The media loves to talk about the economy in a broad sense but what does it mean for us individually? We’ll explain how the current economy is affecting your wallet.

There are four major economic topics that are generating most of the ink in the past several months. What’s happening in the current economy and should we worry?

Debt

There are two types of debt that continue to grow.

National Debt

The national debt stands at $21.3 trillion. At its current rate of growth, by the year 2028, it will be almost equal to the size of the entire U.S. economy. Should we worry?

Well, yes and no. It’s a bit like climate change. We can continue to kick the can down the road, so it doesn’t affect us too much in the short term but long term, this kind of unrestrained debt can have dire consequences.

This amount of debt threatens programs like Social Security and Medicare. These kinds of so-called “entitlement programs” now account for almost two-thirds of the federal budget. It will be hard to cut national debt without making significant cuts to entitlements.

In our country’s existence, we have never found the limit where the national debt becomes too much. If we can’t find the limit on our own, some kind of catastrophic economic correction will find it for us.

Continuing to kick the can down the road this way is immoral. But that doesn’t concern the Boomers whose motto seems to be, “I got mine, fuck everyone who comes after.” Like climate change, by the time the national debt is a problem, they’ll be dead.

Blessed are the young for they shall inherit the national debt.

Tweet ThisIronically, our mad spending on defense now may threaten national security one day. All those shiny new toys the DOD buys now when our national security isn’t at risk from the kind of things they can defend us from means that if the day comes, we are under physical threat, they won’t be shiny and new anymore. But there won’t be any money left for new ones.

We need to worry about the national debt because politicians aren’t. Again, all that pork barrel spending gets them reelected, but when it’s time to pay the piper, they will be long out of office and long dead.

All that said, should you stay awake at night worrying about this? Not for now.

