Not sure where to put your money? You’re not alone. A lot of people just put it in savings, earning next to nothing. But you don’t need to be a finance guru to start investing. Whether it’s $100, $1,000, or $10,000, let’s dive in and figure out how to make your cash work for you.

Where To Invest $100

$100 might not sound like much, but when it comes to investing, time is more important than the amount. For example, if your 18-year-old self had invested $100 a month at an average interest of 7%, your 38-year-old self would have $51,140.61.

If you are older than 18, the best time to start investing was when you were 18; the second best time is now. It’s never too late, but every day, month, or year you wait to start investing is wealth you are foregoing.

Before we start, it’s important to mention that everything in this article is focused on the long term. Whether investing in the US stock market or buying rental properties, you’ll always perform better if you’re focused on the long time. Of course, doing well in the short term is undoubtedly possible, but that is closer to gambling than investing.

Okay, let us move on to your investing strategy.

M1 Finance

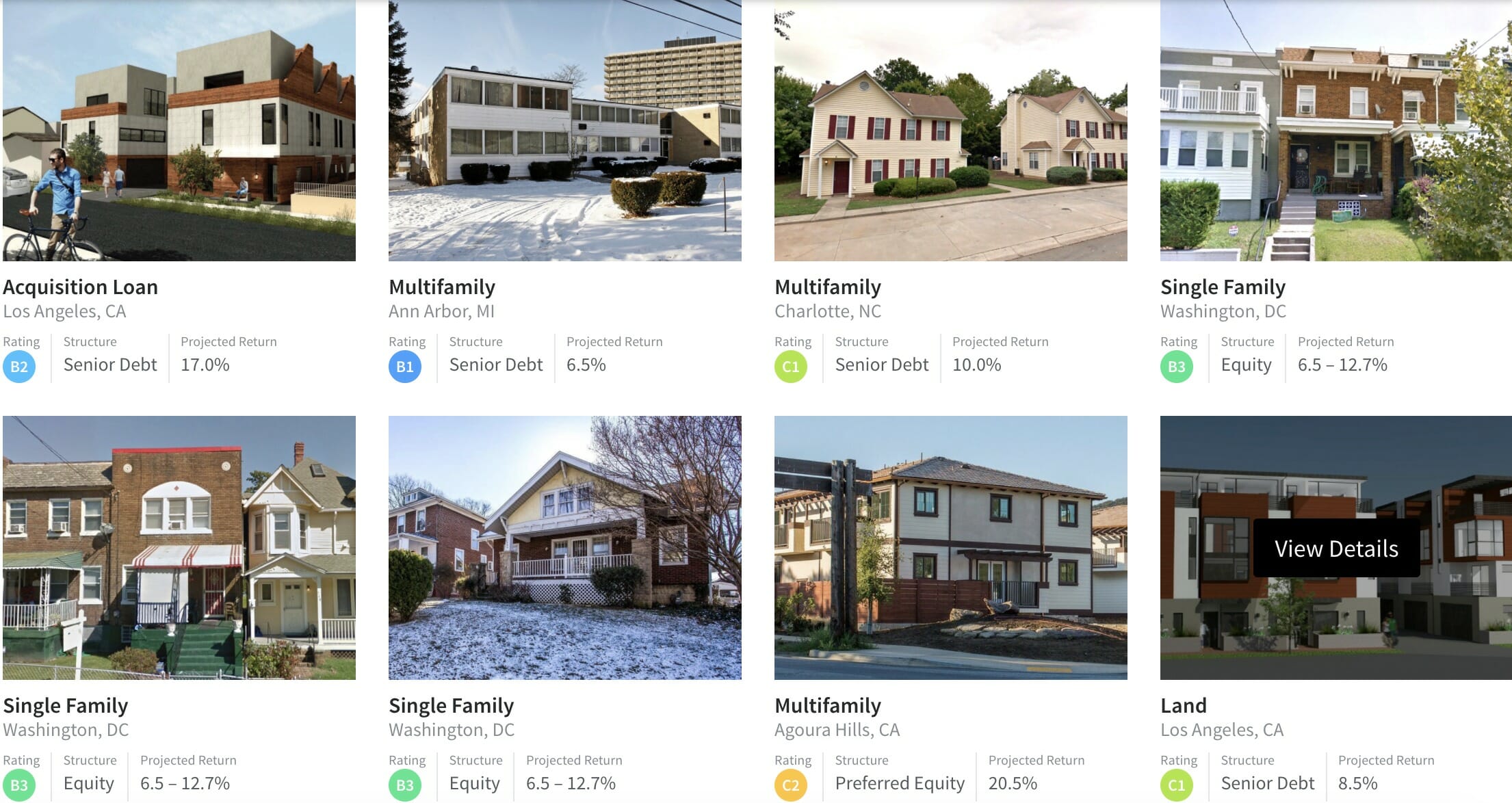

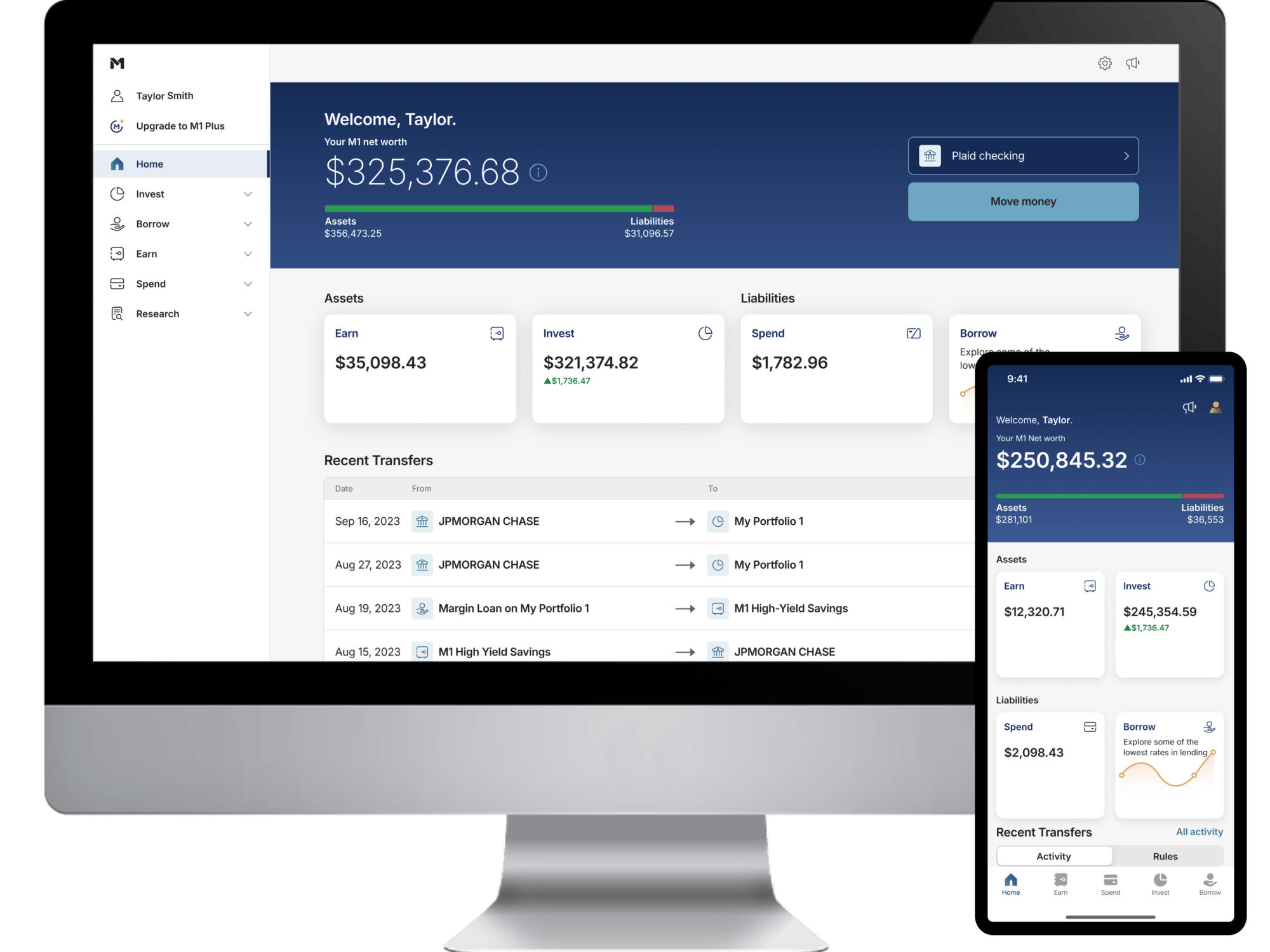

If you find yourself navigating the complexities of investing, M1 Finance offers a promising starting point, combining features of a traditional investment platform with those of a robo-advisor.

M1 Finance lets users build and tailor their investment “pies,” with slices for various assets like stocks, bonds, or ETFs. It automatically manages and rebalances these portfolios based on user preferences. This mix of automation and customization defines M1 as a

Robo-advisors use automated algorithm-driven financial planning software to make investment decisions. It takes humans out of the equation.

These processes reduce labor and overhead costs. Their efficient, scalable model allows for affordable investment management, making financial advice more accessible to a broader audience.

M1 Finance has a minimum of only $100 to open a standard brokerage account and $500 for retirement accounts (IRAs).

M1 Finance is commission-free, or you can pay $36 annually for M1 Plus. When you open any investment account, auto-deposit is strongly recommended. With auto-deposit, you eliminate the need to remember to contribute, ensuring consistent deposits, and prioritizing your financial goals. This “set it and forget it” approach (part of LMM’s philosophy) fosters financial discipline by removing the temptation to spend that allocated amount.

