Agriculture is the one industry that touches every person on the planet. Agriculture produces the food we eat, the liquids we drink, the clothes we wear, and the furniture we sit on. There are nearly 7.5 billion people on earth, all of whom consume what agriculture produces. Which makes investing in agriculture seem like a no brainer.

Although LMM talks about investing a lot and has produced hundreds of podcast episodes and articles. Investing in agriculture is something we’ve never discussed. Why not? Well, because investing in agriculture isn’t the most accessible investment and given the ever-dwindling farming population, not something many of us understands.

In 1900, just under 40 percent of the total US population lived on farms, and 60 percent lived in rural areas. Today, the respective figures are only about 1 percent and 20 percent.

There are some agriculture REITs, but they typically buy farmland and lease it to farmers. Some private equity funds invest in agriculture, but most of us don’t have the six-figure minimum required for that.

Which is a damn shame because no matter what the U.S. or global economy is doing, people gotta eat. And drink and wear clothes. And as the world population continues to grow at an alarming rate, there will be ever more consumers of what agriculture produces.

We don’t like to present you a problem without finding a solution, and we found one for those interested in investing in agriculture! Companies like Vanguard and

What is Agricultural Investing?

Those interested in agricultural investing can invest in farmland, ranchland, and timberland (not the boots). But farmland has a much bigger definition than amber waves of grain. Today it can include vertical farms, hydroponic farms, and aquaculture.

Another option, aquaculture involves the breeding, rearing, and harvesting of plants and animals in all types of water environments. These fish-farming operations can increasingly support the world’s insatiable demand for protein.

As climate change continues unchecked, we will have to turn to these more sustainable methods of growing and raising food and other agricultural products.

But traditional lenders don’t understand these practices and in some cases, like hemp, are nervous about the crop. That’s where Harvest Returns comes in.

They crowdfund the loans much the way Fundrise does for real estate deals. Investors get to invest in small, family farms and will know exactly what they’re investing in. Your investment is passive; you don’t get to make suggestions to the farmers but get this: You can visit the farms! Pretty neat, especially if you’ve never seen a vertical or hydroponic farm before.

Socially Responsible Investing

It’s increasingly, depressingly clear that the only way to make an impact is with your money. That can mean buying yourself a cabinet position, boycotting businesses, and investing in things you believe in and not investing in things you don’t.

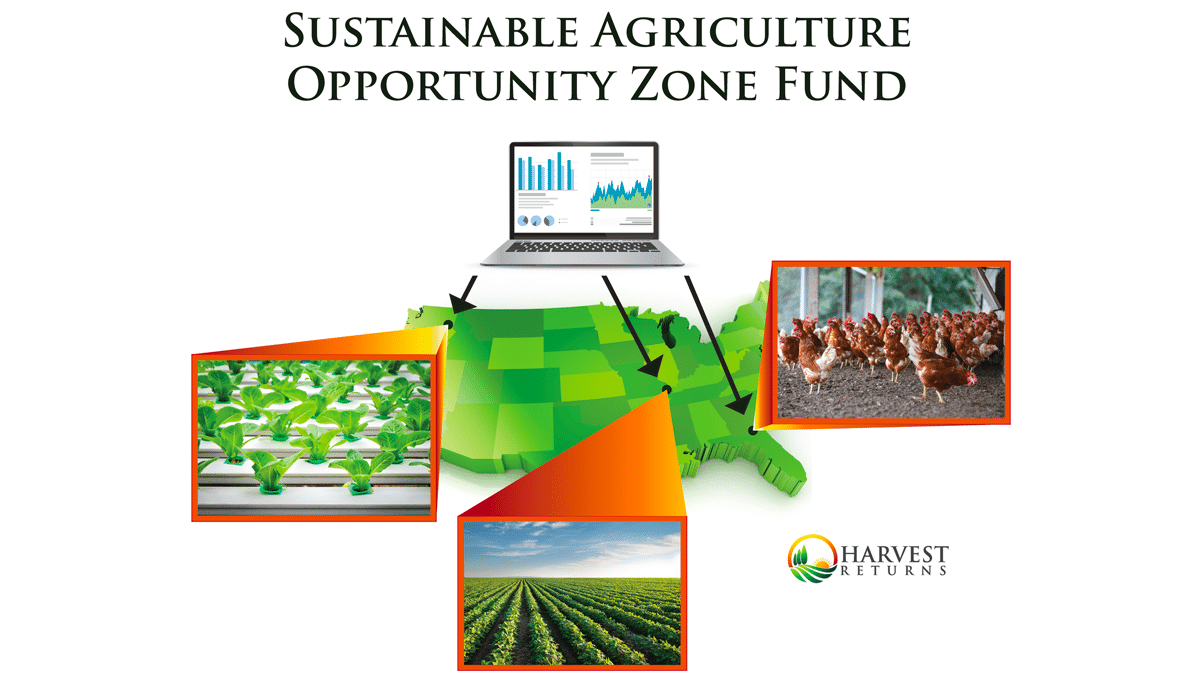

If you want your money to be an impact investment, Harvest Returns offers the Sustainable Agriculture Opportunity Zone Fund, which will:

Invest and create a positive impact on the agricultural industry across economically disadvantaged regions of the United States and provide investors with tax-favorable risk-adjusted returns in non-correlated assets. The fund’s investment objective is to achieve tax-advantaged capital appreciation in production agricultural projects that are economically, socially, and environmentally sustainable.

