Adam Carroll joins us to discuss how to actually save thousands on your mortgage with home equity lines of credit.

When we interviewed Adam for our new Rich Tips series, he mentioned how he is paying off his mortgage years ahead of schedule and saving thousands of dollars in interest. We were intrigued and asked him to join us to explain his strategy in greater detail.

What Is A Home Equity Line Of Credit?

A home equity line of credit, HELOC, is “An open-ended line of credit extended to a homeowner that uses the borrower’s home as collateral. Once a maximum loan balance is established, the homeowner may draw on the line of credit at his or her discretion.

Interest is charged on a predetermined variable rate, which is usually based on prevailing prime rates.” Most institutions will lend up to about 90% of loan to value.

Qualifying for a HELOC is just like qualifying for a regular mortgage. The bank or credit union will want to see a good credit score and enough income to justify the loan amount. You don’t have to get a HELOC through whatever institution you have your mortgage through. The HELOC lender will become the second lien holder on your property.

What if the worst happens and we have another housing crash like 2008?

Will your entire HELOC come due at once? Your lending institution is unlikely to call in its entire marker. They will probably just freeze the HELOC so that you can no longer pull money out, only pay money in. So you’ll have to go back to the old system, but you’ve still saved a big chunk of interest.

Get cash using your equity. Figure provides a speedy online application process with same-day approval and funding in as little as 5 days. Choose between a HELOC, cash-out-refi, or mortgage refinance.

The HELCO Strategy

Adam has an ingenious use for his HELOC and you can use his strategy too. The HELOC is used as a checking account. All of your income is deposited into it, and all your expenses are paid out.

Depositing your paycheck into the HELOC acts like a payment so you aren’t adding a monthly payment. The money left over at the end of the month gets sent to the mortgage. What this does is send a massive payment to your mortgage each month.

The trick to making this work, though is that you have to make more than you spend. For example, you bought a home for $100,000 with a $20,000 down payment. You can immediately take out a HELOC for $10,000. You then put that toward your mortgage.

In order for this to work though, you must make more than you spend. You make $5,000, spend $4,000 and have $1,000 left. That $1,000 goes into the HELOC until it’s paid off for ten months.

Let’s say your interest rate is 5%. So that’s $500 over 12 months, $41.33 the first month in interest but when the income goes in, you’re paying a little less each month because you’re slowly paying the loan down with that $1,000 a month.

Rather than taking ten months to pay off, it takes around 7. And because your mortgage went from $80,000 to $70,000, you will pay less interest not just over ten months but over the entire life of the loan.

This free course outlines a proven framework that thousands of people have used to eliminate their debt, develop better money habits, and start building a secure financial future.

What If You Don’t Own A Home?

You can still use a similar strategy if you don’t own a home. You can get a personal line of credit, PLOC.

A PLOC is “A loan that you use like a credit card account that you access without using a card. Instead, you write special checks or request a transfer to your checking account by phone or online. You have a credit limit, receive a monthly bill, make at least a minimum payment, pay interest based on your outstanding balance, and possibly pay a fee each time you use the account.

PLOC are unsecured, unlike HELOCs, which are backed by a mortgage on your home. PLOCs are offered by banks and credit unions and usually require that you also have a checking account with the same institution.”

PLOCs have their drawbacks. The interest rate is higher than a HELOC and the interest is not tax-deductible. But if you have high-interest debt and don’t own a home, they can be beneficial.

What Keeps Us In Debt

It’s the way we bank and borrow. Taking out a 30-year mortgage is just SOP in the United States. Amortization is the process of paying off a debt, like a mortgage over time with regular payments. An amortization schedule is a table detailing each periodic payment on that loan.

We borrowed $80,000 to buy our home above. With a 30-year mortgage at 3.5%, you will pay $50,000 in interest when it’s all over! Your first mortgage payment will be $359, of that, $233 will go to pay the interest. It won’t be until year 19 than more of that payment is going to the principal that the interest.

Getting rid of that interest is the power of the HELOC strategy. It pays off a huge chunk of principle to offset the interest over the entire length of the loan. Think of a mortgage like a one-way street; you can pay in but you can’t pull out. A HELOC is a two-way street; you can pay in and pull out.

Adam has a $250,000 mortgage with 20% down. He started using this strategy in October 2012. He now owes less than $100,000 on the home and his savings to date on interest are $160,000! He started this by borrowing just $5,000.

