You already know that you have to have a budget. It’s basically Rule #1 when it comes to personal finance. If you don’t know exactly how much money you have coming in and going out and where it’s going, it will be nearly impossible to reach your financial goals.

So, do we all agree that everyone needs a budget?

But the question is, how do you divide up the money? How much should you be putting it towards things like housing, utilities, car payments, debt repayment, entertainment, and retirement?

We can’t give you hard numbers because everyone’s income and expenses are different.

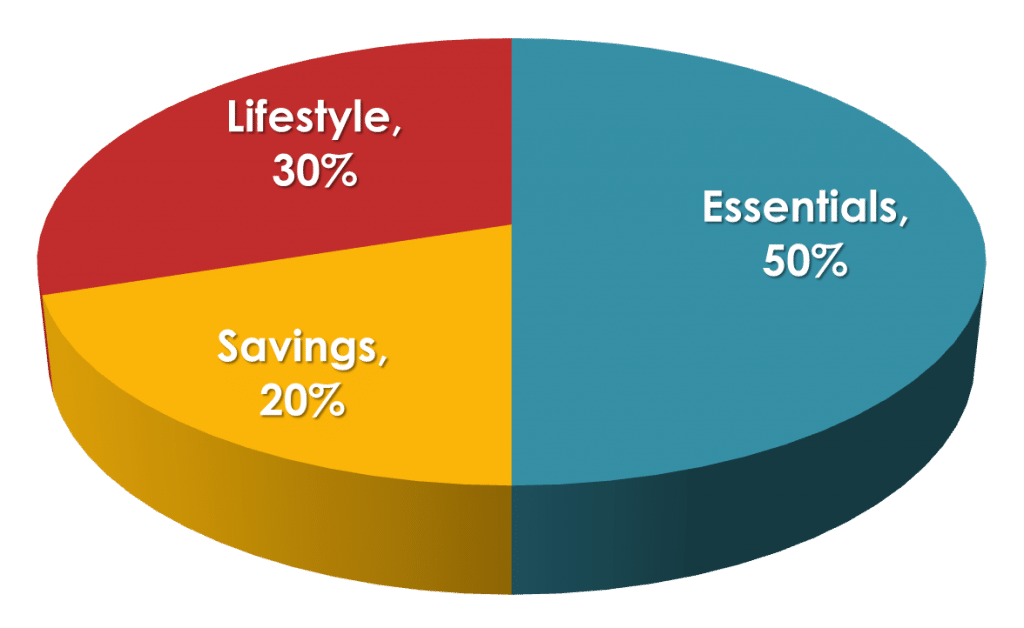

Instead, we’ll show you how to set up your budget categories with the 50:30:20 rule.

And because we are a one-stop-shop for all things personal finance, we’ll show you ways to reduce your expenses within those categories if your numbers are outside of the 50:30:20 parameters. We’ll also include a few ways to increase your income because sometimes you can’t reduce your expenses any further.

