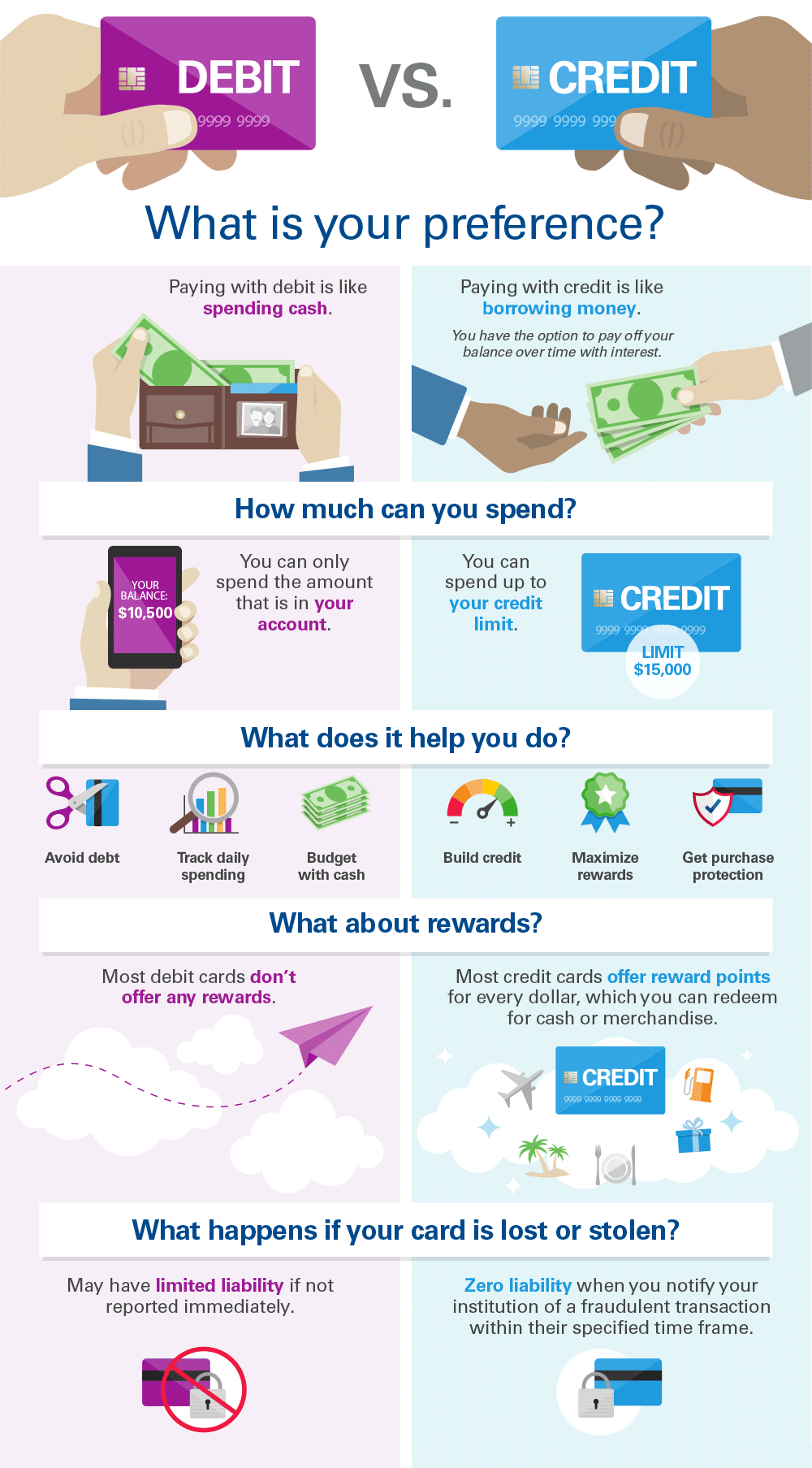

Every purchase presents a choice: credit card, debit card, or cash. Each option has its advantages and disadvantages. Is there a definitive best choice? The ultimate showdown: Credit versus Debit versus Cash unfolds.

