For most of you who listen to and read LMM, your ultimate goal is financial independence. But what is that and how do you achieve it? Here is a roadmap for financial freedom.

When you have a lot of weight to lose, you don’t lose 100 pounds. You lose one pound 100 times. Achieving financial freedom is a lot like that. Like any goal, you have to break down this goal into small, manageable pieces. Here is a roadmap for financial freedom.

What Financial Freedom Means

Financial independence has become a buzzword word in personal finance circles, and like many buzzwords, the real meaning gets lost.

Having financial freedom will have slightly different definitions for everyone, but at the core, it means having enough money to pay for basic necessities without having to work.

You can work, of course; some people enjoy their careers. And most of us want more than the basic necessities but you don’t have to out in a ton of hard work in order to pay your bills. You have assets that generate enough money to cover basic monthly expenses.

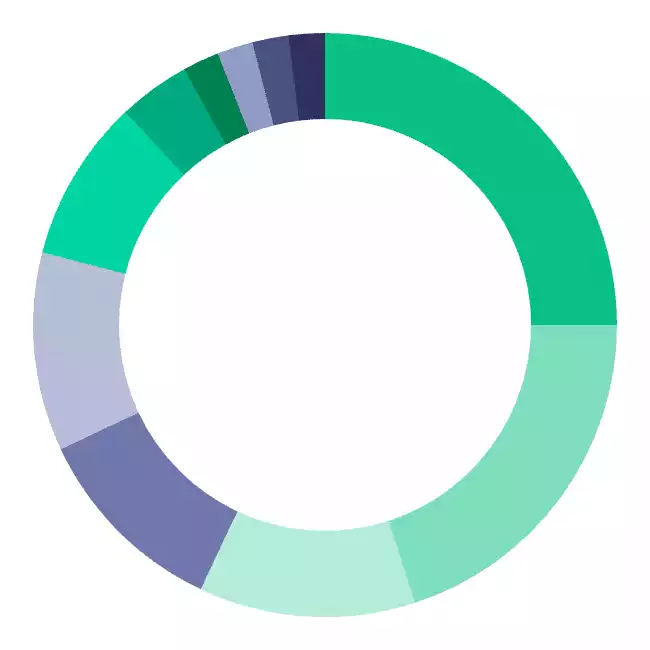

A Stage-by-Stage Road Map

Here is a brief run-through of each stage before we dig deeper into each.

| Stage Zero: Starting from the Bottom | We all start at stage zero, and some of us dwell here for a long time, some of us forever. We're here when we are young and depend on our parents for support, or because you're an adult, but you spend more money than you make. |

| Stage One: Meeting Your Commitments | At this stage, you are financially self-reliant. You are making more than you spend and while you may still have debt that you need to pay off, you are no longer adding to that debt. |

| Stage Two: You're Stable | Your bills are up paid up to date, and you're free of high-interest consumer debt like credit card debt. Now you start building an emergency fund. It can be the difference between a small bump in the road financially and complete ruin. |

| Stage Three: Free of Debt | Not all debt is created equal and it's not all necessarily bad. Some people don't consider this stage complete until they are completely debt free. Others are comfortable with low-interest rate debt like a mortgage. |

| Stage Four: Feeling Secure | This is the first stage that you've achieved some degree of financial independence. Whatever income you are generating that is independent of your job (rental property income, income from investments) is sufficient to pay for your basic living expenses. |

| Stage Five: Feeling Free | At this stage work is no longer mandatory. You can decide to continue in your current job, you might cut back to part-time, you might start your own business, go back to school, or take a low paying job in a field you always loved but on whose pay wasn't enough to live the way you wanted. |

| Stage Six: 'Merican Level Free | Now you can have some fun with your money. You can do the things you have always dreamed of without worrying about money or work. |

| Stage Seven: Your Cup Runneth Over | In the final stage, you can afford your life, the life you want and have plenty of money as a safety net. What adjustments need to be made? Should you start investing more conservatively? What is going to happen to your money after you're gone? |

Don’t worry. You don’t have to complete all the steps to be successful. Some of us are happy being solid B students. So which stage is most important?

Stage Three.

You still have some debt, but it’s not high-interest debt. Your investments are not generating enough money to pay all of your essential bills, but you are mostly debt free between it and the income from your job.

You can live pretty stress-free for a long time in Step Three as long as you don’t hate your job and the job is pretty secure. The closer you get to retirement though, or if you hate your job or it isn’t stable, you need to ensure you are working toward Step Four.

