You may have health, auto, and life insurance, but do you have renter’s insurance? What exactly does renter’s insurance cover, and do you need it?

If you’re an apartment dweller who doesn’t have a renter’s insurance policy, you’re living dangerously. All of your personal belongings are at risk if you don’t have this critical coverage.

What Is Renter’s Insurance?

Auto insurance covers your car or truck, homeowners insurance covers your home, and renter’s insurance covers your personal belongings. People often forego renter’s insurance because they think the landlord’s insurance will cover their property.

But that isn’t true. Any insurance the landlord has covers only damage to the actual dwelling, the building itself. Landlord insurance does not cover a tenant’s personal property.

Editor's Note

What Does Renter’s Insurance Cover?

A renter’s insurance policy covers three things:

- Personal property

- Liability insurance

- Additional living expenses

Personal property coverage pays to replace your stuff if it’s damaged, destroyed, or stolen in the event of things like fire or theft.

Liability coverage insulates you from paying out of pocket for damage you, a family member, or guest cause to the apartment, and from medical bills if a guest in your apartment were to injure themselves.

If you were unable to live in your apartment for a time due to something like water damage, most renter’s insurance policies would cover additional living expenses for things like hotel bills and restaurant meals.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

What’s Not Covered by Renter’s Insurance?

Typically, standard renters insurance coverage does not cover property damage caused by natural disasters like flooding, earthquakes, and sinkholes. Some companies sell additional coverage for these occurrences.

If a pipe were to burst and flood your apartment, standard renters insurance would cover that; it’s considered a separate thing from flooding caused by heavy rain or a hurricane.

“Accidental loss” is not covered, so if you lose your laptop or phone, renters insurance doesn’t offer replacement cost coverage in those circumstances.

If you live with a roommate, their personal belongings are not covered under your policy. They will need to purchase their own renter’s policy.

How Much is Renters Insurance?

A lot of you might have thought about what you pay for car insurance and blanched at the idea of paying for renter’s insurance too. But renter’s insurance is affordable.