Risk/Reward and Asset Allocation

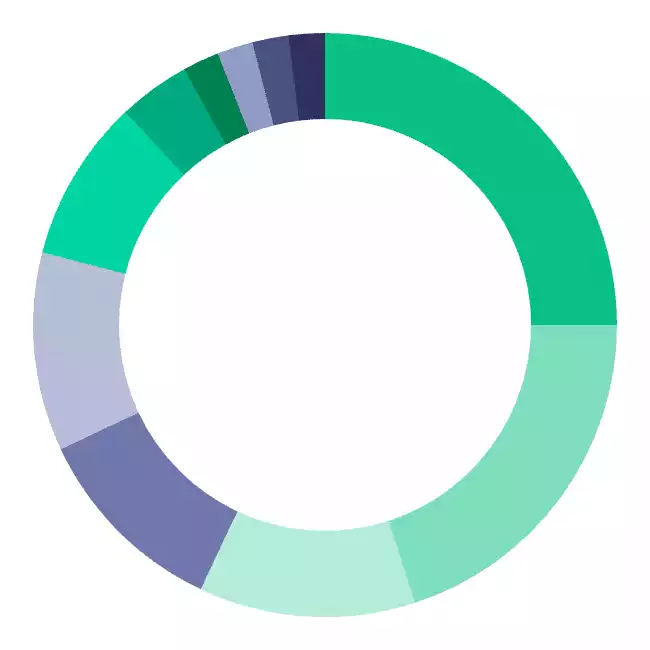

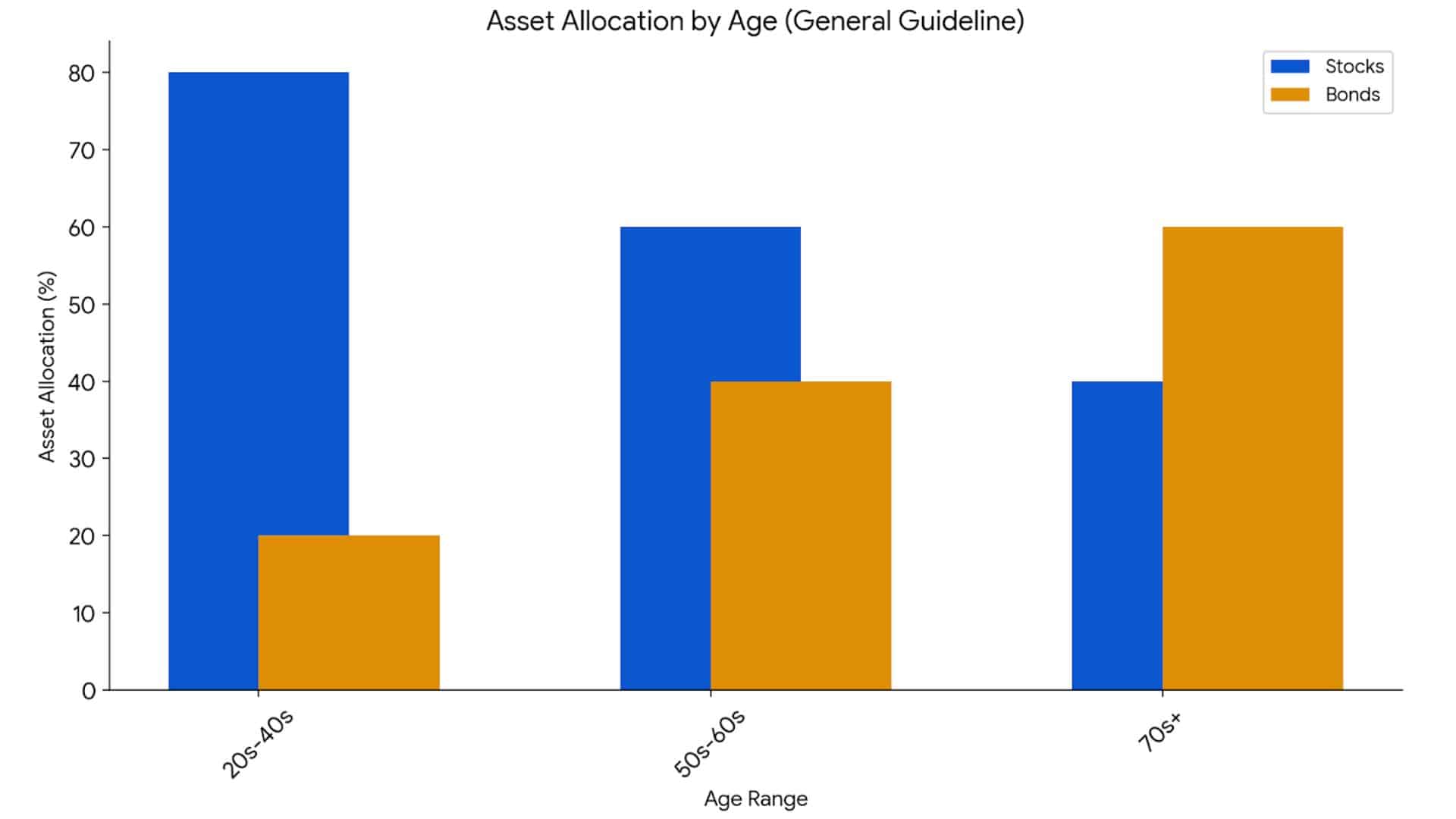

You can’t have high potential gains without also accepting the change of bigger losses (risk/reward), so you need to consider how you balance your investments (stocks, bonds, and cash).