Many of us, certainly not all (Andrew and Thomas) of us, would be pretty happy if we lived out the rest of our days never advancing beyond Step Four.

You can pay basic living expenses independent of your job. You don’t have any debt. You aren’t taking five-star vacations, but some people don’t care about things like that.

Okay, now we know the stages, what each entails, and where we can stop if we’re not overachievers. But how do we progress from one stage to the next?

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Stage Zero

If you’re a kid financially dependent on your parents, lucky you! That means they are paying all of your basic expenses and probably some that are not so basic. So any money you earn during this period is yours to do whatever you want.

You could spend it taking your friends out to eat, new clothes, and accessories for your cell phone. But if you want to advance more quickly through all the stages, what you do at this stage can give you a big leg up.

Educate yourself.

Learn something about personal finance. There are a lot of great books for beginners. We have a whole library of recommendations.

LMM has plenty of information for those new to personal finance. We have great resources for beginners that can teach you about creating a monthly budget, credit, and investing.

Make some more money.

Get a part-time job after school, mow lawns, babysit, get a side hustle or do freelance work online. And don’t spend all of that money. Put it in some kind of bank account or ask your parents to invest in for you.

You can have some fun with the money your work for, but your savings rate should at least 50% of every dollar you earn or are given.

Think about the future.

Decide if college is right for you. It isn’t for everyone. If you want to go, choose wisely; your college and your major. College is too expensive to go to the best school you get in to, and it’s too expensive to get a degree in a field there is no demand for or that has very low pay.

The path to college also doesn’t have to be traditional. Get your prereqs done at a local community college. Live at home and work part-time to save money.

Once that’s done, transfer to a more prestigious school (be sure your credits transfer before choosing a community college and a traditional one). You’ll still get the degree with the fancy name but at a much lower cost.

Or you can work full-time for a year or two to save money to help pay for school. You can work part-time and go to school part-time. No law states that you have to enter college the autumn after you finish high school and finish in four years.

Apply for scholarships, lots of them. As much as you can stand to apply for and then some more. Every cent in scholarship money you get is money that you don’t have to spend or worse, take out in student loans. There are countless scholarships available, and they don’t all hinge on academics.

Things are tougher if you’re no longer a kid and still in or back to Stage Zero, but you can get out of it and move on. You are financially dependent on someone again, maybe your parents or your spouse or maybe your credit cards.

Whatever the reason, to move out of Step Zero, you have to pay off that debt as quickly as you can.

Lower your debt.

The first thing you want to do is lower the debt as much as possible. If your student loan interest rates aren’t great, consider refinancing to a lower rate through a company like Earnest.

If you have a good interest rate but just can’t keep up with the payments, there are several programs that can help lower your monthly student loan payments.

If you have more than one lender, you can consolidate the loans. If will make things less complicated and sometimes lower the monthly payments.

If you have credit card debt, you want to eliminate the high interest rates. They kill you when you’re trying to dig your way out of debt.

The easiest and most effective way is to get a balance transfer credit card. You can roll the balance from the card you are paying a high interest rate to a card offering a 0% APR.

Some cards offer that rate for as long as 21 months which gives you a good long time to get caught up because you are only paying the balance, no interest.

There are sometimes fees involved in doing a balance transfer so beware of that. And you must pay off the balance in full before the introductory rate period ends. If you don’t, the remaining balance is subject to the usual interest rate which may be higher than the one you’re currently paying.

If your credit is not great, you may not be able to get approved for a balance transfer card. If that’s the case, you can try to get a consolidation loan from a company like Upgrade. It will lower your interest rate significantly. If you have a good relationship with your bank, you can try to get a personal loan there.

If you can’t do any of that and you can’t even pay the minimums on your debts, it may be time to consider bankruptcy. Keep in mind that it is nearly impossible to discharge student loan debt in bankruptcy, and consequences can follow you for years. But sometimes it is the best decision.

There is a lot of stigma around bankruptcy but do you think businesses and even cities care about what others will think when they file for bankruptcy? They don’t. It was a business decision, the best one they could make.

Debt Payment Plan

If you don’t have enough debt to file bankruptcy or you simply refuse to, you need a plan to pay that debt down as quickly as possible, so you pay as little interest as possible. Just throwing extra money at various debts randomly won’t accomplish this.