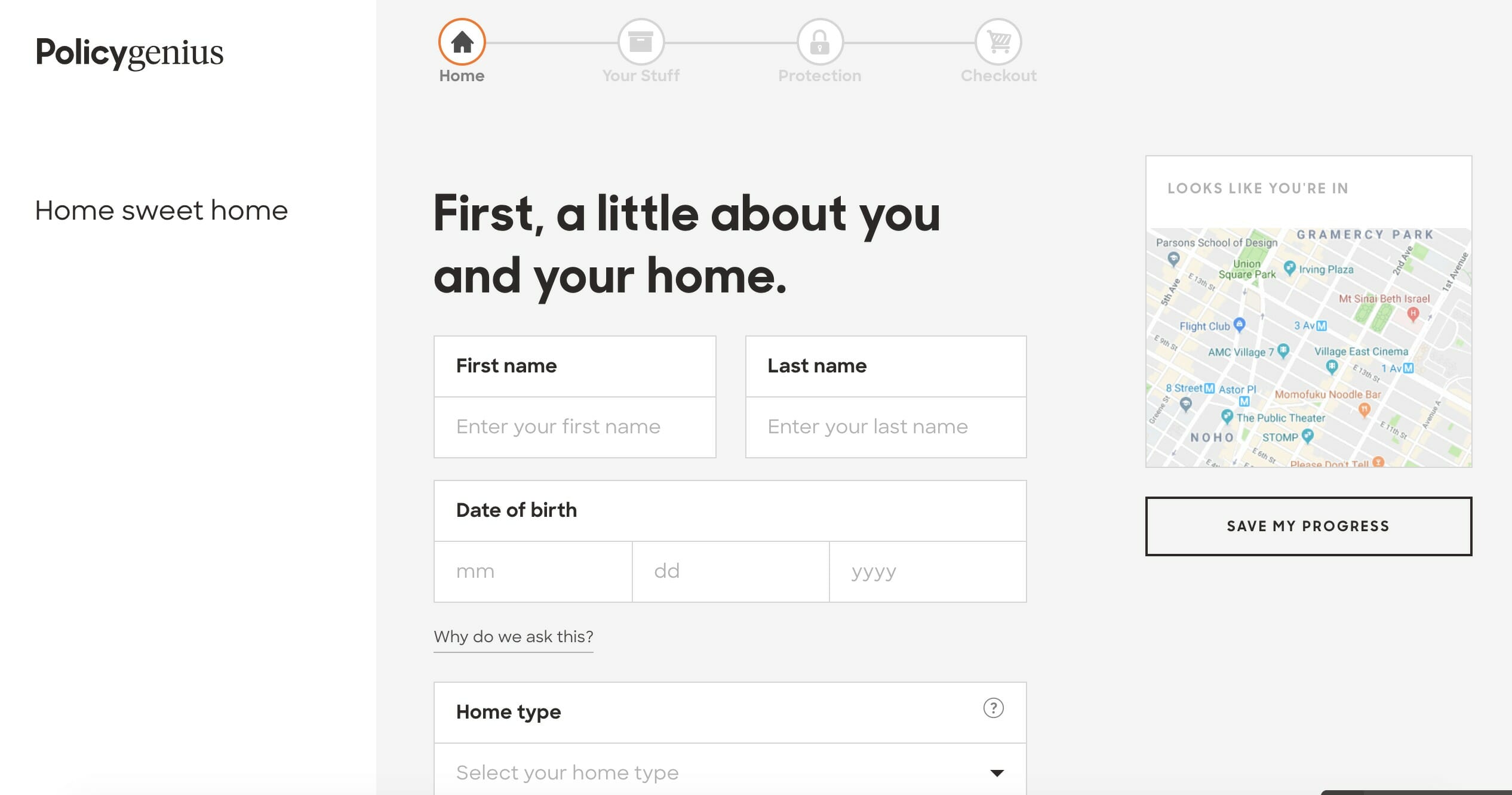

You can go to PolicyGenius and get renters insurance quotes in a few minutes. Just enter your name, date of birth, address, and answer a few basic questions about your apartment and the value of your personal possessions.

Based on your answers, PolicyGenius will suggest the best renters insurance for you.

I live in a small apartment and don’t have a lot of high-end furniture, electronics, or jewelry so I was recommended a standard policy with $25,000 to cover my personal possessions, $300,000 in personal liability, $2,000 in medical payments to others, and $4,000 in loss of use, meaning the amount covered if I was unable to stay in my apartment.

How much is this going to cost me a month? Less than $10, my quote was for $8.83 a month.

No matter how broke you are, I think you can come up with about $10 a month to cover not only all of your stuff but your ass too in case one of your friends gets drunk at your place and falls out a window or something!

Because I like to shop around, I also plugged my information into Lemonade. My quote for $40,000 in property coverage, $100,000 in personal liability, $12,000 in loss of use, and $1,000 in medical payments to others was $12.25 per month.

This Lemonade Video walks through its sign-up process.

Of course, your cost may differ based on how much coverage you think you need. If you have a lot of expensive possessions, your monthly price may be a little higher, but renter’s insurance is affordable.

How Much Coverage Do You Need?

Quick, what is the actual cash value of all of your personal possessions? You have no idea, do you? I think most of us would be hard-pressed to come up with that number.

That’s okay when you’re filling out information to get a quote from an insurance company; you’ll be asked questions that will give you a pretty solid ballpark idea of how much coverage you need to cover your possessions.

“The average renter owns about $20,000 in personal property and is 25 percent more likely to be burglarized than someone who owns a home. “

If you have valuables like artwork, expensive jewelry, or camera equipment, you can purchase a rider that will provide additional coverage for those things. If you live in a flood-prone area, you can buy additional flood coverage.

