I’m sure you’d agree that online stock trading gets complicated – especially if you’re a beginner. Margin accounts, deciphering analyst ratings, and understanding what advanced order types are can make your head spin.

If you are an experienced trader, finding the right broker-dealer can be equally daunting. How much do they charge in commissions and fees? Do they offer access to real-time market data? How user-friendly is their trading platform?

These are all obstacles the new investment app Webull seeks to overcome.

In this Webull review, we take a look under the hood and find out if opening a trading account is worth your time. We’ll examine its features, investment products, commissions, fees, and more.

Let’s go!

An Executive Summary

Minimum Investment:

$0

Management Fees:

Promotion:

Free Stock (expires 8/30/2019)

Tax Loss Harvesting:

No

Portfolio Rebalancing:

No

Assets Under Management:

9 million users, over $10 billion in trade value

Minimum Investment:

$0

Management Fees:

$0, $5 Gold monthly subscription

Promotion:

Get a free stock

Tax Loss Harvesting:

No

Portfolio Rebalancing:

No

Assets Under Management:

10 million users, company valued at $7.6 billion

Minimum Investment:

$0

Management Fees:

$0

Promotion:

Invest for Free

Tax Loss Harvesting:

No

Portfolio Rebalancing:

Yes

Assets Under Management:

$1 billion

Bird’s Eye View

Account Types:

- Individual cash and margin accounts

Fees:

- $0 with commission-free trading

Tradable Securities:

- U.S. stocks, ETFs, and IPOs

Minimum account balance:

- $0

Mobile app:

- iOS & Android

Promo:

- (expires 8/30/2019) Free stock for opening an account

- (expires 9/30/2019) Get second free stock when depositing $100 or more within 30 days of account opening

Humble Brags

Voted Best Online Broker for Commission-Free Stock Trading by Benzinga

Who Is Webull Financial, LLC?

Webull is an online broker offering commission-free trading, no minimum balance requirement, and a quick and easy account setup.

Their mission:

Webull strives to bring exciting and useful tools to help you make smarter financial decisions. We believe that everyone should have an equal opportunity to control their own financial future, and this is why we provide commission-free trading.

Webull officially opened its doors on May 2018. Since then, they’ve surpassed $10 billion in trade value through their platform. Their app is used by over 9 million users around the world for real-time market updates, paper trading, and fundamentals.

CEO Anthony Michael Denier attributes Webull’s success to the great work done by its tech and finance pioneers.

Equipped with a well-rounded skill set, the founders’ resume includes helping launch Alibaba to Wall Street experience working with Goldman Sachs, ING, and Credit Suisse.

Mr. Denier describes the competition as “finance pros that outsource their tech, or tech pros that outsource their finance. Webull does neither.” This sets them apart. The founders are industry leaders with a company all built in-house.

Some of their tools, like advanced order types and customizable charting features, are difficult to find on fee-free trading platforms.

Webull is a U.S.-based broker-dealer and a member of the Financial Industry Regulatory Authority (FINRA). They’re insured by the Securities Investor Protection Corporation (SIPC) up to $500,000 with an extra insurance policy up to the aggregate of $150M bought by their clearing firm, Apex Clearing.

Webull is headquartered at 44 Wall Street, New York City. Webull provides full transparency with FINRA’s brokercheck here.

Webull's app is used by 9 million people worldwide and offers users commission-free, online trading. Gain access to real-time quotes, analyst ratings, and full extended-hours trading. Creating an account is free with no minimums.

Account Types

Webull supports individual cash and margin accounts only. No IRAs, Corporate Accounts, Joint, or Trusts are available at this time.

Margin Accounts

On balances between $0 – $1,999, your margin account gains you access to three day trades within five business days (Anyone under $25,000 per FINRA regulations is limited to three day trades per five trading days). Per FINRA regulations, you must also have a minimum $2,000 account balance to use leverage and their short selling features.

Balances between $2,000 and $25,000 also get you three day trades within five business days with the addition of leverage (up to 4x leverage on day trades and overnight buying power up to 2x) and short sales.