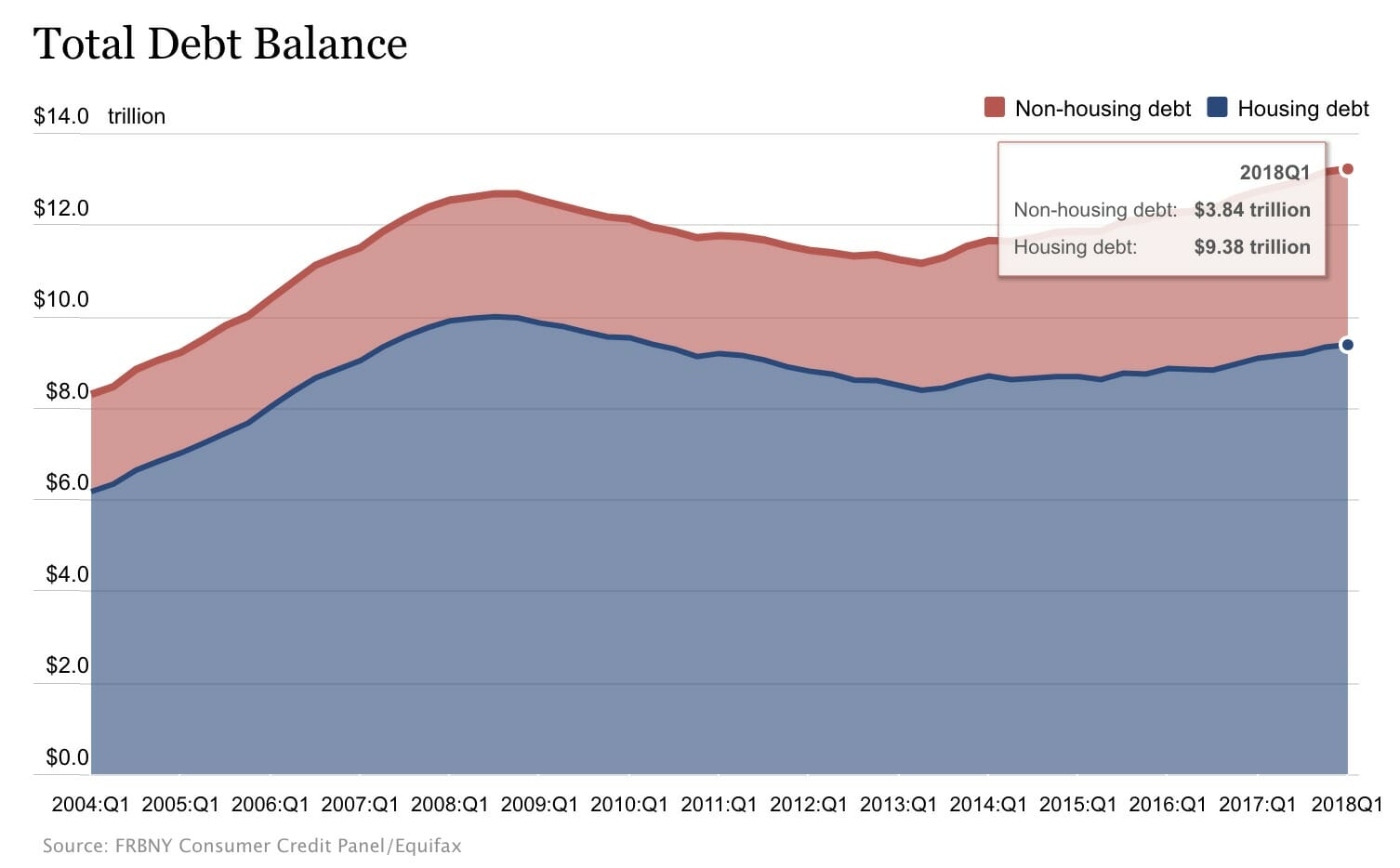

Household Debt

Household debt in the U.S. is also at an all-time high, $13.2 trillion. Most of that is mortgage debt which can be considered “good debt.”

Economists are not bothered by this, explaining that this is largely due to inflation and increased population. And the growth is not as rapid as it was before the financial crisis when mortgage debt increased on pace with housing prices.