Keys To Make This Work

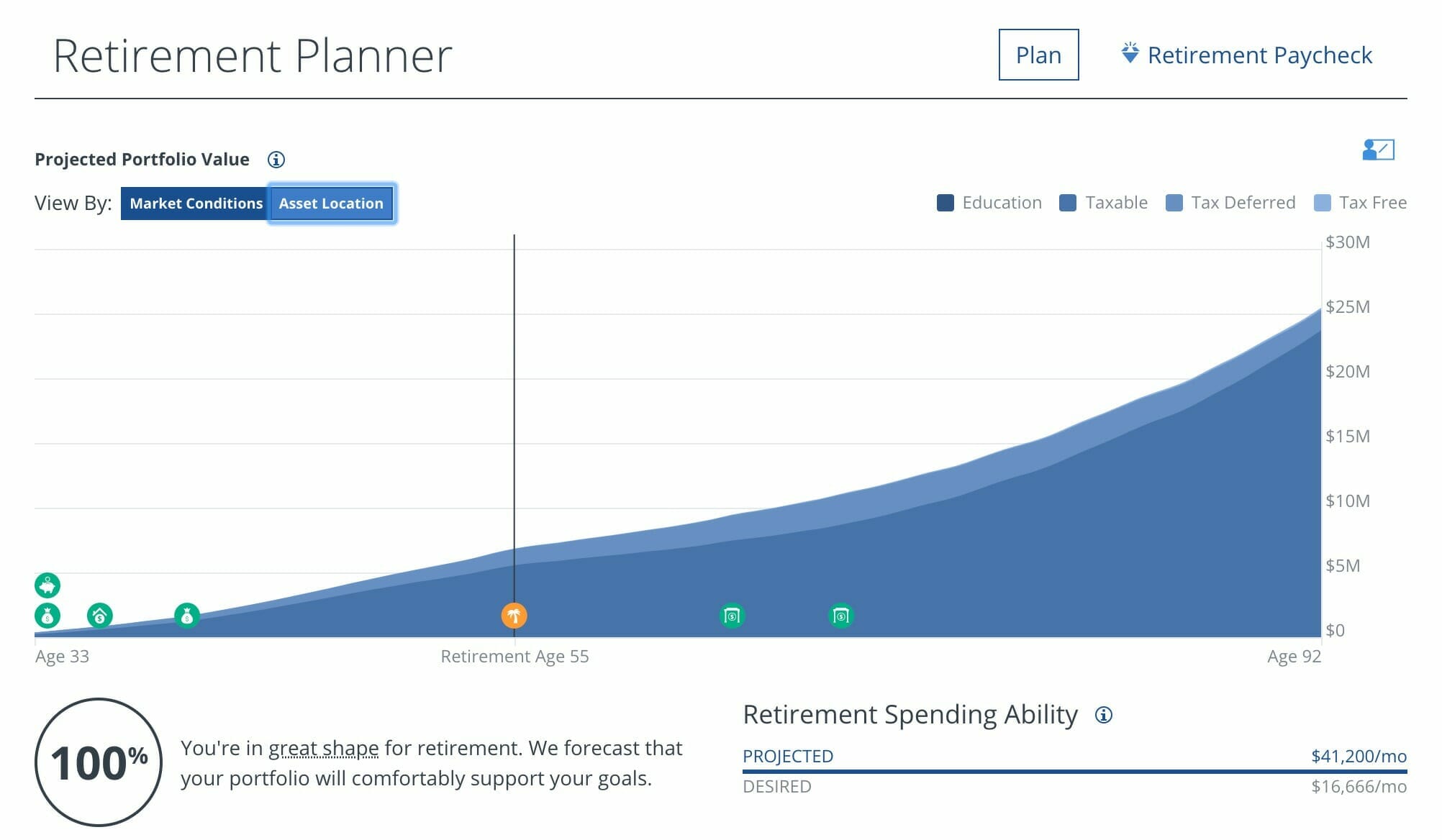

Personal Capital is Now Empower - Track your entire portfolio for free.

All your accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

The keys to make this work are having the discipline to stick to budget and spending less than you earn. If you have money left over each month and are wondering what to do with it, this is a good use.

These are three principles to financial success, a HELOC incorporates them all:

Lean: Keep your monthly payments as low as possible on everything. This way more of your income can go towards debt.

Liquid: In a HELOC you can access the money at any time.

Independent: You don’t need approval to take money out, you can go on-line and transfer money wherever it needs to go.

Your Income Should Have an Impact

Every dollar you earn should have a purpose and a positive impact. Income should do four things;

Cancel Interest: If you have high-interest debt, this is what your income should be doing first. Once that is gone, it can focus on other kinds of interest, like mortgage interest.

Make Interest: Your income should be earning you more income through investments.

Pay Expenses: Of course, you have to pay your bills.

Build Wealth: Your money should build your wealth via things like rental properties.

The problem is, for most people, income is only doing one of these, paying expenses.

Mortgage Interest Deduction

We pay interest for 34% of the money we make over our lives. Some people argue against the strategy outlined here because they enjoy the mortgage deduction they get on their tax returns.

But what if you took the money you saved with this strategy and used it to buy a

Kind of makes the mortgage deduction look measly in comparison.

A New System

We have to rewire our thinking when it comes to home ownership. It’s not necessarily the best thing for everyone but for those who choose to do it, you don’t have to be a slave to a mortgage and a job you hate for thirty years. More than anything else, that mortgage and the interest that comes with it, will be the thing that keeps you in a job you hate.

You can use the HELOC strategy to save thousands on your mortgage and free yourself from that trap.

Build Meaningful Wealth

Manage your cash and optimize your investments in one place. With Personal Capital you can analyze your 401k to diversify your holdings better and reduce fees. I had no idea I was paying over 1% of my assets in fees every year but with there help I was able to get it down below 0.3%.

Once you have all your accounts linked, you can also leverage their Retirement Planner to plot exactly what your retirement would look like. Using a Monte Carlo simulation they determine how likely it is that you’ll reach the level of income in retirement that you’re hoping for.

I’ve been using Personal Capital since 2013 and I haven’t found a better free online tool for building and managing wealth.

Show Notes

Punkless Dunkel: A pumpkin wheat ale.

Dragon’s Milk Bourbon Barrel Stout: A stout with the taste of dark chocolate.

Bankrate Mortgage Calculator: See how much interest you will pay.

![Home Equity Loans: Requirements, HELOCs, and Securing One [UPDATED]](https://www.listenmoneymatters.com/wp-content/uploads/2019/02/home-equity-loans-768x432.png)