You waste money, yes I said it! Instead of wasting your money, learn how to find and plug your spending leaks because money is a terrible thing to waste!

Time might be the worst thing you can waste, but this isn’t a lifestyle blog, it’s a personal finance blog, so we’re going to talk about wasting money. Chances are you are wasting money without even realizing it.

I was too until recently. Maybe you’re paying for HBO and never watching it, or you signed up for the Dollar Shave Club, and you’re not using your blades. Whatever it is, you have to find these money leaks and stop them!

Saving money is essential, but it’s not always easy. But plugging your spending leaks means you’ll stop paying for things you don’t really want or need.

You might be surprised at the extra money you’ll have at the end of the month once you stop spending money you didn’t even notice you were spending.

Plugging leaks doesn’t always mean you stop spending money on something. It can also mean optimizing your spending by finding a better deal on things you buy.

So don’t worry! We’ll show you common spending leaks and how to plug them in ways that help you reach your financial goals without making you feel deprived.

Editor's Note

What Is a Spending Leak?

A spending leak is money that leaks out of your budget without your knowledge.

There are two kinds of spending leaks. The first is money you’re spending or overspending in a particular category that isn’t completely necessary. Takeout food is a good example.

There’s nothing wrong with getting takeout on occasion, but ordering it every day for lunch and a couple of nights per week is an excessive spending leak.

The other kind is money that seemingly disappears. Usually, this happens with cash.

You take out $100 from the ATM on Friday, and by Sunday night, the money is gone, and you really can’t recall how or where you spent it.

Common Spending Leaks

While each of us is unique when it comes to spending money, there are a few areas that are almost universal when it comes to overspending. How many of these common spending leaks are you guilty of?

Food

Food is a significant area of wasteful spending and waste in general.

Americans waste about a pound of food per person each day. About 150,000 tons of food is tossed out in US households each day, equivalent to about a third of the daily calories that each American consumes.

In dollars, a four-person family wastes $1,500 worth of food per year. And it’s not just the food you buy and don’t eat. It’s also too much takeout, fast food, convenience store snacks, and restaurant meals.

Subscriptions

There are so many different kinds of subscription services available these days; monthly boxes of snacks, makeup, or jewelry, movie, TV, and music services, meal delivery, pet supplies, self-care products.

There’s nothing wrong with some of these, and they can even save you money. The blades you get from Dollar Shave Club are cheaper than similar blades in a drug store. And you need razor blades if you shave.

But a lot of these services send you stuff that you don’t need. I know it’s fun to get a new box of makeup every month, but no one needs that much makeup.

For things like movie, TV, and music services, there is nothing wrong with paying for those IF; you use them regularly, and there isn’t a cheaper or free alternative.

And in the case of movie and TV services, if you are paying for those, you should not also be paying for cable TV at the same time. Pick one or the other.

Drugs

Don’t pay for name-brand drugs, over the counter or prescription, when a store brand or generic is available. There is no difference in the active ingredients; you’re paying more only for the name.

It’s also a good idea to compare pharmacy prices. You can do this at GoodRx. I searched for progesterone, and the prices at various pharmacies near me ranged from $17.71 to $22.96.

Going with the cheapest pharmacy saves $5.25 per month or $63 per year. Not a life-changing amount of money, but if you saw $63 lying on the sidewalk, you wouldn’t step over it.

Fees

You’re probably paying fees that you’re not even aware of; bank fees, investing fees, ATM fees, annual fees on credit cards, late fees. Some of these fees are legitimate.

It takes money to run a company so you can’t expect companies like

Or some credit cards that charge an annual fee can be worth it for those who take advantage of the perks those cards bestow like free checked baggage or credit towards things like travel expenses.

But you want to make sure that you know what fees you’re paying, if you’re paying too much, or if there is a free alternative. You should not be paying any fee to have a checking account, for example.

This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Detecting Your Leaks

Detecting spending leaks isn’t hard; a budget will show you exactly where they are. To find your leaks, you don’t have to make a budget.

Set up a Mint account and look through a few month’s worth of transactions. That will give you the data you need t and it will show all of your spending that was done with a credit or debit card.