Stocks are riskier than bonds, so don’t put all your eggs in one basket! Spread your investments across different options to manage risk. Generally, the younger you are, the higher your risk tolerance should be (because time is on your side).

The chart above is just a general guideline. How you allocate your investments depends on your risk tolerance.

The chart above is just a general guideline. How you allocate your investments depends on your risk tolerance.

M1 offers pre-built investment plans and helps automate your savings. Choosing the right plan depends on your comfort level with risk. You’ll want to do some research on your own to understand the options and how they align with your goals.

Even with M1’s features, staying informed and keeping an eye on your investments is important, as market conditions can change over time. So, while M1 is a good starting point, don’t hesitate to learn more about investing to make smart choices for your financial future.

We did an in-depth review of M1 Finance.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

Where to Invest $1,000

In many cases, $1,000 might appear substantial to many people. If you don’t have that sum right now, there are several strategies to accumulate it, see “Earning Additional Income to Invest” later in the post.

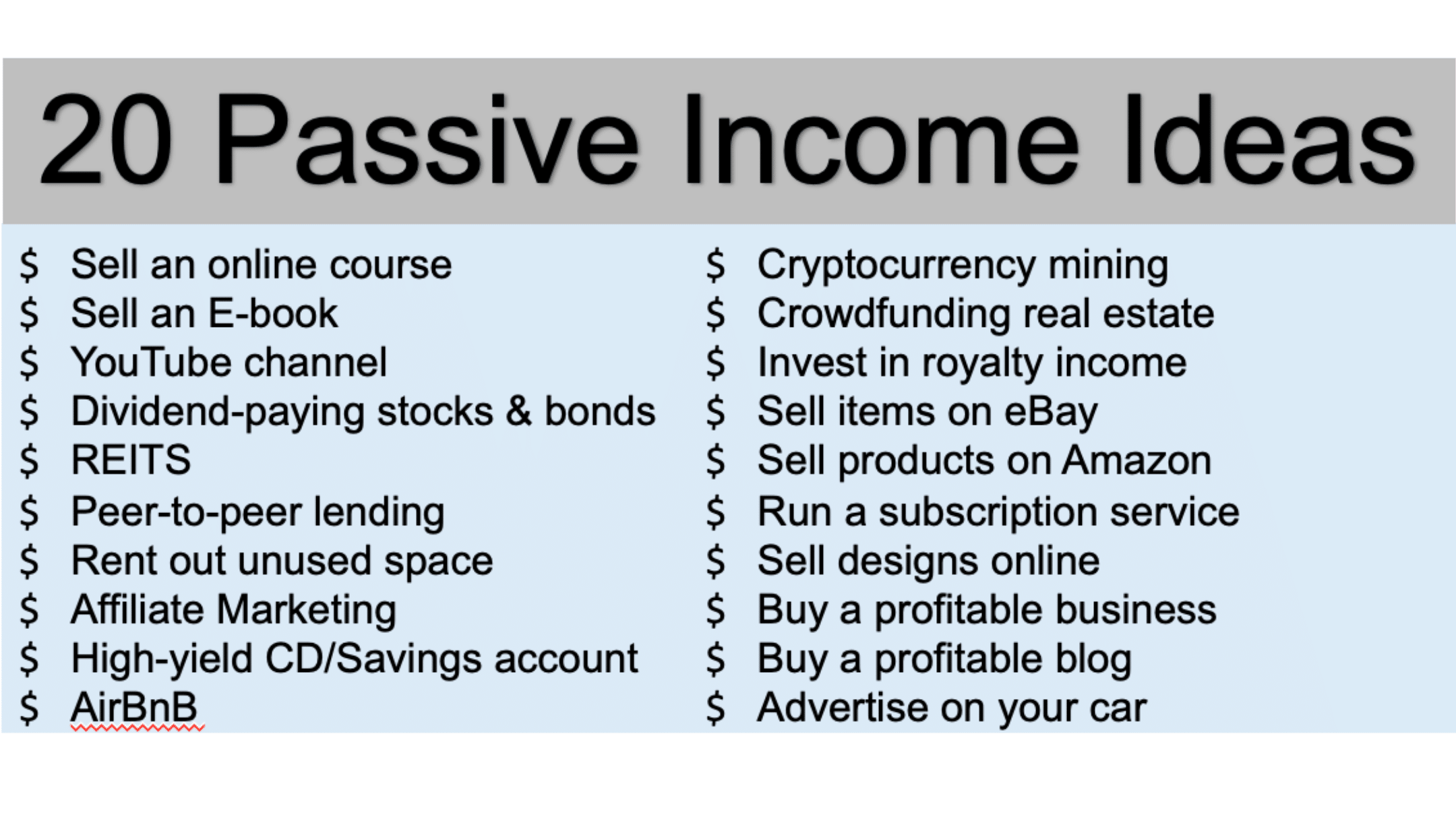

Passive Income Investments

Passive income is money you earn with minimal ongoing effort, like earning rental income from a property, writing an ebook that people buy again and again, or making money from dividends and interest. It’s like making your money work for you, instead of actively working for money.

