Betterment is an automated investing service that considers your age and risk tolerance to build an optimal portfolio. Their goal is for investing to take only a few minutes a month.

If you want to grow your money without spending a lot of time managing it, then

Betterment is best suited for people who want stable long-term investments that beat the market average. They’ve built a ton of efficiencies into their platform, and as a result, they can whip traditional investment managers on cost. As a result,

The question: Is their platform as powerful as it seems?

Our goal is to teach you everything you need to know about

If you want an in-depth analysis of the

Is Betterment good for beginners?

Betterment is an excellent option for beginners who are looking to start investing. As a

Additionally,

How Does Betterment Work and How Do You Use It?

Traditionally when you wanted to invest successfully, you would do two things. First would be a ton of research picking funds or individual stocks if you’re hardcore. Then you would make sure to diversify enough to avoid losing your life savings on a bad day.

You’ll also try to ensure your growth is aggressive enough so you grow your savings over time. Nobody wants to miss out on the boom or get destroyed by a crash.

At its core, this is the problem

The first question you’re asked is, what goal are you saving for?

Are you trying to buy a home, retire, fill an emergency fund, etc.?

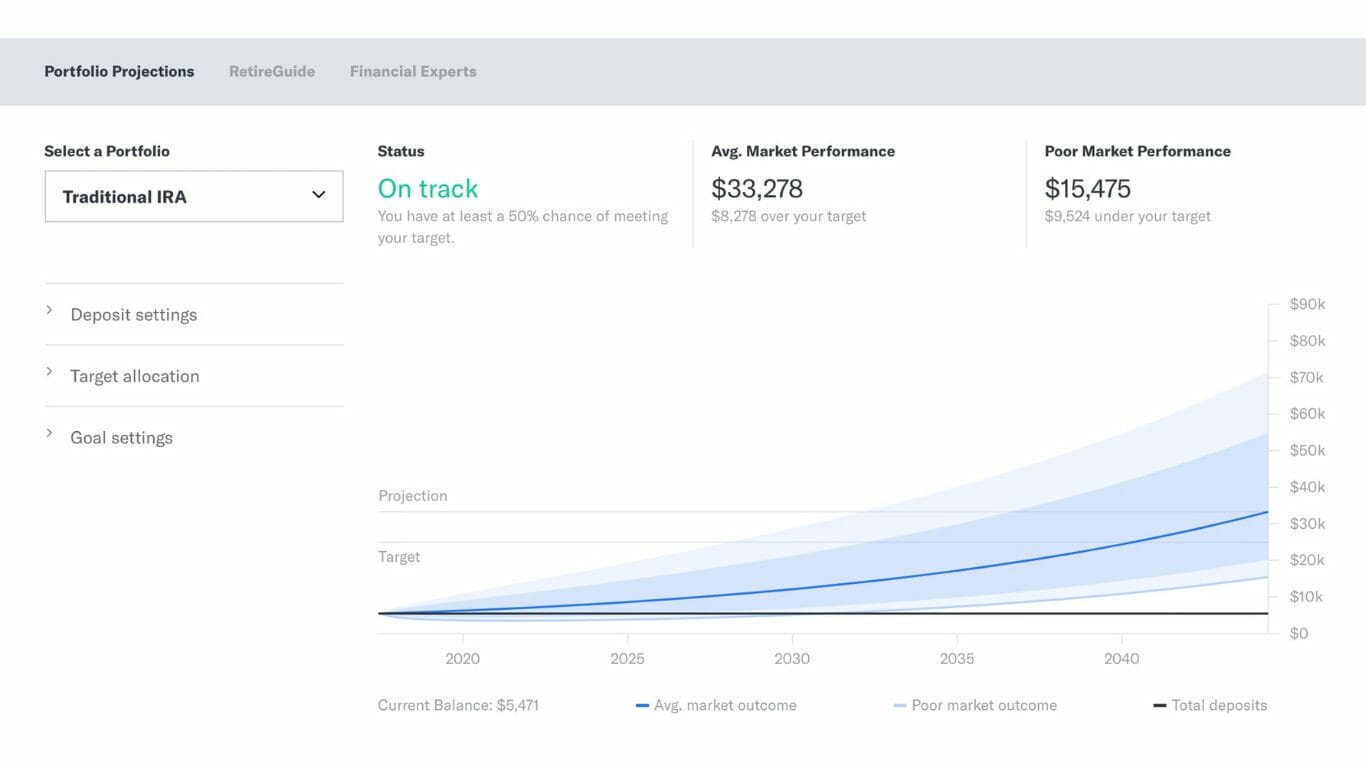

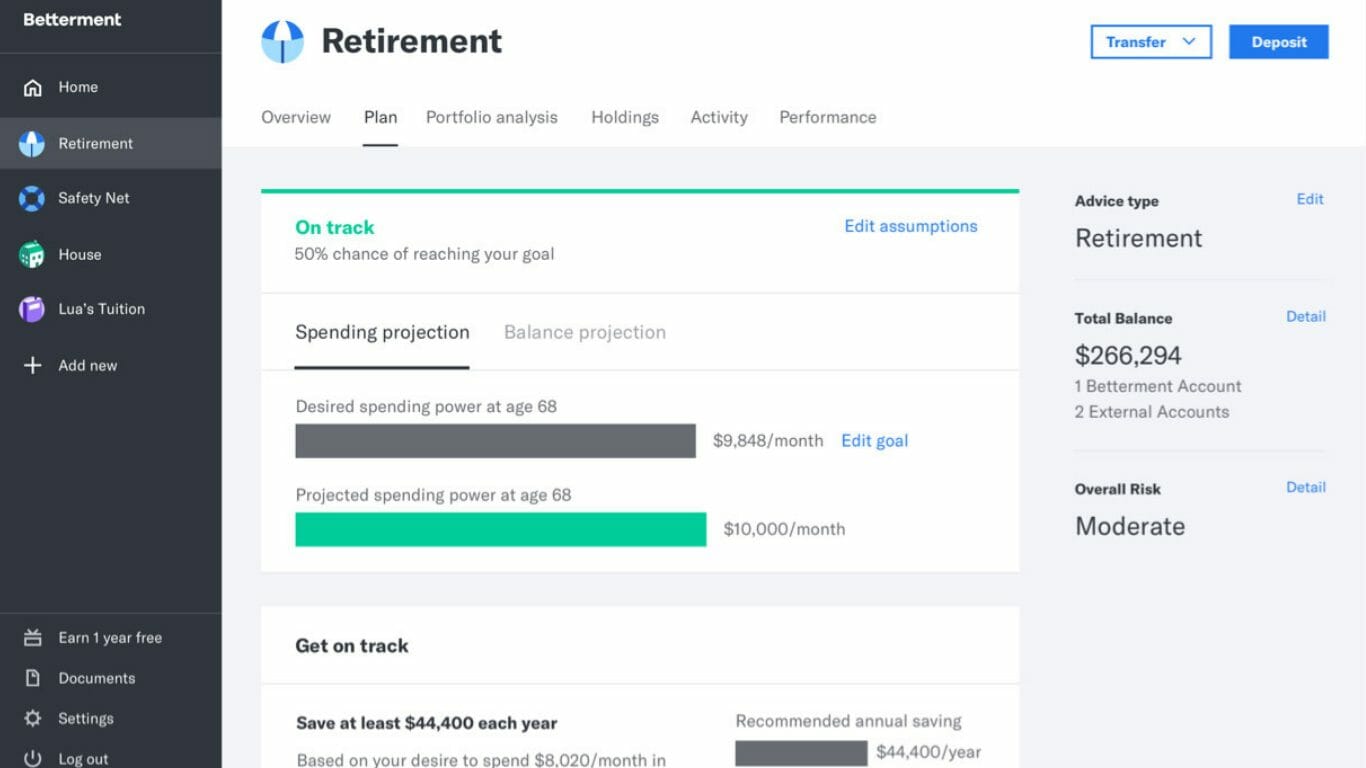

Since every decision you make automatically updates this sweet graph, you will always know what sort of growth you should expect or what adjustments you’ll need to make to hit your goals.

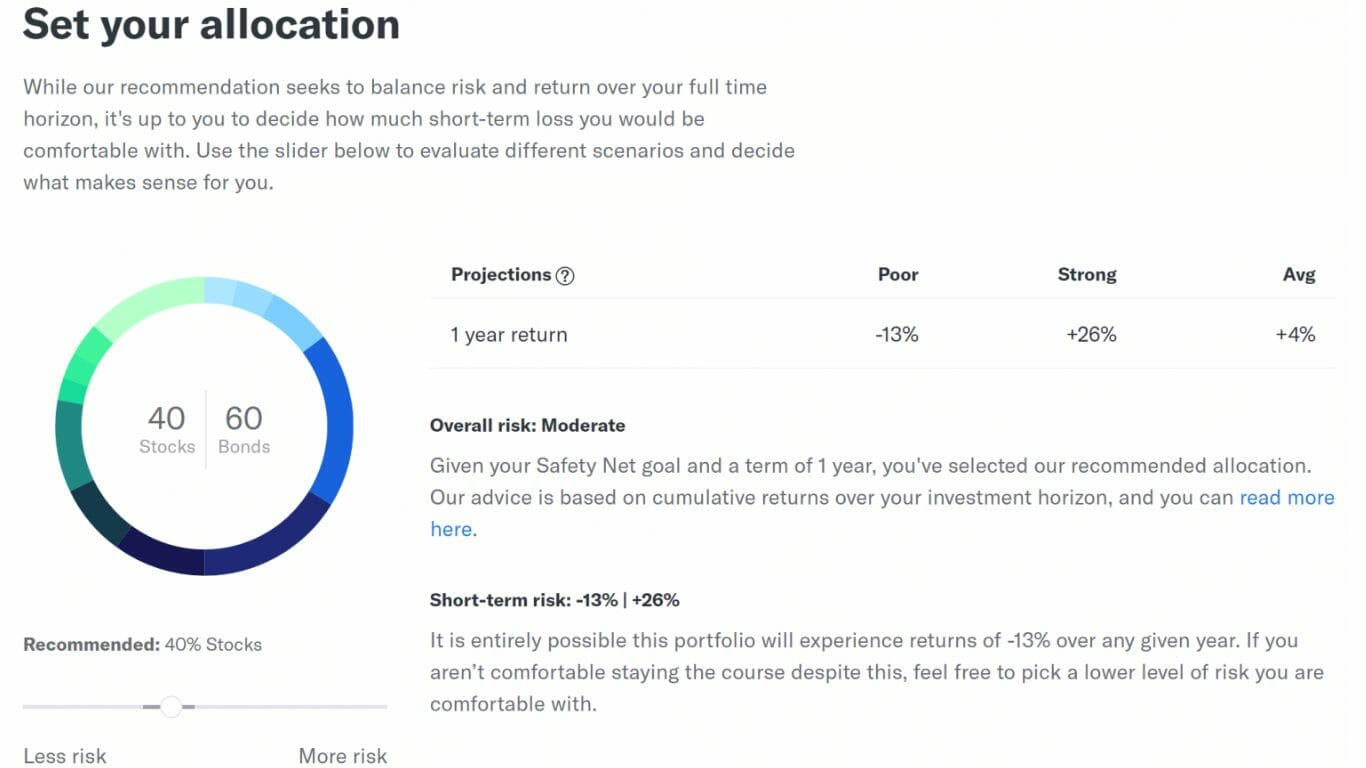

For example, if you’re trying to fill an emergency fund, they suggest you take it slow and recommend a 60/40 stock/bond split.

