This in-depth post breaks down precisely how real estate investors calculate cash on cash return. I’m going to run the numbers for you, so you can determine if yours is a worthy investment. Simply put, if you want to learn how to measure your rental property ‘s performance, you’ll love this post.

Is a Rental Property a Good Investment?

If you’ve been talking about buying a rental property with friends and family, there was probably someone who told you some horror story about owning

It’s important not to make an emotional decision when buying a

Some of us are not numbers people (myself included). Although real estate investment math isn’t calculus, there are a lot of calculations involved. Don’t worry; we’re here to help.

Cash On Cash Return

The cash on cash return metric (CCR) is a simple way of measuring the performance of a potential investment property. It’s a good starting point for quickly filtering potential opportunities.

Cash-On-Cash return = Annual Pretax Cash Flow / Total Cash Invested.

For example, if you put $100,000 cash into the purchase of a property and the annual pretax cash flow is $10,000, then your cash-on-cash return is 10%.

Cash-on-cash return is the return on your

It’s an excellent metric to determine if a property is worthwhile and a straightforward way to compare different properties. Although cash on cash return is a useful back of the napkin evaluation, there are many other essential calculations to consider.

A

Here are some of the key metrics we use to evaluate rental properties so you can get a better understanding of how all the math works.

Annual NOI (Net Operating Income)

It’s the income after property operating expenses. NOI is simply the annual revenue generated by an income-producing property after accounting for all of the income collected from operations and deducting all costs incurred from operations.

NOI excludes any financing or tax expenses incurred by the owner/investor. In other words, the NOI is unique to the property, rather than the investor.

Cap Rate

It’s the annual return on investment without financing.

Gross Yield

This reveals the rate of return on an investment. It’s a valuable number that lets you compare properties quickly. It’s a simple calculation, which is the monthly rent times 12, then divided by the purchase price.

