaks when loans become more expensive (interest rates go up).

Following the bust, rates reset at a nice low level to start the cycle over again. What causes the short-term debt cycle bust?

It’s caused by when the payments of debt in the market exceed the income in the market. This leads to a recession, otherwise known as negative growth.

Long-Term Debt Cycle

This is similar to the short-term debt cycle only much bigger, and it takes much longer to play out – typically 50 years. Consider September 2008 before Lehman’s collapse as the peak of the long-term debt cycle.

The long-term debt cycle peaks when the economy is saturated with debt, and it literally can not take on any more.

This causes massive deleveraging, a process where the vast amounts of debt unwind, although not without a lot of lenders losing a lot of their money.

Why are we telling you all of this?

We’re telling you this because it’s essential to understand that the market works in cycles. It will continuously go up and down, up and down.

Once you know and understand the market, you can stop fearing it and start using it to your advantage.

The one truth is that in the long term, productivity will go up, so over the long-term, will the stock market. This graph is on a roughly 100-year scale.

It’s easy to understand all zoomed out, but when you’re in the thick of it, it’s hard to see where you are in the cycle. Don’t worry, all you need to do is hold in the long-term, and you will do just fine.

Now, that’s a lot of information, and we didn’t even mention The Average Investor and what that means.

The Average Investor

The Average Investor is someone like me or you who don’t try and time the market – buy low and sell high. What’s the point? It’s going up over the long term, and who has time to check stock prices obsessively?

Not only does The Average Investor not try to time the market, but they also don’t try to beat it.

They simply try and achieve average returns. Luckily for The Average Investor, the market average is conservatively at 7% (10% on the high end).

To see what that means, just refer to the first graph in this article. It says that if you invest a certain amount of money for 30 years, at the end of the term, you should expect it to be more than seven times larger than your initial investment.

Translation: Average is pretty damn good.

Being an Average Investor is a great financial goal because it doesn’t involve a lot of work or stress and locks in a nice healthy return over the long term. What more could you ask for?

We called this section The Triumph of the Average Investor because the majority of the big market winners, in the end, are playing the same long-term investment strategy (including our hero, Warren Buffet).

Why gamble all of your money in Wall Street’s casino when the financial goal is to grow your wealth, not lose it all?

Why You Don’t Need a Financial Advisor

Everyone wants to be the success story where only a handful of years of investing results in a mountain of wealth. The truth is, that does not happen often and is very unlikely to happen to you.

That’s fine, though, because we know that over time and with enough patience, we can easily find success. The problem is when people don’t have patience – they start to seek out shortcuts.

One of the most common shortcuts we hear about is people about hiring a financial advisor.

There are plenty of reasons why you shouldn’t hire a financial advisor – these are a few of our favorites:

1. Nobody Will Care About Your Money More Than You

Who do you think will work harder to build your wealth? Some person you just met or yourself? A financial advisor’s compensation is rarely if ever tied to your success.

The majority of their income is based upon the amount they get you to invest so pony up and hope they care.

2. The Ability to Avoid Fees

If you wanted a single investment that has you covered from a performance and diversity standpoint, you could always go with something like a Vanguard Lifecycle fund and pay as low as 0.15% in fees, and that’s it.

On a side note, we have a list of our favorite Vanguard funds and investments for beginners that you should probably check out if you know what’s right for you.

If you go with a financial advisor, you’ll still pay the Vanguard fee, and then you’ll also pay a fee to the financial advisor.

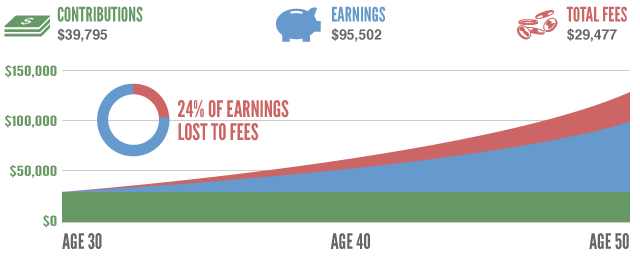

This graph below illustrates what 1% in fees look like throughout your lifetime. That’s of course if you could ever be so lucky as to escape with only 1% in fees.

