Between paying and preparing taxes, I’m not sure which is worse. With so many choices showing up on a simple “free tax software” Google search, even picking your software is challenging. But worry not. We reviewed the top contenders and are comparing them all right here to find the best free tax software.

We’re going to look at the base packages for online tax preparation, meaning we’re going to ignore all the add-ons and upcharges. Most of these are comparable between companies and aren’t worth your money anyway.

What we will consider:

- Ease-of-use

- Accuracy

- Customer support

- “Help” buttons to explain what’s being asked

- Notable features at no additional cost

Everyone’s tax situation is different. We know there’s not a one-size-fits-all, one-ring-to-rule-them-all, clear winner. Because of that, we’ll pit them against each other and see which tax preparation software works best for your situation.

If picturing the tax packages as Tekken or WWE fighters helps, I won’t judge.

Best for Simple Filers

Winner: TurboTax.

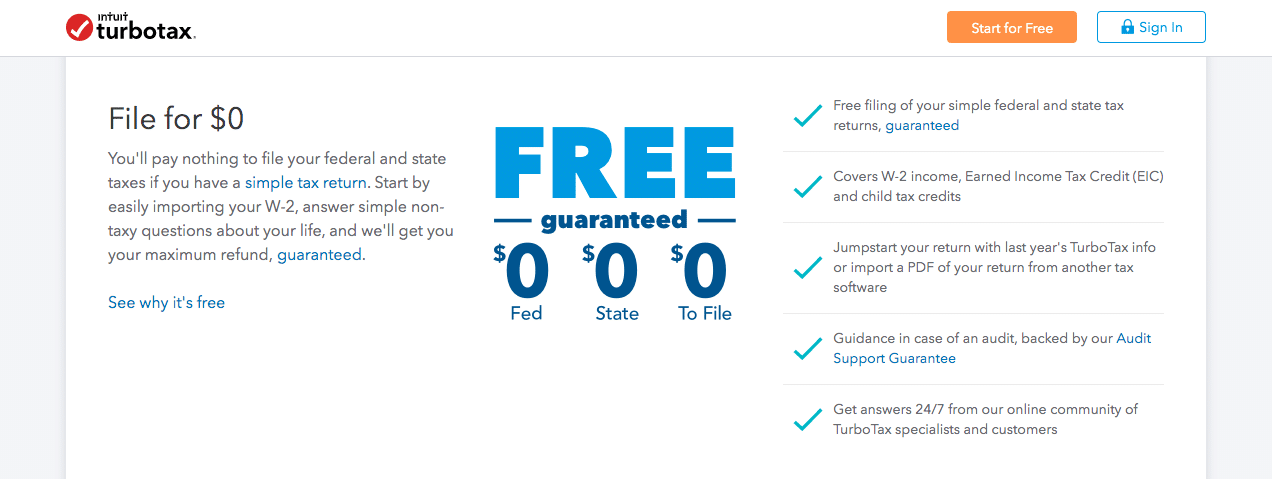

Out of all the software we reviewed, Intuit’s TurboTax ranked the highest. What’s even better is there’s an option to file both federal and state returns for free.

The catch (because there’s always a catch)? The requirements to qualify for the free version are a little restrictive. To qualify, only the following tax matters can apply to you:

- W-2 income

- Small dividends and interest

- Standard deduction (as opposed to itemizing)

- Earned Income Tax Credit (EIC)

- Child Tax Credits

This means you can’t file Schedules 1-6. These schedules contain much of the information that used to be on the old 1040. They were created for the new tax return structure that resulted from the Tax Cuts and Jobs Act in 2018.

Why is this important? Because it means you can’t report student loan interest, Health Savings Account (HSA) contributions, or any other popular items from those schedules.

If this isn’t a problem for you, you’ll have access to TurboTax’s accurate, user-friendly software to maximize your tax refund. You can also use their user forums, download their mobile apps, and try out the new Amazon Alexa skill to check the status of your return.

You can read more about Turbo Tax’s excellent features here.

There is, however, a bit of irony here. Even though TurboTax ranks on our list of the best free tax software, they are infamous for opposing free filing.

I’m all for making money, but it’s worth noting the irony. Do with that what you will.

Boasting millions of happy customers, TurboTax offers both free federal and state filings. Easily import previous year's data and W2s, speak online with an experienced CPA or get a refund estimate using their free tax calculator.

Best for States Without Income Tax

Winner: H&R Block.

Remember how I said TurboTax doesn’t offer Schedules 1-6, which contain the information that used to be on the old, non-postcard 1040?

Well, H&R Block’s free edition does.

The catch? H&R Block only allows you to file your federal tax return for free. They charge $29.99 for a state return.