At a glance, you’ll be able to see things like you spend $60 a week buying lunches at work, or you have subscriptions to not one but two music streaming services.

Ways To Plug Your Spending Leaks

Okay, now you’ve found the leaks. Here’s what you can do about them.

Create a Budget

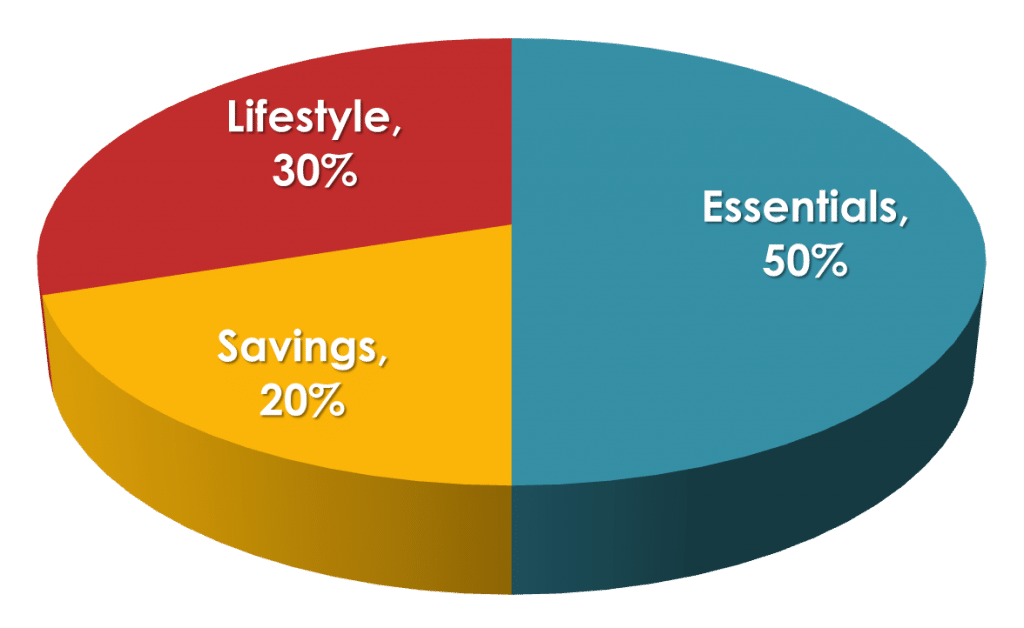

One of the most important aspects of personal finance is having a personal budget. It’s the foundation of healthy finances. And budgeting isn’t difficult. Your budget should follow a 50/30/20 template that looks like this.

We broke this down for you. Within that 50%, you won’t find frivolous spending leaks; these are necessary expenses. But you can still find savings. We’re realistic. Could you save on housing costs by moving into a smaller place or getting a roommate?

Of course, but most people aren’t going to do that.

We’re talking about things like comparison shopping for insurance, utilities if you have more than one provider in your area, and establishing and maintaining a reasonable grocery budget.

Your savings are not part of this conversation, so we’ll move on to the 30% lifestyle portion of your budget. This is where you have the most leaks and what we’re going to concentrate on.

Look for Recurring Expenses

Go through your spending and find recurring expenses.

Anything recurring month to month that is more than $30 should be seriously questioned.

In terms of recurring payments, things like your cable bill can easily be reduced or eliminated. If you do watch a lot of the channels you’re paying for, Billshark may be able to negotiate a lower price for you.

If you don’t watch the majority of the channels offered by your cable company, switch to a streaming service like Hulu or Fubo, which is likely much cheaper than what you’re paying for cable.

The point is, there are plenty of alternatives to the old school expensive take-all-your-money-and-still-show-you-ads services. Google is your friend; use it to stop wasting cash.

You may find recurring expenses that you completely forgot about. Maybe you signed up for a free trial period for a credit monitoring service or Audible and forgot to cancel once you decided you weren’t going to use it.

Use the Four C’s

When looking for ways to plug your spending leaks, you need to look no further than the four C’s.

Cancel: Immediately cancel any services that you don’t use but are paying for like a gym membership or online newspaper subscriptions.

If you can’t be bothered to do it yourself, Trim can do it for you. Trim will analyze your account information to find recurring expenses. When it finds them, you’ll get a message asking if you want Trim to cancel them. If you do, Trim will handle it for you.