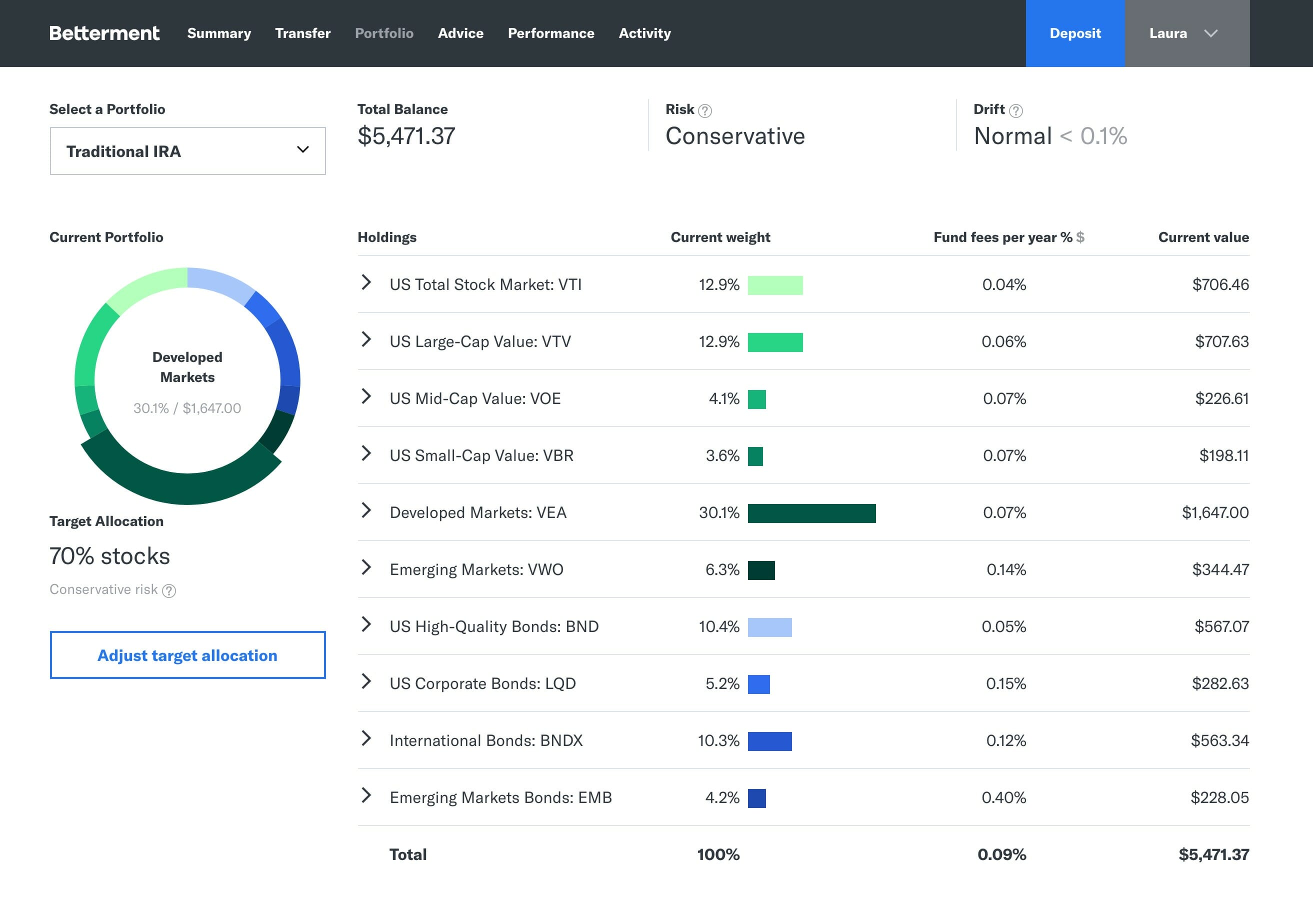

Betterment reviews all of these elements and, with complete transparency, shows you exactly what your risk level means through what your holdings will be:

This leads me to the secret sauce of

Simply put, this is how they diversify and distribute your investment portfolio so that you earn the highest return with the lowest risk possible. Your asset allocation is divided between 12 classes.

If you’re a finance nerd like me, one of the first things you may notice is that most of the ETFs

ETFs are used instead of index funds because of their lower fees, superior tax efficiency, and low minimums. They’re used in all account types and are part of

For example, Vanguard’s Total Stock Market Index Fund (VTSAX) has a minimum balance requirement of $3,000. Their ETF equivalent (VTI) is available at the cost of one share.

With ETFs, you’re getting the diversification of an index fund, but it’s traded throughout the day like a stock.

This is the better choice when using strategies like tax-loss harvesting (more on this in a minute).

Let’s say you want to buy a stock that costs $200 but you can only afford to spend $100. No problem.

None of your cash sits on the sidelines. Instead, your portfolio is optimized down to the last cent.

As you flip your risk slider between 0% and 100%, you’ll notice the fund weightings (and the number of funds) change.

I’d say that half the value of the

Betterment app is in their execution of Modern Portfolio Theory, the fund choices they’ve made and how pleasurably easy it is to manage your money like this.

Betterment Fees, Features, and Competitors

From a bird’s eye view, here is how they stack up against the competition:

Minimum Investment:

$0

Management Fees:

0.5%

Promotion:

Get your first $10,000 managed free

Tax Loss Harvesting:

Yes

Portfolio Rebalancing:

Yes

Assets Under Management:

$13B

Minimum Investment:

$500

Management Fees:

0.25%

Promotion:

Invest your first $5,000 free, for life

Tax Loss Harvesting:

Yes

Portfolio Rebalancing:

Yes

Assets Under Management:

$10 billion

Checkwealth simple comparison Wealthfront vs Betterment vs. Wealthfront.

| Investment Accounts | Individual and Joint Taxable accounts, Roth IRA, Traditional IRA, Rollover IRA, SEP IRA, and Trusts |