Unsure if your state has income tax and thus requires you to file a tax return? These states don’t have income taxes and don’t need no stinkin’ returns from you:

- Alaska

- Florida

- Nevada

- New Hampshire*

- South Dakota

- Tennessee*

- Texas

- Washington

- Wyoming

*New Hampshire and Tennessee require tax returns if your interest and dividend income is over a certain amount. For New Hampshire, it’s currently $2,400 for single filers and $4,800 for married filers. For Tennessee, it’s currently $1,250 for single filers and $2,500 for married filers.

While $29.99 for a state tax return disqualifies H&R Block from being totally free, it’s a fair price for their top-notch software that’s super easy to use. Compare that to TurboTax, where you’d pay $59.99 for a federal return and $44.99 for a state return to access Schedules 1-6.

To see what features you’d get for that $29.99 price tag, take a look at our detailed H&R Block review.

Get our best strategies, tools, and support sent straight to your inbox.

Best for Planners

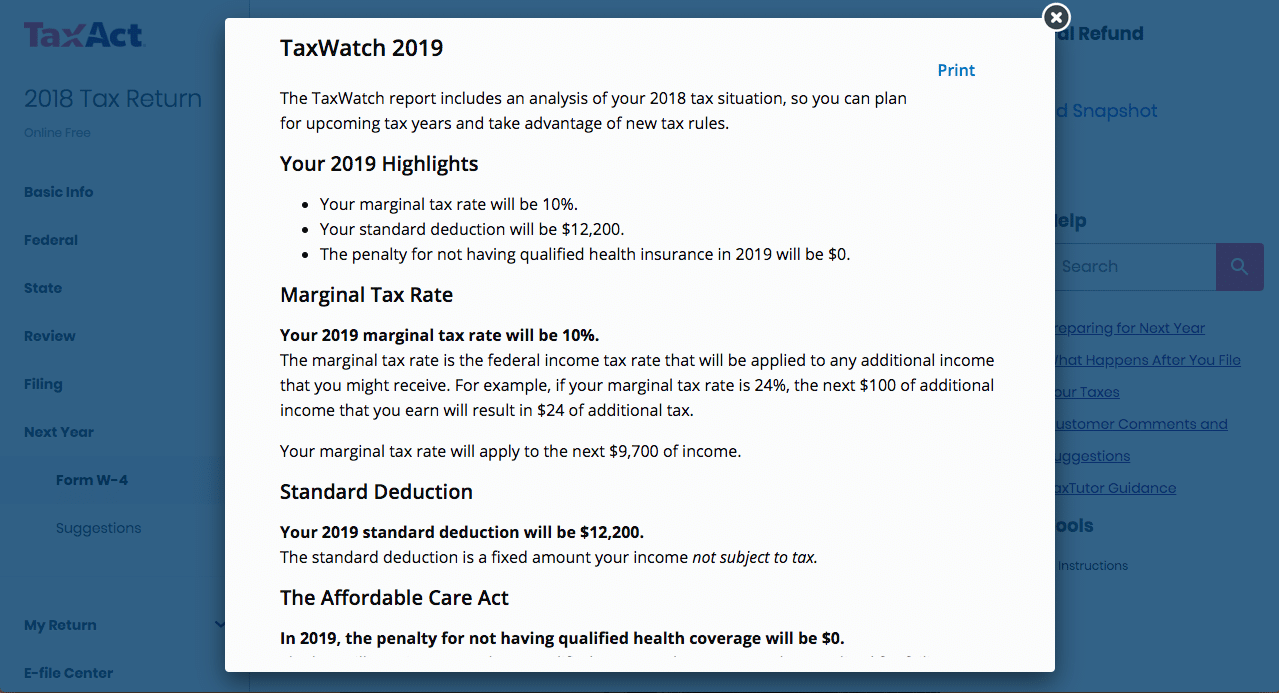

Winner: TaxAct.

The catch? Like H&R Block, state returns aren’t free. You’ll pay $19.95 for a state return.

TaxAct is fairly similar to TurboTax in that it doesn’t offer Schedules 1-6 in the free version. You also can’t claim any dependents unless you upgrade to the paid plans.

With this in mind, TaxAct shines for those who like to run through “what-if” scenarios. Their free, additional features allow you to learn about and plan for your taxes instead of just filing and forgetting about them.

Are you expecting your income to change or wondering what your taxes might look like if you get that promotion next year? TaxAct helps you evaluate your tax withholdings and will help you estimate how this might affect your taxes.

At any point, you can use their TaxWatch system to see important tax planning information. This includes:

- Marginal tax rate

- Standard deduction amount

- Health insurance penalties (or lack thereof)

TaxAct is the champion of additional features, such as the FAFSA worksheet generation. As long as you’re applying for federal student aid for yourself and not your kids (since you have to pay TaxAct to claim them), you can generate answers for the FAFSA while you’re doing your taxes.