Don’t underestimate this category, I’m a seasoned money-saving veteran, and I’ve found quite a lot of savings here time after time. Sometimes you forget about things you signed up for, and that’s okay… as long as you realize and fix your mistake!

Challenge: Challenging credit card charges is a personal favorite of mine. I remember when World of Warcraft came out, you could get into the beta if you signed up for a $15/month Game Stop account online.

It was a great price to get into the beta of a game I was going to keep playing, so I did it!

The following month I forgot to cancel it, and I was charged again.

Now, $15 is not a lot of money, but I was in college, and that was a loss of more than six beers, something I didn’t take lightly. Long story short, I called my credit card company, challenged the charge saying that I canceled the service (which I did before I called), and Game Stop didn’t fight it. $15 saved!

From my experience, most companies that make money off your terrible memory never contest the charge because there are plenty of people who don’t fight, and that’s good enough for them.

Cut: A cut is a downgrade in service. Do you really need unlimited texting on your cell phone plan? Do you travel enough to reap the benefits you’re paying for with the annual fee of a travel credit card?

You can step down to a cheaper phone plan or to a credit card in the same family (so you don’t have to cancel the card which hurts your credit score) that doesn’t charge an annual fee.

Commit: If you are paying for a service each month that you do use, you may be able to get a discount if you pay for a full year upfront. This is often the case for things like certain types of insurance or gym memberships.

It’s also sometimes the case for buying things in a “package.” Facials or sessions with a personal trainer, for instance. If you purchase these services in bundles, six facials, or ten training sessions, for example, you’ll get a discount.

How Do I Stop Overspending?

Plugging your spending leaks is a great, simple step to take. But if you had a lot of leaks, clearly you’re overspending. Let’s see how we can tackle it.

Curb Spending Habits

When is the last time you left your house and came home without having spent any money? Maybe you don’t remember because it happens so infrequently. A lot of this can be attributed to the fact that spending habits are well, habits!

Maybe you walk to work (Good! Saving money on commuting.) and every day stop at the same bodega to buy a coffee. But you just left home where if you’re a coffee drinker, there is undoubtedly coffee.

Even if there isn’t, how long is your walk? Five hours? No, probably not even one hour. So you’ll soon be at your office where there is probably coffee.

You don’t need to spend money on that coffee. Stopping at the bodega and buying the coffee is just a habit you developed within your routine of walking to work.

Good or bad, habits always deliver results.

Tweet ThisSome of our spending decisions aren’t even decisions; they’re just reflex! Recognize this kind of “habit” spending and stop it.

Know Your Weaknesses

We all have certain things we love to spend money on. Maybe it’s video games, clothes, or books. We’re not saying you can’t ever spend money on those things, but they should be accounted for in your budget.

For the most part, you should avoid the stores, (brick and mortar or online), where you typically buy these things.

Don’t walk into the stores and stay off the websites. At the very least, delete your saved credit card information from the sites. Just that extra step of having to get up and get your credit card might stop you from making an unnecessary purchase.

Save Receipts

You only need to save receipts for cash purchases. Any spending done on a debit or credit card will be downloaded into your Mint account or be found on your credit card statement or bank statement.

But as we discussed earlier, cash can be hard to account for, so be sure to collect all of your cash transaction receipts and go through them at the end of each week.

If you see that you tend to waste cash, stop spending it. Don’t take money out of the ATM. Think about the types of places that don’t accept cards, bars, and restaurants are two big ones.

And drinking and eating out are often significant spending leak areas for people. Again, it’s not that you can’t spend money on food and drinks, but it must be factored into your budget.

Do Something With Those Savings!

Hopefully, this whole exercise wasn’t too strenuous for you. I bet that if you took a good hour and did some solid investigation, you could find at least $100 in savings.

Now that you’ve either found those savings on your own or with our help let’s put that money into action and make it work for you!

A major difference between wealthy people and the rest of us is that wealthy people put their money to work.

Wealthy people may go to work to earn money, but every day their savings are also going to work, making them even more money through their investments.

You could use simple set it and forget it services like

Less spending leaks means more money in your pocket.