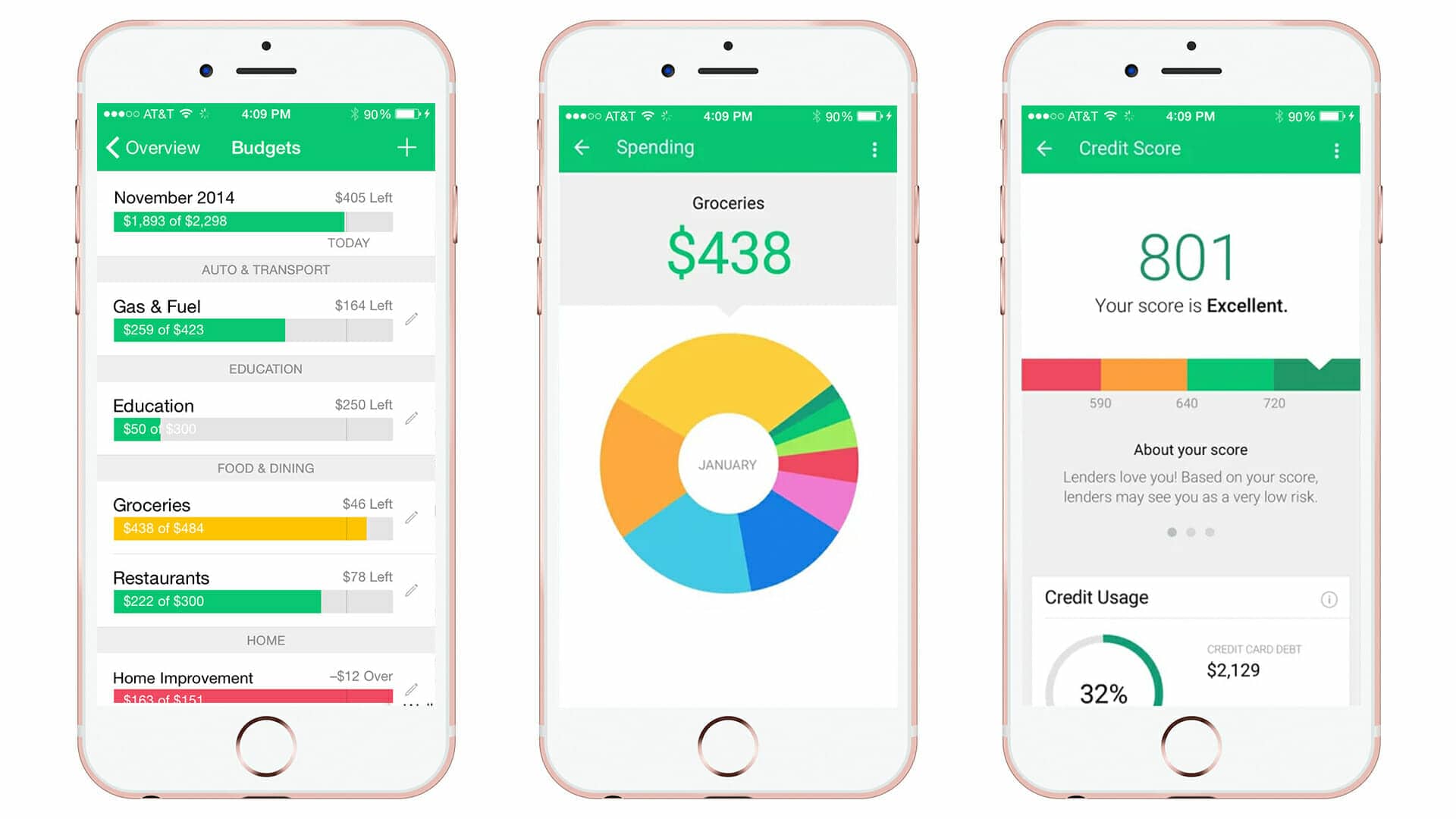

So log into Mint, You Need a Budget, or Personal Capital, or get out your spreadsheet, cocktail napkin, abacus or whatever you use to budget and let’s set up your budget categories with the 50:30:20 rule.

Personal Capital is Now Empower - Track your entire portfolio for free.

All your accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

You Might Not Know

You know who Elizabeth Warren is, a Senator from Massachusettes. But did you know she is the person who originally proposed the Consumer Financial Protection Bureau?

The CFPB was created to protect consumers from abusive, deceptive, and unfair practices by mortgage and payday lenders, credit reporting agencies, debt collectors, and private companies that provide student loans.

Since it’s creation, the CFPB has returned more than $12 billion to consumers who were victims of unfair practices by those entities.

Senator Warren was a Harvard law professor and is a leading authority on bankruptcy. She has also authored a number of books including several on matters of personal finance including “All Your Worth: The Ultimate Lifetime Money Plan” which she wrote with her daughter Amelia Warren Tyagi.

That book is widely credited with popularizing the 50:30:20 rule of budgeting.

And it’s a good rule because it’s so simple and works for everyone because it uses percentages rather than dollar amounts. So let’s break down how to use this easy rule that will simplify your budget and your life.