| Mobile App | Yes; Apple iOS and Google Android. |

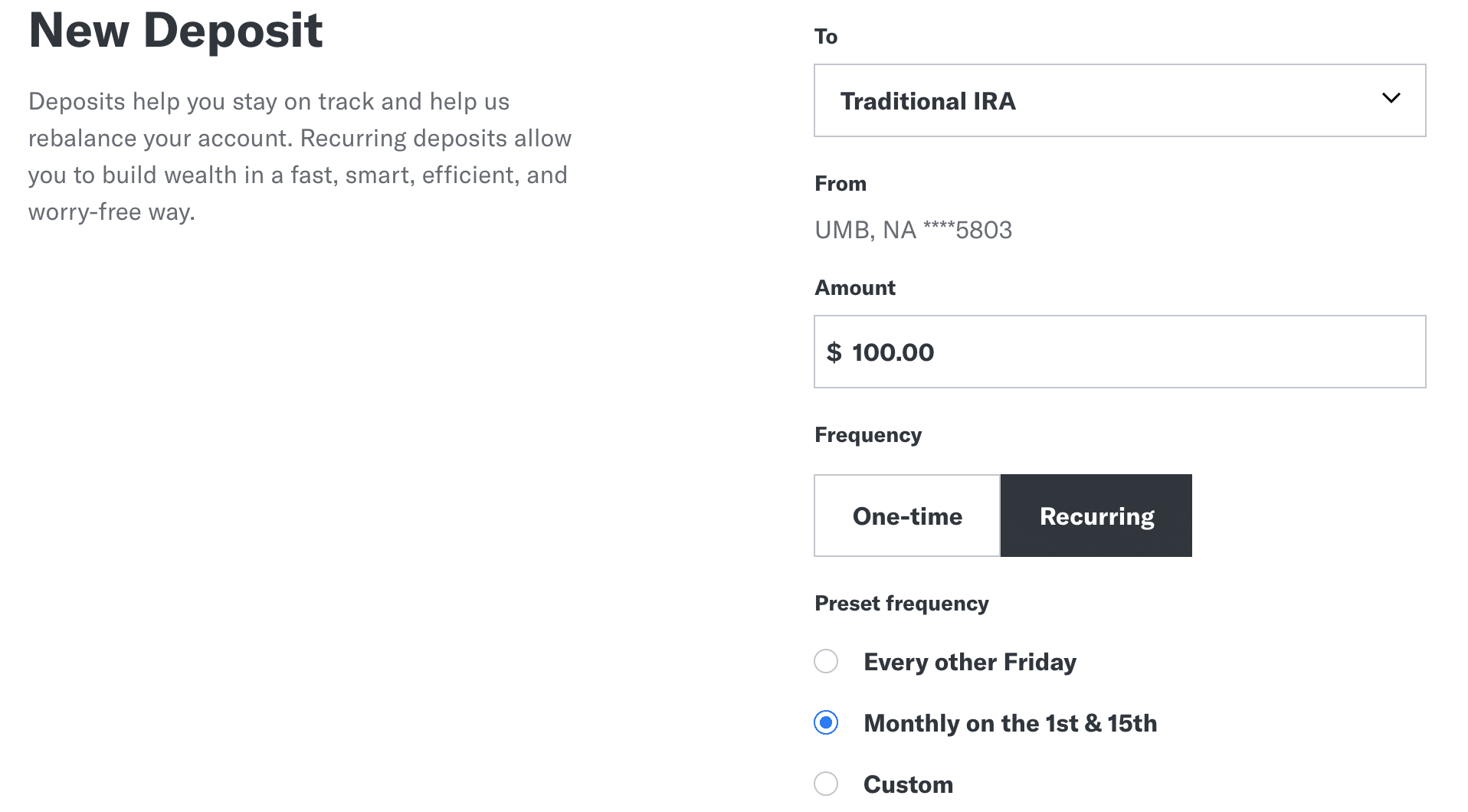

| Automatic Deposits | Yes; Schedule is flexible. |

| Advice | Automated; Digital tier users can book a financial package call; Premium tier users gain unlimited access with Betterment's team of CFP® professionals. |

| Customer Service | Email - 24/7; Phone - Monday–Friday: 9:00 AM–8:00 PM ET & Saturday–Sunday: 11:00 AM–6:00 PM ET; Phone Number - (888) 428-9482 |

What is the average return on Betterment ?

It’s important to note that the average return on

Historically, well-diversified portfolios have generated average annual returns of around 5-8% over the long term, although past performance does not guarantee future results. Remember that individual experiences with