3. You Might Not Get The Best Financial Advisor

Have you ever thought about why this person wants to be your financial advisor? You don’t have millions of dollars, and you likely don’t have hundreds of thousands of dollars either.

The advisors who are actually good get the big clients and the not-so-good ones are managing the money of small fish like you.

Interestingly, less than 25% of financial advisors can beat the market average (market index funds like the S&P500). Chances are, the financial advisor you pick will not be one of the top 25%.

Would you even be able to tell the difference between a good financial advisor if you had a chance to sit down and talk with 100 of them? Chances are you’ll go with the best salesmen.

Better you invest yourself than give your money to someone who doesn’t care and likely won’t beat the market either.

The good news is that this is neither difficult nor time-consuming because, most of the time, we’re just going to mirror the market average. No need to get fancy. The best investments are long term.

Start Investing Simply

Get started with set-it-and-forget-it style investing. With

They automatically diversify you across a whole set of investments based on your risk tolerance. The only investment decision you have to make is what level of risk you’re willing to take.

It’s as easy as moving a slider from 0 to 100. High risk, high reward is 100% stocks, and 0% is the conservative approach with all bonds.

While getting invested is important, understanding having a retirement plan is the goal. RetireGuide is a tool created by

When you can retire and how much you can spend when you’re retired.

The tool is incredibly detailed – we’ve explained it all in our extensive Betterment Review. I’ve been using

Ready to get a complete your investing 101 education? Visit our How to Invest Money resource page for podcasts, articles, and our no-bullshit, just-usable-facts approach.

The Average Investor’s Commandments – Investing for Beginners

If a 7% return is average, then the average is pretty impressive. Fortune favors the bold.

1. Think Long-Term

When you look at investing on a personal scale, it’s very rare for a sudden move in price to mean very much. Unless something cataclysmic happens, things will balance out, so be patient.

2. Invest What You Can Afford

While you can always sell your investments, it would be better if you left them alone and let them grow. Invest as much as you can while reducing the chance you’ll need to sell your investments to cover necessary expenses.

The goal is always to keep a few months’ expenses around in case something happens and invest the rest.

3. Buy What You Believe In

Don’t listen to the radio, don’t listen to a friend, listen to yourself. If you do not know or understand what you’re buying, don’t buy it. Even if you do understand it, only invest in something that you believe in.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

4. Do Your Own Research

Maybe you love bananas, but if you don’t understand the banana business, you either figure out how it works or don’t invest in it. Is the banana business profitable? Are they innovators or just people milking an existing product line? You get the point.

5. Set It and Forget It

We’re not day traders here, so we’re not going to try and be like them. We invest in the future, and our style reflects that. The goal is to automate the investment process so you can spend your time living, not managing money.

6. Consistently Contribute

The truth is, very few people can perfectly time the market, and I’m sorry, but you’re not one of them. That’s ok, though, because you can beat it with Dollar Cost Averaging.

Contribute every month to your investments, and it won’t matter if you buy at the peak or bottom of the market. He who can stay the course wins.

7. Be Fearful When Others Are Greedy

This is the first half of our favorite quote from Warren Buffet. When everyone is a winner, you should be concerned.

If you or your friends are making quite a lot of money very quickly with your investments, act very conservatively.

8. Be Greedy When Others Are Fearful

The best time to buy is when the world is on fire. Don’t be delusional; be realistic. Are the fires real or just the typical knee-jerk reaction of the media? We’re bargain hunters, not suckers.

9. Find and Remove Frivolous Fees

Rule: A bank will always try to trick you into paying fees. Be vigilant and tireless when it comes to reducing your fees.

When the stakes are highest, so are the fees. Even a 1% fee can become significant over the long-term.

Personal Capital is Now Empower - Track your entire portfolio for free.

All your accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

Personal Capital’s Fee Analyzer tells you how much your investments lose to fees and shows you ways to lower them.

10. A diversified portfolio

If it can fail, it will fail. That’s why we always plan ahead for failure. Diversification is your investing 101 cheat code for riding the market. Invest in many different things so no single failure can ever shut you down.

Click the image to view the full infographic.