Account balances greater than $25,000 get you unlimited day trading access and short sales. Leverage your buying power up to four times on day trades and two times overnight.

If your account balance is less than $25,000 and you make four or more day trades within five business days, an equity maintenance (EM) call occurs restricting your day trading. Your account must be restored to the $25,000 minimum equity level, or you run the risk of account liquidation and closure.

Cash Accounts

You’re only able to day trade with settled funds. For example, if you have $500 settled in a cash account, you can only use up to $500 in day trades. Cash accounts have no leverage or short sale capabilities.

A Word On Margin Trading and Short Selling

Margin trading is a form of borrowing. It lets you borrow against your portfolio’s value and buy more securities. The upside to this strategy is that it can boost your returns. The downside is that it can amplify your losses.

Margin trading lets you borrow against your portfolio's value and buy more securities.

Tweet ThisShort selling is when you sell stocks you don’t own in hopes that it will decrease in value. It works in reverse as you’re betting that market prices will drop. It’s like when someone gives you $100 to buy groceries.

But groceries happened to be on sale that day for $50. You’d buy the groceries for $50 and pocket the extra $50. That’s a simplified version of how short selling works.

Margin Interest Rate

Webull’s margin interest rate is only charged to overnight leveraged positions.

The annual margin rate on loans is as follows:

- $0 to $25,000 loan: 6.99% rate

- $25,000.01 to $100,000 loan: 6.49%

- $100,000.01 – $250,000 loan: 5.99%

- $250,000.01 – $500,000 loan: 5.49%

- $500,000.01 and $1M: loan 4.99%

- $1,000,000.01 and $3M loan: 4.49%

- Above $3M carries a 3.99% rate

Webull uses this calculation for the daily interest on long positions:

Daily interest = Borrowed cash * Margin rate/360

Short Sale Fees

Short positions require you to borrow shares. The cost of short selling is the fee for borrowing the stock. The fee changes daily for all available stocks and is also charged daily.

Webull did mention they only offer stocks on the “easy to borrow” list and that stock borrowing fees are quite low. Most carry no fees at all unless it changes to the “hard to borrow” list while holding.

Costs & Fees

Webull’s service is low-cost with commission-free trading and carries no platform fees. There’s no charge to open and maintain your account along with no monthly subscription fees for margin trading (competitor Robinhood charges a $5 monthly subscription fee for this feature).

However, there are a couple of fees charged by FINRA and the SEC that are unavoidable.

These fees are microscopic and Webull doesn’t profit from them. They include:

- An SEC charge of $13 per $1M of principal or a minimum of $0.01 ($0.0000207 * transaction amount)

- A Trading Activity Fee (TAF) from FINRA at $0.000119 per share (sells only), a $0.01 minimum or maximum charge of $5.95

Transfers

There are no fees for ACH fund transfers, but wire transfers range between $8 and $45 (depends whether it’s foreign or domestic).

For security transfers, Apex Clearing (their clearing firm) charges $0 for incoming transfers and $75 for outgoing. Stock transfers usually take 5-7 days.

Be mindful: Transfers of stock into your account may result in a $75 charge from your broker(Contra Broker)

Deposits

ACH deposits usually take five days. When depositing funds via ACH, they must stay there for seven days (aka the minimum withdrawal period). However, Webull will give you up to $1,000 in instant buying power to trade immediately.

Anything over and you must wait five business days to settle for trading and six business days after your deposit day for withdrawal. Wire transfers have a minimum withdrawal period of one day, but you’ll pay a fee. How much?

It depends on whether it’s a foreign or domestic transfer. This means your account balance may differ from the amount you can withdraw.

***Wires will show the next business day at the latest if sent before the day closes.

Settlement Period is the trade date plus two days.

Webull lets you start trading immediately after you make a deposit. Two caveats:

- You can only deposit $50,000 per day into your Webull account (If you have a larger amount Webull can override it but you must contact them for a manual review)

- No recurring deposits are available (but they say it’s in the pipeline)

What Can You Trade?