Passive income can be a great way to supplement your income or even achieve financial independence, but it’s not a magic bullet.

Real Estate

Investors seeking passive income from real estate can explore options such as rental properties, Real Estate Investment Trusts (REITs), crowdfunding opportunities, remote ownership, and real estate funds. These investment avenues enable investors to earn income from real estate without engaging in physical labor or assuming the duties of a landlord.

REITS

You can invest in a REIT, which provides a way to participate in real estate gains without the direct hassles of being a landlord, they are still subject to market risks and don’t eliminate the potential for investment loss.

If you looking to invest in real estate but looking for something a little more hands-off check out Fundrise where you can invest in crowdfunded real estate projects.

Fundrise allows individuals to invest in commercial real estate online through an eREIT. These are private investment vehicles similar to traditional REITs, but not publicly traded on stock exchanges.

Fundrise’s eREITs simplify real estate investing, allowing individuals to invest in diversified portfolios with lower minimums. These electronic trusts pool funds to buy and manage real estate, offering the potential for regular dividends and appreciation.

Diversify into income-producing real estate without the dramatics of actual tenants. Fundrise eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy.

Disclosure: When you sign up with this link, we earn a commission. All opinions are our own. I am investing with Fundrise

Your Retirement Account

Investing in your retirement is arguably the most crucial step for ensuring your financial health. By setting aside funds early, you secure a stable future and potential wealth growth, underscoring the importance of strategic planning for a worry-free post-employment life.