Those shiny credit card offers with their promises of free flights, and cash back can be seductive. We like our debit cards because they help keep spending under control. And some die-hards still like cash because it can make some purchases cheaper. What and when should you choose when it comes to credit vs. debit vs. cash?

What’s More Popular- Credit vs. Debit?

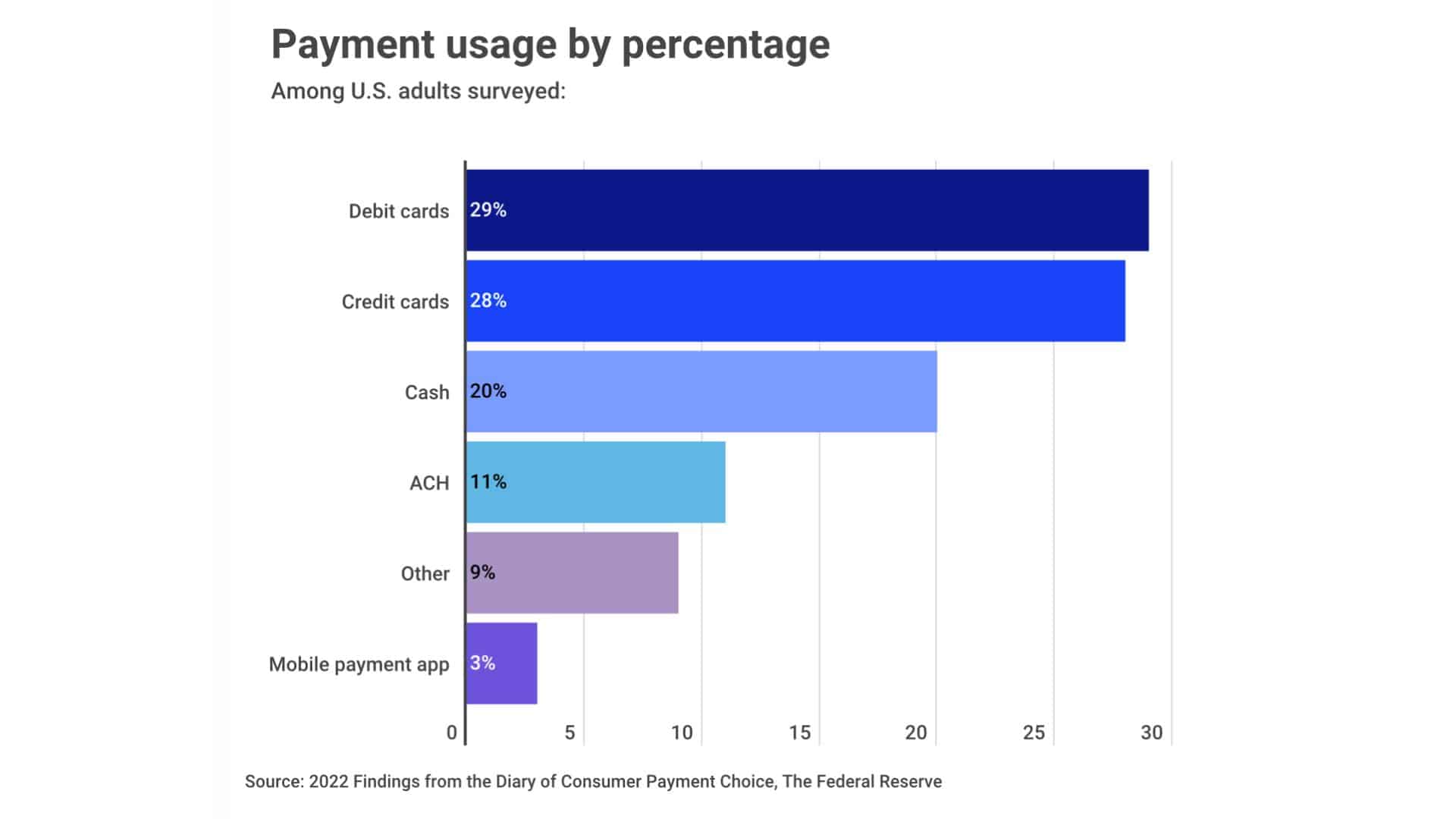

Among our three choices, which do Americans prefer?