Historical Betterment Returns and Performance

Since the bottom of the stock market in February of 2009, the average

Compared to the average private client investor,

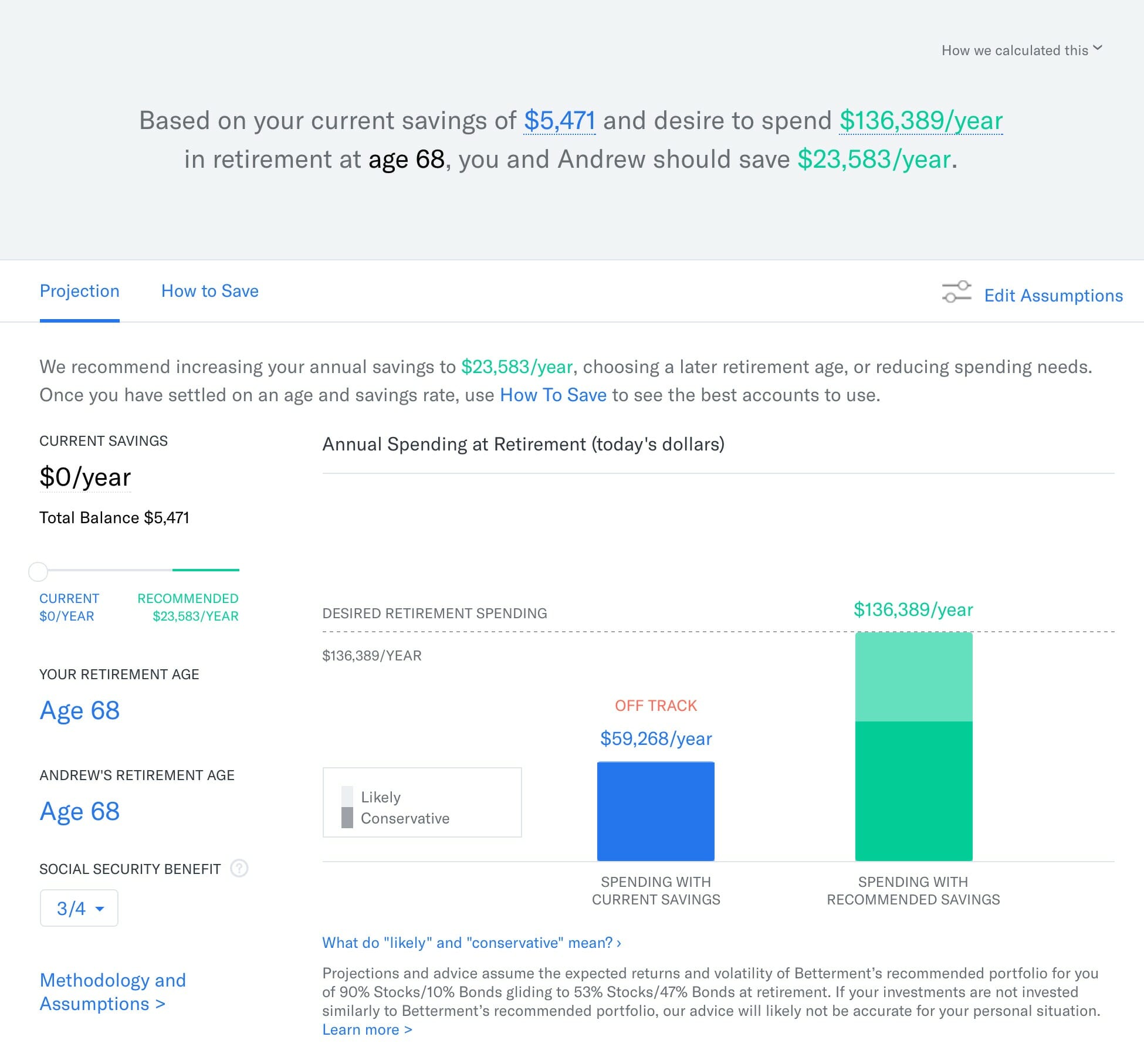

A Retirement Planning Suite at Your Fingertips: Know When You Can Retire

If

Don’t you have anything saved in your retirement account yet? No problem, push back your projected retirement age.

Can’t save enough to hit your spending goal? No problem; you’ll just need to adjust how much you can spend in retirement.

The beauty of answering the above questions is that you can understand if your actions are correct. If not, you can change course before it’s too late.

To be as precise as possible,

Yes,

What impressed me is how they account for things like:

- Existing assets

- Cost of living

- How much income is needed in retirement

For example:

If you lived in Ames, Iowa (50010),

Betterment ‘s calculator says that your cost of living will be 4% less expensive than the national average. However, if you live in Hoboken, NJ, it’s 116% more expensive than the national average.

So, if you live in Hoboken, you’ll have to save a lot more if you want to continue living there AND retire there. Having

Good calculators give you an answer; great calculators make you think. This is a great calculator.

Retirement Withdrawals – So You Don’t Fail

Want to know something important that people talk even less about than when they can retire? How much they can spend in retirement?

Just because you save enough to retire, you still can blow it. So you need to know how much you can withdraw and how often so your nest egg can go the distance.

They run a Monte Carlo Simulation, similar to what they do when you sign up and set your goals. This simulation is in reverse since you’ll be drawing down your account balance while trying to make it last through retirement.

You don’t need to guess what you can withdraw in retirement.

As you continue through retirement,

Simply put,

Betterment takes all of the guesswork out of retirement.

You’re also able to see the tax implications of a withdrawal or allocation change with their Tax Impact Preview tool.

Use Betterment Checking and Betterment Cash Reserve to Earn More

The average checking balance in the US is $8,100, and it earns 0.08% ($6.48) interest a year. That’s why

With Cash Reserve, you’ll earn a competitive APY with Savings. As a result, you’re able to earn substantially more than your average bank offers.

How does

Cash Reserve:

- Competitive, high-yield APY

- FDIC-insured up to $1 million (this article explains how they’re able to get a higher amount than the usual $250,000)

- No account minimum balance

- No fees on balances

- Unlimited withdrawals (compared to a limit of six with most savings accounts)

Checking:

- Worldwide ATM fee reimbursement

- Visa foreign transaction fee reimbursement

- Tap-to-pay debit card

- No account fees

- No overdraft fees

- No account minimum balance

- FDIC-insured up to $250,000

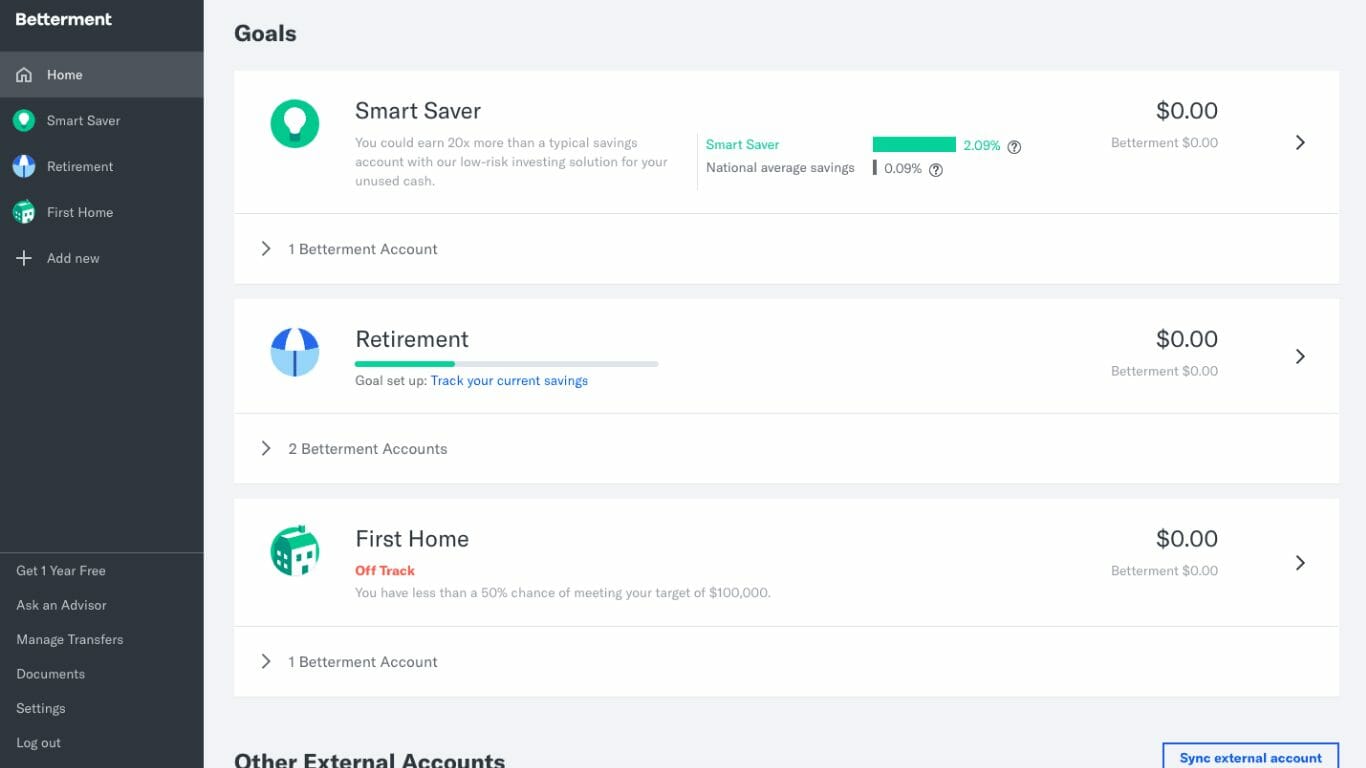

What’s this mean for Smart Saver?