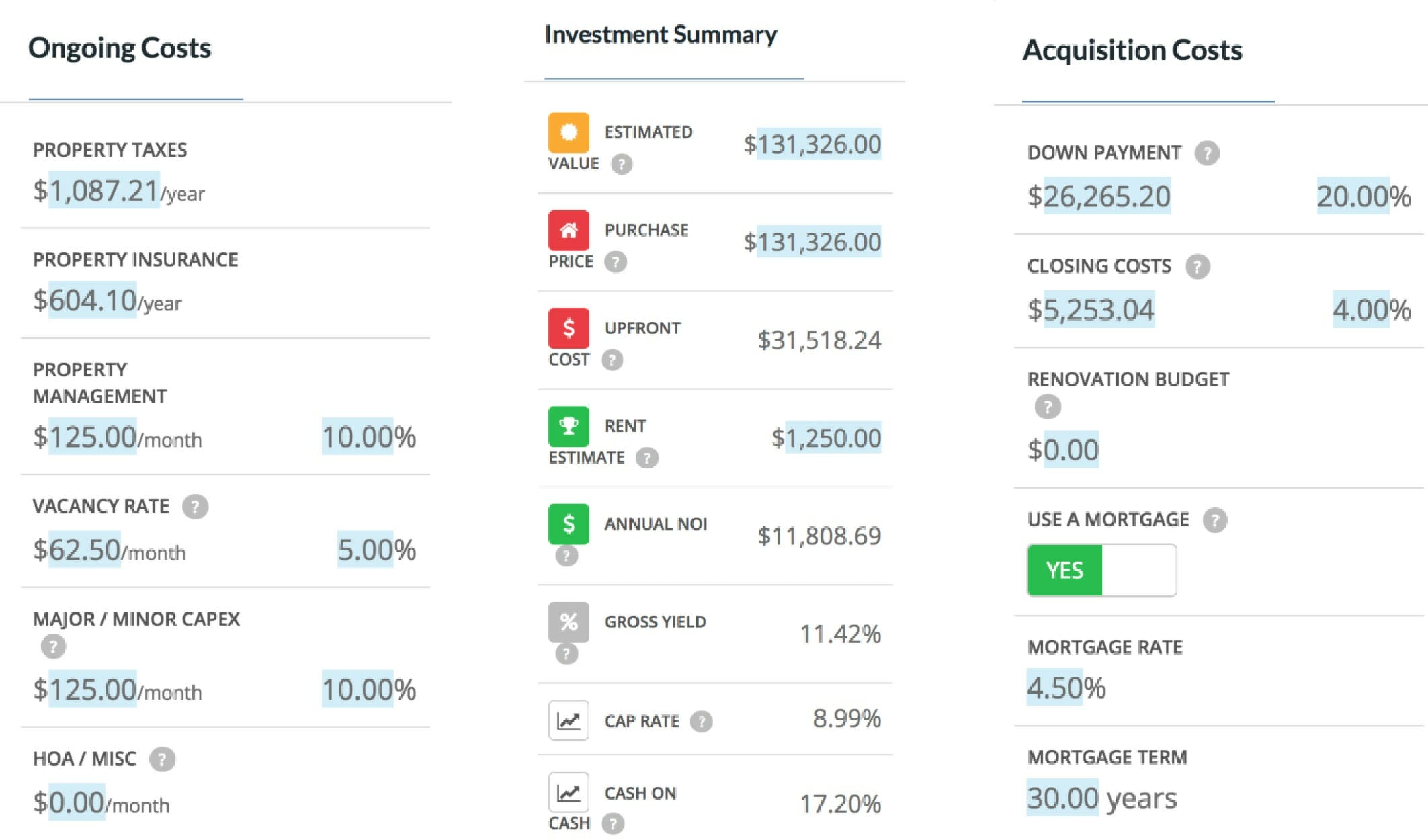

Costs

Purchase Price

It’s the biggest lever you can pull to improve your investment. Even negotiating $1,000 lower can substantially improve your cash-on-cash return.

Getting a good deal on the property itself is the most significant move you can make. We just bought a property for $110,000, and if we negotiated down $1,000, we would have gained 0.5% COC return.

The purchase price determines a

Acquisition Costs

These are the initial costs of purchasing the property, the amount of cash required for financing upfront. The down payment is the amount of money you contribute to a financing deal. The bank funds the remainder of the purchase price in the form of a mortgage.

Like buying a home, you should put 20% down. Private Mortgage Insurance (PMI) is like throwing money away. We went with a fixed-rate mortgage because it allows you to have control of future costs.

You will also want to account for the closing costs. The cost of the transaction, or closing costs, are fees paid at the closing of a deal. Often included in these expenses are the mortgage origination fee, appraisal, and escrowed property taxes.

If you are paying for the property in cash, these costs will be less. You also want to count any major renovation costs as well.

Ongoing Costs

These should be next on your list when evaluating a

Vacancy Rate

It’s an estimation that landlords use to see the total amount of unoccupied rental units. There could be a time when your property is vacant, and you will not be making your estimated monthly rent from a tenant.

To continue the incoming cash flow, even during a vacancy, it would be wise to set aside a percentage of your monthly income in a reserve account.

You can check the vacancy rate for the neighborhood your rental is in, but the U.S. average vacancy rate is 5%. So, let’s say you make $100 per month, 5% or $5 should automatically be funneled into your reserve account.

Capital Expenditures (Cap Ex)

This is money spent on big-ticket items that will need replacing including your roof, windows, and water heater. Set aside a percentage of your rental income to account for these expenditures. It’s not a matter of if they’ll need replacing, but when.

Our proven, data-driven approach to building a portfolio of income-producing rental properties that perform in the long-term.