According to a Federal Reserve report regarding which payment form consumers prefer, 28% chose credit cards, 29% selected debit cards and only 20% percent specified a preference for using cash. According to the Consumer Financial Protection Bureau, “since 2015, consumers have more than doubled spending with credit cards . . .”. During that same period, debit cards now slightly surpassed credit as consumers’ preferred payment card.

The report also found that debit cards were the preferred method of payment for smaller, everyday transactions at supermarkets, gas stations, and convenience stores, while credit was the choice for more expensive purchases, including those at department stores and restaurants, and for travel reservations.

Cash is not king anymore.

Credit Cards Pros

Americans love their credit cards. According to Experion, the average American has 3.84 credit cards in their wallet with an average credit limit of over $30,000. These are good arguments for whipping out the credit card.

Track Spending

When you charge something on a credit card, you can almost instantly see the transaction in your account. If you use a budgeting program like Mint, the transactions are automatically downloaded. This makes tracking your spending and budgeting easy.

It’s a Loan

Charging a purchase to a credit card is like having an interest-free loan if you pay the full balance every month. Most cards offer between 55-62 days before interest charges start accruing.

If you’ve had to make a big purchase on a credit card because you didn’t have cash, you have that amount of time to pay it off before you have to start paying interest. This allows you to spread out the cost of a big purchase over time.

They Help You Score

We’ve talked about the importance of having a good credit score and using credit cards can help build your score.

You Are Protected

You have some consumer protections when you purchase with a credit card. Protections vary by card but some things typically covered include replacing a stolen or damaged item, refunds for a product or service you are unhappy with, and extended warranties.

If you travel, credit cards can offer things like travel accident insurance, luggage protection, and trip cancellation insurance.

If your card is hacked or stolen, it’s the credit company’s loss and not yours. As long as you notify the company within two business days of being hacked or having your card stolen, the maximum you are responsible for is $50.

If you wait more than two days but less than 60 after your statement is sent, the maximum is $500. I’ve had my card hacked though, and the company let me off the hook for the entire amount.

It’s Not Ideal

A credit card is not meant to be used as an emergency fund; you need cash set aside somewhere easily accessible like a checking or savings account. But if you don’t have an emergency fund, you can use a credit card.

If you do this, you need to hustle to get that card paid off as fast as you can. You can use a product like Credit Karma to analyze your outstanding credit. Check out a balance transfer card if you can’t pay it off before you start racking up some significant interest charges. That will give you more time to pay the debt off without interest.

Credit Karma is 100% free and only runs a soft credit check. We use this tool to monitor our credit scores and discover ways to improve them.

Rewards

There is a lot of competition between credit cards, so cards offer some pretty sexy rewards to lure customers. With the right credit card, you can score free flights, and hotel rooms, and make life a little cheaper with cash back on your purchases.d

A good sign-up bonus can give you enough points for a free flight or some free hotel stays and even cash once you meet the spending requirement.

This free course outlines a proven framework that thousands of people have used to eliminate their debt, develop better money habits, and start building a secure financial future.

Credit Card Cons

It’s not all free flights and rainbows when it comes to using a credit card. There are plenty of pitfalls too.

The big con of using credit cards is that if you don’t use them responsibly, you can plunge yourself into debt that can take years or even bankruptcy to clear.

If you have had trouble with credit cards in the past and haven’t learned your lesson, all of the pros combined do not outweigh this con. You can use a product like Cushion to organize your existing bills.

Don't buy things you can't afford with money you don't have to impress people you don't like.

Tweet ThisIf you are currently struggling, use the stacking or snowball method to help pay off the debt faster, and consider getting a loan from Upgrade. You will still owe money, but

A False Sense of Security

Even if you do use your cards well, you shouldn’t become too dependent on them. Theoretically, you can access tens of thousands of dollars in your wallet. This can make you complacent about saving for an emergency fund and a sinking fund.

