- The difference between an Index Fund (ETF) and a Mutual Fund

- 1. Vanguard Total Stock Market (ETF) – VTI

- 2. Vanguard Total Bond Market Index (ETF) – BND

- 3. Vanguard Total International Stock Index Fund – VXUS

- 4. Vanguard Small-Cap Index ETF – VB

- 5. Vanguard REIT Index Fund – VNQ

- 6. Vanguard Social Index Fund Admiral Shares – VFTAX

- 7. Vanguard Target Retirement 2050 Fund Investor Shares – VFIFX

- 8. Vanguard Growth Index Fund Admiral Shares – VIGAX

- 9. Vanguard 500 Index Fund Admiral Shares -VFIAX

- Vanguard Select Funds

We absolutely champion Vanguard, though we recognize that diving into its funds might seem more intricate than your typical Robo Advisor experience. Don’t fret! We’re here to guide you through our top Vanguard fund picks, striking a balance between stellar performance and cost-effectiveness.

Before jumping in, it’s important to mention why we focus so heavily on fees here. Due to their exponential nature, fees of just 1% can cause you to lose up to 25% of your earnings. That’s pretty horrendous and often what turns investors on to Vanguard in the first place.

I also highly suggest you check the fees on your accounts via the free Personal Capital fee analyzer. It runs simulations and pinpoints all of the overly fee-hungry funds across your accounts – retirement or otherwise.

We’ll delve into the world of Vanguard funds, identifying the top eight choices that will provide you with the diversification necessary to withstand market fluctuations and maximize your returns. Whether you’re a seasoned investor or a beginner seeking to build a solid foundation, these Vanguard funds will offer you the perfect blend of assets to ensure a well-rounded and prosperous financial future.

Let’s embark on this journey together and unlock the full potential of your portfolio!

If you’re looking for a deeper dive into our logic as well as some colorful commentary, then check out the podcast episode we did on this:

The difference between an Index Fund (ETF) and a Mutual Fund

First, let’s quickly discuss an Index Fund (ETF or exchange-traded fund) and a mutual fund. Who better to ask than Vanguard themselves?

An ETF is a collection (or “basket”) of tens, hundreds, or sometimes thousands of stocks or bonds in a single fund. If you’ve ever owned a mutual fund—particularly an index fund—then owning an ETF will feel familiar because it has the same built-in diversification and low costs.

Source: Vanguard

A Mutual Fund is very similar to an ETF with one crucial difference:

You can set up automatic investments and withdrawals into and out of mutual funds based on your preferences.

Source: Vanguard on ETF vs. Mutual Fund

In other words, if you are a beginner or want to automate your investing, then you use a Mutual Fund. If you want cheaper fees over time and don’t mind making contributions every month, then you should choose an ETF. I use ETFs because I don’t mind making investments manually, and fees are the worst.

We often get asked how much we need to invest in Vanguard. If you’re investing in a Vanguard ETF, it will cost you the price of one share (Vanguard ETFs typically cost between $50 to several hundred dollars. If you’re investing in a Vanguard Mutual Fund, then the minimum initial investment is between $1,000 and $3,000.

1. Vanguard Total Stock Market (ETF) – VTI

VTI | Vanguard | MorningStar | Fee: 0.03% | 5 Year Avg: 13.84%

Vanguard’s premier ETF stands out as, what we believe to be, their crown jewel. Representing a share class of the Vanguard Total Stock Market Index Fund, this ETF amalgamates Large, Mid, and Small cap U.S. companies, mirroring the CRSP US Total Market Index’s performance.

It’s the lowest expense ratio we’ve ever seen on a fund. That’s because the fund tracks a few smaller indexes allowing it to be mostly automated.

Often when people mention that they invested in Vanguard, they refer to this fund. Since 92%+ fund managers can’t even beat this, I’d be very skeptical if anyone suggested they can perform better after-fees than this fund. Even Warren Buffet agrees. Of course, it would be shrewd to invest in more than just VTI. It’s impressive, but it’s not all things.

The minimum investment is the price of one share.

This fund is a critical component in The All-Weather Portfolio by Ray Dalio.