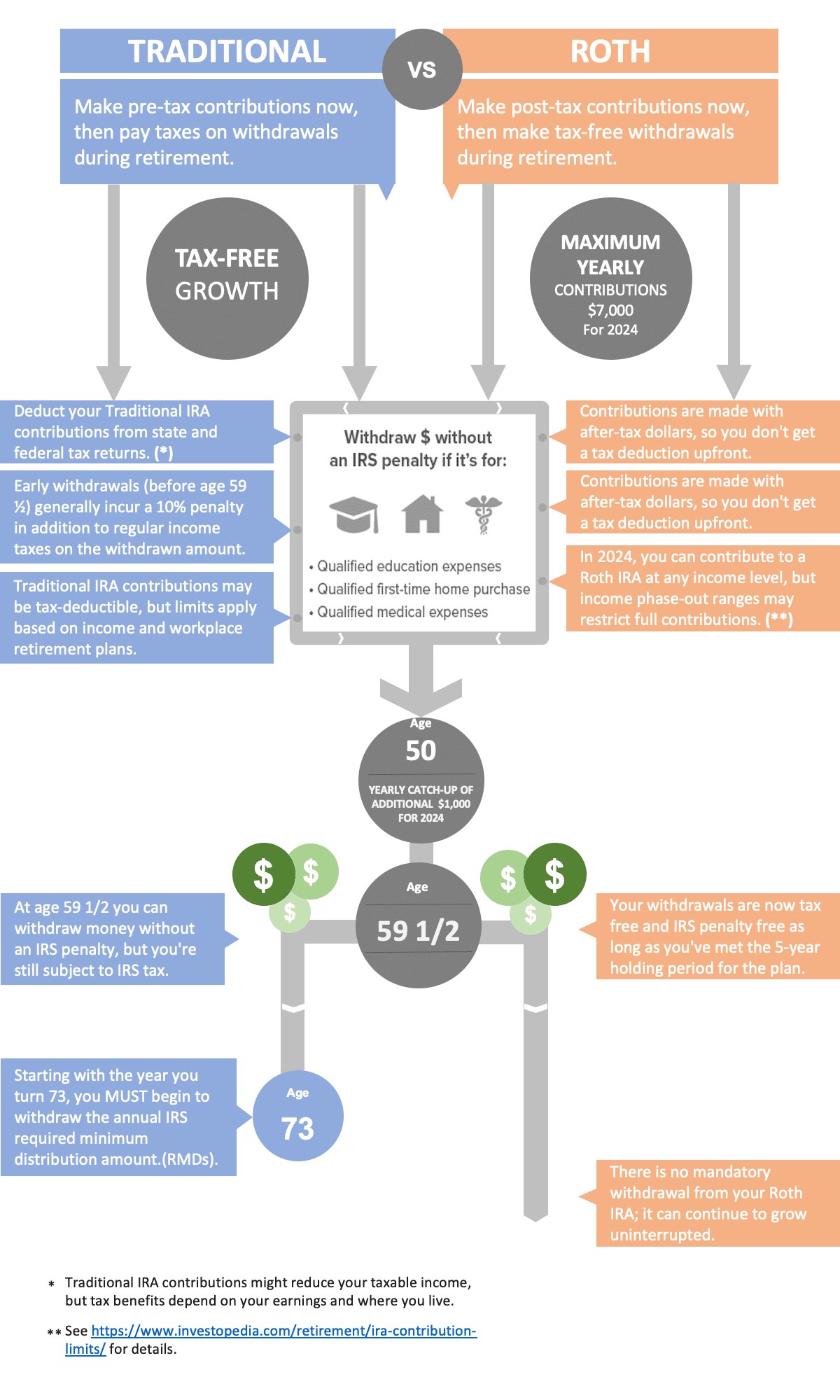

For those who are not self-employed and don’t own a small business, there are two primary types of IRAs you can consider.

Traditional IRA:

- Contributions: Made with pre-tax dollars, reducing your taxable income in the year of contribution. There are annual contribution limits.

- Tax Treatment: Earnings within the account grow tax-deferred.

- Compound Growth: In a tax-deferred IRA, your investments grow without annual taxes on earnings, allowing interest, dividends, and capital gains to compound more efficiently and potentially increase your investment growth rate.

- Withdrawals: Generally taxed as ordinary income after reaching age 59 ½. Exceptions exist for qualified expenses or Roth conversions.

Roth IRA:

- Contributions: Made with after-tax dollars (not tax-deductible).

- Tax Treatment: Earnings within the account grow tax-free.

- Compound Growth: In a tax-deferred IRA, your investments grow without annual taxes on earnings, allowing interest, dividends, and capital gains to compound more efficiently and potentially increase your investment growth rate.

- Withdrawals: Qualified withdrawals, including contributions and earnings, are generally tax-free after reaching age 59 ½ and holding the account for at least 5 years.

Contribution Limits for 2024

- For individuals under 50: The contribution limit is $7,000.

- For individuals aged 50 or older: A catch-up contribution of an additional $1,000 is allowed, bringing the total limit to $8,000.

- Combined limit: These limits apply to total contributions across all your Traditional and Roth IRAs for the year.

- Deadline: You can contribute to your IRA for 2024 until the tax filing deadline, which typically falls on April 15th, 2025 (with extensions potentially available).

IRA Withdrawals

Traditional IRA Withdrawals:

- Age 59 ½ and over: Withdrawals are generally penalty-free, but you’ll still pay income tax on the taxable amount withdrawn.

- Under Age 59 ½ (early withdrawal): Withdrawals are subject to income tax and a 10% penalty, with some exceptions for qualified expenses like medical bills, disability, or certain first-time home purchases.

- Required Minimum Distributions (RMDs): Starting at age 73 (those born after 1951), you must begin taking minimum withdrawals each year by December 31st (except the first year, which may be delayed).

Roth IRA Withdrawals:

- Any Age: You can withdraw contributions (the money you put in) at any time, tax-free and penalty-free.

- Qualified Withdrawals: Earnings (interest, dividends, growth) can be withdrawn tax-free and penalty-free if you meet both the five-year rule and the age 59 ½ rule:

- Five-year rule: At least five years have passed since the year of your first Roth IRA contribution (to any Roth IRA you own).

- Age 59 ½ rule: You are age 59 ½ or older.

- Exceptions to the Five-Year Rule: Penalty-free withdrawals of earnings are allowed for certain exceptions even if you haven’t met the five-year rule, such as:

- Up to $10,000 for a first-time home purchase.

- Qualified higher education expenses.

- Disability.

- No RMDs: There are no required minimum distributions for Roth IRAs during your lifetime.

Always consult your IRA custodian or tax advisor for specific details and exceptions to these general rules.

Invest In Yourself

Investing an extra $1,000 in yourself might sound cliché, but it can be exceedingly worthwhile. The best investment you can make is often in your own growth and potential.

Consider enrolling in a course that could propel your current job forward or obtaining an additional certification that might boost your earning potential. That’s a wise and strategic use of funds.

Also, think about investing in personal finance books. There’s a wealth of knowledge to suit everyone, from novices to those looking to navigate tax breaks or explore rental property investments. To help you out, we’ve curated a list of top personal finance reads.

Improvements in these areas can have a ripple effect, enhancing not just your job performance but also your overall life, including the strength to resist various temptations, be it an indulgent dessert or the urge to splurge.

Get our best strategies, tools, and support sent straight to your inbox.

Where To Invest $10,000

Got $10,000 to invest? There’s a world of options out there to turn that tidy sum into something bigger for your future.

An HSA

A Health Savings Account (HSA) is designed for individuals with high-deductible insurance plans. It offers a tax-advantaged method to both pay for immediate medical expenses and save for future health-related costs.

A breakdown of key points:

HSA stands for Health Savings Account.

Eligibility: HSAs are available to individuals enrolled in high-deductible health plans (HDHPs) that meet IRS qualifications.

Tax Benefits: HSAs offer a triple tax advantage:

- Contributions are made with pre-tax dollars (reducing your taxable income).