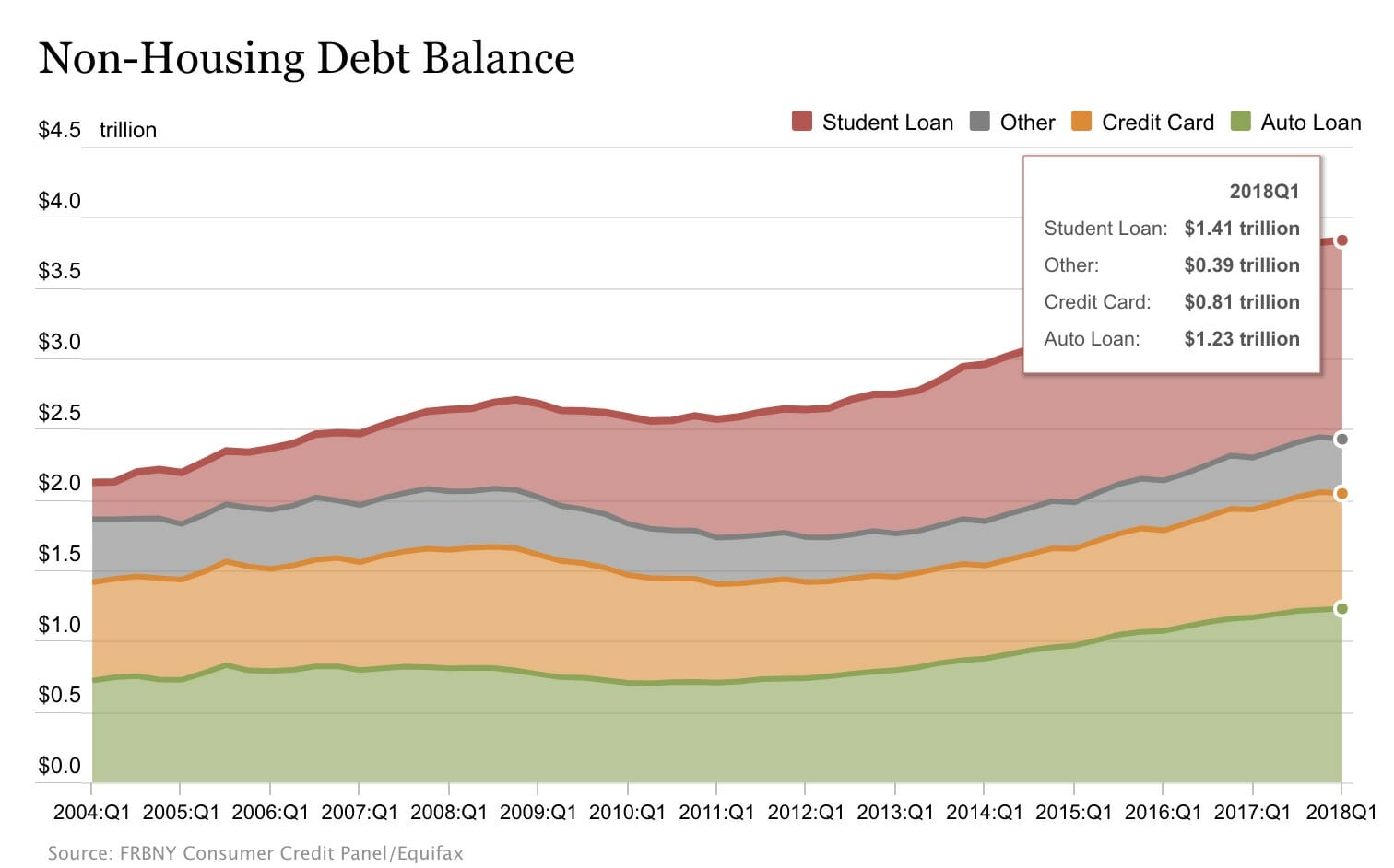

But Americans now have “layers” of debt obtained through a variety of lenders.

Personal loans hit a record $120 billion. What is driving this? Online borrowing which has made getting a personal loan as fast and easy and placing a Seamless order. In 2010, online loans accounted for just 1% of personal loans, that number is now 36%!

Economists are also not concerned about this. Many of these loans are taken out as debt consolidation loans which when used correctly, to pay off a debt with a higher interest rate, they’re a good thing. And the amounts borrowed are small compared to a mortgage.

Are these debts worrisome for us? Again, not if you’re using the loan to consolidate debt. It’s when you start borrowing to pay for things like a vacation or a wedding that they can become problematic.

Trade War

Trade wars are nothing new, these kinds of push-pull skirmishes have been going on forever. The last big trade war predates World War II, and there is a reason for that. A precursor to the World Trade Organization called the General Agreement on Tariffs and Trade created a system to prevent large-scale trade wars.

But we may be on the verge of one.

The Trump has imposed $34 billion in tariffs on Chinese made goods like televisions, aircraft parts, and medical devices. They will now face a 25% border tax when reaching the U.S. The reason is to punish China for a trade imbalance. They export more goods to the U.S. than they import from us.

If Chines made products are more expensive for U.S. consumers to buy, those consumers would buy cheaper products made elsewhere hurting the Chinese economy.

China has no intention of taking this lying down. They are targeting U.S. exports from Trump country like soybeans and Harley Davidson motorcycles. Take that Trump voters! But not only does this affect jobs in flyover country, but it also affects the rest of us too.