Webull lets you trade over 5,000 U.S.-listed stocks and ETFs along with IPOs.

***Fun Fact: Webull is the only commission-free brokerage to offer REAL IPOs to retail investors from underwriters before the stock is listed on the exchange.

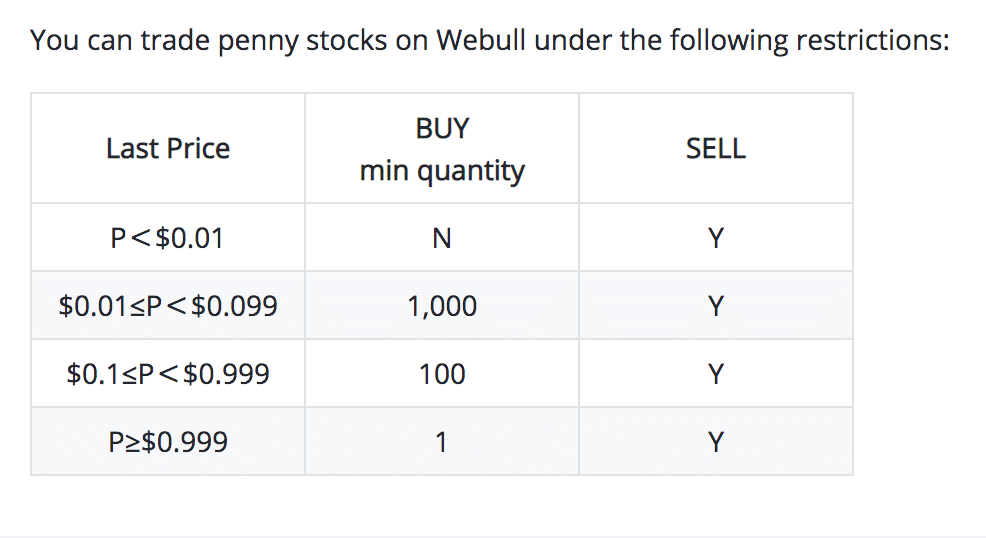

Currently, their trading platform doesn’t support options trading, forex, futures, cryptocurrencies, or OTC stocks. Both mutual funds and bonds are unavailable as well. Penny stocks can be traded but have several restrictions.

***NOTE: Orders of IPOs and secondary offerings are indications of interest (IOIs). Webull said they try to allocate as much as possible to client orders but can’t guarantee full allocation of all shares.

Trading Hours

Webull offers full extended hours trading between 4 am and 8 pm EST.

- Free pre-market trading from 4 am – 9:30 am

- Free post-market trading between 4 pm and 8 pm

Caveat: Webull says price volatility is higher during extended hours and suggests using limit prices to place orders as it’s not possible to place market orders or stop orders outside of normal trading hours at virtually all U.S. brokerages.

Order Types

Webull lets you switch between Order and Advanced Orders.

Order

Limit Order is triggered at a price earmarked by you when creating your order. It’s filled at the limit price or better. If the market price never reaches your limit price, your order isn’t filled.

Market Order is instantly generated when placed and is filled at the market price.

Stop Order (Stop-Loss Order) activates at a predetermined stop price and fills at the current market price.

Stop Limit Order lets you choose your predetermined stop price and fills at your predetermined limit price.

Advanced Orders

Stop-Loss/Take Profit Orders (bracket orders) protect you against losses and help secure profits by grouping an order with a stop loss, a profit target, and a trailing stop. Once one condition is met, the order automatically moves to the exit position.

In addition to Stop-Loss orders, you can build your portfolio using OCO, OTOCO, and OTO(One-Triggers-the-Other) orders.

Placing Orders on the Webull App

Placing orders on the app is a quick and easy five-step process.