This means you don’t have to go back through all your records, try to find your tax return, and try to remember what all of it means when it’s time to apply for aid.

And if you can’t find a copy of your tax return, TaxAct will have a copy for you. They store your taxes for seven years at no additional cost, which isn’t the case for all software.

Our TaxAct review includes all of the details, perks, and user information you’ll need to know.

Best for Advanced Returns

If any of the following apply, I’m talking to you:

- Self-employment

- Rental income

- Itemized deductions

- Large-scale investments

- Capital gains

Winner: Credit Karma Tax.

The catch? “There’s no such thing as a free lunch” in the sense that you’re paying with your data, not your cash. They don’t sell it (yet) but expect to see some targeted advertising coming your way.

What gives Credit Karma Tax an advantage is that it’s totally free. Free for federal. It’s free for state. Free for all forms and schedules, including Schedule C for self-employed income and Schedule E for rental and royalty income.

Schedule C is often the most expensive package for DIY tax software. Because of this, small businesses, freelancers, and independent contractors can get screwed when it comes time to pay for tax preparation.

This doesn’t even include the state filing fees, but some current Schedule C filing fees include:

- TaxAct – $77.95

- H&R Block – $104.99

- TurboTax – $119.99

Remember you get what you pay for. Credit Karma Tax is accurate, but do some squats beforehand because you’ll need to put in some of the leg work here.

Credit Karma Tax isn’t as good at simplifying tax jargon as H&R Block and TurboTax. That’s why their competitors charge those hefty fees.

Tweet ThisIf you’ve been around the (H&R) block a few times and know your way around your tax return, Credit Karma Tax is a great option for you. But if you’re new to doing your taxes, it might be best to start somewhere else.

It’s uncommon to get free filing for things like itemized deductions, rental income, and self-employment income. If you want to know more about how this works and how it’s possible, check out our Credit Karma Tax review.

What If You Don’t Want to Pay with Your Data?

I don’t blame you one bit. Lucky for you, there’s an alternative.

In this case… Winner: FreeTaxUSA.

The catch? You’ll have to pay $14.99 for a state return. Also, FreeTaxUSA isn’t able to file every tax form known to mankind. This shouldn’t impact the majority of filers, but some situations they don’t cover include:

- Foreign employment income

- Installment sales

- Archer MSAs

- Additional tax on excess contributions to IRAs

- Donations of high-value property over $5,000

As long as these situations don’t apply to you, you’re good to go. You can save your privacy and still get awesome, easy, accurate tax return preparation.

For about the same price as a can of dehydrated water, you can file your return and save the $100 or $200 price tag you might pay somewhere else.

If you’re still wondering if this is right for you, read our FreeTaxUSA review for the deets.

Best for Students and Recent Grads

Winner: TaxSlayer.

The catch? You need to have a simple tax return. If you need help, don’t be surprised if you’re put on hold with a fairly sizable wait time for phone support.

What makes TaxSlayer great for students and recent college graduates is the ability to deduct student loan interest and claim education credits for tuition. This isn’t always the case for free editions. Just look back at the “Best for Planners” section to see that TaxAct forces you to pay for these.

I mean, paying student loans with their daily interest accrual is terrible enough. But having to pay to deduct what you already paid is just too much paying.

Thanks to TaxSlayer, the double-edged sword of paying for student loans and their deductions is just a single-edged sword.

It still hurts though.

Check out our TaxSlayer review here to learn all about the pros and cons of their software.

A Note on IRS Free File

If you’re looking for totally free filing and don’t want to sell your data to Credit Karma Tax, there’s still hope.

The IRS has a handy dandy tool called Free File for single and joint filers with incomes under $66,000. This allows you to file your federal and sometimes your state returns for free.

Just go to their website and use their Lookup Tool. You’ll answer a few questions about your age, income, and state residency. After that, you’ll get a list of eligible software you can use for free.

These aren’t just cheap, knockoff software offerings either. When I did this, I was able to use legit programs like H&R Block, TaxSlayer, and TaxAct regardless of what kind of income, credits, and deductions applied.

In Conclusion

Filing taxes is boring and stressful, but it doesn’t have to be expensive. Sure, CPAs and other tax professionals are awesome, but not everyone needs them or can afford them. If we’re doing all the work ourselves, we don’t want to pay CPA prices for online tax software.

Every company is different. Some forms and schedules might be free for one and cost $50 for the next. Research is key, so you’re doing the right thing by seeing what your options are.

Choose wisely this tax season and remember you can switch to a different company – before filing or paying – if something doesn’t feel right.