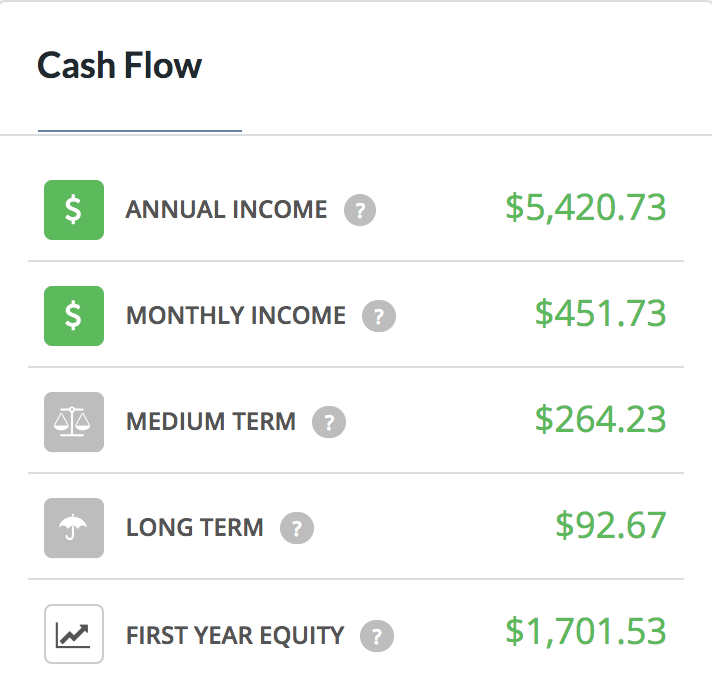

Cash Flow

Annual Cash Flow

This is your profit after all expenses. If this number isn’t positive, that means you’ll lose money every year on this property. If it’s positive, that’s how much you’ll earn. It doesn’t account for a vacancy, maintenance, or broken components.

It does account for taxes, HOA, insurance, management, and other known costs. One way to determine whether a property is a good investment is by the 1% Rule.

What's the 1% Rule?

The 1% Rule is often used in real estate investing and says your monthly rent should equal at least 1% of the

Medium-Term Cash Flow

It gives you an estimation of what your cash flow will be and accounts for vacancy and repairs.

A rule of thumb would be saving 15% of your annual cash flow to account for bumps in the road. The formula looks like:

Rent minus the mortgage payment minus vacancy reserve minus CapEx reserve.

Long-term Cash Flow

It’s similar to the 15% rule for medium-term but more intense. In the long run, you may need to replace a roof, renovate a kitchen, and account for a vacancy.

While not necessary, if you are positive here, you can weather almost any storm and still make money.

Formula: 50% of monthly rent minus the monthly mortgage payment.

Rule of 72

The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. The rule states that you divide the return, expressed as a percentage, into 72.

For example, if your annual rate of return was 9%, your calculation would look like this:

72 divided by 9 = 8 years for your investment to double.