This portfolio's single goal is to make money in all market conditions regardless of interest rates, deflation, what new pandemic is threatening our shores, or who the POTUS is. It does this by focusing on growth and inflation cycles.

Get our best strategies, tools, and support sent straight to your inbox.

2. Vanguard Total Bond Market Index (ETF) – BND

BND | Vanguard | MorningStar | Fee: 0.035% | 5 Year Avg: 4.41%

Any well-balanced portfolio has bonds in it. They’re much less sexy than stocks but are also much less risky. When you’re young, 10% of your portfolio should be in something similar to BND, and as you get older, you’ll increase that percentage significantly.

This one tracks the performance of the Bloomberg Barclays US Aggregate Bond Index.

The bonds within this fund are of investment-grade quality, making it suitable for a medium to long-term holding strategy given its composition.

In preparation for market corrections or, as we see them, investment opportunities, we tend to hold more bonds. Since long-term bond funds rose ~20% in price in 2008, we see this as a win-win.

Since bonds tend to do better when the U.S. stock market is doing poorly, we want our Opportunity Funds to be full of them.

We recommend keeping your Opportunity Fund in a cash account with the best-in-class interest rates.

This fund is also a core component of The Coffeehouse Portfolio:

This portfolio takes its name from the idea that it’s such a straightforward investing strategy you could create it while sitting in a coffeehouse. It focuses on diversification and keeping things simple - it's also exceptionally conservative.

3. Vanguard Total International Stock Index Fund – VXUS

VXUS | Vanguard | MorningStar | Fee: 0.08% | 5 Year Avg: 5.95%

Similar to our #1 choice, VTI, this fund focuses only on companies outside the US. The fund covers both developed and emerging markets.

It’s pretty volatile, so we keep it as a small portion of our portfolio to help offset our heavy US exposure.

This fund is enormous at over a 198 billion market cap. While found in The Coffeehouse Portfolio, it’s better known for its place in the Ivy Portfolio.

This portfolio attempts to diversify your money by dividing it into stocks, bonds, commodities, and real estate in a way that mirrors the Ivy League endowment funds. It doesn't attempt to mirror every move the endowment fund makes.

4. Vanguard Small-Cap Index ETF – VB

VB | Vanguard | MorningStar | Fee: 0.05% | 5 Year Avg: 12.54%

A small-cap is generally a company with a market capitalization of between $300 million and $2 billion. This ETF is a grouping of companies with higher growth than the market, but it’s far riskier since the companies included are not as proven as those found in large-cap indexes like VV.

Also, again, this one’s the riskiest of the bunch. We wouldn’t recommend making this one more than 10% of the total amount you invest in your Vanguard investments.

VB is most known for its inclusion in the Larry Portfolio.

This portfolio's goal is to be both high performance and low volatility. It achieves its performance by tilting your portfolio to higher-risk stocks that are underpriced. Its low volatility is due to only holding 30% in stocks while 70% goes to bonds.

5. Vanguard REIT Index Fund – VNQ

VNQ | Vanguard | MorningStar | Fee: 0.12% | 5 Year Avg: 6.52%

Buying and owning rental properties can be great when it diversifies your personal finances but can be a lot of work; this REIT seeks to solve that. Instead, invest in a REIT and take rental profit and liquidity. This index fund is not just a REIT but a fund of many REITs, so you’re heavily diversified in the rental game.

This REIT is found in The Coffeehouse Portfolio and the Ivy Portfolio.

Note: You won’t find much yield here, which is a bit of a drag considering real estate is a stable income play. As a replacement for the income portion of your portfolio, we recommend Fundrise.

Diversify into income-producing real estate without the dramatics of actual tenants. Fundrise eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy.

Disclosure: When you sign up with this link, we earn a commission. All opinions are our own. I am investing with Fundrise

Compared to VGSLX, Fundrise sticks to mid-size deals overlooked by large funds and, as a result, provides a markedly higher return. You can also opt to concentrate on income or appreciation-focused funds.

