Mike Tyson once made a very sage observation, “Everybody has a plan until they get punched in the face.” Be that as it may, you still need to come up with a plan, for our purposes, a financial plan. But there are so many aspects of financial planning that it can be hard to know where to concentrate your efforts.

Should you prioritize saving for an emergency fund above everything else? What if you have credit card debt? Does the credit card debt supersede an emergency fund? What about coming up with an investing strategy? Is that a separate thing from your retirement plan? How are you supposed to prioritize a retirement plan when you have a negative net worth thanks to the student loans you’re still paying off.

Where do short-term goals and long-term goals slot in when you prioritize your financial plan? You don’t want to live with your parents forever. How much money are you supposed to save for a down payment? What about life insurance and other aspects of estate planning? How much life insurance do you need, should you set up a trust or is a will good enough?

So many questions! Even those of us who proudly proclaim ourselves to be personal finance nerds might be tempted to throw in the towel and hire a financial planner. Not so fast! We have the answers you’re looking for. You can take hold of your financial future. So first things first. We’ll show you how to prioritize your financial plan.

Prioritize Your Financial Plan

Don’t be intimidated by the financial planning process. A financial plan is nothing more than a road map that will help you reach your financial goals. And like any journey, you can mess up, change your mind, start over, and get better the further along you go. But the map gives you a touchstone for the trip so you don’t get too lost and can always find your way back no matter what happens.

Set Some Goals

When creating your financial plan, the most natural place to start is to set some goals; short-term, medium-term, and long-term.

Short-term goals: These goals are things you want to happen in five years or less. They can include saving for an emergency fund, paying off credit card debt, or student loan debt.

Medium-term goals: If you want to save for a down payment on a home or a child’s education, these are considered medium-term goals, things you want to happen in five to ten years.

Long-term goals: This is the big stuff, things that won’t happen for at least ten years. For most of us, our long-term focus is on retirement savings but can include buying a

Create a Budget

Goals show you where you want your money to go, and a budget shows you where it’s actually going. Budgets aren’t just for “poor” people, whatever your financial situation, you need a budget. Not only do you need a budget, you need a budgeting system and a template.

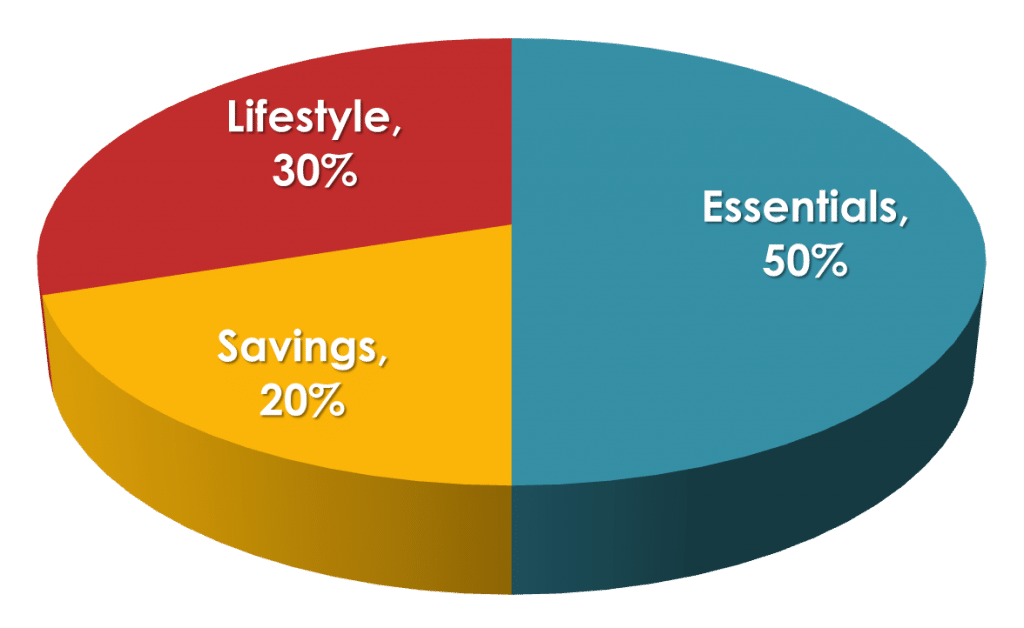

We like Mint because it’s free and easy to use. The template we like is the 50/30/20 method. 50% of your net (after-tax) income goes to non-negotiable expenses like housing, food, utilities, etc. 30% goes to discretionary spending like eating out, clothes, concerts, etc. And the final 20% goes to the goals you listed in your personal-financial plan like debt repayment, saving an emergency fund, and investing.

We feel that if you have high-interest debt like credit card debt, you should swap around the 30% and the 20%. That kind of debt is an emergency because you’re paying more in interest than you can make in any investment.

First Thing’s First

Okay, now we’re getting down to brass tacks. When you’re trying to prioritize your financial plan, without question, the first thing you need to do is to save an emergency fund. This is the thin green line between you and economic destruction.