- Step One: Go to your Watchlists tab on the main screen

- Two: Look up a stock or select a pre-existing stock from your watchlist

- Three: Go into your Stock Quotes page

- Four: Tap Trade at the bottom left-hand screen

- Five: Place your order

Markets

Webull’s platform uses worldwide financial data covering five categories:

They have over 100 exchanges and over 100,000 investment subjects. You’ll get access to their free trading tools with real-time market data.

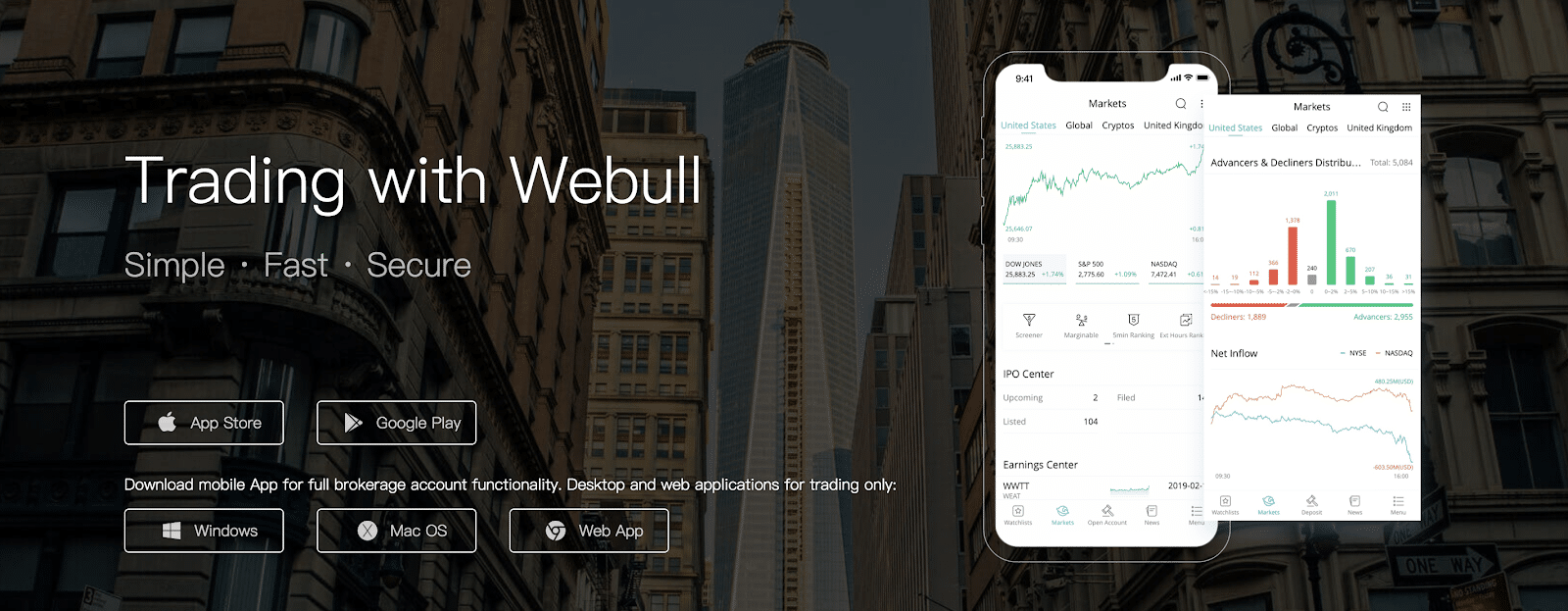

***Tip: You’ll need to download the mobile app for full brokerage account functionality as the desktop and web application are for trading only.

***Update: Their desktop version has received an upgrade with features including paper trading and the ability to open both app and brokerage accounts. Some new features are now desktop-only.

Webull is available on Google Play, iOS, and Windows.

Research Tools and Market Data

Your market data comes in the form of real-time quotes, in-depth charts, analysts rating, and a full financial calendar. If you’re skeptical about the platform, you can open a paper trading account as a trial run without using real money.

Paper trading is a trading simulator letting you explore the Webull app and all its features with low stakes – before putting your money on the line.