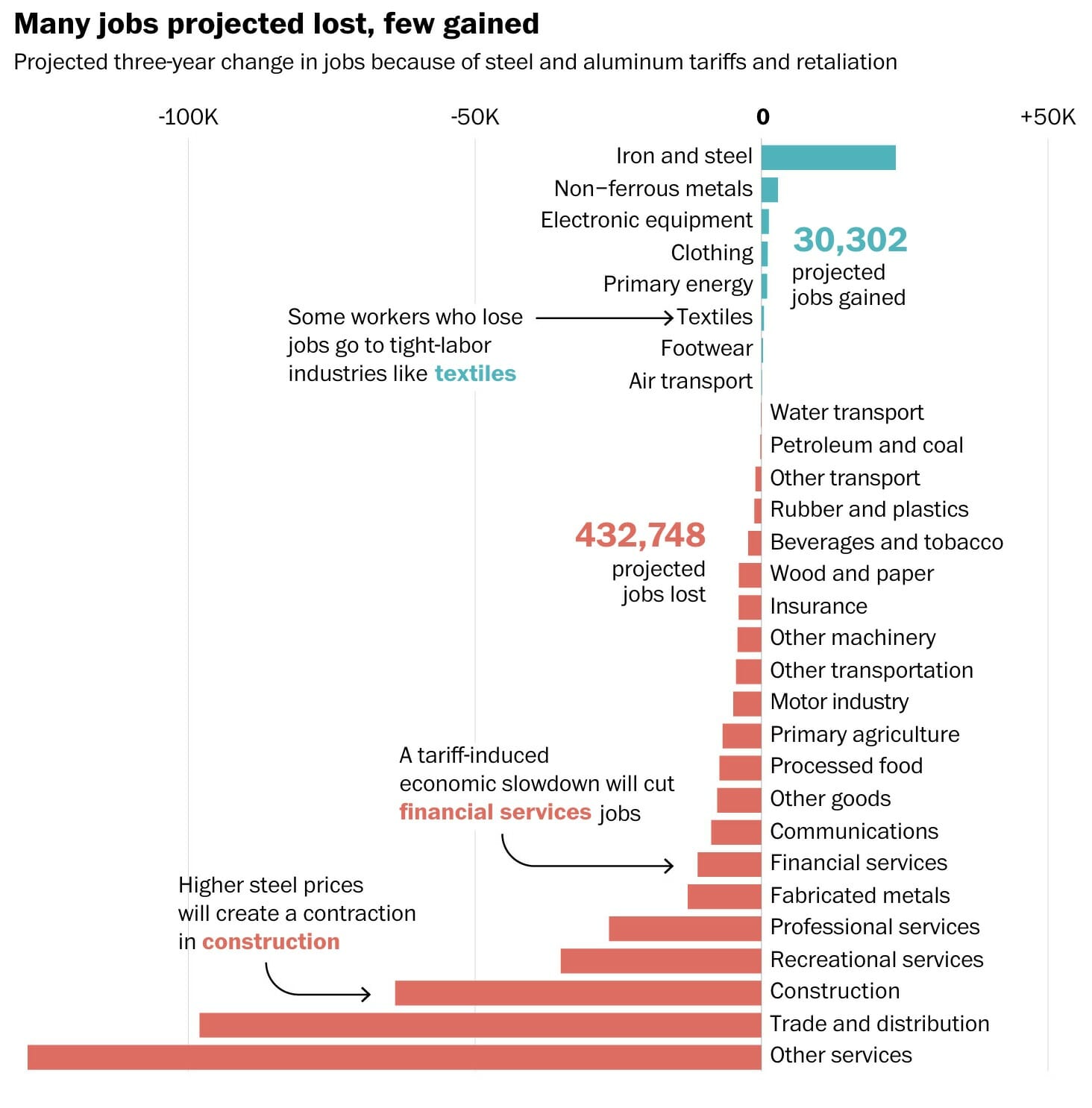

Steel is being hit particularly hard. There is a 25% tariff on $30 billion worth of steel imports. This will make steel more expensive in the U.S. That’s good for companies making steel and aluminum but bad for those who use those products and consumers who buy things made from them.

In the U.S. there are many more companies that use aluminum and steel those companies who make it so this will hurt more Americans than it helps.

If this tit for tat continues it may destroy the rules, the WTO put in place, and a war with no rules is dangerous for everyone. Targeted tariffs will be used to cause as much political and economic damage as possible.

In the scheme of things though, $34 billion is small. Last year, the US imported a total of $478.8 billion worth of goods and services from China. The 25% tariff would be equivalent to a tax increase of $8.5 billion a year, again small when compared to the $150 billion worth of tax cuts Congress approved last year.

Get our best strategies, tools, and support sent straight to your inbox.

INFLATION

Inflation decreases the buying power of your money. If you have $1.00 today, it’s worth $1. You can buy a bottle of water that costs $1. The rate of inflation is about 3%. Next year your $1 is worth $1, but the bottle of water now costs $1.03. Your $1 can no longer buy that bottle of water.

The economy is according to the Federal Reserve, growing but not overheating. Growth is steady, the unemployment rate is low, and the price of goods is only increasing modestly. To keep things growing without overheating, the Fed plans to raise interest rates gradually.

Some economists worry that inflation will rise quickly because the Fed will increase rates faster than “gradually” to balance the effects of the recent tax cuts and growing trade war.

Inflation hit a six-year high this summer of 2.9% which is a sign of economic growth, but wages are not keeping pace with the rise in prices inflation causes. Hourly pay rose just 2.6% for the same period.

The recent increase in inflation is being blamed on increased gas prices. If you were alive in the 1970’s, you’d remember that a similar scenario saw the Fed raise interest rates to double digits which were a disaster for the average American.