Get Your Number

As we all know, the amount of money we earn is not the amount of money we end up with. There are pesky things called taxes that are taken out of our paychecks before we get them.

To use the 50:30:20 budgeting rule effectively, we need to get the amount of our after-tax income. How much money do we have left once things like state, local, and income taxes, Medicare, and Social Security are deducted?

The number we’re left with is our after-tax income or our take-home pay.

This is easy if you work a salaried job, it’s a little harder if you’re paid by the hour and the number of hours you work week to week vary, if you’re self-employed, if you work in an industry that pays via commission like real estate, or any number of other situations where income isn’t consistent.

If your take-home pay isn’t consistent, look back at your monthly after-tax income from the previous year. The number you want to use is your minimum monthly income rather than your average monthly income.

This is especially important if you have big swings in your monthly income. If you live in Minnesota and your business is lawn care, you make a lot more money in July than you make in February. If you base your budget on your July numbers, the budget isn’t going to work.

Using the minimum monthly income to budget might mean you have to make some cuts, but it also means you will be less likely to end up over budget most months.

Okay, got your number? Good, let’s get budgeting.

Wait. What About My Side Hustle Money?

LMM is always encouraging everyone to have a side hustle, and we’ve given you tons of side hustle ideas. If you’re making side hustle income, should you factor it into your budget?

The answer depends on how much you’re bringing in and how consistent that income is. If it’s less than a couple of hundred bucks every other month, which is indeed nothing to sneeze at, don’t include it in your budget.

This money is used best for things like building up your emergency fund, paying off credit card debt, starting an investment account or even treating yourself to something like a nice dinner out.

If your side hustle income is reasonably substantial and regular (well done!), then you can add it to your budget for living expenses. Use the same method we described above for those with irregular income, look back at the past year (or as far back as you’ve been bringing in this money) and use the minimum monthly number.

Okay, now we’re ready to budget.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

The 50 Percent

Take the number you got for your monthly take-home pay and divide it by two. This is the number that will make up 50% of your budget. This will go towards essential living expenses.

Before we define “essential,” take 30% of this number. This is for housing, your rent or mortgage payments. This payment should be no more than 30% of your after-tax income. Easier said than done. But there’s a good reason to make it a goal.

Why 30 percent? It’s a standard the government has been using since 1981: Those who spend more than 30 percent of their income on housing have historically been said to be “cost burdened.” Those who spend 50 percent or more are considered “severely cost burdened.”

“Cost burdened” is government-speak for “you’re going to be broke.”

For most, housing is our most significant expense, so it makes sense to keep it as low as possible. Sure you can take your lunch to work, cancel cable, and all those other money-saving tips but they aren’t nearly as impactful as keeping your housing costs low.

Some experts recommend keeping all housing expenses at or under 30% of your net income, including utilities, taxes, etc. Because just keeping the housing payment under 30% is tough, I don’t think it’s realistic to include anything else in that percentage. Even better if you can, but not achievable for many people.

The rest of the 50% is for things like utilities, groceries, health insurance, and car payments.

Essentials is a pretty small list. It does not include things like a gym membership, dinners out, or clothing. When listing out your expenses, be honest. We all have different spending priorities, but essentials don’t vary much from person to person.

The 30%

This is your “fun money,” your discretionary income. You get to spend this money on whatever you want, Starbucks, vacations, new clothes, tech upgrades.

But because you’re reading a personal finance blog, we will assume that you don’t have an endless supply of fun money to spend, and you want to get the most out of what you do have.

You will get more enjoyment from the money you spend when you use it to buy experiences rather than things.

There is plenty of science to back this up.

When you buy an experience, you buy memories. And memories, unlike things, last forever. So don’t use your work bonus or your tax refund check to buy a new TV. Use them to take a trip or to buy concert tickets.

That said, there are some things you can spend money on that while not necessarily making you happy the way a great experience does, can improve your life. A good mattress, quality kitchen knives if you cook, the right running shoes.

Things like those are a good investment and worth spending a little more money for. That means you might have to save up for a bit, but delayed gratification is part of being an adult. A crappy part but still.