First-time Webull users and beginner investors find this feature appealing.

Their market data platform gains you access to all of the technical information you’ll need. Webull’s charts currently support over 25 technical indicators with minute-by-minute time interval data.

Side-by-side chart comparisons let you see how your stock measures up against industry indices and ETFs. There’s a customized stock screener function you can set to your personal preference when searching for your newest investment options.

You’ll also have access to press releases, news, historical earnings per share (EPS), and revenue data.

Account Opening

If you’d like to open a Webull account, you will have to meet a few requirements:

- Must be 18 years old

- Have a valid social security number

- A legal U.S. residential address

- Have U.S. citizenship, permanent residency or valid U.S. visa

No Fractional Shares

Because Webull doesn’t support fractional shares, stock splits are handled differently. Using Webull’s example of a reverse stock split occurrence, your fractional share will either be:

- Cash-in-Lieu: The value of the fractional share will be paid out as cash and will show up in your account in 2-3 weeks

- It will be rounded up into a full share

- It will be rounded down into nothing (Webull does provide cash in lieu of equivalent fractional share amount)

Free Stock

(expires 8/30/2019) When you complete your account opening within 24 hours, you’ll get free stock valued between $2.50 – $250. The stock you get is random and determined by an algorithm. Your free stock is credited to your account once it’s claimed.

(expires 9/30/2019) After you open your account and fund it with a $100 deposit or more, you get a second free stock within 30 days after opening your account. Your second free stock is valued between $8 – $1,000.

How Webull Makes Money

Offering commission-free trades always carries an accompanying follow-up question: How do you make money?

Webull makes money like most brokerage firms: back-end revenue streams. These include payments for order flows, stock loans, interest on credit-free balances, and margin interest.

A Word On Order Flows and Commission-Free Trades

Brokerage firms get paid for directing their orders to market makers and third-parties. There’s a conflict of interest when your broker doesn’t inform you about how their fee structure is streamlined.

Typically, most brokerage firms offer transparency on how they get paid. When they don’t is when they run into trouble. Robinhood was criticized for this practice at the end of 2018 for its increased revenue through order flow payments.

Robinhood co-founder and CEO Vlad Tenev wrote a detailed blog post defending their position.

It’s a common practice in Wall Street, but one investors should be aware of.