And because we don’t invest money for entirely altruistic reasons, we want to get something out of it; there are some pretty nice tax advantages to investing in Opportunity Zones.

- Temporary Deferral: Capital gains from the sale of any asset (when reinvested in 180 days) are deferred until the sale of the new investment or December 31, 2026, whichever comes first.

- Step-Up In Basis: Any investment re-invested and held for five years gets a tax basis increase of 10%, and any investment held for seven years gets a tax basis increase of 15%.

- Permanent Exclusion: Investments held for ten years will pay no capital gains tax on post-acquisition gains. This permanent exclusion applies only to the gains accrued in the OZ Fund.

There are also tax advantages to agricultural investing in general, including depreciation, property tax savings, and conservation trusts.

Agricultural Investing as an Alternative Investment

A few episodes ago, we discussed using your self-directed IRA to make alternative investments as a way to diversify your portfolio. Agricultural investing is an excellent way to add diversification, and you can invest in Harvest Returns though the self-directed IRA you opened with Alto!

The best investment on earth is the earth.

Tweet ThisSome types of transactions may not be allowed, so you’ll need to check with the custodian of your self-directed IRA.

Risks of Investing in Agriculture

As you know, there is no such thing as a risk-free investment. That said, people have to eat no matter what the economy is doing or what shape their finances are in. On the other hand, we can cut back on the number of new iPhones we buy when a recession hits or when we lose our jobs.

Within agricultural investing, you can diversify. There are different sectors with different risk profiles. You can invest based on location, production method, or crop type. As an alternative investment, agriculture has little or no correlation to the stock market.

Tariffs and trade wars are something farmers, and other producers are dealing with. The solution may be for producers to transition to a new crop. Soy farmers who are losing out to Brasil may switch to peas which are an ingredient in meat alternatives and vegan protein products. Hemp is another increasingly popular crop due to its use in CBD oil products.

Get our best strategies, tools, and support sent straight to your inbox.

Who is Investing in Agriculture For?

Investing in agriculture is more complicated than investing in the stock market through

If you’re to the point in your investing life where you have or are considering investing in real estate, i.e., you have a substantial emergency fund, you’re maxing out your retirement accounts, and you’re looking to increase the diversity of your portfolio with alternative assets, investing in agricultural could be something to consider.

Harvest Returns

Harvest Returns was founded in 2016 by Chris Rawley. The platform offers:

An equity partnership format, agriculture producers and landowners are able to collect capital and maintain control over their operations, while investors passively fund them and collect returns from harvests.

Agriculture producers submit their operation to Harvest Returns for inclusion on the platform. Investors can read the specs of each investment opportunity and choose those they want to invest in. Investment minimums range from $5,000 to $25,000.

Choosing Producers

The platform is looking for those with a history and background in agriculture, not city people who move to the country and start a hobby farm as a lark. They also want people who are good business people. You can be a good farmer or rancher or doctor or lawyer and be a terrible business person.

Harvest Returns wants producers who have large contracts for their products already in place. And they’re looking for excellent opportunities that traditional banks turn down for reasons we discussed above.

The company has done a few small, experimental projects overseas, including a cocoa farm in West Africa, but most of the investment opportunities are in the U.S.

Investing with Harvest Returns

Anyone can create an account and peruse the investment opportunities on Harvest Returns. Do you have to be an accredited investor?

Maybe. Most of our deals require investors to be accredited per SEC regulations. There are some deals listed under Rule 506(b) that allow a limited number of “retail” or non-accredited deals. Details on who can invest are in the offering listing and offering documents which should be read before investing.

You can track your investment on your Dashboard, and you will receive regular updates on the progress of your investment. And remember, you can visit the farm! Distributions are made once crops are harvested. That can be quarterly for vertical farms, but most crops are harvested annually.

For Producers

Are you a producer looking for funding who has been turned down by traditional lenders? Harvest Returns may be the answer. You can apply on the site. If you meet the initial requirements, the company will ask for additional documentation to learn more, including a business plan and financial projections.

If accepted, you’ll sign a Listing Agreement that explains the terms of the crowdfunding and what to expect during the process. The project will go live on the platform. If the goal is met, you’ll receive funding. You and Harvest Returns will work together to keep investors updated, provide financial statements and tax documents, and make investor distributions.

We’ve Learned Something New

Everyone at LMM is a committed city dweller, so agriculture was not on our radar in any sense nevermind as an investment. But we learned something new and wanted to share it with all of you.

These kinds of alternative investments can not only help your portfolio but help small producers, struggling communities, and the environment too. Pretty intriguing. We hope you thought so too.

Show Notes

Fat Orange Cat: A white stout brewed with coffee and chocolate

Melcher Street: A double dry-hopped IPA

Dallas Blonde: An American blonde ale.

Harvest Returns: Impact investing in small farms.