Smart Saver will transition into Savings as

Cash Reserve comes with a few perks that didn’t apply to Smart Saver, including:

- Competitive, high-yield APY

- FDIC-insured up to $1 million (compared to Smart Saver which wasn’t FDIC-insured)

- Faster withdrawal times (transferring money between your linked bank accounts now takes 1-2 business days instead of 4-5)

Betterment Cash Reserve, Cash Analysis, and Two-Way Sweep: The Perfect Trifecta

Your extra cash is money that could be earning more if it were in an account which combats the effects of inflation.

But simply knowing isn’t enough.

Perhaps the best part of

Your minimum balance covers your expenses while earning the highest interest rate possible. It also returns cash to your checking account when your balance runs low.

You can change the target balance for your checking account, and

Invest your Change with Smart Deposit

While there is support for scheduled monthly investments, one-size-fits-all doesn’t work for everyone. If you’re a contractor or self-employed, this should make you very excited.

With

The most important part is that you can set a maximum deposit. If you set Smart Deposit to trigger at $5,000 and you get a $3,000 check in the mail, that doesn’t mean you want to send all $3,000 to be invested.

Smart Deposit is very easy to set up from your account and only needs to be configured once.

While Acorns is the first tool to focus on trigger-based investing, it isn’t nearly as sophisticated.

It doesn’t withdraw nearly enough for any serious retirement plan. Let’s not kid ourselves, investing the “change” by rounding up every transaction to the nearest dollar won’t save you much.

As per research conducted by the Federal Reserve, the average family makes 58.7 transactions per month across Cash, Credit, Debt, and “Other.” If every one of those were for $0.01, you’d only be investing $58 a month.

Amp Betterment Returns with Tax Loss Harvesting (TLH+)

Everybody talks about the monster gains they get when investing but few people talk about the cost of those gains.

When the tax man cometh.

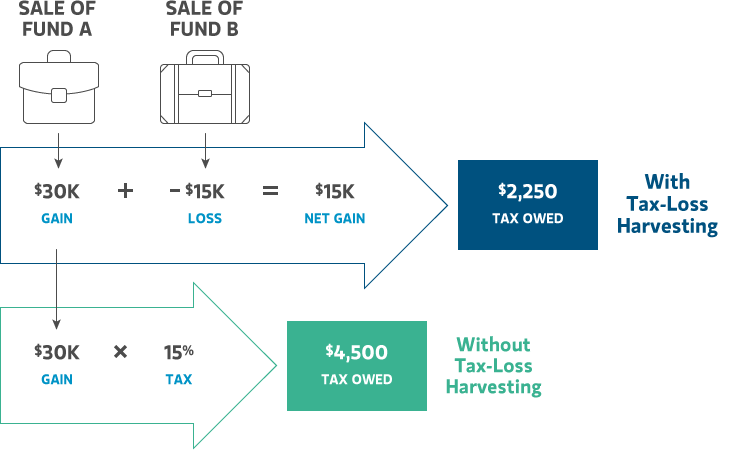

Unless you’re the lucky 0.5% richest investors or 1% poorest, you will pay a 15% long-term capital gains tax rate. That means if you profit $1,000 you need to hand $150 over to the government for the privilege.

Betterment’s Tax Loss Harvesting tips the scales in your favor by harvesting the natural dips in the stock market as losses to weigh against your gains.

These micro-losses add up over time, and when it’s time for you to withdraw your investments it dramatically reduces your tax bill. It’s important to note that you never actually lost any money, it’s more of a clever paperwork process that you’d need a computer to accomplish.

While there is a lot of complicated logic behind the scenes which pulls this off, the concept is straightforward.

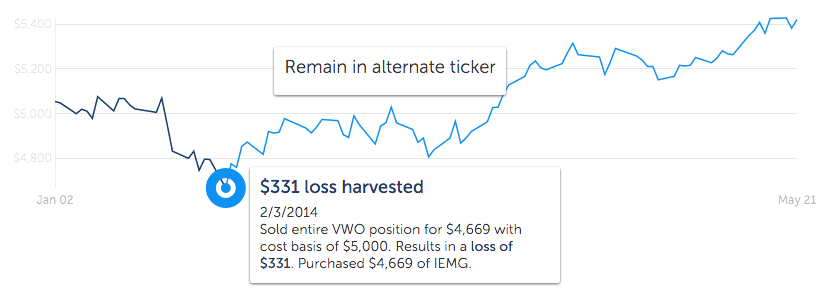

For every fund in your portfolio,

For example, VTI (Vanguard’s Total Stock Market exchange-traded fund) will get swapped with SCHB when the timing is right. You can read about it in all of its glorious detail in this Betterment white paper. I highly recommend reading it if you’ve been having trouble sleeping lately. It’s that good. Sorry,

When your primary fund is at a point where it’s below the value you purchased it at, it is automatically sold and the identical secondary fund is purchased. This process is repeated as often as necessary.

Betterment outperforms the competition in this process by 0.99% as per that white paper.

The result is more money in your pocket when it comes time to withdraw your investments. Could you do this on your own? Sure. Would you want to spend your time on this instead of going outside and having fun? Probably not.