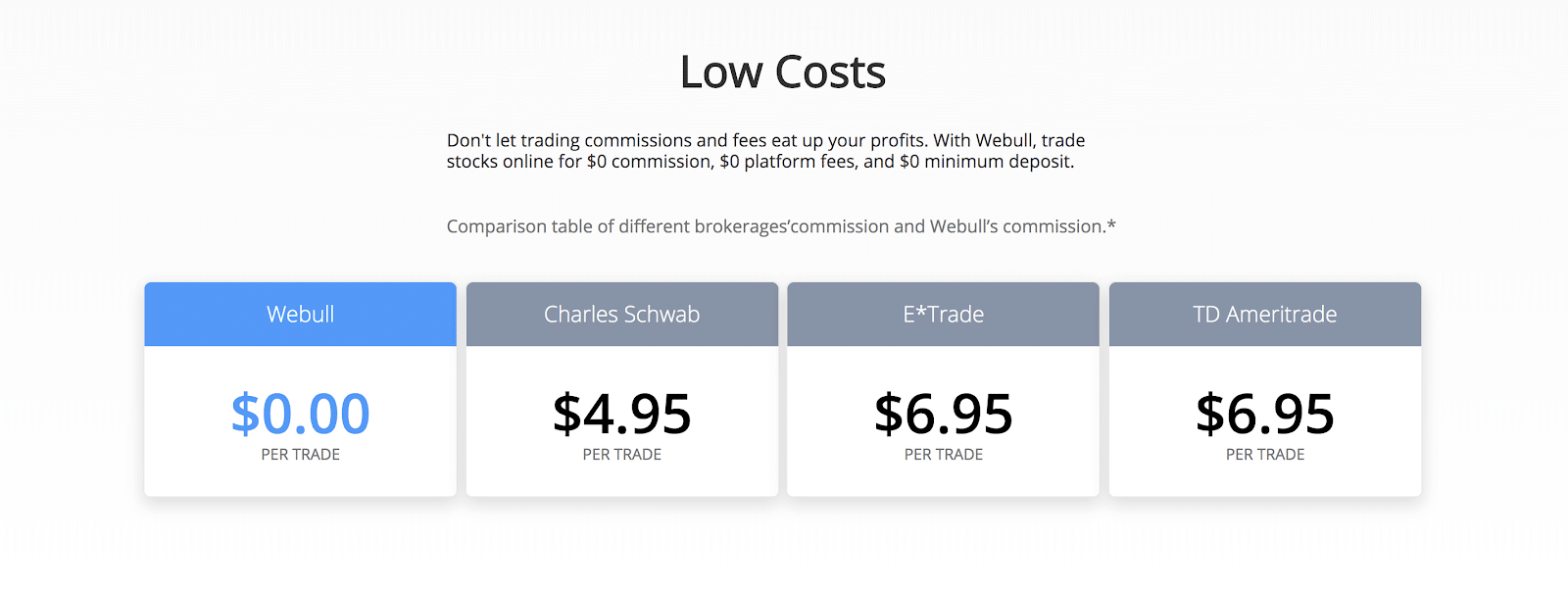

Cheaper Than the Competition

Webull’s commission-free trading beats Charles Schwab’s $4.95 per trade fee along with TD Ameritrade and E-Trade (both at $6.95).

Customer Support

Like most online platforms, getting in touch with a human being can prove challenging. The primary ways to access Webull’s team is through the Live Help button in the app, social media, or email.

Webull has received praise for its timely, 24/7 account monitoring and customer support.

Desktop App and Mobile Devices

You can download the Webull app at the Apple Store or Google Play. Desktop applications are available on Windows, MAC OS, and the Chrome Web application.

Is Webull Safe?

Webull is a fully compliant, SEC-registered member of FINRA and SIPC. As mentioned earlier, your account is insured up to $500,000 with an extra insurance policy up to $150M bought by their clearing firm, Apex Clearing.

Webull uses state of the art security with 256-bit encryption on its servers and never shares your information.

Does Webull Make Sense for You?

If you’re looking to day trade in an individual account, or want to try your hand at their paper trading simulator before diving into the deep end of the pool, Webull might make sense.

If you want to save for retirement through an IRA, Trust or Joint account, you may want to look elsewhere as Webull doesn’t support those account types.

The end goal is to make fundamental traders of us all. Consolidating all these resources on one platform and offering it for free allows even the greenest of traders to develop a good mindset for trading. – Webull’s Director of Trading, Mike Constantino

Pros

- Fee-free, commission-free trading

- Start trading immediately after your deposit

- High-quality analysis tools, real-time market data, and technical indicators

Cons

- Limited account types (individual cash and margin accounts only)

- Doesn’t trade options, forex, futures, cryptocurrencies, OTC stocks, mutual funds or bonds

- No recurring deposits (told they’re working on this feature)

Final Thoughts

Webull has an attractive offer in commission-free trading. There’s a limited number of online brokers providing this feature. It costs nothing to create your account and carries no minimum deposit requirements.

Users gain access to a sophisticated trading platform with real-time quotes, historical data, and technical indicators. You’re able to create custom filters and watchlists for an enhanced stock trading experience.

However, if you’re looking for more traditional investment options in the shape of mutual funds or bonds through an IRA retirement account, you will want to look elsewhere.

Webull could also boost its trading experience for users by offering options, futures, forex, and cryptocurrencies.

However, there’s still a lot under the hood with their investing app, and if you’re looking to cultivate an excellent mindset for trading in the stock market, their platform will be worth a look.

![M1 Finance: A Comprehensive Review [UPDATED]](https://www.listenmoneymatters.com/wp-content/uploads/2018/08/LMM-Cover-Images-2-768x432.jpg)