Are you thinking of buying a home? Ideally, you will have at least a 20% down payment. Here are some ways to save for a house fast.

For many of us, owning our own home is still part of the American dream. Once upon a time, banks were handing out mortgages to anyone with a pulse. After the 2007 crash, that all changed. If you want to buy a home, you’ll need a down payment. We’re going to save for a house fast!

Step 1: Know Your Budget

Be Realistic

It’s seductive when you start seeing those numbers in mortgage calculators. If you bought a house, the monthly payment would be less than your rent!

But that low number is deceiving, there are lots of hidden expenses during the home buying process, not to mention those expenses a homeowner has that a renter doesn’t.

When you buy a home you will pay a loan origination fee, the real estate agent’s fee, if you worked with one, you’ll be required to buy various types of insurance, closing costs.

Once the house is yours, you’ll need to pay moving expenses, possibly buy additional furnishings, lawn care equipment, the home might need some renovations. It all adds up.

Personal Capital is Now Empower - Track your entire portfolio for free.

All your accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

Use Percentages

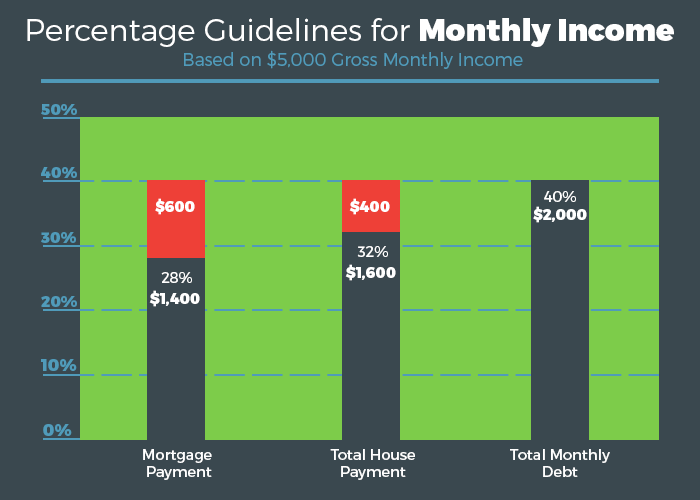

It’s cleaner and easier to understand percentages than dollar amounts when you’re calculating how much house you can afford. There are a few easy rules of thumb we can use to figure it out.

Your monthly mortgage payment should not exceed 28% of your gross monthly income (the amount you earn before taxes are taken out).

Your total housing payments, which includes the mortgage and things like, homeowner’s insurance, private mortgage insurance, common fees (if you’re in a condo), and property taxes, should not exceed 32% of your gross monthly income.

Lastly, your total debt, housing, loans, credit card balances, should not exceed 40% of your gross monthly income.

Step 2: Decide What Kind Of House

A Single Family House

If you have visions of white picket fences and weekends spent gardening, this is the choice for you. This will probably be the choice with the most additional expenses, though.

A Multi-Family Home

A single family home is not necessarily an investment. But a multi-family home is. You live in one unit and rent out the others as a source of passive income. You may even be able to rent at a rate that pays the entire mortgage so you are essentially living in your home mortgage free.

Even if you live in the apartment next to your renters, you don’t have to be a hands-on landlord if you don’t have the time or inclination. You can hire a property management company to handle all aspects of being a landlord.

A Condo

If you aren’t the DIY type when it comes to things like clogged drains and yard work, a condo might be just the home for you. Just like any other type of home, though, there are costs other than the mortgage. In a condo, you will have things like common fees and assessments.

Fixer Upper

If you are the DIY type, you can get a good bargain on a fixer-upper. If you can find a place that doesn’t need a complete overhaul, even better. You can live in the house and work on it as time and money allow.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Step 3: Your Down Payment

How Much Will You Put Down?

At least, twenty percent of the purchase price is ideal. If you have that much cash, you’re more likely to be approved for a mortgage, you’ll get a lower interest rate, have more equity in your home from the start, and have a lower monthly mortgage payment.

First Time Home Buyer Programs

You can buy a home with less than a 20% down payment, even with no down payment under some first time home buyer programs. The most common type of low down payment mortgage is available through the FHA, the Federal Housing Administration, who back loans made by approved lenders.

If you can’t save up the 20% down payment or if you have a low credit score, you may still be able to get a mortgage through one of these programs. If your FICO score is above 580, you can qualify for the 3.5% rate. You can even get a loan with a FICO score of 500 but will be required to put 10% down.

If you meet eligibility requirements, you may be able to get a mortgage with $0 down through a Veteran’s Administration loan or a US Department of Agriculture loan.

Of course, nothing is as good as it seems and there are some extra expenses if you take out a low down payment mortgage. You will be required to have mortgage insurance, known as MIP, mortgage insurance premium. A conventional mortgage requires insurance, PMI, or private mortgage insurance but there are ways to avoid it, which is not the case for an FHA mortgage.