Again, credit cards are no substitute. You need to focus on building those two funds. Okay, you don’t have an emergency fund, and you need a $3,000 car repair. You can put it on a credit card, and while it may take a few months to pay it off, it won’t hurt too bad.

But what if you lost your job and it took six months to find a new one? Putting six months of living expenses on a credit card is going to hurt, and it’s going to hurt for a long time.

Annual Fees

Some rewards cards charge an annual fee. If you take full advantage of the card’s benefits you can come out ahead but plenty of times you sign up for those rewards with dreams of first-class travel in your head but don’t travel enough to make the annual fee worth it.

There are plenty of cards though that have rewards and don’t charge an annual fee.

Debit Cards Pros

Imagine having to go to the bank, actually into the bank, and ask a teller to give you money from your account! Crazy! But that’s what people had to do before debit cards. Ride their dinosaurs to the bank to get cash!

Debit cards have their champions and for good reason.

Track Spending

Like credit cards, spending on a debit card is easy to track. You can see your transactions almost in real-time, so you always know how much money you have.

No Effect

Part of your credit score is based on utilization, and how much of your credit you are using. If you charge up your credit cards, it hurts your utilization and thus your credit score. Using a debit card does not affect your credit score.

If you have $10,000 in your account and spend $8,000, it won’t matter to your score.

No Dinosaurs

The biggest pro of using a debit card is their convenience. A debit card gives you access to cash.

There are over 520,000 ATMs in the US, so you are never far from one.

It might not be affiliated with the bank that issued your debit card in which case you will have to pay a fee, but the fees are small enough that if you are charged one occasionally, it’s not the end of the world.

If you are not near an ATM or don’t want to pay that fee to use an out-of-network one, you can use a debit card to get cash back at thousands of places like grocery and drug stores.

No Debt

When you spend on a debit card, you won’t go into debt. You can’t spend money you don’t have.

Anyone Can Get One

Not everyone can get approved for a credit card, but as long as you haven’t been blacklisted from having a checking account, you can get a debit card. You don’t need a good credit score or any credit score to get one.

Debit Card Cons

These might give you pause the next time you reach for the debit card.

Limited Protections

Remember when we said that if your credit card is hacked or stolen it’s the credit card company’s problem? Well, if your debit card is hacked or stolen, it’s your problem. At least for a time.

Your responsibility is the same as it is when this happens to a credit card, a maximum of $50 or $500, depending on when you report the incident. However, the money the thief stole from your account leaves your account instantly.

It can take a few days for the bank to sort this out and reimburse you. During this time, the money stolen is money no longer available to you. If you have expenses that must be paid from that account, you might be in real trouble.

Debit cards also don’t offer the more comprehensive consumer and travel protections that some credit cards offer.

No Rewards For You

This isn’t the worst con of using a debit card, but it’s the saddest. I love rewards cards and have used them for free flights several times. I have also gotten $500 worth of statement credits with a new cash-back card.

None of those terrific rewards are available when you use a debit card. Unless…

Upgrade has a debit card that gives you up to 2% cash back on common everyday expenses, recurring payments, and subscriptions. Unlimited 1% cash back on all other purchases.

No Effect

While using a debit card doesn’t hurt your credit score, it doesn’t help it either. A credit score is a way to show how likely you are to repay borrowed money whether that money is in the form of a credit card or a mortgage.

You aren’t borrowing money when you use a debit card, that is your money. So it does not affect your credit score.

Declined

If you don’t have enough money in your checking account to cover a debit card transaction, the card will decline. This is embarrassing, but if what you were trying to purchase is a necessity, embarrassment might be the least of your problems.

You can prevent this by setting up overdraft protection on your account. This might sound like a good thing but for each transaction you overdraft, you will be charged a fee, and it might be as high as $35.

Just a few unexpected debit card transactions that you can’t immediately cover can quickly leave you facing a significant overdraft. This can result in potentially hundreds of dollars in bank fees, putting a significant strain on your budget.

Cash Pros

We had the paper before we had plastic and while the paper is increasingly on its way out, it’s still clinging on. If you just refuse to give up spending cash, we can sort of see it.