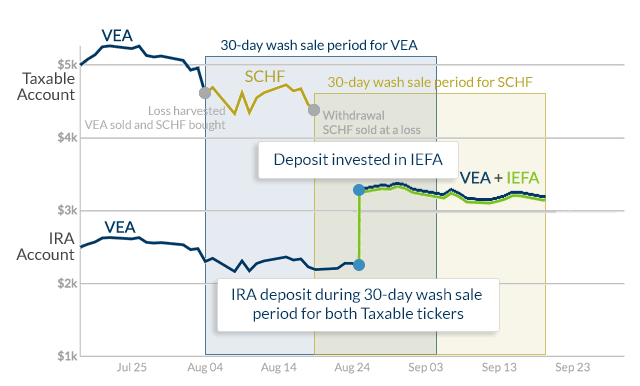

In addition to TLH+ for your account,

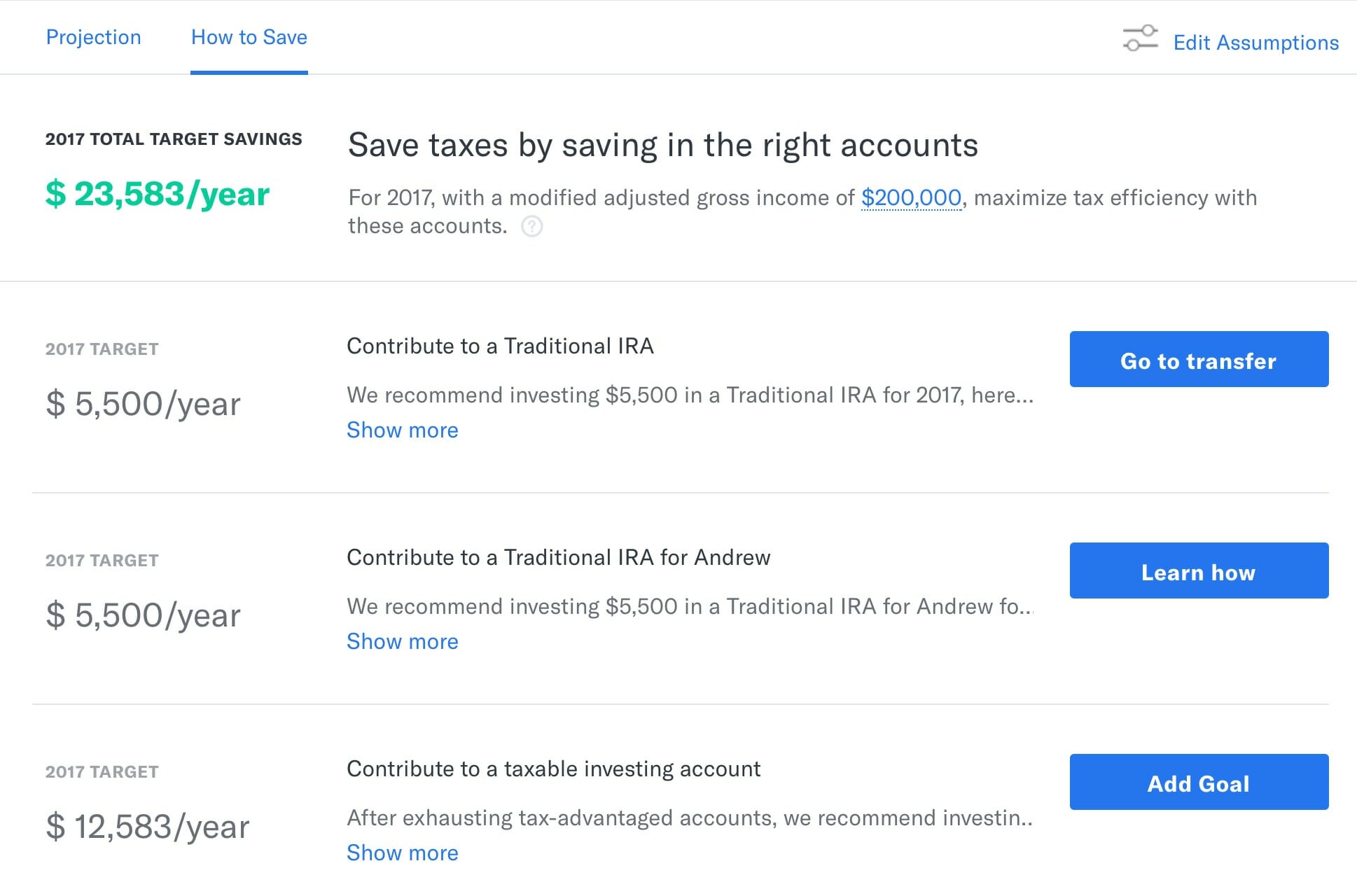

They also feature Tax Coordinated Portfolios. From the

Tax-Coordinated Portfolio optimizes and automates a strategy called asset location. It starts by placing your assets that will be taxed highly in your IRAs, which have big tax breaks. Then, it places your lower-taxed assets in your taxable accounts.

Our research shows that this strategy can boost after-tax returns by an average of 0.48% each year, which approximately amounts to an extra 15% over 30 years.

TLH+ with an IRA in all its glory!