- The money in the account grows tax-free.

- Qualified medical expenses paid from the HSA are withdrawn tax-free.

We did a deep dive episode for HSAs that will help explain all the details.

A 529 Savings Plan

Do you have any children (or planning to have children)? The cost of higher education is not getting any cheaper. According to U.S. News and World Report, tuition and fees at private National Universities have jumped about 132% over the last two decades

Studies suggest a college degree can lead to higher lifetime earnings by $1 million to $1.5 million on average (versus a high school diploma).

529 Plans allow you to save for education expenses with tax-free withdrawals for college costs like tuition, fees, and books. Some plans allow limited use for K-12 expenses. Use the money for something else? Taxes and penalties apply.

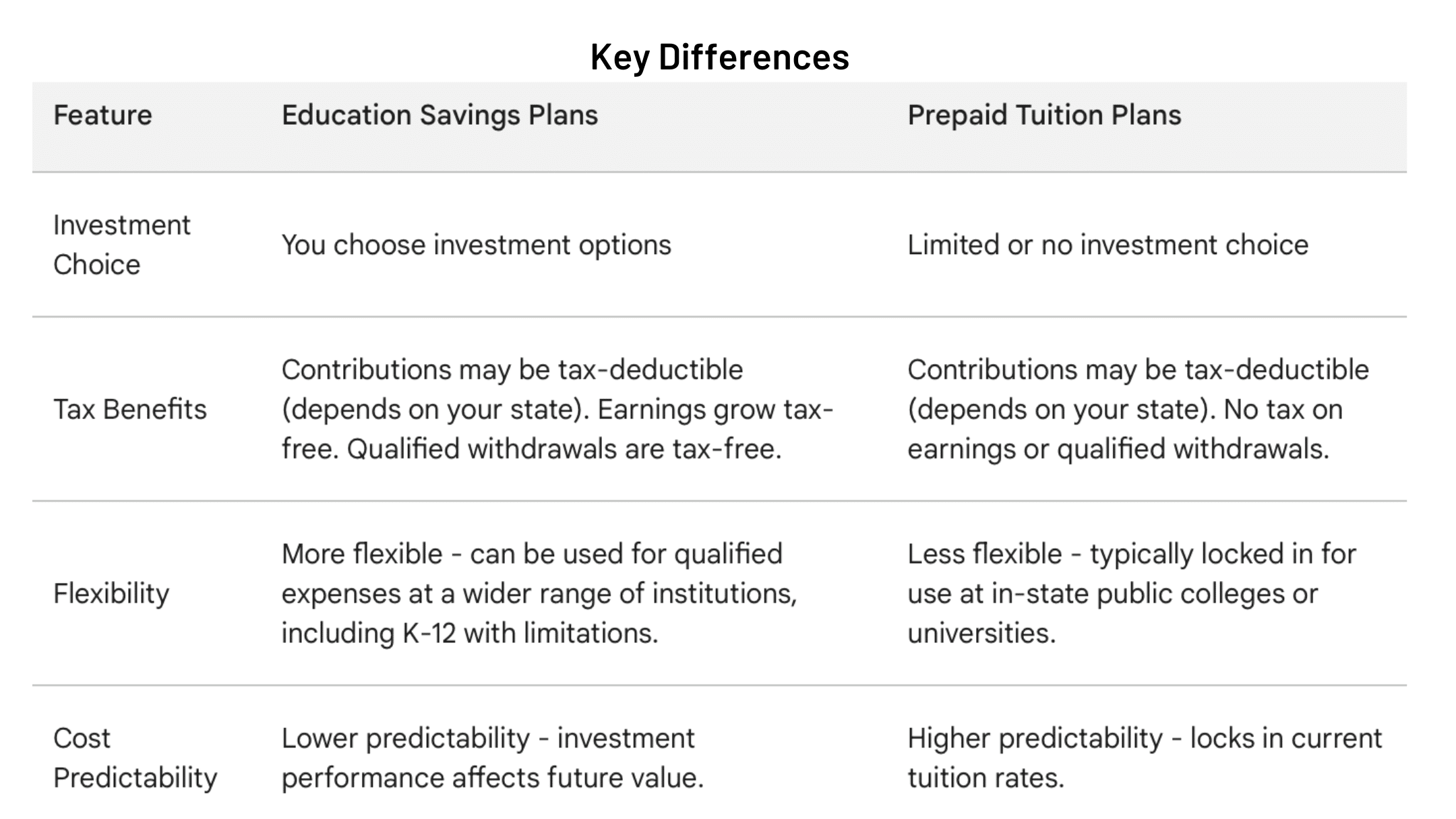

There are two types of 529 plans:

-

Education Savings Plans: These are investment accounts that allow you to choose how your money is invested, similar to a mutual fund. They offer tax-advantaged growth and flexibility in how you can use the funds for qualified education expenses.

-

Prepaid Tuition Plans: These plans lock in the cost of future tuition at in-state public colleges or universities based on current prices. They offer more predictability in education costs but can be less flexible in how you use the funds.