The 20%

Now we’re getting down to brass tacks. This category is the important one and what you do with this money will be a big part of determining your financial situation and future. This money is either for debt repayment or savings goals.

Debt with high-interest rates like credit card debt is an emergency and paying it off needs to be your priority. If you continue only making the minimum payments, it will take years to get this debt paid and you’ll end up paying thousands of dollars just in interest.

Out of debt, out of danger

Tweet ThisUse the snowball or stacking method to pay off all of your credit cards. Both methods work and have their advantages, but the stacking method allows you to pay the least amount of interest.

Low-interest debt like student loan or mortgage debt is not so urgent. There are ways to reduce those debts, and we’ll cover that, but they can go on the back burner.

Once your debt is under control, you can focus on the future. You want to have a six-month emergency fund stored in your savings account.

Fully fund your retirement accounts, a 401k if your employer offers one, and an IRA. These accounts are tax-advantaged which is why you prioritize them over regular investment accounts.

When you have maxed out your retirement accounts, you can start investing. We like robo-advisors like

Customize Your Budget

The 50:30:20 rule is a good budgeting blueprint. But there are ways you can and in some cases, should make a few changes.

If you have high-interest credit card debt, flip the 30% and the 20%. That means you should be using 30% of your income for debt repayment and 20% for discretionary spending. That debt is like an anchor holding you back from reaching your financial goals, so you need to get rid of it fast.

If you are someone who wants to be part of the FIRE movement, we recommend you do the same. Save 30% of your after-tax income and spend 20% on non-essentials. The more money you save, the earlier you can retire and spend your time however you want.

Making Some Cuts

If you’ve run all your numbers and you’re outside the 50:30:20 guidelines, there are some cuts you can make to save money.

The reason it can take so long to pay off debt is that of the interest rates. Credit cards have high interest rates, so you want to lower them.

The most effective way to do this is to take out a debt consolidation loan with a lender like Upgrade. You’ll still have debt, but it will likely be at a much lower interest rate than your credit cards had.

If your credit score isn’t good enough to get a loan, you can turn to National Debt Relief. They will negotiate a settlement with your credit card companies and may save you as much as 30% on your debt.

If you have student loan debt, the first step is to find out if you’re available for one of the forgiveness programs. If you don’t qualify or if your loans are private rather than federal, you can refinance to a lower interest rate with Earnest.

Even lowering your rate by 1% can save you thousands of dollars over time.

Those are the big things. Here are a few little things you can do to save money.

Let Trim lower the cost of things like your cable, security, and cell phone bills. Let Trim cancel those services you pay for every month but don’t really use like Pandora, subscription boxes, or Audible.

When you shop online, shop through Ebates. You’ll earn cash back when you shop with participating retailers.

Make a Little Extra

You have plenty of free time. Americans spend five hours a day watching television. We know there are a few of you who work eight jobs and have seventeen kids and genuinely don’t have free time, but that’s not true for most of you.

So you need to spend a little of that time making a little extra money. It’s easier than ever so there is no reason you can’t bring in some more cash.

We want you to set a goal of making an extra $50 a week.

That isn’t a lot, and you can make a lot more, but we want to set a low bar at first to build your confidence!

We have tons of information on ways to make extra money. Here are some highlights.