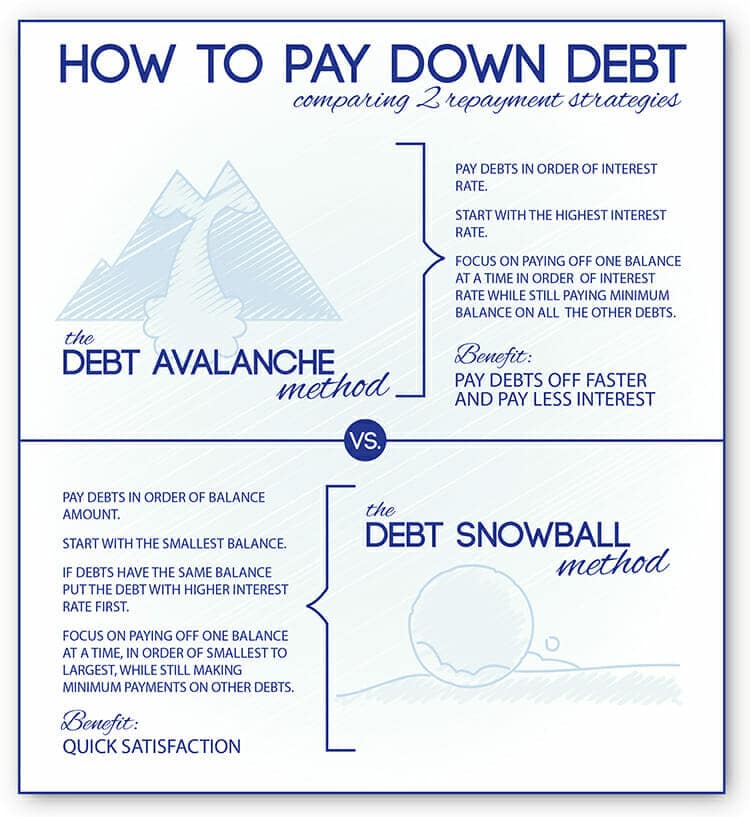

There are two popular methods of debt repayment. We have written extensively on both.

But here is a quick summary of each:

Snowballing means listing all of your debts in order of smallest to highest dollar amount and then using any extra money to pay off the smallest balance while only paying the minimums on the others.

If you have a $5,000 student loan at 4% interest, a credit card balance of $6,000 with 17% interest, and a $10,000 car loan with 9% interest, you pay off the student loan first, followed by the credit card and finally the car.

Once the smallest debt is paid, you move to the next smallest using the same strategy and include the amount you were paying on the first debt into your monthly payment on the next. You continue to do this until all of the debts are paid, the largest being the last one to go.

To use the stacking method, you list your debts in order of highest to lowest interest rate, regardless of the dollar amount of the debt. You throw as much money as you can at the debt with the highest rate of interest.

If you have the same debts we listed above, they would be ordered this way; the $6,000 credit card, the $10,000 car loan, and finally the $5,000 student loan.

Once each debt is paid, you move down to the next highest interest rate one, again, using the money you were paying towards the last debt, and do the same. So on and so on until all the debts are paid.

Both have pros and cons which we detail in the article. Spoiler, though, the stacking method will save you more in interest charges.

Cut your expenses.

Now that the debts are under control, you need to tackle expenses. I won’t lie, this part is going to suck. You may need to move in with family, get a roommate, or move to a cheaper place because housing is typically our biggest expense.

Anything that is not an absolute necessity has to go. Cable, Netflix, the gym. All of it, gone. Every penny you save goes to getting out of debt. Sell anything you can.

You’ve taken steps to save money; now you need to make some. Our homes are full of stuff we don’t use. Sell it on eBay, Craig’s List, Facebook, and have a garage sale. This will make it easier if you have to downsize your place or move in with someone temporarily, less stuff to move or store.

If you are only working 40 hours a week, that’s not enough. You need to spend some evenings and most weekends doing something else to bring in extra money. Drive for Uber or Lyft, get a part-time retail job (retail has flexible hours), tend bar.

It can seem impossible to dig your way out of this, and it is mostly going to be unpleasant If you’re strategic, it can be done faster than you thought.

Stage One

You did it! You have dug yourself far enough out of your hole that you don’t need anyone to help support you. You may still have some debt but your payments are current, and you aren’t adding any new debt. Keep working on that debt using the stacking or snowball method.

Maintenance

The important thing at this stage is to ensure that you never fall back to Stage Zero. You are understandably ready to move out on your own if you’ve been living with family. If you can keep your housing costs at no more than 30% of your income, go ahead.

If they’re willing to host you a bit longer, take advantage of the additional time to keep chipping away at your debt and building an emergency fund.

If you’ve been working more than one job, you might be able to cut back on the part-time gig. This doesn’t mean you shouldn’t have some second income stream, though. You no longer have to work hard every evening and weekend but keep some extra money coming in from somewhere.