Max it Out

Opening an IRA with your initial $1,000 was an excellent first step towards saving for retirement. However, it’s time to escalate our efforts.

Legally avoiding taxes is one of the most effective strategies for maximizing wealth accumulation. Utilizing an IRA is one way to achieve this.

As mentioned earlier, investing in a Traditional IRA offers dual benefits. Firstly, it reduces your taxable income at present, likely higher than what it will be in retirement. Secondly, upon retirement, when you withdraw the funds, they will be taxed at a potentially lower rate.

Consider allocating $7,000, the current maximum annual IRA contribution limit, from your $10,000, thereby maximizing your account for the year.

Become a Dividend Aristocrat

Use that $10,000 to build a portfolio of dividend stocks. When you own stock in a company directly or through a fund you may receive dividends. A dividend is a distribution of a portion of a company’s profits.

A dividend aristocrat is a stock in the S&P 500 Index that has a history of increasing its dividend payout to shareholders for at least 25 consecutive years. Here’s a breakdown of the key points:

- Focus on Dividend Growth: These companies are known for their reliability in consistently increasing their dividend payouts each year.

- S&P 500: They are specifically a part of the Standard & Poor’s 500 Index, which tracks the performance of 500 large-cap companies listed on stock exchanges in the United States.

- Track Record: The key requirement is that they have increased their annual dividend payouts for at least 25 years straight.

So, dividend aristocrats are like reliable income providers in the stock market, with a history of steadily growing dividend payments. They are generally considered to be large, well-established companies with strong financials. Coca-Cola and McDonald’s are two examples.

The S&P 500 has an index called The S&P 500 Aristocrat Index that has an annualized rate of return of 8.06% (through March of 2024).

You can invest in The S&P 500 Aristocrat Index using ETFs (exchange-traded funds) or M1 Finacial.

This is an index fund of the most consistent dividend-paying companies in the S&P 500. It has historically outperformed the S&P 500 long-term. Over the past 10 years, it has returned 10.98% on an average annual basis whereas the S&P 500 only returned 10.53% during that same period.

Here’s a curated list of portfolio strategies we’ve covered if you’d like to learn more about where to invest:

- Coffeehouse Portfolio

- Ivy Portfolio

- Swensen Portfolio

- Larry Portfolio

- Permanent Portfolio

- Lazy Portfolio

- Minimum Variance Portfolio

- Golden Butterfly

Earning Additional Income to Invest

There are a few things that are Personal Finance 101, things that everyone should do to be financially healthy; make a budget (we love Mint), build an emergency fund, invest early, and have more than one source of income. That’s where a side hustle comes in.

A side hustle means making extra cash alongside your main job. At first, it might not be much, but it could turn into a lot later on. It’s risky to only have one paycheck because jobs can disappear suddenly, for any reason, or sometimes for no reason at all. Having a side gig can give you more money and more security.

Here are some side hustle ideas to consider:

Freelance

Freelancing means working for yourself, not a specific company. Freelancers take on projects or contracts from various clients, setting their schedules and handling their taxes. They’re self-employed, offering flexibility and control over their work and income. For more details, visit this source.

Take a look at freelancer sites like Upwork and see what kinds of jobs are available. When most people hear the word “freelance,” they think of writing and while there are certainly plenty of postings for writers, there are dozens of other categories too.

See if any of them fit your skills, make a profile on the sites, and include some examples of past work if you have any, if not, create a portfolio and start applying.

In the beginning, it’s worthwhile to apply for a few low-paying jobs. It will give you a body of work to include in your profile and hopefully get you a few good reviews.

Babysitting

Looking for a flexible way to make some extra cash? Consider babysitting! Platforms like Sittercity connect you with families searching for childcare. They offer a variety of opportunities, from full-time nanny positions to occasional date night sitting. You can browse postings, apply directly to famil,ies, and even set your own schedule.

Become a Tutor

Tutoring in person is an option, but it requires the initial investment of time to gather clients. However, this effort can pay off, as word-of-mouth often helps in acquiring new clients once you get started.

Meanwhile, an accessible alternative is online tutoring. This option offers a straightforward entry into the tutoring field.

Wyzant is an online tutoring platform connecting students with tutors for personalized one-on-one learning across various subjects and levels. Tutors set their own rates and schedules, offering flexibility for both parties. The platform supports finding tutors, scheduling sessions, and managing payments, making the tutoring process seamless and secure.

Join the Rideshare Economy

Cruise behind the wheel and set your own schedule with Lyft! This ridesharing platform offers flexibility, perfect for those seeking extra income alongside other commitments.

Keep in mind, that earnings aren’t fixed. While bigger cities typically offer higher fares, your income depends on several factors including location and passenger demand

Invest In Something, Anything

The bottom line is, no matter how much money you have or don’t have, there is a way to use it to help secure your financial future. I know it’s more fun to blow that extra money on any number of things, dinner, gadgets, a vacation. But always remember not to give up what you want most for what you want now. If you’ve been sitting on money you didn’t know where to invest, now you know. Get started!