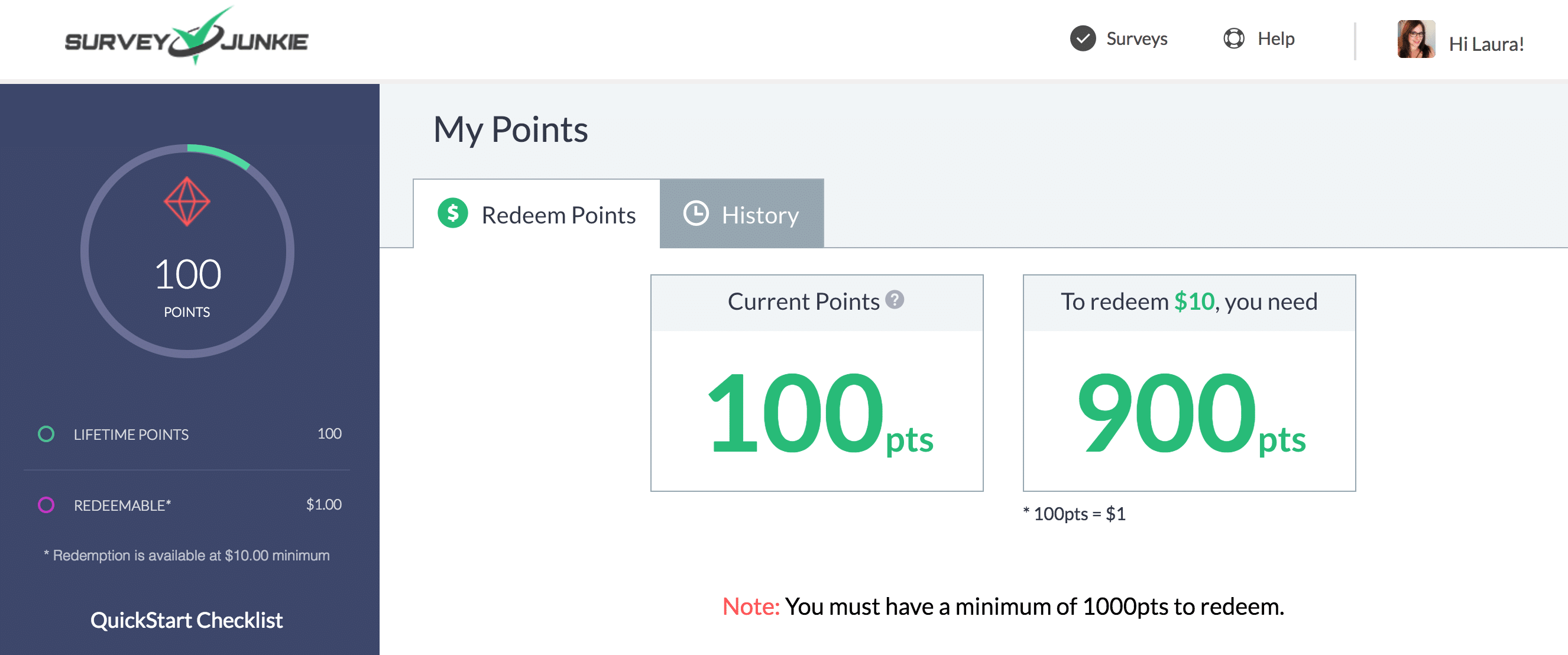

Drive for Uber or Lyft. Rent out your place on Airbnb. Sell old electronics on Gazelle. Start selling all those clothes you bought and never wore on Poshmark. Take surveys on Survey Junkie.

Earn free Amazon gift cards (almost as good as cash and you can sell them for cash), look for freelancing work on Upwork, start a blog, pet or babysit on Sittercity.

For real, you guys can easily make $50 a week at least. And a lot of these methods don’t even require you to leave the house! And your side hustle may grow into something more. You wouldn’t be alone.

More than one third (36 percent) of U.S. workers are in the gig economy, which works out to a substantial number of approximately 57 million people.

With the rise of Uber, Lyft, Etsy, Amazon Mechanical Turk, Freelancer.com, eBay, and others, more and more workers are doing part-time work, side hustles, as they are often called, and are joining the “Gig Economy” as it is more formally known.

It’s too risky these days to have a single source of income. Any of us could lose our jobs through no fault of our own. If that were to happen, maybe your side hustle wouldn’t entirely replace your income but having something coming in is better than nothing.

No excuses, get hustling.

No Budget, No Bueno

You must have a budget no matter how much money you make. You’ve heard those absurd stories about people making six figures and still living paycheck to paycheck or lottery winners who blew through literally millions of dollars in a matter of years.

Not having a budget is why. So you have to have a budget.

We like Mint for budgeting because it’s free and easy to use. We wrote an article showing you how to create budget categories without going nuts, and now you know how to split your money up.

You have all the tools you need; the rest is up to you. Because no budget is no Bueno.