6. Vanguard Social Index Fund Admiral Shares – VFTAX

VFTSX | Vanguard | MorningStar | Fee: 0.14% | 5 Year Avg: 16.67%

This ETF applies a Socially Responsible Investing lens to VTI, spotlighting eco-friendly companies emphasizing social impact. These enterprises champion initiatives ranging from renewable energy sources to gender pay equality. Prominent companies adopting these investment principles include Apple, Microsoft, Google, and Tesla — all commendable players in their fields.

Reducing energy costs and attracting the best talent is great for business, so it’s not surprising that this fund outperforms VTI.

There is no better place to use this than an SRI version of the Golden Butterfly Portfolio.

This portfolio is a socially responsible version of the Permanent Portfolio with one additional asset class. This is done to incorporate some of the characteristics of a few other notable lazy portfolios.

Note: However, you will notice that we use JUST by Goldman Sachs in the portfolio. That’s because it’s an ETF, so that we can buy it on the open market, VFTAX, you need to buy directly from Vanguard.

7. Vanguard Target Retirement 2050 Fund Investor Shares – VFIFX

VFIFX | Vanguard | MorningStar | Fee: 0.15% | 5 Year Avg: 10.42%

This fund is a lifecycle fund, so it starts with most of the money invested in stocks and slowly tilts its asset allocation into bonds over time. The point is you take on risk now while you’re young and gradually reduce risk as you reach retirement age, so big market swings don’t wipe out your retirement money.

While this fund isn’t their best regarding the fee, it covers a much-needed gap in most people’s portfolios. As you know, we’re big fans of buy and hold, and this fund fits in there perfectly.

The number in the fund name, for example, “2050”, corresponds to your “typical” retirement date – usually, that’s when you’re 59 1/2. We often find ourselves picking funds with dates well past the typical retirement age, so we get something a bit more growth-focused early on, which is why this is the best pick for most people.

8. Vanguard Growth Index Fund Admiral Shares – VIGAX

VIGAX | Vanguard | MorningStar | Fee: 0.05% | 5 Year Avg: 19.74%

With this Growth Fund, Vanguard picks high-growth companies that will knock it out of the park for you. It’s a bit riskier, but the returns are substantial.

Even though the focus is on high-growth stocks, the fund follows a buy-and-hold approach where once they locate a stable company, they stay invested in them for a while. Longer-term investments typically perform better.

9. Vanguard 500 Index Fund Admiral Shares -VFIAX

VFIAX | Vanguard | Morningstar | Fee: 0.04%

Pioneering the market as the first index fund tailored for individual investors, the 500 Index Fund offers an affordable gateway to the vast U.S. equity landscape. By investing here, you tap into the potential of 500 of the U.S.’s leading enterprises across a spectrum of industries, ensuring diverse exposure. Given its breadth within the large-cap segment, this fund deserves a pivotal spot in your investment portfolio.

Vanguard Fund Tracking and Monitoring

Manage your cash and optimize your investments in one place. With Personal Capital, you can analyze your 401k to diversify your holdings better and reduce fees. I had no idea I was paying over 1% of my assets in fees every year, but with their help, I was able to get it down below 0.3%.