What’s the ideal amount for an emergency fund? It’s 6 to 9 months of bare-bones expenses. You could cancel cable if you had to, but you have to pay rent. This is a lot of money, and it can take time to build up. What if you have debt? It depends on the kind. If it’s high-interest like credit card debt, work towards saving $1,000 for an emergency fund. Once you do that, your extra money should go towards that debt. If it’s relatively low-interest debt like federal student loan debt, a fully-funded emergency fund is your priority.

Where should you keep your emergency fund? If your fund is $1,000, keep it in a savings account. If it’s more, the answer depends on your risk tolerance. Several thousands of dollars is a lot to be sitting in a savings account, earning less than 1% interest. If you don’t mind taking a bit of risk, consider one of these short-term investing options.

It’s the Debt

Paying off high-interest debt is your next priority. If your credit score is good enough, you may be able to get a loan from a company like Prosper or Credible to pay it off. Yes, you still have debt, but the interest rate is lower.

Again, if your credit score is good enough, you may be approved for a balance transfer credit card. The card has an introductory interest rate of 0% (usually 6 to 18 months). You transfer the balance from a high-interest card to this card. During the introductory period, all of your payments go to paying off the balance, which helps you pay it down more quickly.

If you’re doing this on your own, using the snowball or stacking method can help you pay off the debt more quickly and efficiently. Stacking will save you the most money in interest.

What about student loan debt? The interest rate isn’t as high as it is for credit cards, but the lower your interest rate, the more you can save. Earnest can refinance your student loan debt to a lower interest rate, potentially saving you thousands of dollars over time.

But with or without a refi, student loan debt usually has a lower interest rate working against you than the return you can have working for you when you invest your money. If your only debt is low-interest, you should be paying it off while investing. The longer your money is invested, the more it grows so you don’t want to wait until you’re 100% debt free to invest because you can’t make up for that lost time.

Retirement Accounts

Great! Your emergency fund is fully funded, and you have no bad debt. What’s next in the financial planning process? Retirement savings. Because of inflation, the dollars you have now will be worth less than when you retire, so you need to accumulate those dollars now. Most of us will also not be able to rely on social security or pensions once we stop working.

The biggest reason to prioritize retirement savings over “regular” investing is because of the tax advantages. The best place to start is an employer-sponsored 401k, especially if your employer offers to match. That match is free money. In fact, we even think that those with credit card debt should contribute the minimum amount to their 401k to receive that match.

Never turn down free money.

Tweet ThisThe ultimate goal when it comes to retirement saving is to max out your 401k and IRA contributions each year. For 2019, 401k max is $19,000 and the IRA max is $6,000. Once you’ve maxed out, you can move on to the next steps.

Regular Investing

By regular investing, we mean investing in non-retirement accounts. Why do you need both? There are penalties for pulling money out of retirement accounts. While all investing should be considered long-term, there’s “long-term” and long-term.

What if you want to buy a house in eleven years? You don’t want to pull money out of your retirement accounts because of the penalty, and you can’t leave a few hundred grand in your savings account because it’s losing money to inflation.

That’s why you have regular investment accounts like a

Part of the 20% of your budget that goes to your financial goals should include regular, automated contributions to your regular investment accounts.

Passive Income and Diversity

Passive income is money you don’t have to do anything (or much) to earn. Investing can be considered passive income, and you’re doing that. But ideally, not only will you have more than one stream of passive income, but the stream you choose will help to diversify your portfolio too.

Real estate investing can be the perfect solution; it provides passive income while diversifying your portfolio. LMM loves rental properties.

Andrew and Laura own three turnkey rental properties. No late-night calls about clogged toilets or broken AC systems.

They even created a course, Rental Properties for Passive Investors, where you can learn their criteria for finding (and closing) the right property, the foundations of their successful rental business, the decisions they make, and why they matter!

Our proven, data-driven approach to building a portfolio of income-producing rental properties that perform in the long-term.

If buying

Estate Planning

Even more than retirement, your death seems very far away. And it usually is, we hope it is. But that’s not always the case. The unwillingness to acknowledge this, because it recognizes our own mortality, is what prevents a lot of people from making an estate plan.

But if you have a family, you must create a plan. At the very least, you need a will and life insurance. We prefer term over whole life insurance.

Term life insurance lasts for a set number of years (the term) before it expires and you’re no longer covered. Why do you want a life insurance policy that runs out? Because you may not need that financial protection anymore, and you don’t want to pay for an unnecessary insurance policy.

But what about a trust? Most people think they don’t have enough assets to justify the aggravation and expense of setting up a trust. But what if we told you that those with assets of more than $100,000 (so probably less than just your house is worth) could benefit from a trust, and you can create one in about 30 minutes and for only a few hundred dollars?

Trust & Will is to estate planning what

Get Your Priorities Right!

There you have it! A pretty simple road map to help you prioritize your financial plan. You can’t do all of the steps in one day, but Rome wasn’t built in a day was it? But when you map out your financial plan, you have the plan you need to reach your financial goals.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Show Notes

Rogue Farms Pumpkin Patch Ale: The perfect October beer.

Village Idiot Punk O’ Lantern: A local Jersey brew.