Everyone should have more than one source of income because you just never know.

Grow your network.

You should use some of your new free time to improve your ability to earn money from your main career. This might mean going back to school part-time in order to get a degree or some certification that would enable you to earn more in your current career.

If you’re in a low-paying field, you might need to go back to school or find some training to change fields. It might just mean doing more networking to find better opportunities.

You need to be doing something to advance your money-earning potential as a bulwark against falling back to Stage Zero.

Stage Two

Things are stable and have been for a while. You’ve taken steps to improve your career, so more money is coming in. The biggest buffer between you and State Zero is a healthy emergency fund.

There is no magical number for everyone, but there is a minimum everyone should aim for; $1000. That will sound like a little to some of you and a fortune to others. But that should be your first target.

Build an emergency fund.

You need to prepare for any unexpected expenses so the end goal for an emergency fund is six months of expenses.

That might seem impossible if you are living paycheck to paycheck, but we’re taking bare bones expenses, housing, utilities, food, etc. You don’t need to include things like cable bills, clothing, and meals out. You could cut all of those things in a financial emergency.

Where should your emergency fund be on your list of priorities? Should you continue to build it if you still have debt?

Until you get that first $1,000, the emergency fund should come even before paying off high-interest credit card debt. Even Dave Ramsey who is much more conservative than we are at LMM and advocates for no debt of any kind agrees about this.

Once you get that $1,000, concentrate on paying off high-interest debt like credit card debt. You can focus on getting to your six-month number when that debt is paid off. Low-interest debt like mortgage and student loan debt shouldn’t impede your progress to a completely topped-up emergency fund.

Easy investing.

This is also the stage you want to start investing. If your employer offers a 401k, take advantage of that, especially if they offer to match, that is free money!

You don’t have to be an investing pro to get started here. Companies like M1 Finance can help you manage it so you can more time doing other things.

Stage Three

This is the stage where you become debt free. Exactly what that means is up to you. At the very least it means getting rid of high-interest consumer debt.

We showed you how to use the stacking or snowball methods to do that above. Whether or not you pay off your low-interest debts like mortgage and student loans is up to you. There are pros and cons for both options.

There are some questions that might help you decide if you should pay off low-interest debt early:

- Is your emergency fund fully funded?

- What medium-term goals do you have? Do you want to buy a home, buy a

rental property , start a business, go back to school? Can you still afford those things if you’re putting all of your extra money to debt repayment? - Can any of your debt be forgiven? If you work in certain sectors, your student loan debt will be forgiven if you’ve met certain criteria.

- What are your long-term goals? Do you want to retire early or pay for your children’s college education? Will paying off these debts early impact those plans?

Remember that to move to Stage Four, income from investments alone, not income from your job, has to be sufficient to pay your basic expenses. You need to start ramping up your investing through Stage Three.

Your 401k should be maxed out, as should your IRA. You should have investments independent of your employer through a company like Vanguard or M1 Finance. If you’re in a position to do it, consider starting to look at rental properties. In the right situation, it’s a very good source of passive income.

They're perfect for DIY investors who prefer a hands-off approach but can still pick individual stocks and funds. We specifically use them for the Golden Butterfly portion of our portfolio.

Stage Four

Those investments in you made in Stage Three have paid off. You are now able to pay your basic expenses on that income alone. Some people never get to this stage so if you have, congratulations! You are in a good financial situation to start investing.

Don’t slack off now.

You’re close to the final stage that many of us will be happy with. You need to focus on income investing. Income investing means having a mix of assets like stocks, bonds, and real estate that generate an annual income and build wealth.

How much do you need to have saved to pay all of your expenses solely from investment income? You can use the 4% rule to get that number. We did show an article on this where you can get more in-depth information but here is a simple explanation.

If you have $100,000 saved for retirement, you can make a withdraw 4% of that each year to live on, $4,000 (of course, you’ll need more, but I wanted to use easy-to-understand numbers for the example) without running out of money.

Investments that generate income.

Aristocrat Dividends: We previously discussed these in a podcast episode. These are stocks that pay shareholders a portion of their profits.

When you own stock in a company directly or through a fund, if the company turns a profit, you may get a percentage of that profit. The amount you receive depends on how much stock you own and how much profit there was to divide.

An aristocrat dividend is a company that has paid a dividend and increased that dividend for at least twenty-five years. Coca-Cola and McDonald’s would be two examples.

The S&P 500 has a fund called The S&P 500 Aristocrat Fund that has over the last five years had returns of 17.56%.