You Don’t Own a Picasso!

Once you have your coverage in place, go through your apartment and do a thorough inventory of all of your belongings. It’s helpful to have a written inventory as well as video and photographs of your belongings. This will help you prove what possessions you owned should you ever need to file a claim.

You don’t need to document every washcloth and pillowcase, but a good camera pan of your linen closet will help determine how much monetary loss you’ve suffered.

For more expensive items like your furniture and electronics, photograph or scan your receipts.

If you’ve already tossed them, go back through your credit card and bank statements and find the value of these items. Note the make and model of them along with their cost.

This seems like a pain when you’re doing it, but it will help your insurance company accurately estimate how much money you’re due and to settle your claim more quickly.

Be sure to keep these inventories off-site. A fat lot of good it’s going to do you if they burn up with all of your stuff! Leave them at your office or a friend or family member’s home.

Filing a Claim

There are steps you must follow to file a claim. If not followed correctly, your claim could be delayed or even denied.

Notify your landlord of any damage or theft you’ve suffered. This reporting is mandatory in most states and may be required under the lease you signed. If you had items stolen, you’d need to file a police report. So if you were thinking of reporting that laptop you left in an Uber as stolen, guess again.

Filing a false police report is illegal.

Next, contact your insurance company. You’ll need your policy number, the details of what happened and when, and a number they can reach you.

Take photographs or videos of any damage suffered and be specific about what items were damaged. Don’t throw damaged items away until a claim adjuster has been to your apartment. Depending on the value of the items, a visit by the adjuster may not be necessary.

Once you’ve documented the loss, you’ll fill out and file a claims form. The insurance company will then investigate the claim. How long this takes depends on how severe the damage and losses are. This can take a few hours or several days.

If your area has suffered a natural disaster, some insurance companies will send extra employees to the area to help expedite claims as quickly as possible.

Reasons For Claims Denial

Insurance companies are in the business of making money just like any other company, and they don’t make money by paying out claims willy-nilly. There are some circumstances under which your claim might be denied.

If you have a deductible and the claim is less than that amount, your losses will have to be covered out of your own pocket. Most deductibles for renter’s insurance are pretty low. The quote I got from PolicyGenius came with just a $500 deductible. The damn thing for my health insurance is $2,000, so $500 is peanuts to me!

We mentioned that all natural disasters are not covered so if your damage was caused by one that wasn’t covered, your claim will be denied.

If the insurance company investigates and finds that damage was inflicted intentionally, no payout for you. I’m sure none of you would do this, but I’m sure these companies have dealt with plenty of scammers who intentionally take a baseball bat to their television because they want a new one.

The insurance company may determine that your landlord is the one responsible for damage and refuse the claim. This could happen if the landlord refused to fix bad wiring that resulted in a fire that damaged your property. In that case, the landlord would be responsible for that damage.

Don’t Live Dangerously

“Do I need renter’s insurance?” isn’t even a question. Everyone needs renter’s insurance. Disaster can strike any of us at any time.

I live in New Orleans in a neighborhood that did not suffer a lot of flooding during She Who Shall Not Be Named (starts with a K) and I live on the second floor of an already elevated building but I not only have renter’s insurance but flood insurance too which is a damn sight more expensive than renter’s insurance to the tune of several hundred dollars per year.

By failing to prepare you are preparing to fail.

Tweet ThisBut it’s worth it. This is all my stuff! Everything I own in the entire world is contained within these four walls. I like my stuff. I dragged it all the way from New York City to the swamp! If something happens to it, I want to be able to buy new stuff. So why wouldn’t I, or anyone else, pay the measly $10 a month for renter’s insurance!?

You have an emergency fund, right? It’s money set aside to protect you from an unexpected disaster. Well, think of renter’s insurance that way. It’s an emergency fund for your stuff!

Go to Policygenius or Lemonade and get your quotes today. Every day you wait is a day spent tempting fate.