No Debt

Like spending with a debit card, spending cash is an excellent way to ensure that you don’t fall into the trap of debt. This is why the envelope method is a great budgeting system for people who have had problems staying out of debt. Once the cash is gone, you are done spending.

Gimme a Discount

This isn’t going to work at a chain store, but if you are shopping at an independent retailer, some of them are willing to give you a discount when you pay cash. Maybe they want to avoid the transaction fees they have to pay when a customer uses a debit or credit card.

Maybe they don’t report cash transactions as a way to avoid paying taxes. Whatever, none of your business!

Cash Cons

Using cash instead of a credit or debit card has several disadvantages, particularly in today’s digital and global economy.

No Tracking

If you’ve taken out $100 on a Friday and wondered how by Sunday you only have $14 left, you know what I mean. Unless you are meticulous about keeping receipts and recording them, it’s hard to track spending when you are spending cash. Using a product like Mint can help with this.

No Credit History

Using credit cards responsibly and paying off balances on time helps build a positive credit history, which is crucial for obtaining loans, mortgages, or leasing a car. Cash transactions do not contribute to your credit history.

No Protections

Credit cards often come with purchase protection that covers items bought with the card against theft or damage for a certain period after the purchase. Cash transactions do not offer this benefit.

Spending cash leaves you vulnerable.

No Rewards or Cash Back

Many credit cards offer rewards, points, or cash-back incentives on purchases. Using cash means missing out on these benefits, which can add up to significant savings or rewards over time.

Limited Emergency Resources

Credit cards can provide a crucial financial lifeline in emergencies, offering immediate access to funds beyond what you have in your bank account. If you rely solely on cash, you may find yourself in a bind if faced with unexpected expenses.

Increased Risk of Theft or Loss

Carrying cash poses a risk of loss or theft, and once cash is gone, it’s often gone for good. Credit cards, on the other hand, offer fraud protection, and lost or stolen cards can be quickly canceled and replaced.

You’re Gonna Need a Lot of It

If you want to buy a house or a new car with cash, you better start saving now. Not many people can afford to buy big-ticket items using only cash.

Lack of Financial Leverage

How do you pay your utility bills in cash? Either you have to take cash to their payment center or buy money orders. How will you buy an airplane ticket, book a hotel, or rent a car?

Credit cards can offer financial leverage, such as the ability to make large purchases and pay them off over time, potentially with low-interest rates if you qualify for promotional offers. Cash transactions do not offer this flexibility.

You Can’t Shop Online

If you only use cash, you can’t shop online, and you will never know all the awesome stuff you can buy on Amazon, Etsy, eBay, and a million other sites.

Using cash can be remarkably inconvenient. It’s to the point where you can’t even place an order on Seamless! Instead, you’re forced to revert to what feels like ancient practices, like picking up your food. It’s a throwback to a less digital, more Neanderthal era of communication.

Your Money Isn’t Working

When you invest your money, it makes more money with no effort from you. When you invest, you are growing your wealth for the future. If you want to retire one day, you have to invest. The easiest way to invest is to let a company like

These options aren’t available to you if you only pay in cash.

And the Winner Is…

I think we can rule out cash. The only situation where we would recommend spending cash is if you have difficulty sticking to a budget and want to use the envelope system.

Even then you will only use it for certain budget categories like food and entertainment. It’s not practical to use cash for things like utilities and housing but those aren’t the categories you overspend in.

So that leaves us with credit vs. debit.

Provided that you don’t use credit cards to buy things you can’t afford, credit cards are the clear winner. Using credit cards gives you benefits like short-term interest-free loans, help to build your credit score, and consumer protections that debit cards just can’t match.

Just make sure you use a credit card like an adult.

Credit cards are a tool, and when used responsibly, they can improve your finances which is something we all want.

Show Notes

Mint: You should be using this FREE online software to track your expenses and set up your budget.

Upgrade’s Credit Cards: With a wide assortment of card choices, find the card that’s right for you.

Find the Upgrade Card That's Right for You

- Cash Rewards

- Life Rewards

- Upgrade Select

- Upgrade OneCard