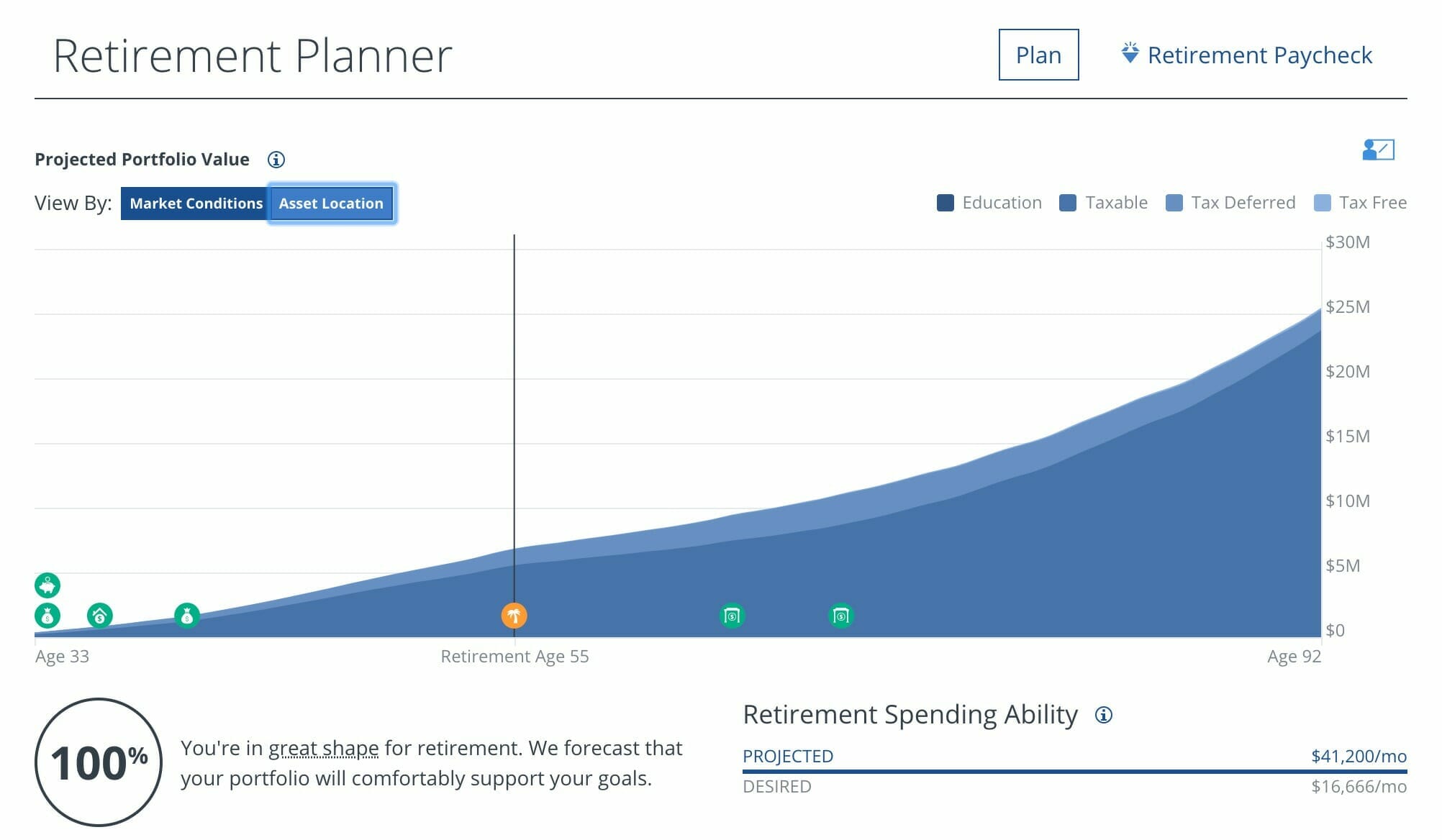

Once you have all of your brokerage accounts linked, you can also leverage their Retirement Planner to plot out exactly what your retirement would look like. Using a Monte Carlo simulation, they determine how likely it is that you’ll reach the level of income in retirement that you’re hoping for.

I’ve been using Personal Capital since 2013, and to date, haven’t been disappointed. I haven’t found a better free online tool for building and managing wealth.

Vanguard Select Funds

Vanguard created a shortlist of their funds called the Vanguard Select Funds. One exciting thing about the list is how they determine what funds get on it:

The Vanguard Portfolio Review Department evaluates our low-cost fund lineup on an ongoing basis to determine the funds selected. This in-house team of investment professionals evaluates the funds using a proprietary screening process and criteria. – Vanguard Select Funds

So, they’re hand-picked using voodoo. I will say that a lot of their most expensive funds (where they can make the most money) are on that list, like the Windsor II, whose fee is 0.34%.

It’s worth mentioning that most of the funds on our list are on their list, with the exception that we excluded the high-cost funds. There are a billion studies that show there is no correlation between a high cost and a high return. That’s why we focus on “shooting for the average” on the show, easily the best bang for your buck given the risk.