Step 4: Earn More Money

Use Your IRA

You can take money from your IRA without the 10% early withdrawal penalty when you use the money for a home. If you have a traditional IRA, you can up to $10,000 with no penalty but you will still be required to pay taxes on the amount. If you have a Roth IRA that is at least five years old, you can use it to fund a home purchase without tax or early withdrawal penalties.

Change Jobs

Sure you can ask for a raise but even if you get one, it will probably only be a few percentage points. The average raise in 2014 was a measly 3%. If you want to earn more money, you need to change jobs. If you stay in a job longer than two years, you will make an average of 50% less over your lifetime than if you had job hopped.

Tighten up your resume and start looking around. Not just until you have your down payment, though, you should always be on the lookout for a better-paying opportunity.

Work A Second Job

This is good advice whether you’re saving for a down payment, trying to pay off debt, or looking to retire early. It doesn’t have to be forever, even picking up an evening, weekend retail job around the holidays for a few weeks will help you build up your down payment money.

Start A Side Hustle

If you have an irregular schedule at your day job, starting a side hustle will give you more flexibility. People tend to think of side hustles as online projects and they can be, but it’s faster and easier to make money in the regular world.

Start driving for Lyft or Uber. Become a tasker through Task Rabbit. Start a babysitting service. Give music lessons. A side hustle doesn’t have to be something really formal, just a way to make some extra money in your spare time.

Sell Your Stuff

You have too much. You don’t want all that old stuff cluttering up your new home do you? And the less stuff you have, the less stuff you have to pay movers to take to your new place. Sell your stuff!

Step 5: Save More Money

Taxes

There is a tax credit called the saver’s credit for low to moderate income taxpayers who save for retirement. If you are eligible, you can claim this for the following retirement accounts: 401k, 403(b), 457 Plan, Simple IRA, SEP IRA, traditional and Roth IRA’s.

Some low to moderate wage workers may also be eligible for the Earned Income Tax Credit. If you earn less than $52,427 per year, check here to see if you qualify. If you do, it can reduce the amount of taxes you owe and may give you a tax refund.

Student Loans

It’s important to pay off debt but some student loans have pretty low-interest rates so if saving for a home is a big priority for you, it’s worth looking into ways to lower your student loan payments.

You may be eligible for the income-based repayment program if you have a federal loan. Your monthly payment is based on your income and family size. You may have been eligible for some time but weren’t saving for a big savings goal like a home so were not taking advantage of the program.

You may also be able to defer your payment entirely for a certain amount of time. Keep in mind, that you will likely end up paying more interest if you take advantage of one of these programs so decide what your priority is, saving for a home or killing of these loans.

Lower Big Expenses

Yes, you can cut down on your coffee habit and we’ll cover that, but that is not going to have nearly as much impact as cutting down on the big-ticket expenses.

Housing is the biggest expense for most of us. There are a few ways you can cut this. No one likes to downgrade to a smaller place or one in a less desirable neighborhood but think about why you’re doing it.

If you can just suck it up and live in a studio for a year or live in a place not surrounded by great bars, restaurants, and fun things to do (also saving you money), you will save so much. And when you’ve saved all that money, you will be able to live in a whole house! You can celebrate by turning cartwheels in all that open space.

The only thing I would caution against if you’re thinking of doing this, is not to move so far away from work in order to save money that your commute becomes more expensive and more unbearable. Remember, money isn’t everything and a two-hour daily commute is no way to live, no matter how much it saves you.

You can also rent out part of your current place. Get a roommate or even just rent the whole place or a room out via Airbnb.

Transportation

I know in some places you must have a car due to the lack of public transit. If you live in such a place, you get a pass on getting rid of the car entirely. But do you have to drive everywhere?

Make a list of every car trip you took for a week. Now look at the list. Surely there are a few trips you could cut, either by walking or biking or just be more strategic and planning your day so you can combine errands into fewer trips.

If you do live in a place with public transit, seriously consider getting rid of the car. Why do you even have one in the first place? Convenience, laziness? Not good enough if you really want to save for a house fast.

Lower 401(k) Contributions

It’s important to save for retirement and if you’re getting matching, continue contributing the amount you need to sustain that because it’s free money. But if you’re still decades from retirement, consider lowering your contribution until you have your down payment saved.

Live On One Income

This only usually comes up after a child and one parent decides to stay home with the baby. Lots of people make one income work in this case. Why can’t you do the same? Of course, one partner won’t quit their job. The two of you will just figure out how to live in one income while putting the rest in a savings account.

Lower Small Expenses

No, this won’t have the same impact that moving to a cheaper place will have, but every dollar counts. I won’t belabor this because we all know where you waste money, buying coffee, buying lunch, going out for dinner and drinks too often.

These things all add up and if you’re serious about buying a home, you’ll give them up. Go through your Mint transactions and see where these little leaks are coming from.

Your Big Savings Goal

Saving up tens of thousands of dollars can seem overwhelming when you’re starting from near zero but people do it. It’s not only rich people buying houses, not yet anyway. Be realistic about what you can afford and you can start picking out paint colors sooner than you think you just need a savings plan.