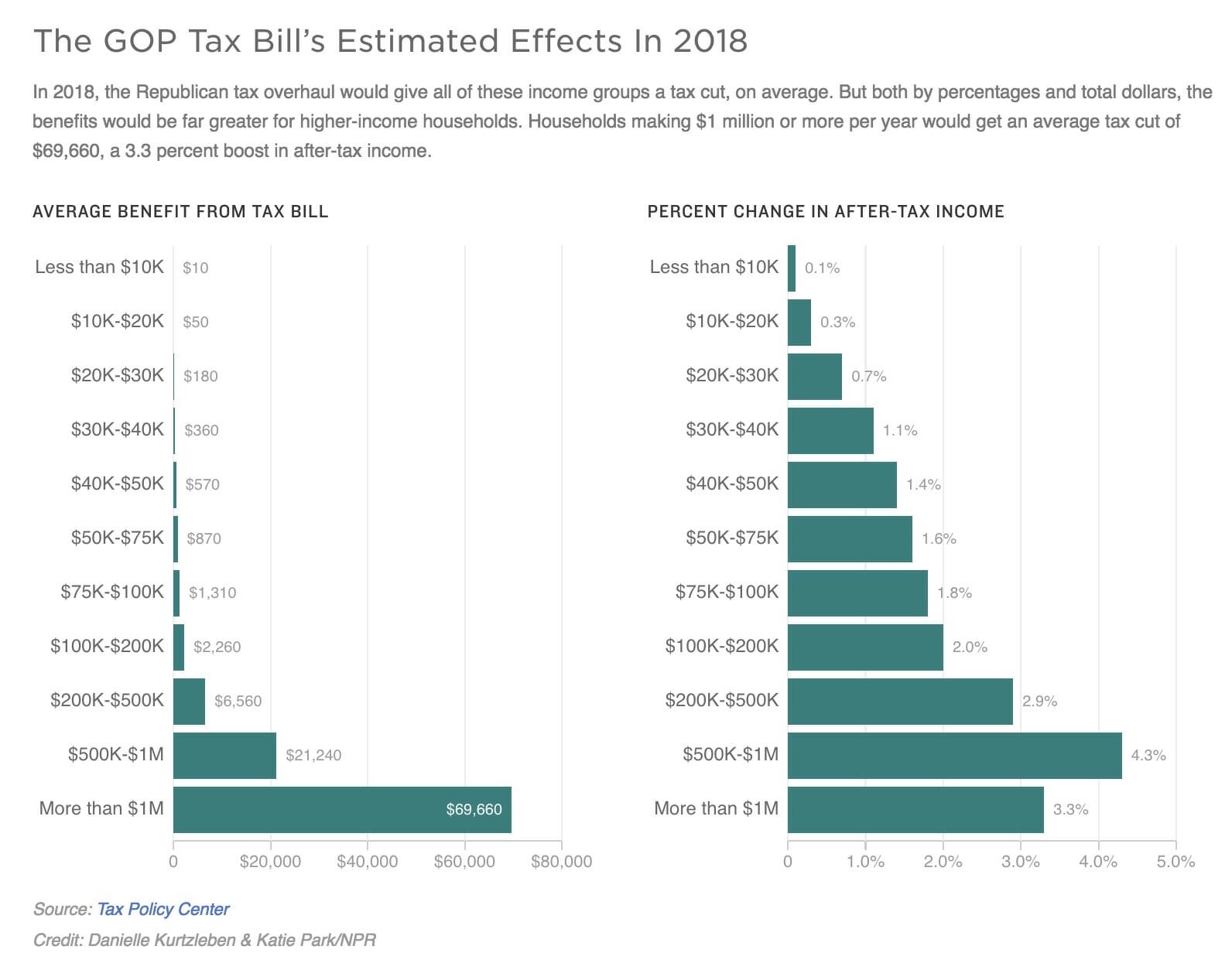

GOP Tax Cuts

The 2018 tax year is when you’ll see the results of the GOP tax cuts. The average household will see a tax cut of $1,610, an increase of about 2.2% in income. Those earning $50,000-$75,000 will see a tax cut of about $870, a 1.6% increase in income. BFD. We just showed you that inflation is 2.9% so this isn’t going to do jack shit for most of us.

If you want to see a real benefit, you better be rich. Households making $1 million and up get a cut of $69,660, a 3.3% increase.

And if you think this still sounds good for most Americans, in keeping with our kicking the can down the road thread, the GOP has timed most of the small benefit the 99% get under this cash grab for the rich out of existence by 2027. Under these cuts, in 2027, 53% of tax filers will see a tax increase.

What Can You Do?

I hate it when we give you bad news you can’t do a lot about, so I’ll tell you what always works in whatever economic climate we happen to be in. Don’t let any news, economic or political, good or bad, change your set-it-and-forget-it investment philosophy. Keep investing.

Perhaps top up your opportunity fund so that when we have a correction, you can scoop up some deals cheaply. If you have “bad” debt, pay it off as quickly as you can. Start or add to your emergency fund. Keep your financial friends close.

And remember, everything is temporary. Countries are too economically entwined to want to see other countries crushed. No matter what we do to China, they still need us to go to Walmart in droves and buy their cheaply made crap.

Show Notes

Neither host is drinking beer this week! I think that is a first.

The Financial Toolbox: All the best stuff we use to manage our money.

Thank you to our sponsors: Divvy and Policy Genius

![Universal Basic Income: Is It Just Another Handout? [UPDATED]](https://www.listenmoneymatters.com/wp-content/uploads/2018/01/LMM-Cover-Images-66-768x432.jpg)