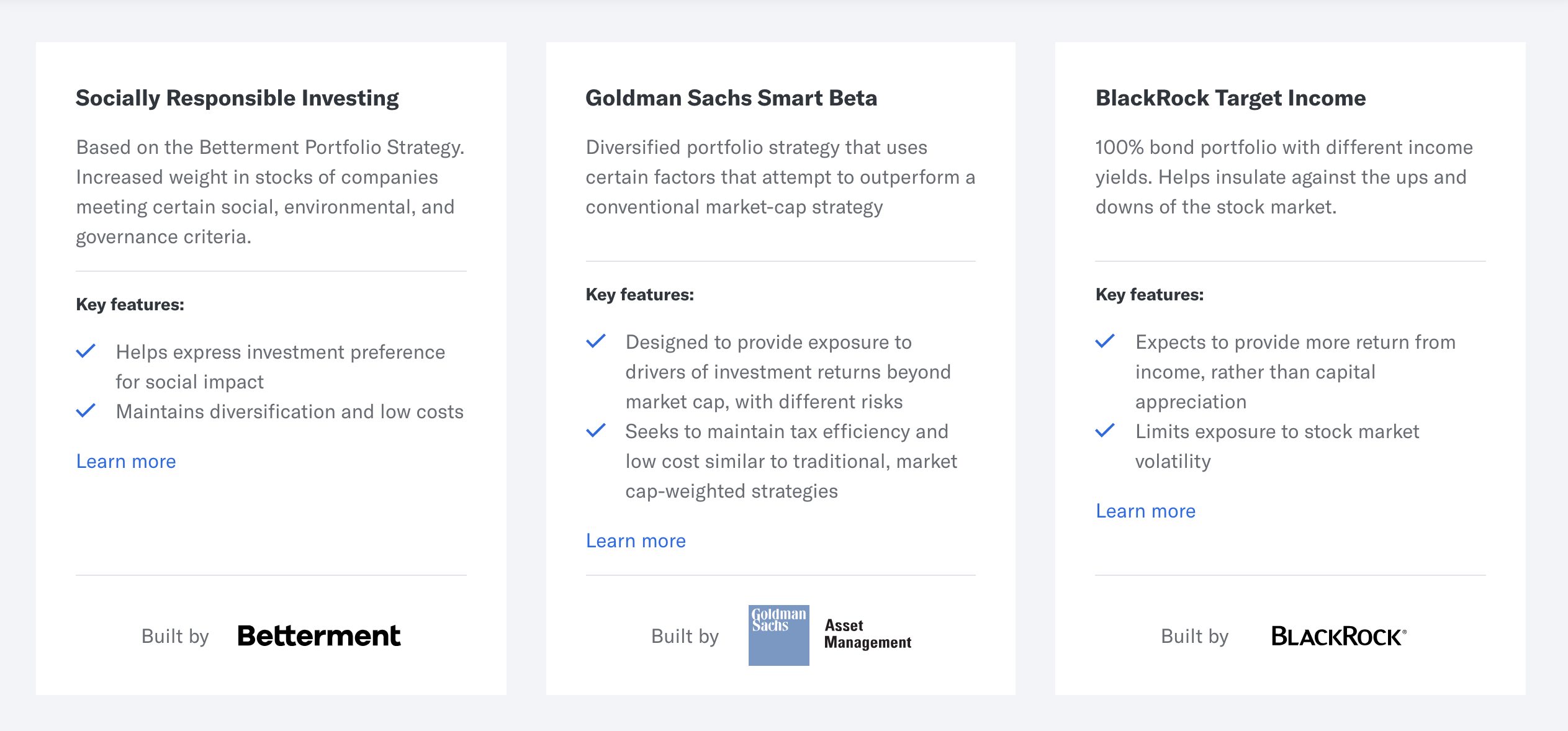

Additional Portfolio Strategies

In addition to their goal-based, core portfolios,

Socially Responsible Investing(SRI)

Invest in companies that align with your values. SRI emphasizes businesses focused on environmental, social, and governance issues.

In

An approach to investing that reduces exposure to companies that profit from poor labor standards or environmental devastation.

SRI still maintains a globally diversified portfolio without affecting overall performance.

Goldman Sachs Smart Beta

Smart Beta seeks higher returns through increased, calculated risk.

Or, as

A Smart Beta portfolio sits somewhere between a passive and active investing strategy. It was created to help meet the preference of our customers who are willing to take on additional risks to potentially outperform a market capitalization strategy.

If your risk tolerance is high and you’re in it for the long haul, Smart Beta might be a better alternative.

BlackRock Target Income

Charitable Giving

Donate your securities instead of cash!

When you donate securities that have gone up in value to a charity, you pay zero capital gains come tax time. If charitable giving is your cup of tea, this might fit with your overall investing strategy.

Gain Access to Betterment ‘s Financial Advisors

In addition to the number of features that come with parking your cash at

Sometimes you just want to speak with a person and make sure everything is going according to plan – we get it. And with

The real value-add with the financial expert tiers is that you will have people, in addition to computers, looking at your

Financial packages currently offered:

- Getting Started Package ($199): One 45-minute call with a licensed financial expert. A step-by-step tutorial that will set you up for financial badassity and show you how to make the most of your accounts.

- Financial Check-Up Package ($299): One 60-minute call with a financial expert who will examine your investment accounts with a fine-toothed comb and look for ways to optimize your portfolio.

- College Planning Package ($299): One 60-minute call with a Certified Financial Planner to get all your ducks in a row for your little one’s higher education.

- Marriage Planning Package ($299): One 60-minute call with a Certified Financial Planner to secure a financial-friendly ride off into the sunset with your betrothed.

- Retirement Planning Package ($299): One 60-minute call with a Certified Financial Planner that will provide you with all you need to know to live comfortably in your golden years (or whenever you hit FI)

If you’re looking for something more hands-on,

If premium plans aren’t your brand of bourbon, consider getting set up with an independent CFP professional through

TL;DR Betterment Review Summary

Betterment is a simple to use automated tool ideal for new and hands-off investors. However, what it accomplishes is by no means simple.

Under the hood, it’s a beast of a service putting traditional brokerages to shame with both its technological prowess and solid returns. As a result, they now have over 400,000 customers and $16 billion in assets under management (AUM).

Betterment is the largest and fastest growing Investing Robo Advisor.

Here’s a pro/con breakdown of the service from a birds-eye-view:

Betterment Positives:

- No Trade or Withdrawal Fees: Should you fear these

Betterment fees? Nope, there’s no transaction cost for touching your money. Add and withdraw money for free just like you would a savings account. - Easy Hands-Off Investing: You don’t need to do your research, monitor your investments daily, or worry about the tax implications of your actions. They take care of all of it. If you haven’t invested yet, or are nervous to get started on your own, this service is for you.

- Cheap Portfolio Management: Most portfolio management services will charge you 1% for an equivalent service. Even LifeCycle funds like what Fidelity offers will cost 0.75% or higher. These are 3x-4x more expensive than

Betterment without half the features. - Plot your Retirement with their Retirement Planning Suite: This tool takes your entire financial picture into account as well as helping you determine what you’ll need when you retire. It plots the whole thing out for you and helps keep you on track so you can be confident you’ll have what you need when the time comes. It’s deeply integrated into the entire

Betterment service.

Betterment Negatives:

- DIY Investing is Cheaper: As you’d expect, if you did everything

Betterment did on your own, you’d save an average, 0.25% a year in annual fees. There is nothing stopping you from mirroring their allocation and monitoring it on your own. Savvy investors might find this more appealing than a set-it-and-forget-it approach.

Betterment: Frequently Asked Questions

Is Betterment Safe? What if Betterment goes out of business?

That means your funds are protected in the unlikely event that

That said, I’d argue that the tools

How does Betterment Make Money?

That amounts to $2.50 a year for every $1,000 you invest with them through their Digital Plan.

Who Owns Betterment ?

Betterment Holdings, Inc. was established in Delaware on January 29, 2008, and it is privately owned.

How do you Close or Delete a Betterment Account?

They’ve got an article for that.

Is Betterment Legit?

You bet it is!

Final Thoughts

Portfolios are optimized down to the last cent through tax-loss harvesting, automatic rebalancing, and fractional shares.

Take your hands off the wheel and let

Check out our candid conversation with

Still hungry for more? Get schooled by