This is an index fund of the most consistent dividend-paying companies in the S&P 500. It has historically outperformed the S&P 500 long-term. Over the past 10 years, it has returned 10.98% on an average annual basis whereas the S&P 500 only returned 10.53% during that same period.

Bonds: There are many types of bonds, but the most basic description would be, a bond is an IOU. A coupon is the interest payment, and you get that on a semi-annual basis until the bond matures. At maturity, you get the face value back. Bonds pay interest so can provide you with a steady and predictable income.

Real Estate: We have talked to you a lot about a

But, if you still can’t get on board with becoming a landlord, you can still use real estate to generate income by investing in REITs. A REIT is a real estate investment trust. It’s a company that owns income-generating properties. It’s similar to a mutual fund and can provide investors with regular income.

Diversify into income-producing real estate without the dramatics of actual tenants. Fundrise eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy.

Disclosure: When you sign up with this link, we earn a commission. All opinions are our own. I am investing with Fundrise

Stage Five

In Stage Five, you can maintain your current standard of living, not just your basic expenses, strictly from investment income. You can now consider leaving full-time employment or at least your current full-time job.

Life after financial freedom.

If there is something you have always wanted to do for a living but for whatever reason chose a different path, now is the time that you can do it. Teach, start a hobby farm, write a book, volunteer. You have financial security and don’t have to work for money anymore.

Make sure your portfolio is diversified. Now is probably the stage where you want to consider reducing some of the risks in your portfolio. Not a major shift but if you’re 80/20 between riskier and less risky investments, you may want to shift to 70/30.

Stage Six

This is the time to make some of your dreams come true. You can, within reason, spend money on whatever you want. But you want that money to be well spent, to make you happy. You don’t want to just the rich asshole who walks into a strip club and makes it rain (well, maybe once).

Money can buy happiness, but it depends on what you buy. We are made happier when we buy experiences rather than things. And it makes sense if you think about it. Experiences are things like a vacation. When you think back to your last trip, there are several stages that gave you pleasure and made you happy.

Planning and daydreaming about the trip, actually taking the trip and sharing that experience with the people or persons you were with, and sharing and savoring memories after the trip is over.

Now think about the last big purchase you made. When you think of it, does it bring up the same fond memories that your last vacation did? Probably the only exception to this is a really baller bed. If you have more money than you can spend, buy a really top of the line bed and bedding.

Giving is another way spending money can make you happy. Whether it’s surprising someone close to you with a gift, one of those “random acts of kindness” or supporting a cause you care about with a donation, giving is good for you. In fact, spending money on others makes you happier than spending it on yourself.

Stage Seven

You have to manage this money. When it’s this much, checking your Mint account every week isn’t really good enough anymore. Should you hire a financial advisor to manage your money?

We don’t think so. No one is going to care more about your money than you, and there are plenty of instances where financial advisors fleeced clients with outrageous fees or just outright theft.

You don’t want to manage your money to become a full-time job though, and it doesn’t have to be.

There are some yearly check-ups you need to do.

- Is your investment strategy on track? Each year you should list your priorities and strategies to reach them. Does your portfolio still line up with your financial goals? You may need to rebalance.

- Are you tax efficient? Are you deferring and reducing taxes on your investments? You can’t control the market, but you can control how you use that provide tax advantages.

- Do you have the right kinds and enough insurance? A lot can change in a year, so you need to evaluate your insurance coverage. If you’ve had a child you will want to increase your life insurance, if you’re an empty nester, you might consider reducing it. If you’ve divorced, make sure you update the beneficiary of your policy. If you are nearing retirement age (although you may have been retired for many years already) you should investigate long-term care insurance.

- Do you have an estate plan? You want to make sure that your assets are distributed according to your wishes. Do you have a will? Does your family or executor know where to find the relevant documents? Who will make health care decisions for you if you are unable to make them for yourself?

What Stage Are You In?

This can all seem pretty intimidating. Honestly to me, Step Seven isn’t even all that appealing. I don’t want to deal with my money to become a job in itself. But remember, you don’t have to do all seven stages to be achieve financial freedom.

There aren’t strict timelines for these stages. Obviously, at some point, it will be too late to fit in all the stages, but it’s not as if you haven’t reached Stage X by Age Y you’re a loser who should just give up and go live beneath a bridge.

And these stages aren’t meant to make you feel bad. They are just guidelines and goal posts. If financial freedom is a goal of yours, it’s good to have some markers to measure yourself against so you know if you’re on track to reach that goal.