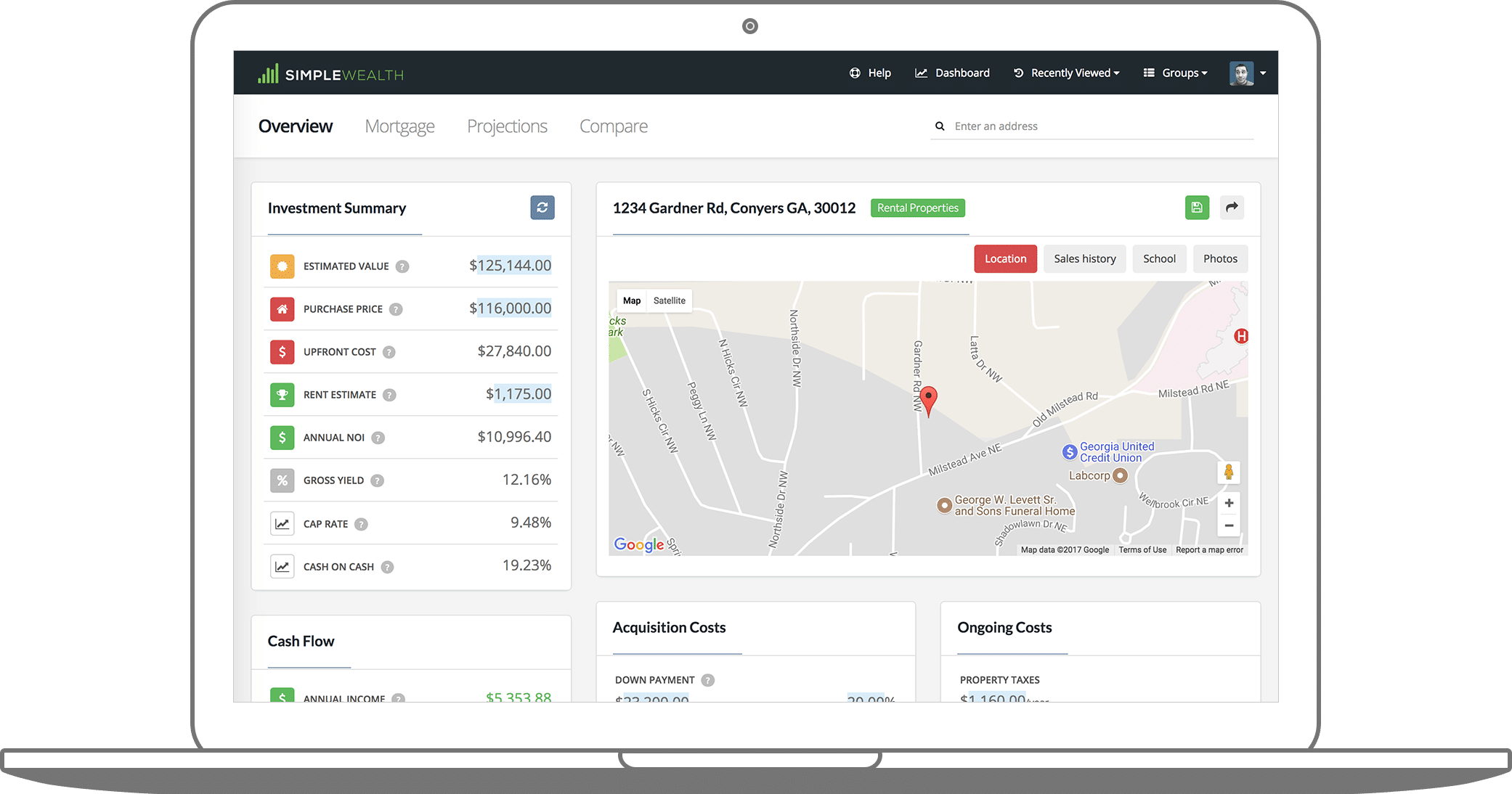

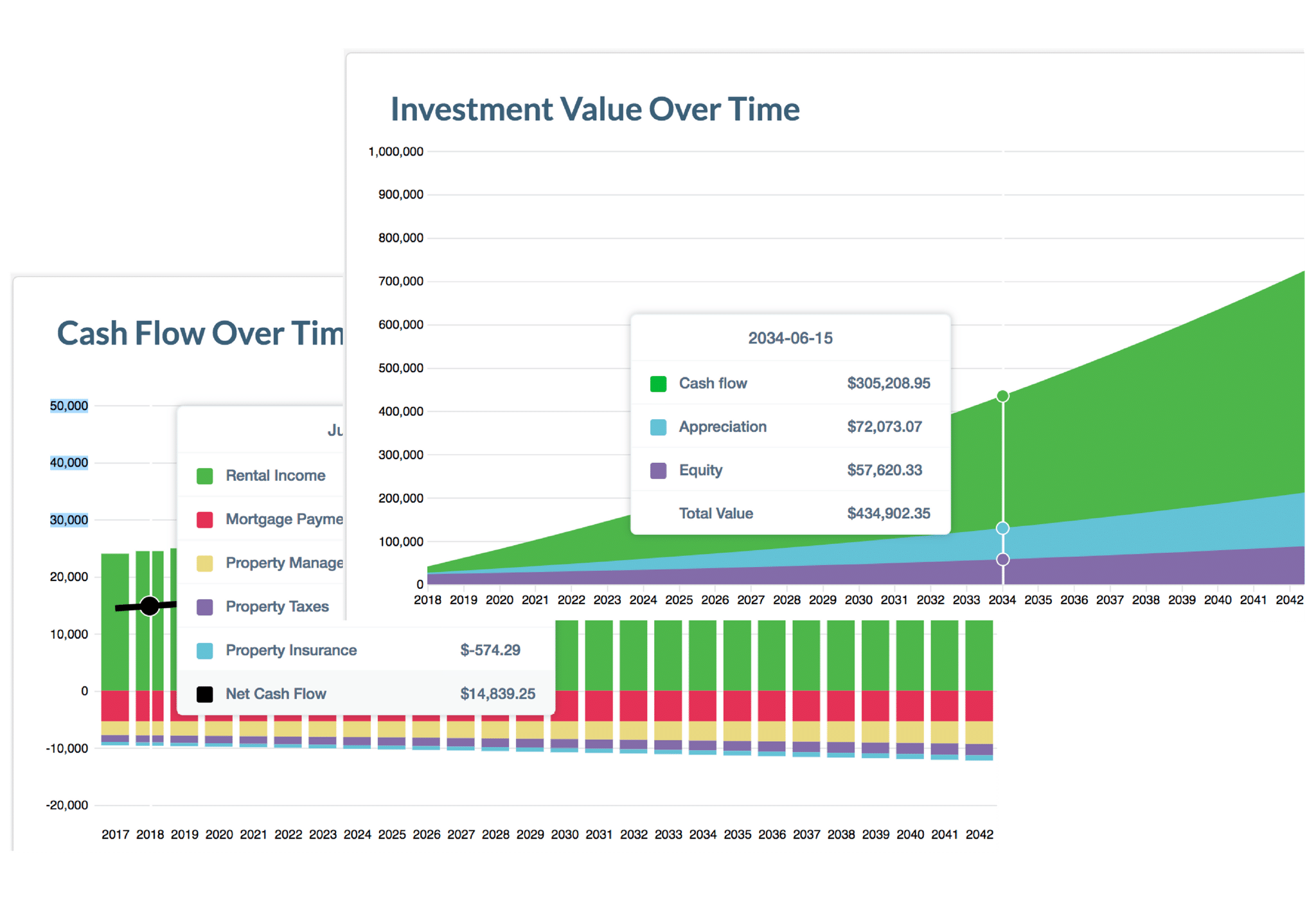

We Created a Tool to Do the Math for You

Unless you enjoy getting elbow-deep in nerdy spreadsheets, we have something that will do the math for you. Investable is a platform that will help you research, evaluate, and track rental properties.

Not only will it calculate your cash on cash return, but it will also help you understand your property’s income, appreciation, and equity. It will also help you determine your cap rate, NOI, gross yield, rent estimates, and vacancy rate.

If you’ve always wanted to build a profitable real estate investment portfolio, this tool will show you how.

Start your free property analysis.

And if you’re looking for something that walks you through the entire process of building a portfolio of income-producing rental properties, check out our course: Rental Properties for Passive Investors.

You’ll learn our exact approach for finding (and closing) the right property, the foundations of a successful rental business, the advantages of shielding your assets in an LLC, and more!

Final Thoughts

Real estate investing for beginners can seem intimidating at first, but once you understand math, you will trust it. The cash on cash calculation is one way to shield yourself from making poor investment choices. It’s a number’s game.

Do your homework and learn everything you can before getting started. Connect with other real estate investors and ask as many questions as possible. Go to local meetups or talk to some experts in the LMM Community.

Show Notes

Investable – Create a free account today